- Several blue-chip U.S. companies have completed or announced plans to spin off units

- The corporate move comes as the IPO market remains cold as year-end approaches

- We highlight key spinoffs in the chip space, healthcare arena, and transportation industry

What a difference a year makes in the capital markets. November 2021 was perhaps the height of speculation with many stocks and cryptocurrencies notching new all-time highs while interest rates were stable, and IPOs were plentiful. Fast-forward to today, though, and it’s big news when an exciting IPO prices and then celebrates its first day of trading on the secondary market.

IPOs: Out. Spinoffs: In.

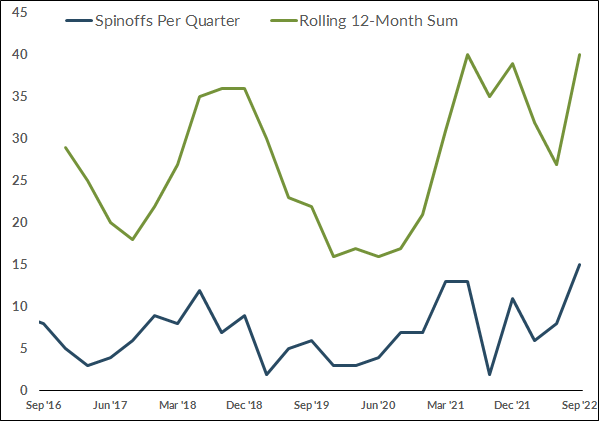

Spin-offs have become the new IPOs. While the annual count of IPOs is down a massive 59% from a year ago, Wall Street Horizon’s corporate event data, which covers 10,000 companies worldwide and more than 40 event types, show a significant increase in spinoffs over the last four quarters. Through Sept. 30, there have been 40 significant spinoffs matching the amount from the 12 months ending June 30, 2021, for the highest since 2016.

Surprising Stat: Spinoff Count Soars

Source: Wall Street Horizon

A company might elect to spin off part of its business for a variety of reasons. Often, a management team looks to streamline its processes to focus on its core competencies. Investors sometimes take a shine to stocks that divest one niche to devote more energy and financial resources to what’s working. The new firm can then take its own path without the red tape of being part of a conglomerate. Recall the 1990s when General Electric (GE) tried to put its hands in too many parts of the business world. Shares went on to underperform the broad market for decades to come. While just one example, becoming a behemoth does not always work out in the long-term best interests of shareholders.

Spinoffs: A Storied History

A characteristic among spinoffs is that the new public entity often gets bid up during its initial days of trading. What instantly comes to mind among seasoned investors is the famous (or infamous) corporate event in which 3Com carved out Palm near the height of dot-com mania. The story is now part of behavioral finance lore as 3Com, the parent, sold 5% of its stake in Palm through an IPO. The offspring company skyrocketed to, at one point, $165 per share, up from the offering price of $38. That share price made Palm worth more than 3Com – which still owned most of Palm!¹

Today’s market is, of course, nothing like that. But let’s look at four recent announcements and deals to get a feel for the temperatures of the capital market waters.

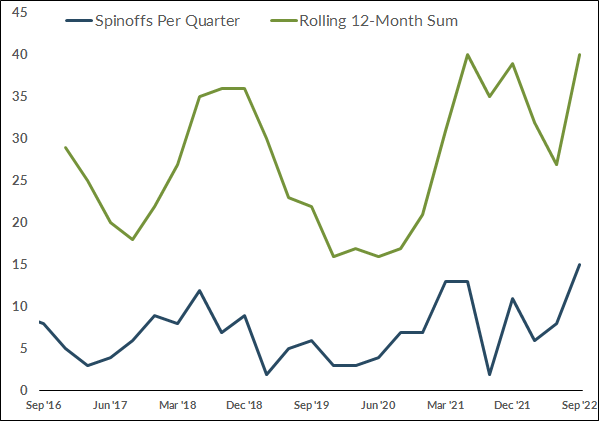

- Intel (INTC) made a splash in markets during late October with its break-apart, Mobileye Global Inc (MBLY). The new stock surged from an IPO price of $21 to a maiden-session peak near $30. Since then, though, shares have been under some pressure, but remain comfortably above the offering price. Mobileye, the former self-driving car unit of Intel, raised nearly $1 billion for the smallest component of the Dow. Unfortunately, Intel had hoped for a more lucrative valuation, reportedly around $50 billion. Still, the IPO price is above what Intel paid for Mobileye back in 2017.²

Mobileye: Shares Holding Above the IPO Price

Source: Stockchart.com

- General Electric (GE) aimed to create value for shareholders via spinoff of their healthcare businesses. While still pending, GE plans to create a new healthcare holding company: General Electric Holding Company (GEHC). On Oct. 31, 2022, both Fitch and Moody’s assigned first-time credit ratings to the new enterprise. It’s expected that GEHC will be an established leader in its $84 billion market. The firm forecasts annual growth in the 4% to 5% range through 2025 with decent long-term growth prospects. Both credit rating agencies rate the firm’s debt at the lower end of investment grade.³

- Another Industrial sector member, Minnesota-based 3M (MMM), completed a spinoff of its Food Safety business back on Sept. 1 while it now focuses on splitting off its healthcare division, which accounted for a massive $8.6 billion of 2021 sales. The company expects the corporate event to close by year-end 2023.⁴

- Finally, the latest spinoff buzz on Wall Street is in the bellwether transportation industry. On Nov 2, 2022, shares of RXO began trading after XPO Logistics (XPO) Board of Directors approved the separation of its full truckload freight transportation unit. According to XPO, the new company will be the fourth largest “FTL” freight transportation broker in the U.S. XPO, meanwhile, will then stand alone as a leading provider of less-than-truckload, or “LTL,” services in North America. More corporate action might then take place as XPO slims down further – the Connecticut-based Industrials sector company plans to divest its European transportation unit.⁵ XPO shares rallied following better-than-expected earnings on Halloween, too.

The Bottom Line

Investment bankers and credit rating agencies are happy to have a suddenly busy spinoff season. With a dearth of IPOs and limited dealmaking amid tight credit markets, several key spinoffs have made headlines. While buybacks and dividends catch much of the press, spinoffs have a history of producing significant value for shareholders, too. Keep your eye out for more market-moving spinoff announcements as CEOs look for creative ways to spark investor optimism.

₁ https://www.nytimes.com

₂ https://www.wsj.com

₃ https://www.fitchratings.com

₄ https://news.3m.com

₅ https://www.globenewswire.com

—

Originally Posted November 9, 2022 – Spinoffs Suddenly Popular on Wall Street: Deal Flow Higher Year-on-Year

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.