Companies that consistently grow their dividends are popular with investors. These high-quality companies typically offer stable earnings and strong histories of profit and growth, as well as solid fundamentals and business models.

Historically, dividend growth companies have outperformed the broader S&P 500 index and provided durable income growth across market caps and industry sectors. These attributes have timeless appeal, but they can be particularly relevant during turbulent markets.

Enduring Quality

Quality always deserves a place in our investment portfolios. In the investing sense, quality can be measured using both qualitative and quantitative metrics.

- Qualitative — Companies that have durable and sustainable competitive advantages (what Warren Buffett calls an “economic moat”) and are run by shareholder-friendly management teams are generally considered high quality.

- Quantitative — Companies’ quality can be quantified by measuring their balance sheets and earnings. The more a company earns from its assets, equity and capital, and the lower its levels of debt, the higher its perceived quality. It is even better if those results have been consistently produced.

But there may be a simpler way to identify quality through examining a company’s dividend history. Companies that have consistently increased their dividends year after year tend to be of high quality. They’ve endured—and even thrived—through countless up and down economic cycles. And they’ve steadily increased revenues and cash flows, which in turn has enabled them to consistently increase their payouts to shareholders.

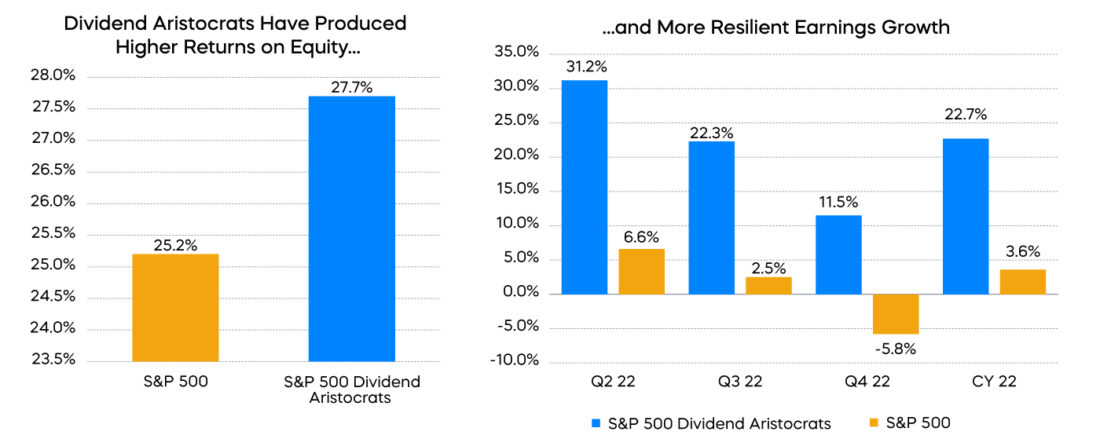

Dividends may be the strongest signal a company can send about its ability to increase profits and cash flows into the future. The S&P 500 Dividend Aristocrats, for example, are an elite group of large-cap companies that have grown their dividends for at least 25 consecutive years, with most doing so for over 40 years. They have produced greater return on equity and shown significantly more resilient earnings growth over time compared with the broader S&P 500.

Source: FactSet, 3/1/22 – 4/20/23. Return on equity measures how efficiently a company generates profits and equals a company’s net income divided by shareholders’ equity. CY is defined as current calendar year. Index returns are for illustrative purposes only and do not represent fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index. Past performance does not guarantee future results.

All-Weather Outperformance

There are many potential benefits that come with investing in quality companies that continually grow their dividends. For example, a significant benefit of the S&P 500 Dividend Aristocrats is its history of all-weather outperformance. With its strong track record, investors can potentially use the Dividend Aristocrats to help anchor almost any well-diversified portfolio across a myriad of market conditions.

- Since its inception, the S&P 500 Dividend Aristocrats Index has outperformed the S&P 500 with lower levels of volatility—potentially turning a $10k initial investment made in May 2005 into over $61k by March 2023.

- With an upside-downside capture1 of 91% and 80%, the S&P 500 Dividend Aristocrats has delivered strong performance in both rising and falling markets.

- It has been particularly resilient during market drawdowns, outperforming the S&P 500 by over 12% in 2022. In fact, the Dividend Aristocrats Index has outperformed the S&P 500 during eight of the 10 worst quarterly drawdowns since 2005.

