If you watch enough bad television or ancient re-runs (like me), it is inevitable that you will see advertisements for insurance products like Colonial Penn and Car Shield. Thanks to my decades as an options market maker, I have always paid extra attention to insurance commercials. In that role, I considered myself to be an insurance underwriter – not for life or auto, of course, but for financial risks. I bring up the topic today because insurance is most useful for hedging asymmetric risk, and that is exactly what we face today.

Insurance is most necessary when someone faces a low probability, high outcome event. The odds of one’s house catching fire on a given day is quite low, but it would be a catastrophe if it occurs. So, we buy fire insurance and hope that the premiums are wasted expenses. I would assert that the debt ceiling creates a similar type of event. There may a low probability that a default occurs, but one would be a high outcome catastrophe. Although the risk of financial arson exists, we’ve also noted that equity investors are generally taking the view that we’ve skirted this risk before so it’s not worth worrying about now.

But not all investors are completely sanguine. The significant volume and open interest in upside VIX calls expiring in June tell us that some are buying insurance policies, just in case. So far this morning, over 150,000 VIX 30 strike calls expiring June 21st have already traded on a line with over 550,000 open interest.

Yesterday’s rally reinforced the notion that an agreement may be in sight, which may be why the bulk of the calls mentioned above traded on the bid side. A holder may have decided that insurance is less necessary today than previously. Yet the buy-the-rumor, sell-the-news aspect of markets may offer an even greater rationale for hedging now. For one, it’s cheaper today. For another, if a greater probability of success gets priced in, it increases the impact of failure.

I was asked recently if VIX was too high or too low. Quite frankly, if this was a high school debate I could reasonably take either side. Let us start with a piece of visual evidence:

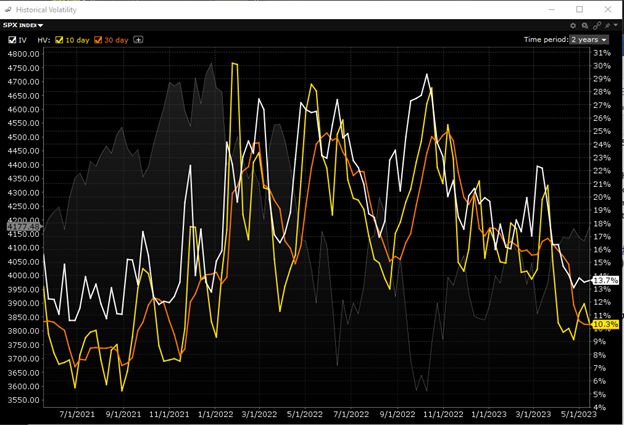

2-Year Chart: SPX Historical Volatility, 10-Day (yellow), 30-Day (orange); Implied Volatility (white); SPX Level (faint grey)

Source: Interactive Brokers

If we assert that VIX is too high? If we look at the historical volatility of the S&P 500 Index (SPX) on either a 10-day or 30-day basis, we see that it is quite depressed. Both are just about 10% on an annualized basis. That shouldn’t be too much of a surprise; as we noted yesterday, SPX was almost exactly unchanged on a quarter-to-date basis as of Tuesday’s close. If you believe that we will remain mired in the current trading range, then a VIX level of 16.60 seems high.

If we assert that VIX is too low? If you believe that there is a reasonable chance for a stumble along the way to a debt deal, let alone a default, then VIX has plenty of room to run and run quickly. We have seen a couple of quick spikes on relatively minor downdrafts, as the chart below shows. On Monday, May 1st, when VIX touched 15.50, we wrote that markets felt eerily calm. By Thursday, VIX traded over 21. When implied volatilities are at relatively low levels, they tend to rise abruptly at even modest signs of trouble. And as the chart above shows, the last time historical and implied volatilities were this low was the late 2021 – early 2022 period when major indices topped out.

VIX 20 Day Chart, 15-Minute Bars

Source: Interactive Brokers

Given what I said earlier about the importance of insurance in protecting against low probability, high outcome events, you should be able to figure out which side of the debate I find more appealing. The latest rhetoric from D.C. has been positive, but a deal remains murky. When we consider that equity markets have not sold off in response to default fears, it seems reasonable to think that they won’t rally much if an agreement is reached. In a one-tailed risk scenario, it is often prudent to purchase insurance. As with your homeowners policy, you may not want the insurance to pay off, but it may help you sleep better at night.

For further reference about the similarities and differences between conventional insurance and listed options, please read this piece from August 2021: Moral Hazard, Insurance, and Options | Traders’ Insight (ibkrcampus.com)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

How do I learn to trade the Fibonacci method ?

Hello Gil, thank you for reaching out. We have several articles and resources on the Fibonacci method. For instance, this video illustrates how to add Fibonacci trendlines to your TWS charts: https://www.ibkr.com/faq?id=92008925 while this article discusses the history behind Fibonacci numbers: https://ibkrcampus.com/ibkr-quant-news/the-magic-of-fibonacci-numbers/. If you have other questions, please ask.

This was an excellent addition to my education, for which I thank you.

We’re glad to hear that, Jack!

Point well made, thank you for your experience.

Thank you for reading, Martin! We hope you’ll continue to.