Key Takeaways:

- S&P 500 blended EPS growth for Q4 increases for the second week in a row, now expected to come in at -4.7%.

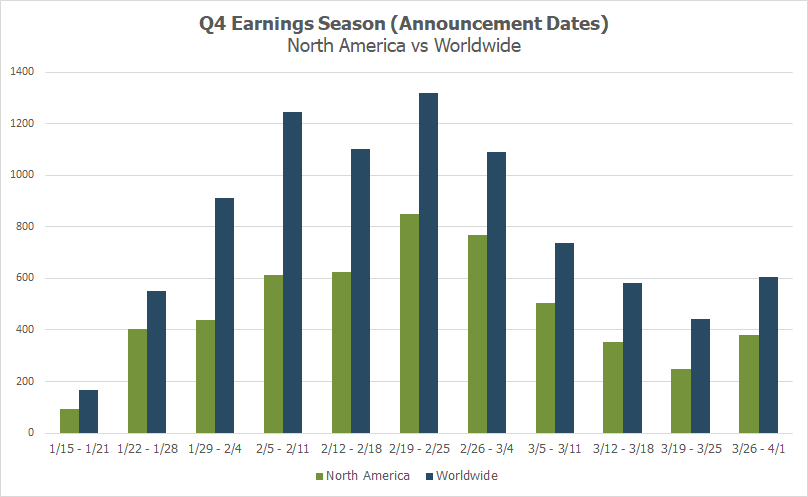

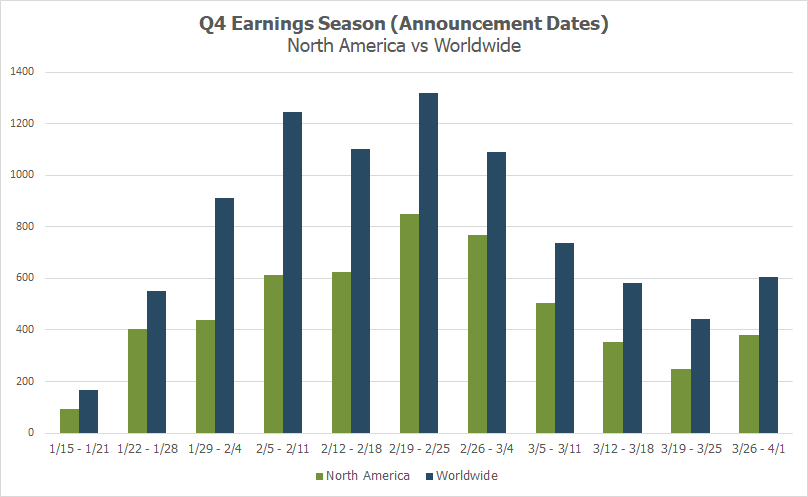

- Peak earnings season rolls on this week with 1,524 global companies expected to report, as investors start to focus on Consumer Discretionary names

- Potential surprises this week: EBAY

This marks the fourth peak week for the Q4 earnings season. If you recall, the fourth quarter reporting season stretches longer than any other, typically with four or five peak weeks vs. the three peak weeks seen for Q1 – Q3. This week we start to get results from the retailers, but there is debate as to whether those reports will be as rosy as the reading we saw on Retail Sales last week.

January Retail Sales increased 3% MoM, much better than the 1.9% that was expected. These numbers are not adjusted for inflation, meaning that consumers out-shopped the 0.5% inflation rate for the month as measured by CPI. But while the consumer has remained resilient in the face of inflation, in large part due to a steady job market, many retailers have been forthcoming about how difficult it’s been to entice shoppers to spend their discretionary income. A heavy promotional environment which started in October as part of the holiday shopping season has held on longer than retailers ever intended, with discounts deeper than desired. So while it’s great to see a consumer that is still active, those dollars are hard-earned.

While Retail Sales showed restaurants and bars pushed growth higher for January, we continue to see consumers trade down in this segment. A handful of operators of fast casual and casual dining restaurants reported last week, and while Denny’s (DENN), Shake Shack (SHAK), BJ’s Restaurants and Bloomin’ Brands (BLMN) were all able to beat on the bottom-line, the former three came roughly in-line on revenues, while BLMN missed sales estimates. Texas Roadhouse (TXRH) missed on both earnings and sales. The same story holds from last week, with fast food continually outpacing fast casual and casual dining.

Heading into the retail earnings parade, S&P 500 EPS growth now sits at -4.7% the second consecutive week of improvement, up from -4.9% last week.¹

Peak Earnings Season Continues – Week 4 of 5

This marks the fourth peak week of the Q4 earnings season, with 1,522 companies (from our global universe of 9,500 equities) anticipated to release results, 61 of those coming from the S&P 500. All eyes will be on retailers as we get results from: Wal-Mart (WMT), Home Depot (HD), TJX Companies (TJX), Etsy (ETSY), eBay (EBAY) and Wayfair (W)

Source: Wall Street Horizon

Potential Surprises in the Week Ahead

This week we get results from a number of large companies on major indexes that have pushed their Q4 earnings dates outside of their historical norms. Five companies within the S&P 500 confirmed outlier earnings dates for this week, four of which are later than usual and therefore have negative DateBreaks Factors*. Those four names are DaVita Inc. (DVA), DTE Energy (DTE), Genuine Parts Company (GPC) and Celanese Corporation (CE). According to academic research, the later than usual earnings dates suggest these companies will report “bad news” on their upcoming calls. PublicService Enterprise Group (PEG) confirmed an earlier than usual date, suggesting they will report “good news” on their upcoming call.

eBay (EBAY)

Company Confirmed Report Date: Wednesday, February 22, BMO

Projected Report Date (based on historical data): Tuesday, February 15

DateBreaks Factor: -2

eBay technically isn’t included on the list of late reporters from the S&P 500 because their DateBreaks factor is only -1.9 which is a slightly less significant than the outliers (those with a DateBreaks factor of -/+2 and -/+3) we tend to focus on, but in this case the fact that EBAY confirmed their earnings date so late has our attention.

Typically EBAY confirms their Q4 earnings date around January 11 plus or minus 7 days. This year they didn’t confirm until February 1, or 21 days past their mean confirmation day. While this would typically have us on high alert, it is important to note that they announced their acquisition of 3PM Shield, a “provider of advanced AI-based marketplace compliance solutions,” earlier this week. M&A activity tends to result in earnings date movements.

Wall Street analysts expect eBay to post flat YoY profit growth and a revenue decline of 6% YoY, the 7th consecutive quarter of sales decreases. The company also just announced it was trimming their workforce by 4%.

Earnings Wave – 74% Confirmed, 44% Reported (In our universe of 9,500 global equities)

This week marks the fourth week of Q4 peak earnings, with 1,524 companies (from our global universe) expected to report. Currently February 23 is predicted to be the most active day with 678 companies anticipated to report.

Source: Wall Street Horizon

¹ https://advantage.factset.com

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

—

Originally Posted February 21, 2023 – Signs Point Towards Not So Rosy Outlooks from Retailers

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)