Global equity markets have been in a bit of a funk. After another morning of “sell the rips”, which resulted from an overnight bounce that once again failed, we saw European markets close mostly lower and US markets gave back their early gains. The NASDAQ 100 Index (NDX) was up over 1% shortly after the open and down more than 1% within 90 minutes. Traders are apparently confused by the news flow emanating from the Russia/Ukraine crisis. We see that confusion in relatively elevated levels of the CBOE Volatility Index (VIX) and in its persistently inverted futures curve.

Investors often have trouble pricing in geopolitical concerns. They are quite adept at discounting company or industry specific events that directly impact companies’ revenues or earnings. They have much less conviction about how faraway events that directly impact market psychology but have nebulous effects upon company valuations.

We recently discussed that volatility arises from investors’ inability to reach a consensus about the fair value of assets. That is not an easy prospect under normal circumstances, when traders are continually repricing a wide range of securitized assets, and even more difficult when the repricing is caused by global megatrends rather than routine flows of money. It is therefore not surprising to see this uncertainty reflected in elevated levels of the CBOE Volatility Index (VIX).

We have become accustomed to hearing VIX described as the market’s “fear gauge.” I have long contended that VIX was not constructed as a such, but functions as one nonetheless because traders are more skittish during environments when fear outpaces greed. (I debated this point in a recent podcast with one of the index’s early adopters). I prefer to think of VIX as an uncertainty index, and one can certainly assert that we are amidst a period of global uncertainty. Either way, we shouldn’t be surprised to see VIX flirting with the 30 level, as it has been doing in recent days.

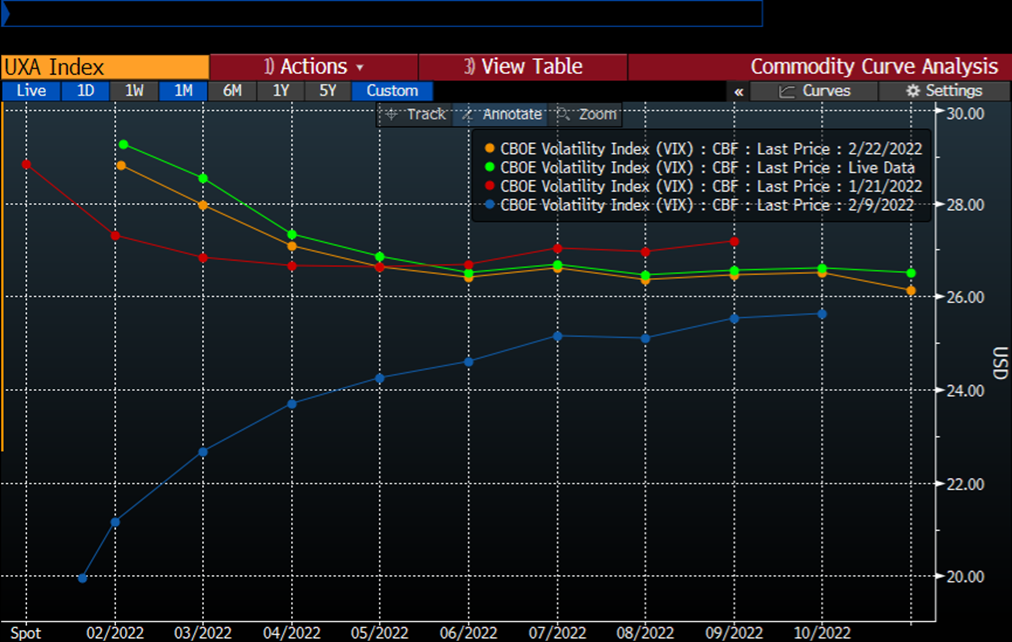

As we reckon with the nature of the current crisis, we see an inversion, or backwardation, in the VIX futures curve. Remember that a futures curve in backwardation usually means there is a temporary shortage of the commodity in question. In this case, the commodity is volatility protection. We see from the graph below that the VIX curve has largely been inverted during this morning’s (green line) and yesterday afternoon’s trading (orange line), and that the market is pricing in relatively high levels of volatility throughout the rest of the year:

VIX Futures Curves – Today (green), Yesterday (orange), 2 Weeks Ago (blue), 1 Month Ago (red)

Source: Bloomberg

It is quite interesting to see how the market flipped from nervous one month ago (red) to sanguine two weeks ago (blue) then back to nervous. A glance at a chart of the S&P 500 Index (SPX), upon which VIX is based, should make the reasons for that shifting sentiment more apparent:

One Month Chart of SPX, 10 Minute Bars

Source: Interactive Brokers

We see that the dip in VIX coincided with a bounce in SPX and vice versa. I don’t find it at all curious that either the broad market bounced, nor that VIX moved inversely with SPX – both are normal – but I do find the rapid shifts in sentiment to be notable. It is as though traders were so eager to see a rebound that they were willing to ditch the protection that they sought so dearly just two weeks prior, only to want it once again shortly thereafter.

I have heard certain market commentators refer to certain levels of VIX as buy and sell points. Some view 20 as a buy level and 30 as a sell point. I find that simplistic and worthy of a contrarian view. If you had used a 20 VIX level as your rationale to buy stocks two weeks ago, you would have rued that decision quickly. Conversely, had you waited until VIX reached 30 to become a seller, that would have involved riding stocks considerably lower before that signal arose.

Instead, I prefer to look at the shape of the curve, along with its level, and to take both into context. In my experience, an inverted curve, such as we are seeing now, is a necessary, but not sufficient signal. A sharply inverted VIX futures curve often accompanies major bottoms. Those occur when many of the staunchest bulls find themselves clamoring for protection, meaning that the selling has climaxed. We can see spot VIX well into the 30’s or higher when that occurs.

What we see now is indeed an inversion, but it is somewhat flattish, with spot exceeding front-month futures by about a single point and only 3 points above outer-month contracts. The market is telling us that traders are nervous, but not necessarily climactically so. I interpret the message of the market to be that we should continue to expect volatility – remember that volatility encompasses moves in both directions – but not to expect that a major bottom was put into place in recent sessions.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)