Today is April 20th, or 4/20, one of the magic numbers to Elon Musk whisperers. Of course this is the day that Tesla (TSLA) reports earnings after the close.

TSLA is perpetually the most actively traded stock and options class by Interactive Brokers’ customers, so it is reasonable to think that many of you have a vested interest in seeing the options market’s anticipation for the post-earnings reaction to TSLA earnings.

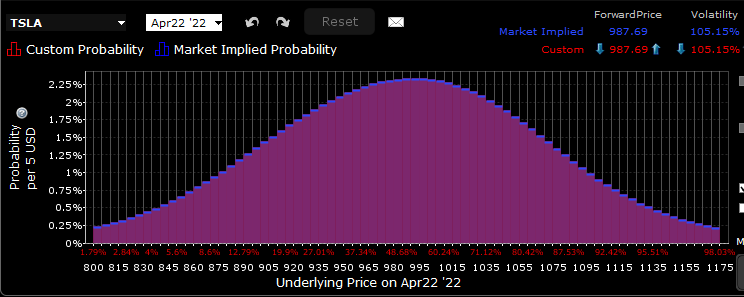

The chart below shows that option expiring this Friday have a fairly symmetrical probability distribution, thought with relatively fat tails. That implies that traders are prepared for a wide range of outcomes, with no particular preference for an advance or decline.

IBKR Probability Lab for TSLA Options Expiring April 22nd, 2022

Source: Interactive Brokers

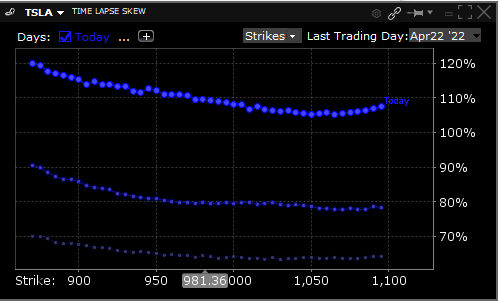

We have seen the skew on those options show a steady amount of risk aversion, even as the implied volatility rose. It is normal to see implied volatility rise as we approach a company’s earnings date, since options buyers want to wait until the last minute before buying an option with high implied volatility and decay. The current at-money options imply a roughly 7% move after earnings, which is about average for TSLA:

Time Lapse Skew in TSLA Options Expiring April 22nd, 2022, as of April 20th, 19th, 18th (top to bottom)

Source: Interactive Brokers

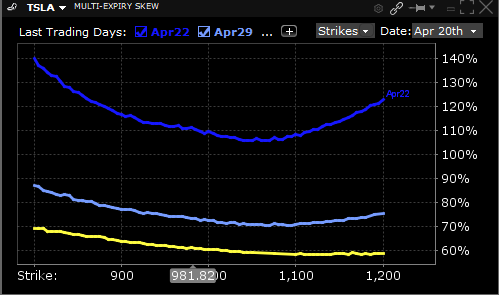

Finally, the multi-expiry skew shows relatively normal levels of risk aversion, with implied volatilities for near-term weekly options showing a dip about 7% above the current market price.

Multi-Expiry Skew for TSLA, April 22nd expiry (dark blue), April 29th (light blue), May 20th (yellow)

Source: Interactive Brokers

In short, traders are expecting relative normalcy from TSLA, with a roughly 7% post-earnings move priced in and some traders relatively sanguine about seeing that move occur to the upside.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)