TLDR

Market appears unable to rally further on the cooling CPI / pivoting Fed combo. Does this mean we go back to fundamentals?

Why did the market not rally more this week?

‘Twas the perfect week. CPI printed low, J-Pow provided an accommodating message – markets should have rallied. No?

Well markets had rallied … already. Since October in fact. And it seems that fundamentals are not providing a cap to the willingness of markets to rally more.

Seems a lot of traders got caught on a classic Bogdanoff trap.

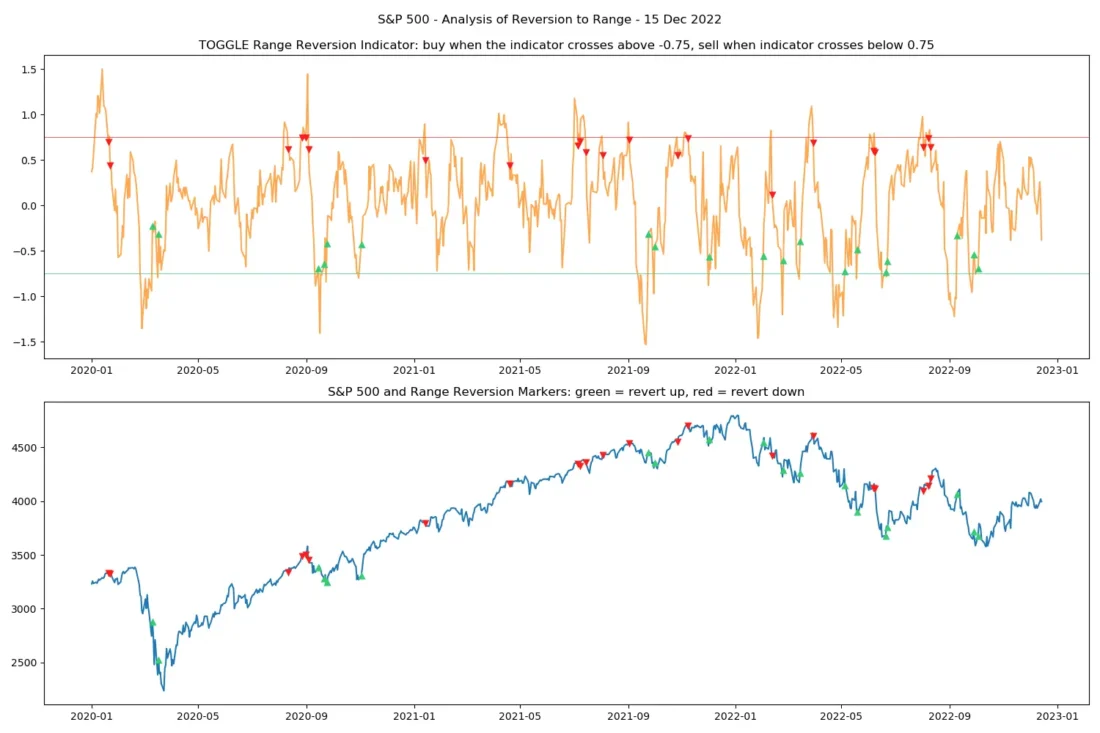

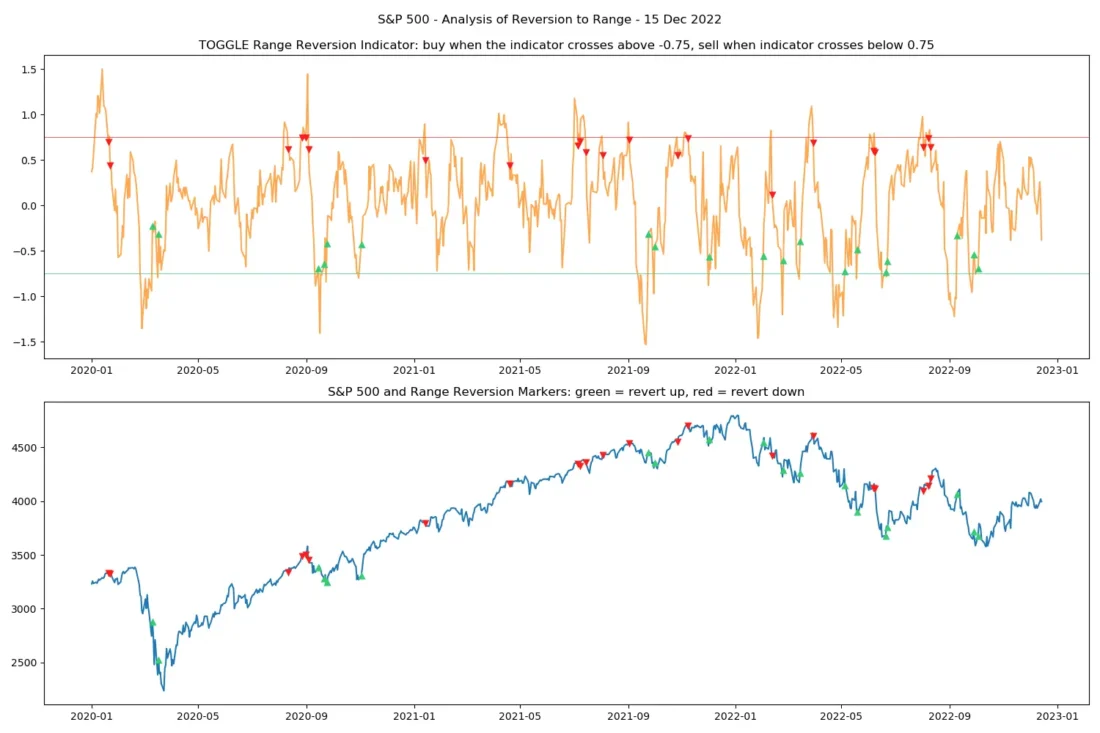

The Rangefinder index

The Rangefinder index remains caught in a range, trending downwards in the last few days. We’re keeping an eye for when it reaches the oversold level. Learn more about this index here.

What does the market look like?

The market is stalling as the Cool CPI + Fed Pivot theme has been largely priced in – whilst the underlying fundamentals are bad and equities are expensive.

What’s bullish?

- Falling Inflation. Inflation has come down and leading indicators like Input Price PMIs suggest it will continue to fall. Powell pivoted yesterday and pointed to a 50bp hike in December.

- Short Positioning. S&P 500 Futures Positioning remains short at -20% even after the post-CPI monster squeeze.

- Bullish Leading Indicators. The TOGGLE Leading Indicator is heading towards positive territory.

- Recovering Earnings. S&P 500 Forward EPS are posted a nice comeback at $228.40.

What’s bearish?

- Expensive Valuations. Valuations are expensive. S&P P/E at 17.2x with dropping PMIs and earnings is not great.

- Weak Economic Growth. Growth looks shabby across the world, with New Order PMIs at 47 in the US and … 40 (!!!) in Europe

- Bad Seasonality. S&P 500 Seasonality is bad for the next 3 months, hovering around flat.

What’s next?

At this point we enter the lull of the holiday season, until PMIs start to print again in January.

In conclusion?

We said it in the past, we’ll say it again: range-bound markets. It’s all warm and fuzzy when inflation cools down, but high P/E + falling EPS is no good.

Idea Spotlight: Alphabet

Shares of Alphabet are on track for their worst losing streak in four years – falling almost 10% over the last week – amid a broader tech selloff.

Speaking of fundamentals, TOGGLE analyzed 7 similar occasions in the past where valuation indicators reached a recent low and historically, this led to an increase in Alphabet stock.

—

Originally Posted December 15, 2022 – So where’s the rally?

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.