- Banking turmoil has cast aside the Fed and inflation as the key macro risk

- With Q1 earnings just a few weeks away for many large and small Financials sector companies, volatility likely persists in the near term

- We spotted one regional bank with a suspiciously late earnings date confirmation that warrants closer attention following the SIVB collapse

Did you have “systemic regional banking crisis” on your 2023 financial risks bingo card? What makes a market shock a true black swan is that few market participants see it coming. Everyone from Wall Street pros to families on Main Streets across America knew that inflation was a key concern in 2023. And every pundit was sure that the Fed’s actions could bring about volatility in both the equity and fixed-income markets this year. But the sudden failure of SVB Financial (SIVB) brought a crisis in confidence in the banking industry front and center.

Shifting Focus to Individual Companies

And there’s still so much uncertainty. With Signature Bank being taken into survivorship by regulators and UBS poised to takeover Credit Suisse, it feels like 2008 all over again. Portfolio managers must aim to be a step ahead of risk – of course, that is easier said than done. But one strategy is to turn away from the macro for a moment and see what events could spark volatility at the asset-specific level.

Wall Street Horizon tracks and reports on more than 40 corporate event types so that clients can pinpoint when volatility may spike at the company level. It’s by using these singular events that broad macro analysis can also be performed in a risk-focused way.

KeyCorp: Late Earnings Date Confirmation

One name that we are growing more concerned about is Key Corp (KEY). We will leave it to our clients to make their own decisions on where the stock could go, but this name is a red flag. Here’s why: KEY typically confirms its Q1 earnings date around February 7 with a standard deviation of about 20 days. As of March 20, the firm has yet to confirm its reporting date, making the delay about two standard deviations later than normal.

Our research shows that firms with abnormally late earnings confirmation dates tend to report bad news, then underperform when they finally issue quarterly numbers. Will that be the case for KeyCorp? Hard to say, but with regional banking worries left and right, this is not a bullish look for the Cleveland-based $11 billion market cap Financials sector firm.

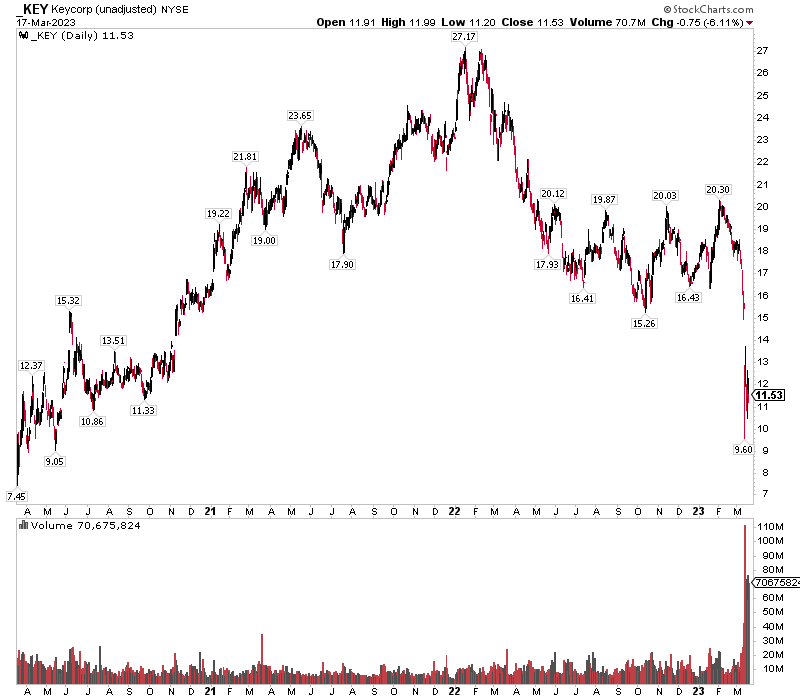

KEY 3-Year Stock Price History: Massive Plunge on Huge Volume

Source: Stockcharts.com

KEY missed Q4 earnings estimates back in January as a result of rising costs on deposits and an increase in its credit loan provision. Hindsight’s 20/20 but that is now a big focus among bank analysts – where depositors’ money is flowing as 4.5% yields are there for the taking in money markets and high-yield online savings accounts.

