We recently launched a new report designed to guide our institutional clients during earnings seasons. It is based around an “Earnings Screen Score” ranking methodology that draws on selected inputs from our long-standing MAER stock database to identify companies which have strong near-term fundamental momentum going into an earnings report.

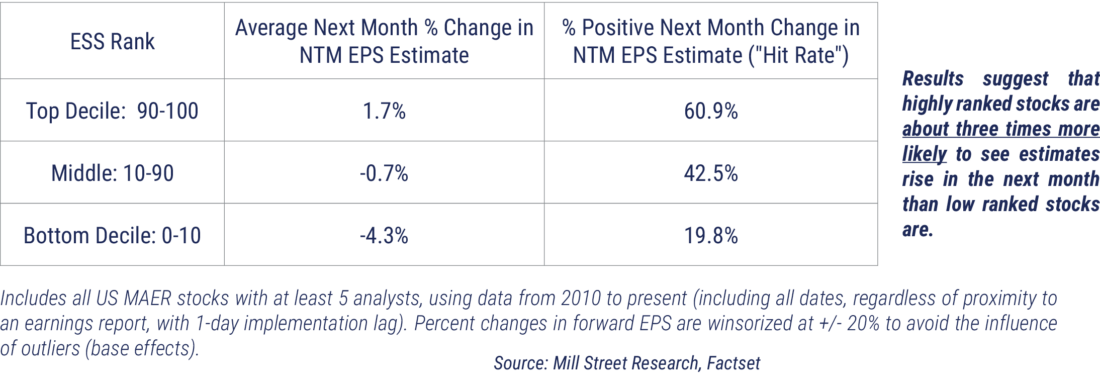

Our research indicates that companies scoring highly in our ranking have a much higher chance of near-term improvements in analyst expectations (i.e., “beat and raise” outcomes) than those that score poorly in the ranking.

The goal of our Earnings Screens Score (ESS) is to find stocks for which analysts are likely to raise earnings estimates over the next month — that is, where some news that was not already expected provokes analysts to change their forward (next-twelve-month) estimates meaningfully. Strictly speaking, then, we are not attempting to specify whether the soon-to-be reported quarterly earnings will or will not “beat” consensus estimates, but to answer the related and more relevant question of whether the news surrounding the earnings report will provoke analysts to adjust future earnings estimates (which then tends to lead to stock price outperformance).

By screening here only among stocks that are due to announce a quarterly earnings report soon (within the next two weeks), we focus on names where earnings announcements and the associated conference calls, guidance, etc. are likely to lead to analyst estimate changes, i.e. highly ranked stocks are expected to “beat and raise”, low ranked stocks are not.

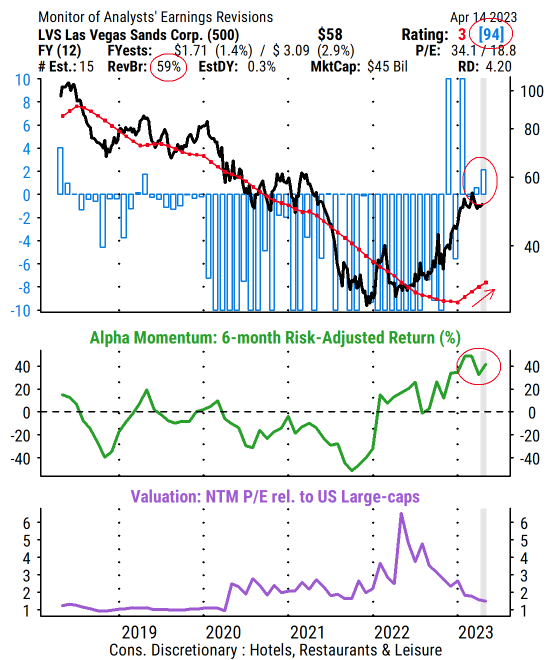

The process for identifying stocks likely to produce earnings estimate activity (positive or negative) is based on four metrics drawn from our global MAER database, which we rank separately and then combine into an overall score:

- The percent change in forward estimates over the prior 30 days (the blue bars on a MAER chart, 30% weight)

- The percentile rank of the 30-day estimate change in the context of the stock’s own five-year history (the “magnitude percentile” shown on MAER charts, 30% weight).

- The latest revisions breadth ratio (reflected in the red line on a MAER chart, 20% weight).

- The latest Alpha Momentum reading (shown in the green line on a MAER chart, 20% weight).

An example MAER chart of a highly ranked stock is below for demonstration purposes only (not a recommendation).

Source: Mill Street Research, Factset

These metrics focus on the most recent changes in estimates (60% of the weight is in the two 30-day estimate change metrics), and look for corroboration from revisions breadth (the proportion of analysts raising versus lowering estimates) and intermediate-term price action (Alpha Momentum, i.e., risk-adjusted price momentum over the last six months).

Our research indicates that these metrics are useful for forecasting the direction and magnitude of estimate revisions over the subsequent month.

The general principles are that:

- fundamentals tend to move in trends,

- analysts tend to show herd behavior and conservatism around quarterly reporting, and

- price trends can foreshadow earnings results at times.

This means that companies for which analysts have been raising estimates most recently, and that have been showing favorable price momentum, are much more likely to see additional increases in estimates in the next month. Conversely, those companies where estimates have been falling just ahead of an earnings report, and the stock has been lagging, are more likely to show weaker results and further declines in earnings estimates.

The new report will be updated weekly for Mill Street’s institutional clients during the roughly six weeks of each calendar quarter when earnings reports are published by companies (“earnings season”).

—

Originally Posted April 20, 2023 – New Earnings Season Screens report offers guidance during reporting season

Disclosure: Mill Street Research

Source for data and statistics: Mill Street Research, FactSet, Bloomberg

This report is not intended to provide investment advice. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report.

All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Mill Street does not represent that any such information, opinion or statistical data is accurate or complete. All estimates, opinions and recommendations expressed herein constitute judgments as of the date of this report and are subject to change without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mill Street Research and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mill Street Research and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.