ZINGER KEY POINTS

- Tesla is among the early reporters in the mega-cap space.

- Price cuts are widely expected to dent margins and revenue growth is also expected to slacken.

Tesla, Inc. shares have been stuck in a rut ever since the electric vehicle maker reported lackluster deliveries for March. As the company prepares to share its quarterly financial scorecard with the Street, here’s what Tesla investors should watch out for:

Key Q1 Metrics:

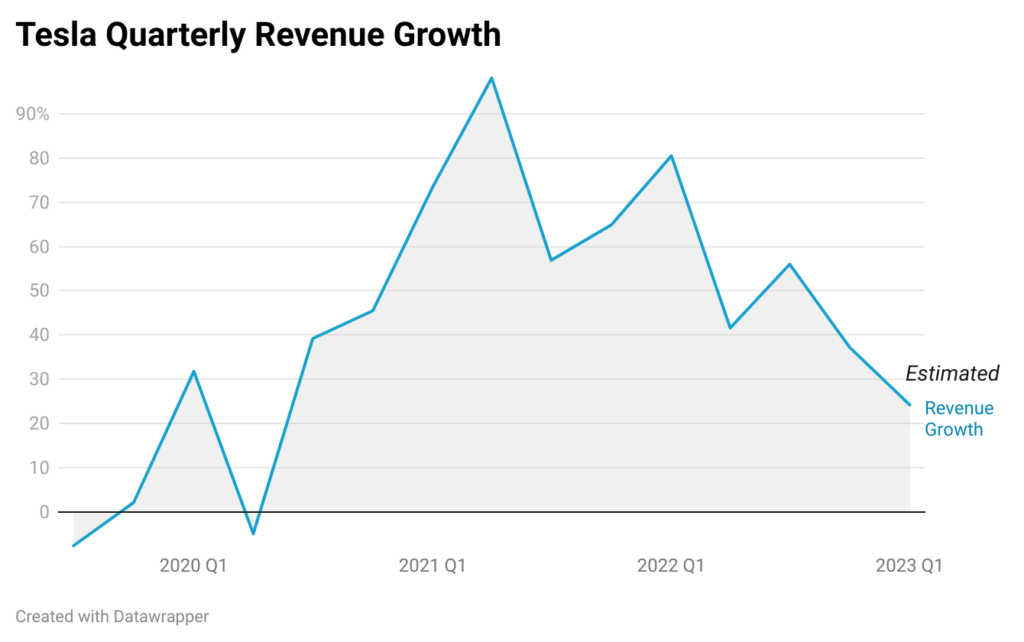

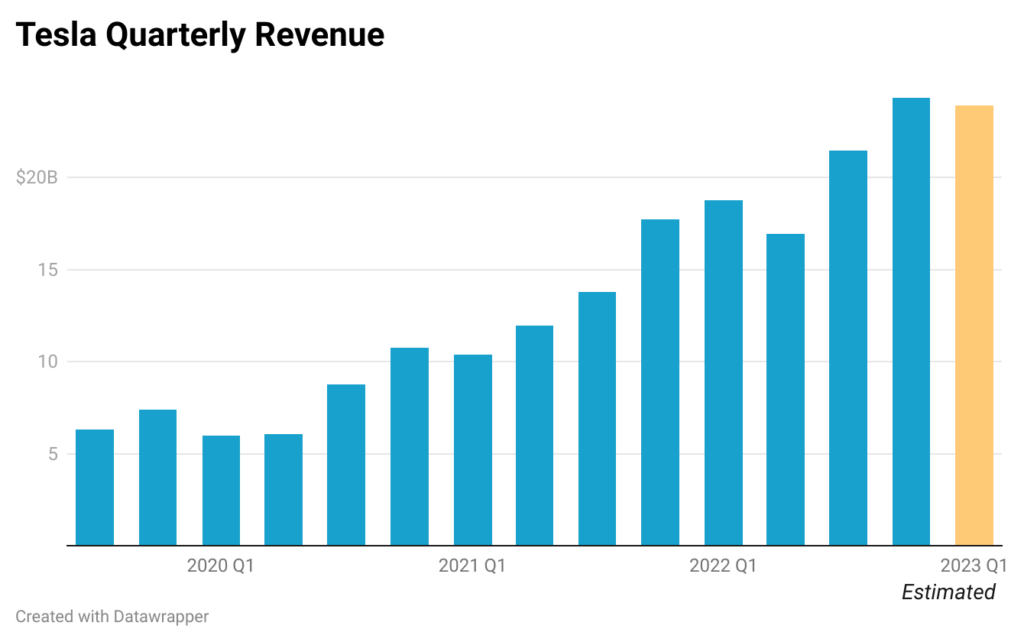

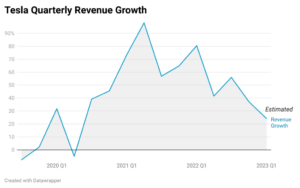

Tesla is widely expected to report the slowest year-over-year revenue growth since the second quarter of 2020 that followed the outbreak of the COVID-19 pandemic globally. In 2020, the second quarter saw a revenue decline of 4.9%.

