STOCKS – NONE

MACRO – SPY, QQQ, RATES DOLLAR COPPER

So CPI came in cooler than expected today, at 7.7% versus 7.9%. Certainly not what I expected, and that is how it sometimes goes. Unfortunately, I am a person like everyone else. I have been wrong plenty of times in the past. I have plenty of readers that remind me of that every day. The Cleveland Fed’s data has been consistent and far better than any source I have followed for some time, and to have bet against them would have been a mistake, in my opinion. All one can do is assess the market and use the information. Unfortunately, it is not the first time I have been wrong, and it will not be the last.

But, it is essential to remember this isn’t likely to change the path of monetary policy anytime soon. It was enough to spark a massive short-covering event, and it probably removes a 75 bps rate hike off the table for December, which was questionable at best to begin with. But remember, the more rates fall, the more the dollar weakens, the more stocks rise, the more financial conditions ease, the more the Fed needs to tighten, and the more Powell will fight back against the market. Remember Jackson Hole.

The S&P 500 managed to climb 5.5%, which is odd and almost the equivalent to what the S&P 500 rallied off that CPI print in October from the low.

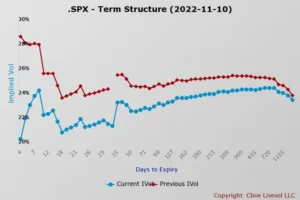

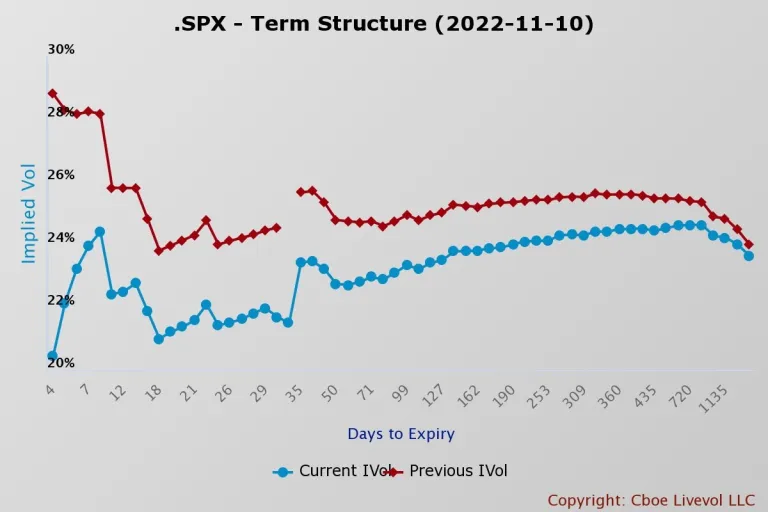

It would imply, I think, that much of the rally, again, was what we have learned to see throughout this bear market. Events lead to elevated implied volatility, and once the event ends, the IV drops dramatically, and stocks squeeze higher. This tells us that these rallies, which feel good, are not stable.

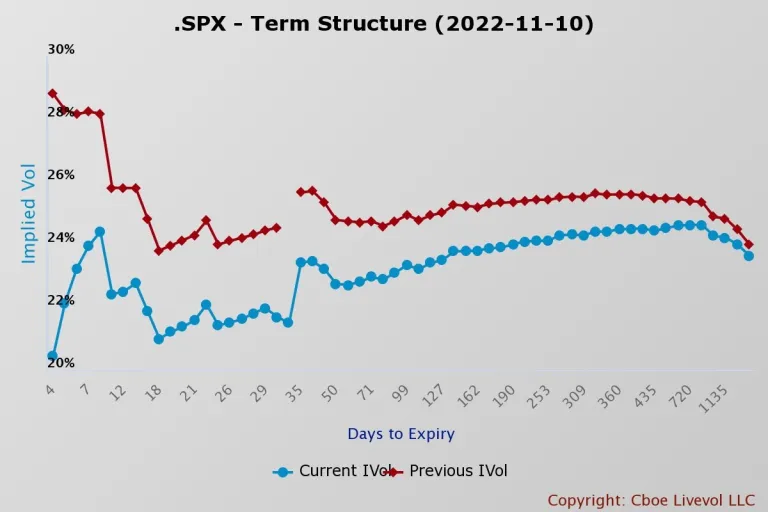

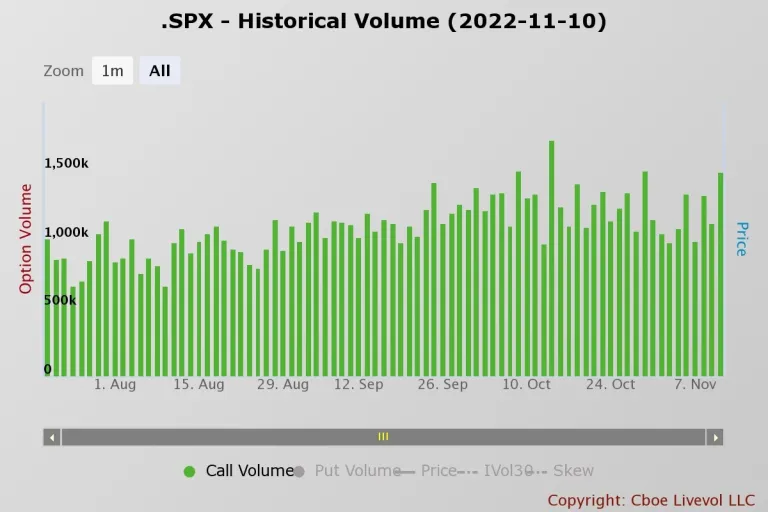

Also, today, we saw a tremendous amount of call volume, with most of it for today’s expiration date. This tells you that you saw an IV-led rally and a gamma squeeze on top of it. Call buyers push the markets higher by creating positive deltas for market makers to hedge against, causing them to buy S&P 500 futures.

Rates

Tomorrow the bond market is closed, so it will be interesting to see how the stock market trades without bonds. The 2-yr rate fell today to around 4.30% and stopped at support.

The 10-Yr also closed right at support today as well.

Dollar

I’m concerned about the dollar because it fell through a significant uptrend, and a weakening dollar does not help the Fed’s cause. The next level I am watching to see if it holds comes at 107.25. If that breaks, then the dollar probably has much further to fall.

Copper

Why is the falling dollar terrible news? Because it means higher commodity prices, and copper was not an exception today, rising by more than 2%. What does copper at $4.6 mean for inflation?

NASDAQ (QQQ)

There is not much to say here, the QQQs are now back to resistance around $285, and unless the options market starts playing, the QQQs could be stuck at $285 because that is roughly the area where the prominent call positions are.

–

Originally Posted on 10th November – Stocks Rip Higher On Cooler Inflation As The Mechanical Bull Rides Again

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)