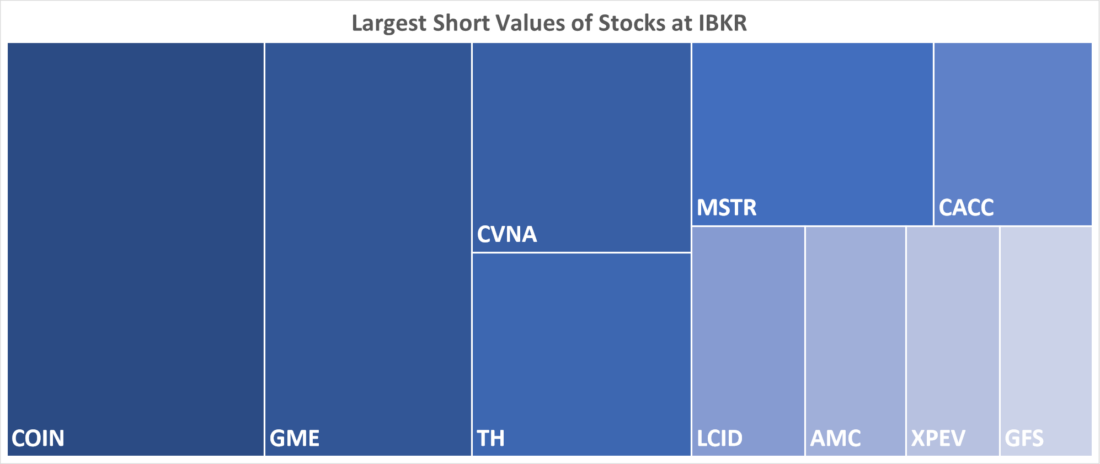

Largest Short Values of Stocks at IBKR

| Rank | Stock | Description |

| 1 | COIN | COINBASE GLOBAL INC -CLASS A |

| 2 | GME | GAMESTOP CORP-CLASS A |

| 3 | CVNA | CARVANA CO |

| 4 | TH | TARGET HOSPITALITY CORP |

| 5 | MSTR | MICROSTRATEGY INC-CL A |

| 6 | CACC | CREDIT ACCEPTANCE CORP |

| 7 | LCID | LUCID GROUP INC |

| 8 | AMC | AMC ENTERTAINMENT HLDS-CL A |

| 9 | XPEV | XPENG INC – ADR |

| 10 | GFS | GLOBALFOUNDRIES INC |

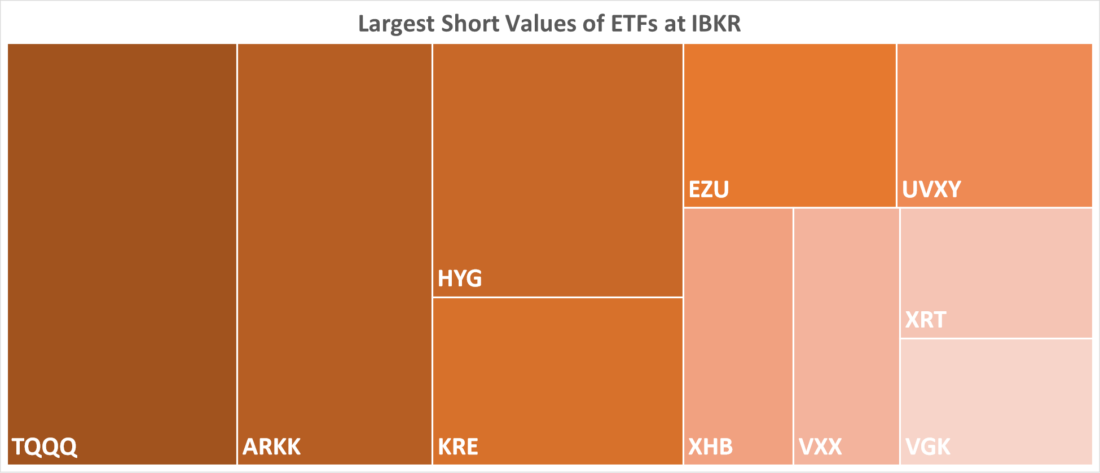

Largest Short Values of ETFs at IBKR

| Rank | ETF | Description |

| 1 | TQQQ | PROSHARES ULTRAPRO QQQ |

| 2 | ARKK | ARK INNOVATION ETF |

| 3 | HYG | ISHARES IBOXX HIGH YLD CORP |

| 4 | KRE | SPDR S&P REGIONAL BANKING |

| 5 | EZU | ISHARES MSCI EUROZONE ETF |

| 6 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| 7 | XHB | SPDR S&P HOMEBUILDERS ETF |