Analysts, on average, expect the Elon Musk-led company to report revenue of $23.29 billion, according to Benzinga Pro data. This would mark a 24.20% growth from the year ago’s $18.76 billion, but a 1.73% quarter-over-quarter drop.

Automotive revenue accounted for 87.6% of the total revenue in the fourth quarter of 2022 and roughly 90% of the revenue in the year-ago quarter.

The first-quarter non-GAAP earnings per share are expected to decline 20.6% year-over-year from $1.07 to $0.85.

Margin Overhang:

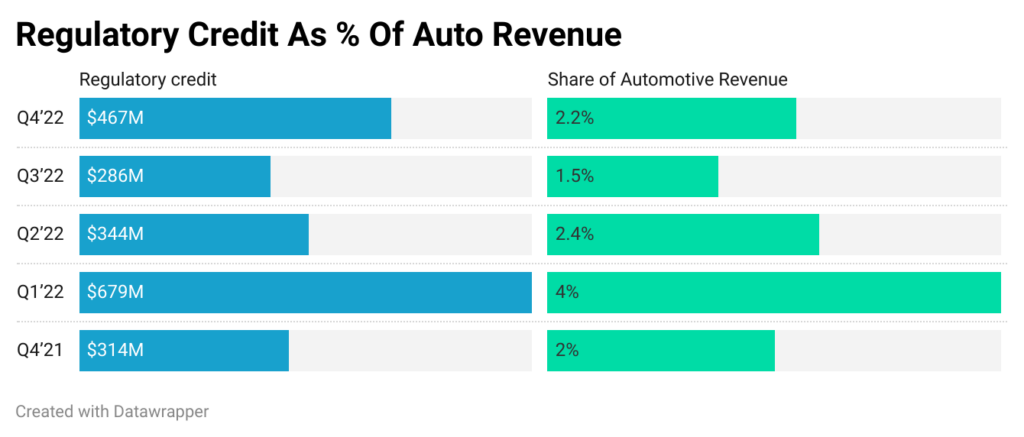

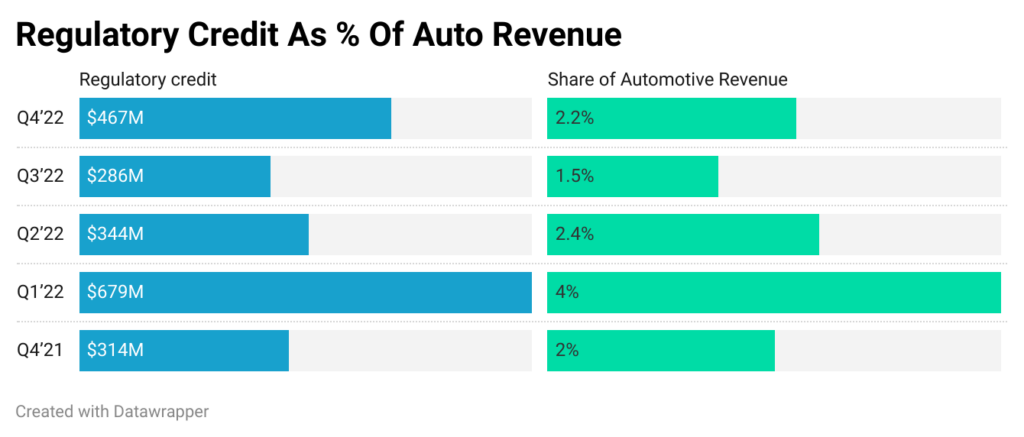

Analysts typically consider regulatory credits as noise on gross margins. Regulatory credits, with their 100% gross margin, have the capacity to boost both automotive and overall gross margin performance.

