For the five trading sessions that spanned Feb 17 to 23, the Straits Times Index (STI) slipped 1.4 per cent with the Hang Seng Index declining 2.4 per cent and the FTSE Bursa Malaysia KLCI falling 2.3 per cent.

Institutions were net sellers of Singapore stocks over the five sessions with S$135 million of net outflow.

Keppel Corporation, Singtel, Jardine Matheson Holdings, Singapore Airlines and DBS led the net institutional outflow for the five sessions.

Meanwhile, Yangzijiang Shipbuilding, Mapletree Logistics Trust, Genting Singapore, Sembcorp Marine and Nanofilm Technologies International led the net institutional inflow for the five sessions.

Share buybacks

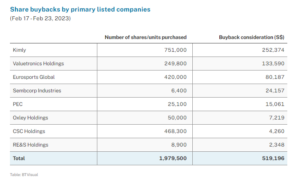

As the earnings season continues, there were eight primary-listed companies conducting share buybacks over the five trading sessions through to Feb 23, with a total consideration of S$519,196.

Kimly led the consideration tally, buying back 751,000 shares at an average price of S$0.34 per share.

Director and substantial shareholder transactions

The five trading sessions saw close to 30 changes to director interests and substantial shareholdings filed for 15 primary-listed stocks.

This included six company director acquisitions with no disposals filed, while substantial shareholders filed three acquisitions and three disposals.

Wilmar International

Wilmar International chairman and CEO, Kuok Khoon Hong, increased his deemed interest in the company following the release of its FY22 (ended Dec 31) financial results.

Between Feb 22 and 23, HPRY Holdings, in which Kuok has a deemed interest, acquired 535,000 shares at an average price of S$3.95 per share.

The consideration of the acquisitions totalled S$1,975,000. He maintains a 13.13 per cent total interest in Wilmar International.

Aside from exercising 495,000 employee share options on Dec 23, his preceding acquisitions were on Dec 21, with 5,800 shares purchased at S$4.09 per share through Hong Lee Holdings, and between Dec 1 and 8, with HPRY Holdings acquiring 6,421,700 shares bought at an average price of S$4.08 per share.

Kuok has extensive experience in the agri-business industry and has been involved in the grains, edible oils and oilseeds businesses since 1973.

He has gradually increased his total interest in Wilmar International from 12 per cent in August 2015.

On Feb 21, Wilmar International reported a record US$2.40 billion net profit for FY22, with all key segments reporting higher profits.

Excluding non-operating items and changes in fair value of biological assets, core net profit for FY22 improved 31 per cent to US$2.42 billion, while overall revenue increased 11.6 per cent in FY22 from FY21 to US$73.4 billion.

Wilmar International maintains three core business segments.

The feed and industrial products (tropical oils, oilseed and grains and sugar) segment contributed 55 per cent to Wilmar International’s FY22 revenue (prior to inter-segment transfer eliminations), while food products (consumer products, medium pack and bulk) contributed 39 per cent and plantation and sugar milling contributed 6 per cent.

In FY22, the feed and industrial products segment achieved a 23 per cent increase in pre-tax profit to US$1.56 billion (FY21: US$1.26 billion) on the back of sustained good performance from the tropical oils business and better margins from sugar merchandising activities in H2FY22, partially offset by weaker crush margins from the oilseeds business.

Kuok highlighted that FY22 was an exceptional year.

The Wilmar team managed operations well despite the volatility in the commodities markets and general economic slowdown during the past year.

He added that Wilmar benefitted from increased palm oil and sugar prices, good palm processing margins and higher shipping profit due to increased freight rates.

Looking forward, Kuok said he expects that FY23 will be challenging as plantation profits and palm processing margins are expected to be under pressure, but China should perform better due to the ending of its zero-Covid policy.

He mentioned that Wilmar will continue to build on its strategy and work towards expanding its footprint in the food and agri-business globally.

It will also be strengthening the integration across the various segments of the business, while maintaining reasonable confidence that FY23 results will be satisfactory.

First Sponsor Group

On Feb 21, First Sponsor non-executive chairman Calvin Ho Han Leong purchased 200,000 shares at an average price of S$1.37 per share.

With a consideration of S$274,726 this increased his total interest in the property group from 46.50 per cent to 46.52 per cent.

The principal business activities of the group are property development, property holding and property financing, with property development remaining the key business segment of the group.

Ho was appointed the non-executive chairman of the company on Apr 2, 2015.

Prior to this, he served as the non-executive vice-chairman of the company since Oct 1, 2007.

He has accumulated extensive experience during his tenure as CEO of Singapore-incorporated Tai Tak Estates, having been involved in its businesses, including in plantations, listed and private equities, and property holding and development.

He has also been instrumental in assisting the group’s senior management in the conceptualisation and setting of its strategic direction and corporate values.

First Sponsor Group is supported by both its established key controlling shareholders, the Hong Leong group of companies, through its shareholding interests in City Developments, and Tai Tak Estates, a private company with a long operating history, which was incorporated in Singapore in 1954.

On Feb 17, First Sponsor Group reported a FY22 (ended Dec 31) net profit of S$131.3 million, reflecting 8.1 per cent growth from FY21.

It also highlighted that the group has, on its own and with joint venture partners, made a record purchase of development land plots (all of which are in Dongguan) in FY22.

As such, it is expected that the group would have a record number of development projects under pre-sale in FY23.

Mapletree Pan Asia Commercial Trust

On Feb 21, MPACT Management independent non-executive director Lilian Chiang Sui Fook acquired 18,000 units of Mapletree Pan Asia Commercial Trust (MPACT) at S$1.71 per unit.

With a consideration of S$30,780, this took her deemed interest in the real estate investment trust to 64,000 units.

Chiang is the senior partner of Hong Kong law firm Deacons and the head of its property department.

She has extensive experience in all types of real estate related transactions.

She is also the chairperson of the property committee of The Law Society of Hong Kong as well as the deputy chairperson of the Council of the City University of Hong Kong and a member of the nomination committee of the City University of Hong Kong.

On Jan 31, MPACT Management reported that MPACT’s gross revenue and net property income for Q3 FY22/23 (ended Dec 31) grew 84.0 per cent and 76.8 per cent from Q3 FY21/22 to S$239.8 million and S$179.4 million respectively.

The growth was mostly driven by the full quarter contribution from the properties acquired through the merger and higher earnings from the Singapore portfolio.

Distribution per unit was however dampened by higher finance costs and stayed at 2.42 Singapore cents for the quarter.

MPACT’s portfolio comprises 18 commercial properties across five key gateway markets of Asia – five in Singapore, one in Hong Kong, two in China, nine in Japan and one in South Korea.

Heeton Holdings

On Feb 22, Heeton Holdings chairman and executive director Vince Toh Giap Eng acquired 380,000 shares of the real estate conglomerate for a consideration of S$95,000.

At an average price of S$0.25 per share, this took his total interest in Heeton Holdings from 40.90 per cent to 40.98 per cent.

On Feb 20, Heeton Holdings reported a net profit after tax of S$4.40 million for FY22 (ended Dec 31), compared to a net profit after tax of S$28.41 million recorded in FY21.

With current assets located in the UK, Thailand, Japan and Singapore, the group maintains that its principal focus in Singapore remains real estate development, management, and investment.

It further noted on Feb 20 that its two retail malls continue to perform to expectations, and highlighted that it achieved more than 93 per cent sales within the first month of launch of its executive condominium project, Tenet.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted February 27, 2023 – Wilmar chairman Kuok Khoon Hong adds to stake following FY22 results

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)