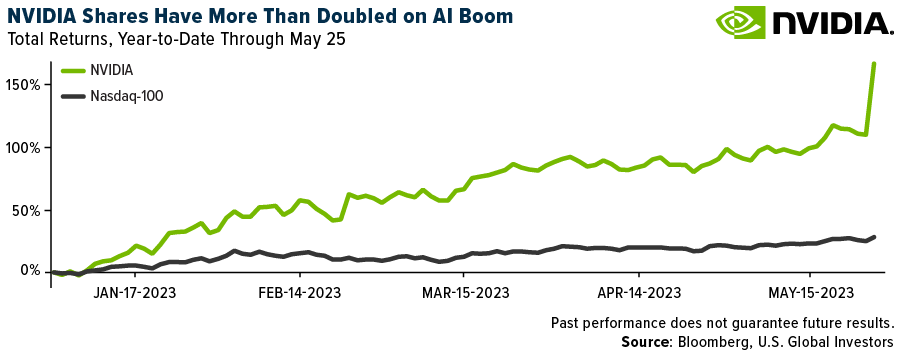

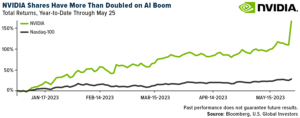

If you were doubting whether the age of AI has arrived, NVIDIA’s stock performance last week may have given you second thoughts.

Shares of the Santa Clara, California-based chipmaker rocketed up more than 24% on Thursday, marking one of the top five biggest one-day market cap gains of any publicly traded U.S. company ever. With an approximately $957 billion valuation, NVIDIA may soon join the likes of Apple, Microsoft, Alphabet and Amazon in the highly exclusive $1 trillion+ club.

Year-to-date through today, NVIDIA’s stock has returned over 160%, compared to the tech-heavy Nasdaq, up around 30% over the same period.

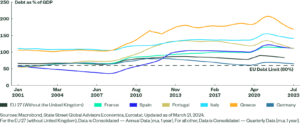

So what’s going on? The U.S. Treasury could run out of cash as soon as June 5, the yield curve is flashing a recession and household debt now tops $17 trillion. Is this more “irrational exuberance”?

That’s hard to say in the short term, but over the long term, I believe a bet on semiconductors, artificial intelligence and data centers is looking more and more attractive as AI is set to be applied to countless functions. NVIDIA is just one way to play it.

ChatGPT Leads The Race In Generative AI… For Now

NVIDIA reported blockbuster results in the quarter ended April 30, logging net income of over $2 billion, a 26% increase over the same period last year. Data center revenue hit a record $4.28 billion during the quarter, with founder and CEO Jensen Huang stating that “a trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.”

Today, when most people hear “generative AI,” they probably think of ChatGPT, the large language model (LLM) launched by OpenAI in November 2022. As I shared with you before, ChatCPT reached 100 million active users in as little as two months (for comparison’s sake, it took TikTok nine months to reach that goal), and it attracted 1 billion visitors to its website in February.

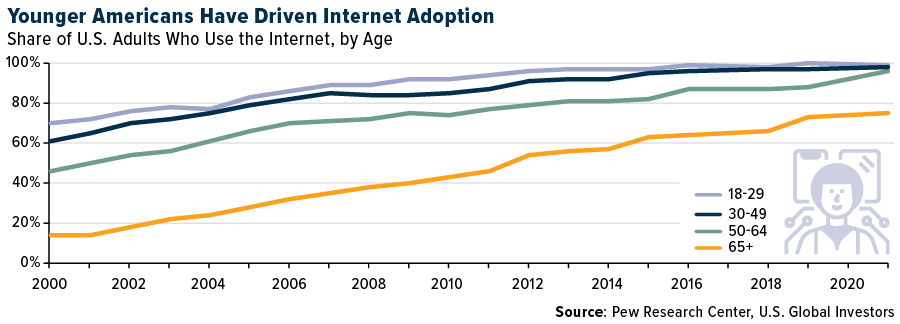

But ChatGPT is only the start, just as America Online (AOL) was many people’s first gateway into the internet 25 to 30 years ago. Over the coming months and years, I expect to see an eruption of new AI-focused companies and applications.