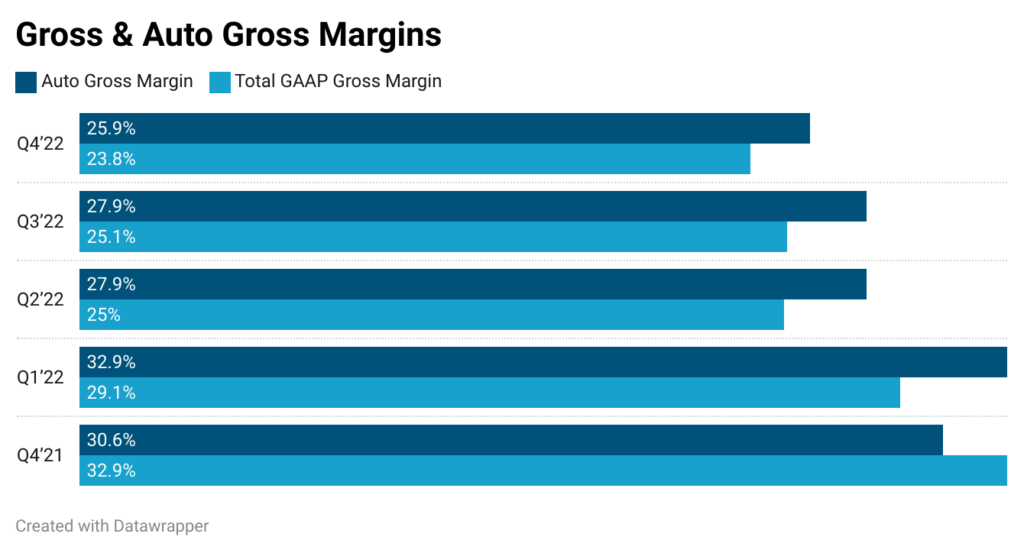

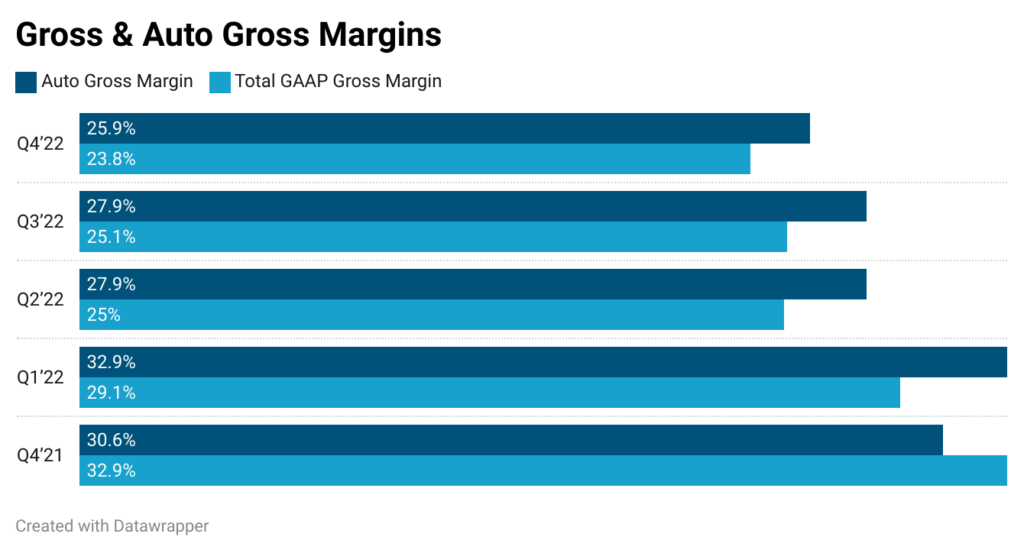

The series of price cuts announced by the company since October in China, and since the start of this year in both China and the rest of the Tesla’s global markets, have been a cause for analysts’ concerns and Tesla investors alike. As recently as Tuesday, a day ahead of the quarterly results announcement, the company reduced prices of Model Y and the base variant of Model 3 vehicles. CFO Zach Kirkhorn said on the fourth-quarter earnings call that he expects automotive gross margin to be around 20%, excluding leases and credits.

Future Fund’s Gary Black tweeted this week that he expects the company to talk down the volume and gross margin assumptions on the earnings call. ” “My sense is both estimates may come down given TSLA’s declining order backlog and Elon’s affordability narrative,” he said.

Wedbush’s Daniel Ives, a Tesla bull, said in a recent note that the “price cuts came at a price and this tug of war between volumes and margins is now the big debate on the Street heading into earnings and the rest of FY23.”

The analyst also sees further price tweaks in several geographies based on demand trends as well as tax credits.

Focus Of Earnings Call:

Tesla officially guided to a 2023 volume of 1.8 million units, a 37% year-over-year increase, trailing the company’s long-term target of 50%. Musk, however, did say that the unofficial estimate was at 2 million units.

Shareholder questions compiled by Say showed that Tesla investors are keen on getting updates on Cybertruck’s launch timeline and features, Tesla Energy, vehicle pricing strategy, the possibility of dividend payment, and the timeline for new models.

Tesla Stock:

Tesla shares have gained about 50% year-to-date, a solid rebound from the 66% drop in 2022. After starting the year on a low note, stung by a first-quarter deliveries miss, the stock recovered nicely.

The stock hit a high of $217.65 in mid-February. The turnaround came amid the broader market strength, hype around the March 1 Investor Day, and the aggressive price actions implemented by the company.

Following the release of first-quarter deliveries, the stock pulled back and has been going through a consolidation phase.

If the stock fails to hold support at its 200-day moving average of $180, it could pull back toward its mid-March lows of around $164. On any potential upside, the stock could stall at its psychological resistance of $200. Further up, the $207 level could serve as resistance.

Tesla shares were down 2.64% to $179.44 during early trading on Wednesday, according to Benzinga Pro data.

—

Originally Posted April 19, 2023 – Tesla’s Crucial Q1 Earnings Reveal: Can Margin And Volume Outlook Ignite A Stock Resurgence?

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.