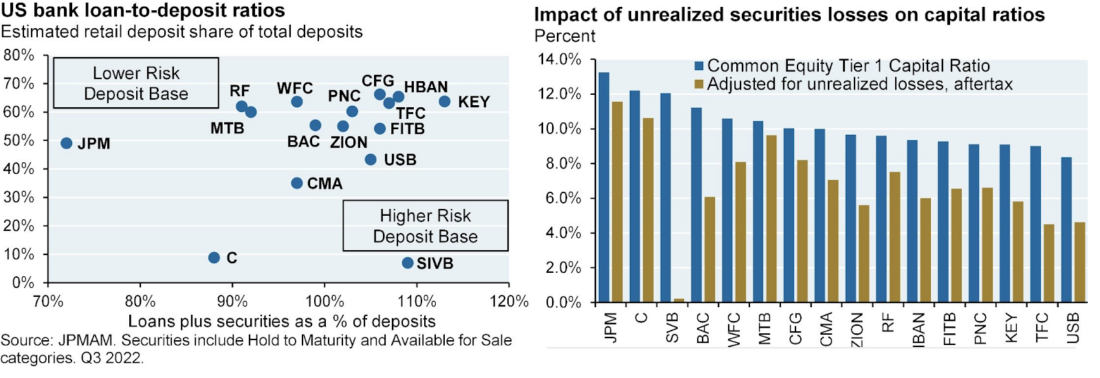

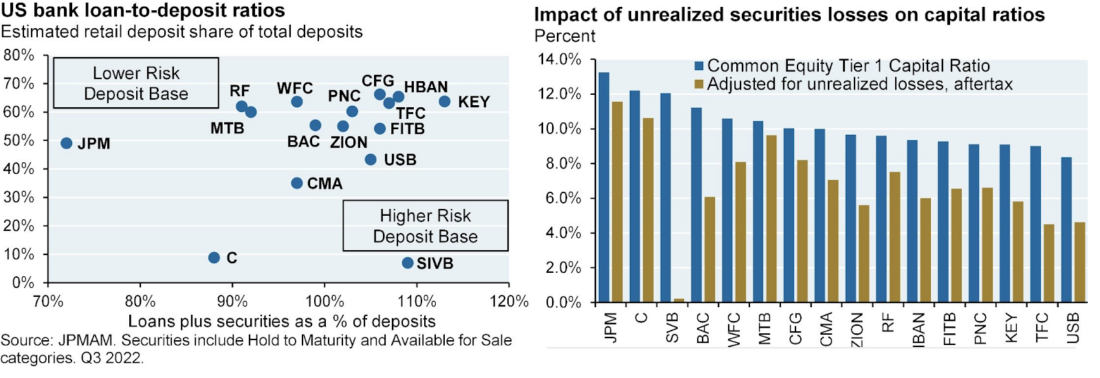

Unlike SIVB, though, KeyCorp has a higher retail share of its total deposits, which is generally seen as a lower risk compared to the concentrated tech-oriented nature of SIVB’s customer base. Still, there’s risk with KEY’s balance sheet as loans plus securities represent more than 110% of total deposits. The bank’s common equity tier 1 capital ratio is near 9%, but after adjusting for after-tax unrealized losses, that figure drops to just 6%. Investors will want to pay attention to trends in KeyCorp’s deposit costs and flows, as well as the value of securities on its balance sheet when the firm reports Q1 numbers.

KEY: Significant Unrealized Losses on its Assets, But Lower Rates Today Help

Source: JPMorgan

The good news for banks writ large is that the steep fall in Treasury yields this month is actually a boon. Those unrealized losses in held-to-maturity assets improve markedly when investors flock to the safety of government bonds. As we all know, Treasury prices rise when yields fall. In a sense, for strong financial institutions, the cure for a banking crisis in an inflationary environment and with an inverted yield curve is … a banking crisis. That’s what makes 2023’s financial turmoil different from the 2008 crisis. It’s not that bad loans were made this time – it is the mismanagement (or investors’ fears of mismanagement) of assets and liabilities. Duration risk, or asset-liability matching, is one of the fundamental risk management tasks for a bank.

The Silicon Valley Bank Saga

SIVB is a tragic example of terrible governance in that (for starters) the company went a stunning eight months without a Chief Risk Officer. But the true flaw was that the VC and PE-centered bank failed to hedge its long-Treasury and MBS portfolio from rising yields (and falling prices). As the tech world slowed suddenly last year, trouble began. And once fears of the bank’s solvency were tweeted about following a failed capital raise in early March, depositors demanded their cash. That caused the firm to have to liquidate parts of its available-for-sale portfolio, resulting in further unrealized losses in the held-to-maturity book. The bank could not absorb the financial hit from selling its HTM portfolio, thus government support was needed.

The Bottom Line

That’s a story for the history books now, though the saga is still unfolding. Traders will soon turn their focus to the Q1 earnings season that begins in a few weeks. We expect KeyCorp to issue results on Thursday, April 20 BMO. So, mark that date on your calendar to see if there is something to its unusually late earnings date confirmation.

—

Originally Posted March 20, 2023 – What’s the Next Financial Shoe to Drop? Eyeing a Late Earnings Date Confirmation

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.