| 8 | VXX | IPATH SERIES B S&P 500 VIX |

| 9 | XRT | SPDR S&P RETAIL ETF |

| 10 | VGK | VANGUARD FTSE EUROPE ETF |

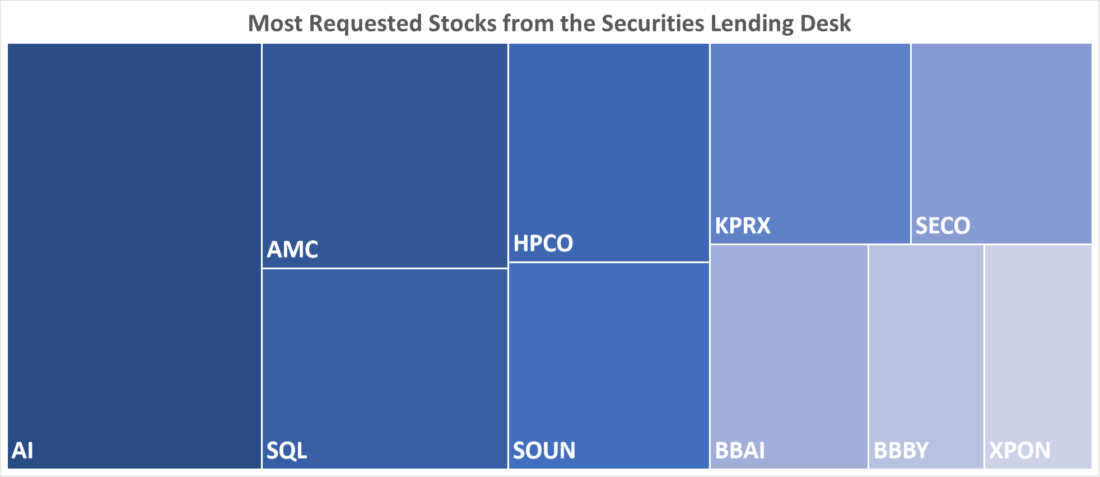

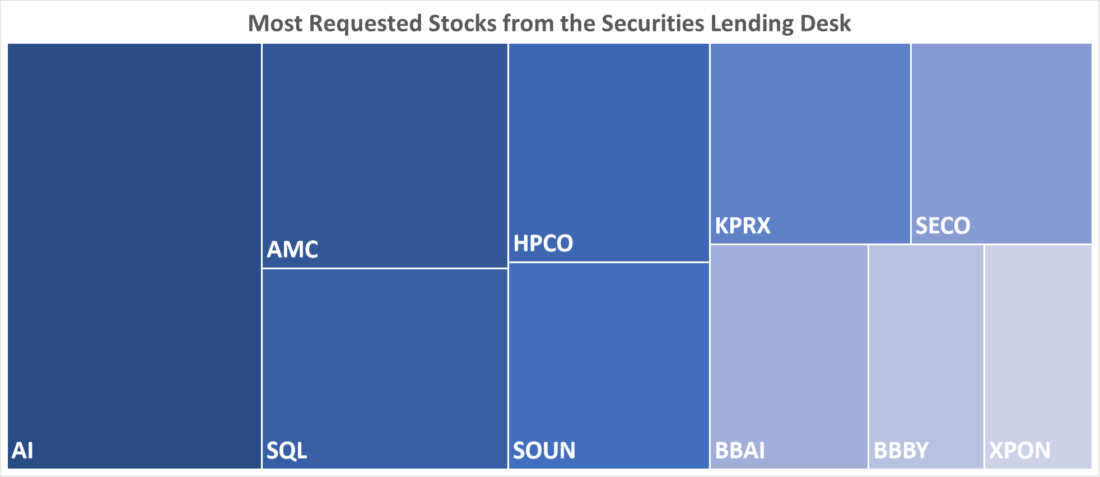

Most Requested Stocks from the Securities Lending Desk

| Rank | ETF | Description |

| 1 | UPST | UPSTART HOLDINGS INC |

| 2 | VLON | VALLON PHARMACEUTICALS INC |

| 3 | BBBY | BED BATH & BEYOND INC |

| 4 | AI | C3.AI INC-A |

