Featured Ideas delivers live bullish and bearish investment ideas based on technical and fundamental analysis and is supported by backtested strategies. Featured Ideas scans the market for trade opportunities and delivers only those relevant to your unique style.

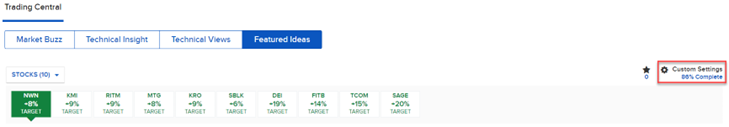

Using Trading Central’s “Featured Ideas” screener inside the IBKR Portal, I screened for bullish opportunities in U.S equities in all sectors that have listed options available and have the best setups from a fundamental and technical perspective.

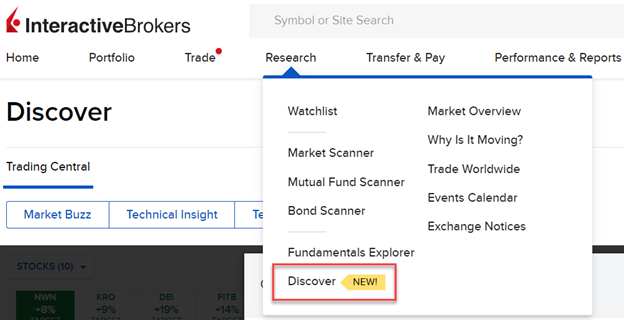

You can locate Featured Ideas in the IB portal under Research-Discover New:

Search criteria can be edited by clicking on custom settings:

More about Trading Central

Trading Central is a global leader in financial market research and investment analytics for retail online brokers and institutions. Trading Central’s product suite provides actionable trading ideas based on technical and fundamental research covering stocks, ETFs, indices, forex, options, and commodities.

Here are a few stocks that caught my interest.

Sage Therapeutics (SAGE: NASDAQ) has the highest upside potential indicated at +20% after the stock confirmed a Bullish continuation diamond pattern. The pattern indicates a 6-week to 9-month opportunity which was recognized on March 29th.

What was found:

- This stock has formed a pattern called Continuation Diamond (Bullish), providing a target price for the intermediate-term.

- A bullish event triggered for Fast Stochastics when the %K line crossed above the %D line. The close prices are trading closer to the upper end of the recent high-low price range, which is associated with price increases.

- Also the Fast Stochastics %K line has risen above -20 indicating a recovery from oversold.

This matches Trading Central’s “Diamond (Bullish) + Fast Stochastics (USA)” strategy which produced a 10% annualized 5-year historical return.

Clicking on Watch: will allow you to track the stock performance to see how the idea plays out.

Kinder Morgan (KMI: NYSE) confirmed a Head and Shoulders Bottom reversal pattern with an upside potential of 9%.

Multiple bullish events have been found from a technical and fundamental perspective:

- The stock’s price has broken upward to confirm a classic chart pattern, offering a target price for the intermediate-term.

- The stock is looking like a good value investment because it is above average in two key valuation ratios;

- Price/Book Ratio is 1.30 which tells us that the stock price is reasonably low when compared to the company’s book value (representing the value of all equity);

- Price/Cash Flow Ratio is 8.07 which tells us that the price of a share is relatively low when compared to the cash flow being generated by the company.

- Earnings Yield is 6.31% which represents the return the company earns on every dollar invested.

This matches Trading Central’s “Value Investor Basics + Breakout (USA)” strategy which produced a 13% annualized 5-year historical return.