According to a Pew Research survey, almost 60% of U.S. adults have heard of ChatGPT, but only 14% have actually used it. Just as we saw during the early days of the internet, younger Americans have been far more likely to try ChatGPT than their older peers. Nearly one in three (31%) Americans under 30 reported using the app, compared to only 4% of those age 65 and older.

An Insatiable Appetite For GPUs

What does this have to do with NVIDIA? Well, ChatGPT requires biblical amounts of processing power. Its latest product, GPT-4, is reportedly trained on a staggering 170 trillion parameters, making its responses sound even more genuine and humanlike than the previous version.

(In case you were wondering, ChatGPT was not used to write this. But then, how would you know for sure? One study found that over 63% of Americans can’t tell the difference between human-generated content and AI-generated content.)

Since OpenAI is a private company (valued at $30 billion in January), verifiable data is hard to come by, but according to an estimate by UBS, ChatGPT uses 10,000 NVIDIA graphics processing units (GPUs)—with the potential for thousands more as the model becomes more sophisticated and the number of active users grows.

In other words, if AI were the California Gold Rush, then NVIDIA would be the biggest seller of picks and shovels.

Investing In Data Centers

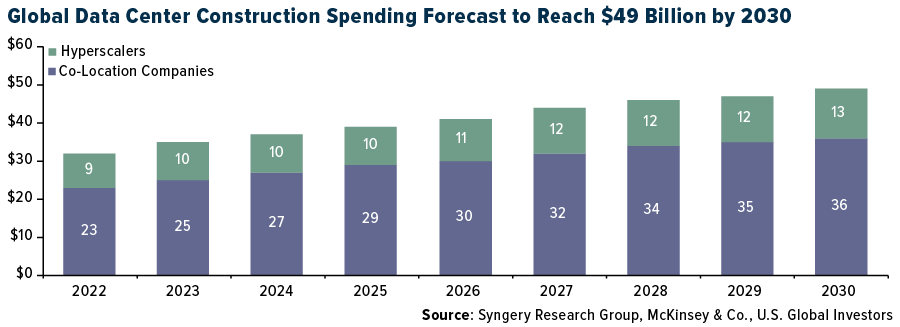

Besides chipmakers, another way to play the AI boom is with data centers, which can feature utility-like cash flows. Virginia hosts the largest concentrated data center market in the world, with Northern Virginia home to data centers operated by Microsoft, Amazon Web Services (AWS), Google, Visa and many more.

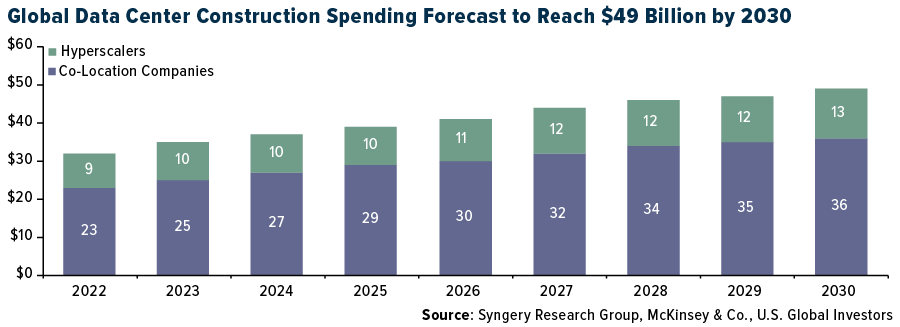

By 2030, global demand for data centers is expected to reach 35 gigawatts (GW), up from 17 GW in 2022, according to McKinsey. Construction spending could hit $50 billion by 2030, up from around $35 billion today. That would represent a compound annual growth rate (CAGR) of 5.4%.

Last week, billionaire real estate investor Kyle Bass told Bloomberg that he likes data centers right now, saying people can’t even finish developing one “before one of the FAANGs leases it for 30 years.”

“Data centers are white-hot,” he added, urging investors to consider them as a way to position for expansion in AI.

The NASDAQ-100 Index is a modified capitalization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ. No security can have more than a 24% weighting.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2023): Apple Inc., Amazon.com Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

—

Originally Posted May 30, 2023 – NVIDIA Expected To Join The Trillion-Dollar-Valuation Club As AI Dominates

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.