| 5 | LUNR | INTUITIVE MACHINES INC |

| 6 | IBIO | IBIO INC |

| 7 | SI | SILVERGATE CAPITAL CORP-CL A |

| 8 | SERA | SERA PROGNOSTICS INC-A |

| 9 | AMC | AMC ENTERTAINMENT HLDS-CL A |

| 10 | XPON | EXPION360 INC |

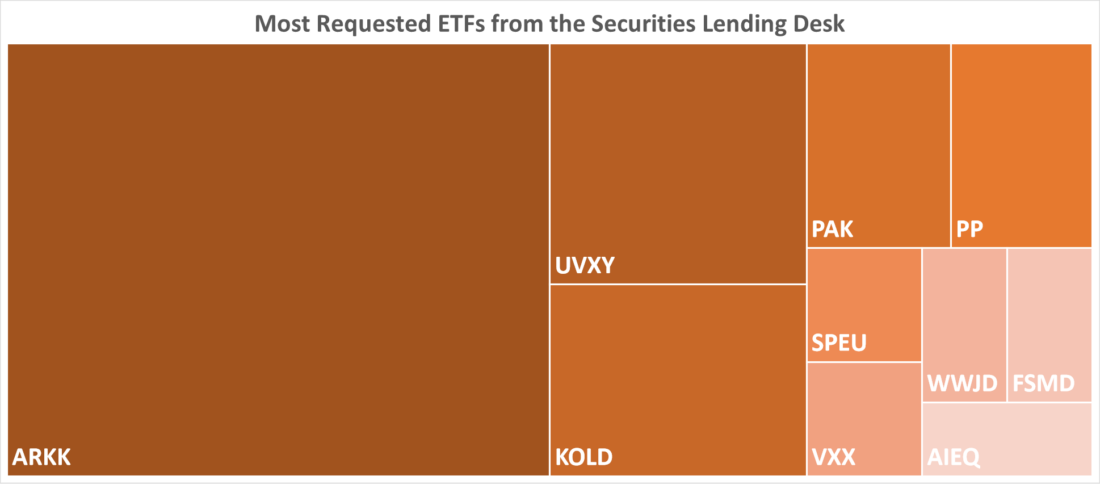

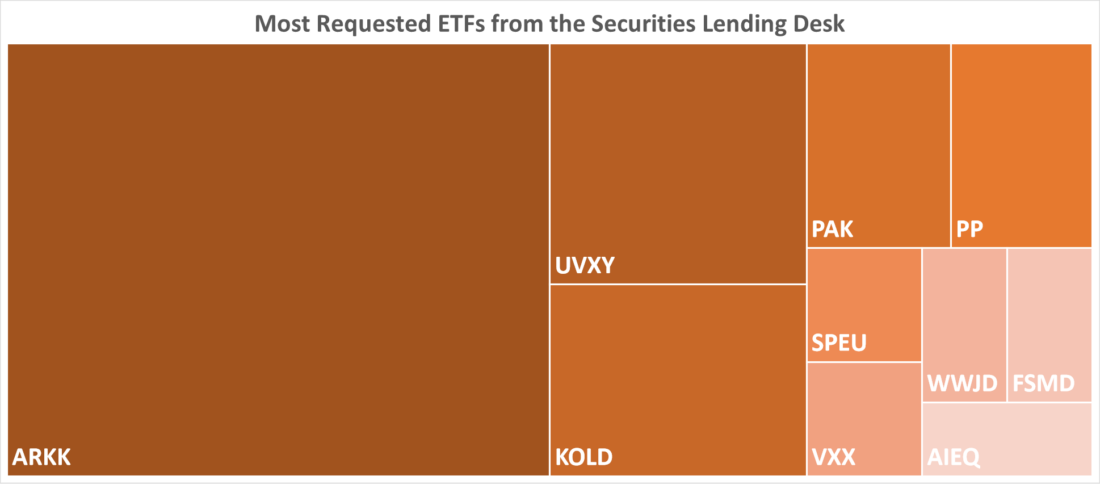

Most Requested ETFs from the Securities Lending Desk

| Rank | ETF | Description |

| 1 | ARKK | ARK INNOVATION ETF |

| 2 | KOLD | PROSHARES ULTRASHORT BLOOMBE |