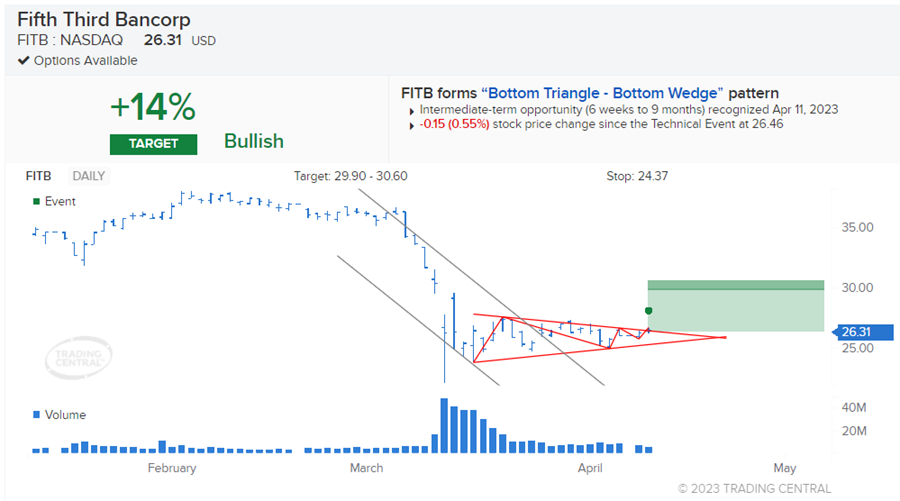

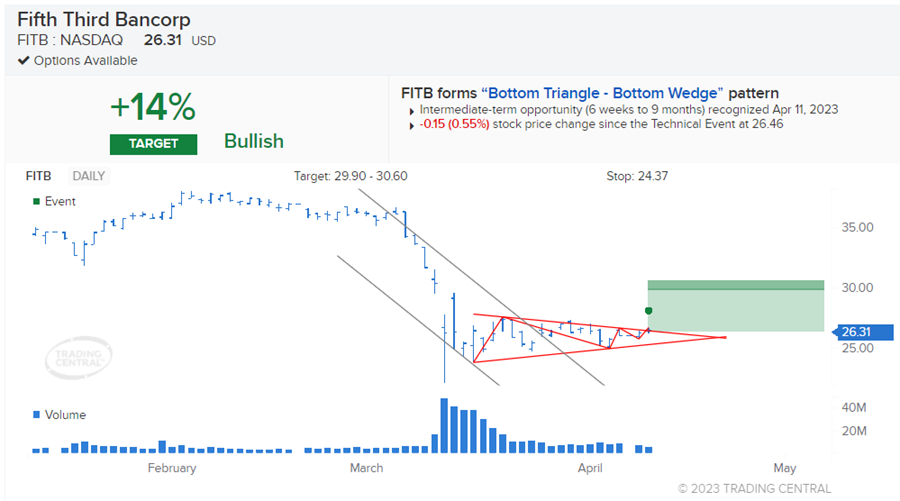

Fifth Third Bancorp (FITB: NASDAQ) confirmed a bottom triangle-Bottom Wedge pattern with an upside potential of 14%.

What was found:

- The stock’s price has broken upward to confirm a classic chart pattern, offering a target price for the intermediate-term.

- The stock is looking like a good value investment because it is above average in two key valuation ratios;

- Price/Book Ratio is 1.18 which tells us that the stock price is reasonably low when compared to the company’s book value (representing the value of all equity);

- Price/Cash Flow Ratio is 2.84 which tells us that the price of a share is relatively low when compared to the cash flow being generated by the company.

- Earnings Yield is 13% which represents the return the company earns on every dollar invested.

This also matches Trading Central’s “Value Investor Basics + Breakout (USA)” strategy which produced a 13% annualized 5-year historical return.

Trading Central “Featured Ideas” is a quick way to search for high probability setups each day in only a few minutes. Go try it out, customize your strategy and find out what unique opportunities exist today.

—

The investment ideas presented here are for information only. They do not constitute advice or a recommendation by Trading Central in respect of the investment in financial instruments. Investors should conduct further research before investing.

Gary Christie is head of North American research at Trading Central in Ottawa, Canada.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Trading Central and is being posted with its permission. The views expressed in this material are solely those of the author and/or Trading Central and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)