Key News

A very wet day here in the Northeast reminding me of the Eurythmics’ classic Here Comes the Rain Again. Market action suggests staying in bed would have been advised. Hopefully, we will be referencing the Eurythmics other hit Sweet Dreams soon enough.

Asian equities were a sea of red as Taiwan, Japan, Hong Kong, Singapore, Indonesia, and South Korea underperformed. Mainland China held up well. US Fed bond tapering and Toyota auto production cuts were widely cited as negative catalysts. Markets appear to be increasingly worried about the delta variant’s effect on global growth, China’s Ningbo port shutdown being an example. Hong Kong suffered a broad sell-off with only 73 advancing stocks and 415 declining stocks with every sector lower.

Tencent was hit despite yesterday’s strong results as headlines scream about “regulation”. Yes, revenue growth was the slowest quarter in two years led by tepid game growth, though fintech growth was strong as it likely will be the largest revenue segment next quarter. Yesterday, I proposed my “air pocket” thesis that there are simply no professional buyers willing to step up to buy China internet stocks without clarity on regulation. Today’s price action leads me to believe that Asian active managers are late to the unload game. As evidence, Tencent experienced a large net sale day from Mainland investors via Southbound Stock Connect.

The internet space was off on reports that the Ministry of Industry and Information Technology (MIIT) mentioned several companies have a week to make their apps compliant with user data laws. I have no doubt they will! There was also chatter about Meituan having its commissions capped.

Luxury goods were smoked on “common prosperity” with Prada’s Hong Kong listing down -14.36%. The only bright spot in Hong Kong was the electric vehicle (EV) ecosystem, which also outperformed on the Mainland.

The Mainland market held up with growth names outperforming, such as the EV ecosystem, autos, rare earth metals, clean technology, and semiconductors. The STAR Board was up +2.53% as an exchange comprised of all things growth. Brokerage stocks had a very strong day while energy, materials, and industrial metal stocks were down as copper prices go off a cliff. Real estate was weak as “common prosperity” is being interpreted as a catalyst to implement a property tax.

Remember China’s census shows that incentivizing parents to have more kids is key. Making multi-bedroom apartments more affordable makes sense to me. Foreign investors were net sellers of Mainland stocks though the trend has been overweight Mainland stocks versus Hong Kong. Ping An Insurance and liquor stock Wuliangye Yibin saw the largest net selling. Mainland China bonds had a strong day.