| 3 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| 4 | SMH | VANECK SEMICONDUCTOR ETF |

| 5 | IWM | ISHARES RUSSELL 2000 ETF |

| 6 | TQQQ | PROSHARES ULTRAPRO QQQ |

| 7 | XHB | SPDR S&P HOMEBUILDERS ETF |

| 8 | WWJD | INSPIRE INTERNATIONAL ETF |

| 9 | FSMD | FIDELITY SMALL-MID MULTIFACT |

| 10 | VXX | IPATH SERIES B S&P 500 VIX |

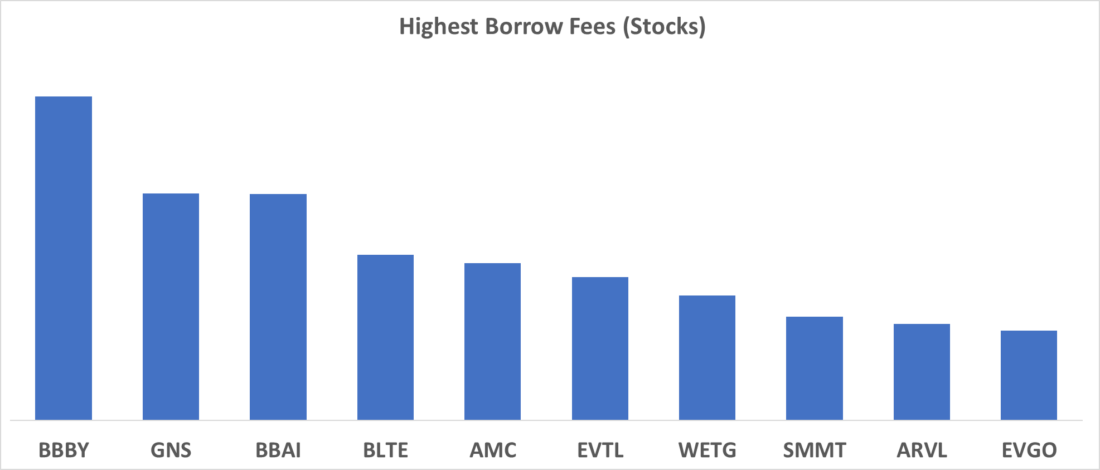

Highest Borrows Fees (Stocks)