Consistent Dividend Growth Strategies Have Outperformed, with Less Volatility

Sources: Bloomberg and Morningstar, 5/2/05 – 3/31/23. Since inception performance of the S&P 500 Dividend Aristocrats versus the S&P 500. The performance quoted represents past performance and does not guarantee future results. Index returns are for illustrative purposes only and do not represent fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index.

Focusing on Dividend Growth vs. High Yield

Dividend strategies are often used to generate portfolio income. Too often, however, investors focus on immediate levels of yield. We view dividend income growth and sustainability as more important factors that demand greater attention, especially during periods of uncertainty.

- High dividend yielding companies often reduce dividends in difficult periods—during the Great Financial Crisis of 2008, for example.

- High yielders tend to have higher dividend payout ratios, affording them less financial flexibility—if revenues or cash flows suffer during a downturn, vulnerable dividends can put pressure on stock prices.

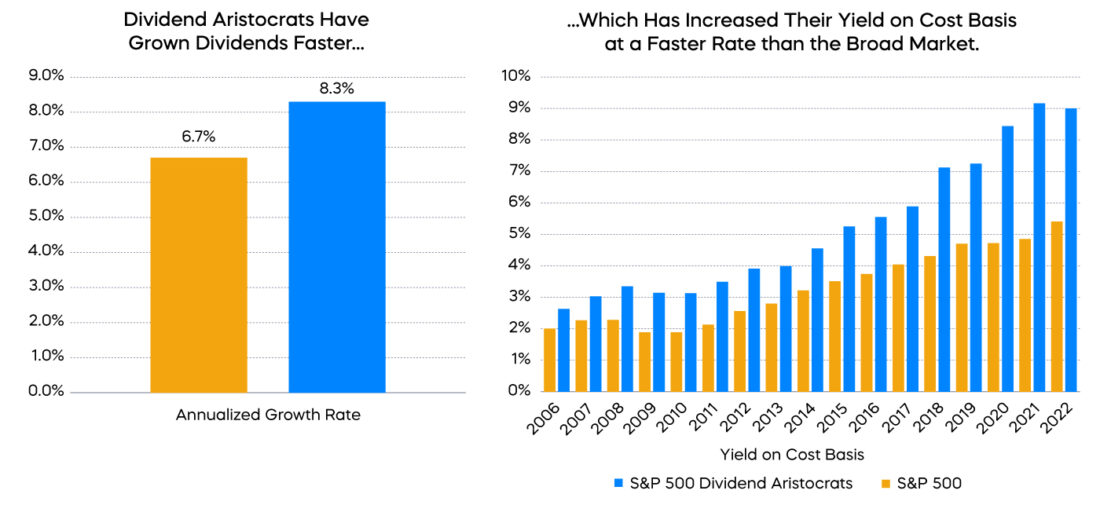

- By consistently growing their dividends, the S&P 500 Dividend Aristocrats have demonstrated higher levels of yield on cost compared to high dividend yielding companies, despite lower levels of initial yield.

Source: Standard & Poor’s and ProShares calculation. 5/2/05 – 12/31/22. Yield on cost measures dividend yield based on the original purchase price of a stock, and it can grow significantly over time if a company regularly increases its dividend.

The Takeaway

While growth and value styles of investing often receive more attention, focusing on quality is a timeless strategy for anchoring your portfolio. An easy way to identify quality is to look for companies with an extended history of dividend growth. Companies in the S&P 500 Dividend Aristocrats Index have grown their dividends for at least 25 consecutive years, and they have outperformed the S&P 500 over time. As a group, the S&P 500 Dividend Aristocrats have also provided faster and more durable income growth, producing attractive levels of yield on cost.

1Upside/downside capture ratios show whether an investment outperformed (gained more or lost less than) a benchmark during periods of market strength or weakness, and if so, by how much.

—

Originally Posted May 8, 2023 – Why Dividend Growth Is a Timeless Strategy

This is not intended to be investment advice. Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Index information does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

The “S&P 500® Dividend Aristocrats® Index” and “S&P 500®” are products of S&P Dow Jones Indices LLC and its affiliates and have been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and both have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by these entities and their affiliates as to their legality or suitability. ProShares based on these indexes are not sponsored, endorsed, sold or promoted by these entities and their affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

ProShares ETFs (ProShares Trust and ProShares Trust II) are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor or sponsor.

Your use of this site signifies that you accept our Terms and Conditions of Use.

Disclosure: ProShares

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at the time. Whether or not actual results and developments will conform to ProShare Advisors LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing involves risk, including the possible loss of principal. This information is not meant to be investment advice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from ProShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or ProShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.