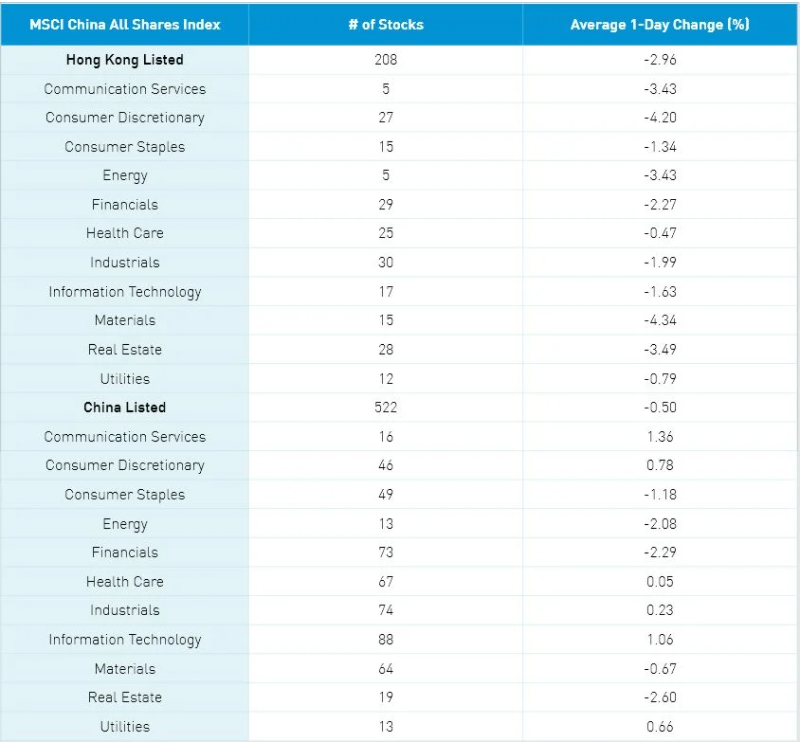

H-Share Update

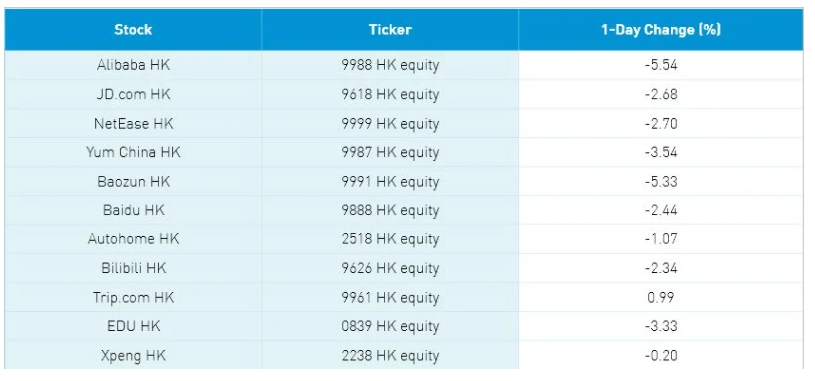

The Hang Seng opened lower and kept going in that direction closing -2.13% as volume increased +22.59% from yesterday which is 98% of the 1-year average. The 208 Chinese companies listed in Hong Kong within the MSCI China All Shares lost -2.93% led lower by materials -4.31%, discretionary -4.17%, real estate -3.45%, communication -3.4%, energy -3.39%, financials -2.23%, industrials -1.95%, tech -1.6%, staples -1.31%, utilities -0.76% and healthcare -0.43%. Hong Kong’s most heavily traded by value were Tencent -3.44%, Meituan -7.15%, Alibaba Hong Kong -5.54%, Ping An -5.78%, Geely Auto +2.1%, BYD +0.62%, Xiaomi -2.44%, Hong Kong Exchanges -2.03%, China Mobile flat, AIA +0.15%. Southbound Stock Connect volumes were moderate/high as Mainland investors sold $504mm of Hong Kong stocks as Southbound trading accounted for 14.8% of Hong Kong turnover.

A-Share Update

Shanghai, Shenzhen and STAR Board diverged closing -0.51%, +0.2% and +2.53% on volume +1.34% from yesterday which is 131% of the 1-year average. The 522 Mainland stocks within the MSCI China All Shares were off -0.49% as communication +1.37%, tech +1.07%, discretionary +0.79%, utilities +0.67%, industrials +0.23% and healthcare +0.06% while real estate -2.59%, financials -2.29%, energy -2.08%, staples -1.17% and materials -0.66%. The Mainland’s most heavily traded by value were Orient Securities +4.58%, broker East Money -3.4%, BYD +3.55%, China Northern Rare Earth +2.74%, Tianqi Lithium +10%, GF Securities +2.01%, Industrials Securities +2.14% and Ganfeng Lithium +6.33%. Southbound Stock volumes were elevated as foreign investors sold $1.662B of Mainland stocks today as Northbound trading accounted for 5% of Mainland turnover.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.49 versus 6.48 yesterday

- CNY/EUR 7.59 versus 7.59 yesterday

- Yield on 10-Year Government Bond 2.84% versus 2.85% yesterday

- Yield on 10-Year China Development Bank Bond 3.18% versus 3.18% yesterday

- Copper Price -2.00% overnight

—

Originally Posted on August 19, 2021 – Here Comes the Rain Again

Author Positions as of 8/19/21 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)