| Rank | Stock | Description |

| 1 | BBAI | BIGBEAR.AI HOLDINGS INC |

| 2 | GNS | GENIUS GROUP LTD |

| 3 | SMMT | SUMMIT THERAPEUTICS INC |

| 4 | AMC | AMC ENTERTAINMENT HLDS-CL A |

| 5 | BLTE | BELITE BIO INC – ADR |

| 6 | EVTL | VERTICAL AEROSPACE LTD |

| 7 | TTCF | TATTOOED CHEF INC |

| 8 | BYND | BEYOND MEAT INC |

| 9 | BBBY | BED BATH & BEYOND INC |

| 10 | QS | QUANTUMSCAPE CORP |

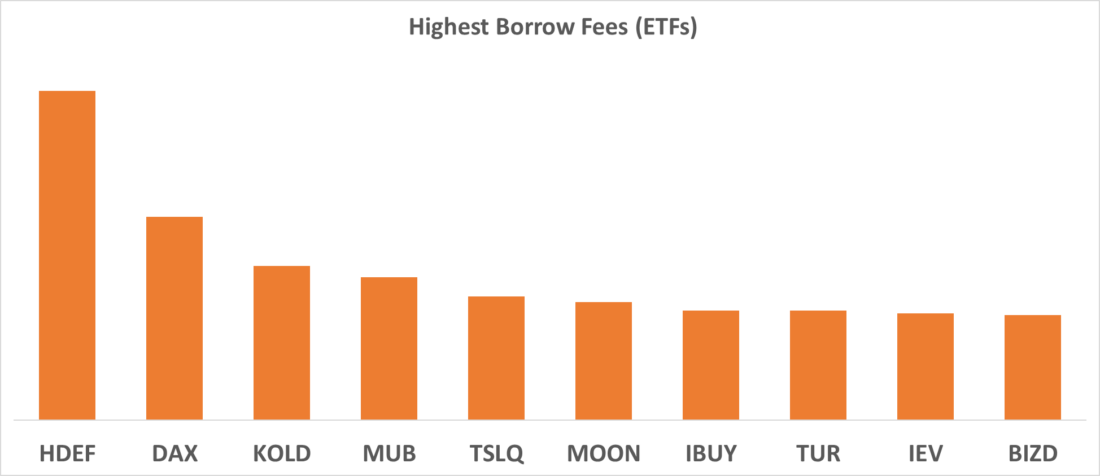

Highest Borrow Fees (ETFs)

| Rank | ETF | Description |

| 1 | HDEF | XTRACKERS MSCI EAFE HIGH DIV |

| 2 | DAX | GLOBAL X DAX GERMANY ETF |

| 3 | KOLD | PROSHARES ULTRASHORT BLOOMBE |

| 4 | MUB | ISHARES NATIONAL MUNI BOND E |

| 5 | TSLQ | AXS TSLA BEAR DAILY ETF |

| 6 | MOON | DIREXION MOONSHOT INNOVATORS |

| 7 | IBUY | AMPLIFY ONLINE RETAIL ETF |

| 8 | TUR | ISHARES MSCI TURKEY ETF |

| 9 | IEV | ISHARES EUROPE ETF |

| 10 | BIZD | VANECK BDC INCOME ETF |

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Disclosure: Penny Stocks

Low priced microcap securities (also known as “Penny Stocks”) represent low priced shares of small companies typically not traded or quoted on an exchange. Prices are often not available. Investors in Penny Stocks often are unable to sell stock back to the dealer that sold them the stock. Thus, you may lose your investment. Be cautious of newly issued Penny Stocks. For additional information please review the Penny Stock Trading Risk Disclosure at https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=9490

Disclosure: OTC Securities

An investment in an OTC security is speculative and involves a high degree of risk. Many OTC securities are relatively illiquid, or "thinly traded," which tends to increase price volatility. Illiquid securities are often difficult for investors to buy or sell without dramatically affecting the quoted price. In some cases, the liquidation of a position in an OTC security may not be possible within a reasonable period of time.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)