STOCKS – TIP, TLT, RINF

MACRO – SPY, YUAN CHINA

Stocks finished the day higher, with the S&P 500 rising by around 1.2%. It was a curiously odd rally because the China markets were smashed overnight, with Hong Kong dropping more than 6% and the Chinese Yuan rising to over 7.30 to the dollar. That is a big deal, and the China 5-Yr CDS, yes credit default swap, increased by 13 handles to close above 130, its highest level since 2016.

The S&P 500 peaked at 3,810 on the cash market today and hit wave three’s 38.2% retracement mark. Given the sideways nature of this market since the middle of September, it is possible this could be a wave four sideways consolidation. For that to work, the index must hold around this 3,800 cash level.

On top of that, this 3,800 level marks the 50% retracement from the September 12 peak.

It also marked the 78.6% retracement from the September 21 peak.

Today, the index came within 6 points of touching its upper Bollinger band, an overbought signal.

Inflation

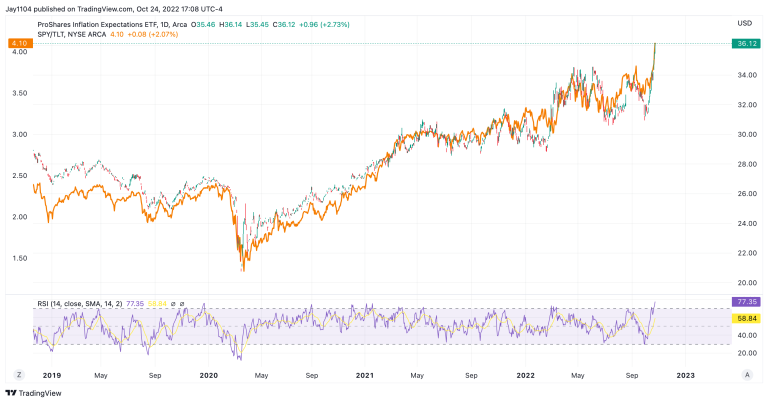

There are plenty of good reasons for the S&P 500 to stop here. What is interesting here, too, is that long-term inflation expectations are exploding higher, with the RINF ETF rising rapidly.

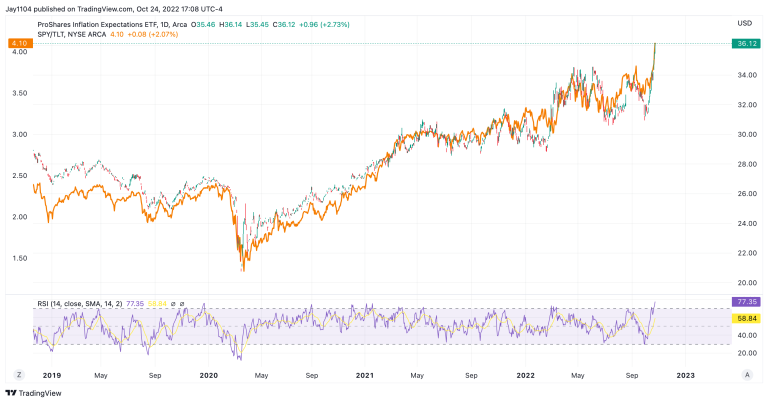

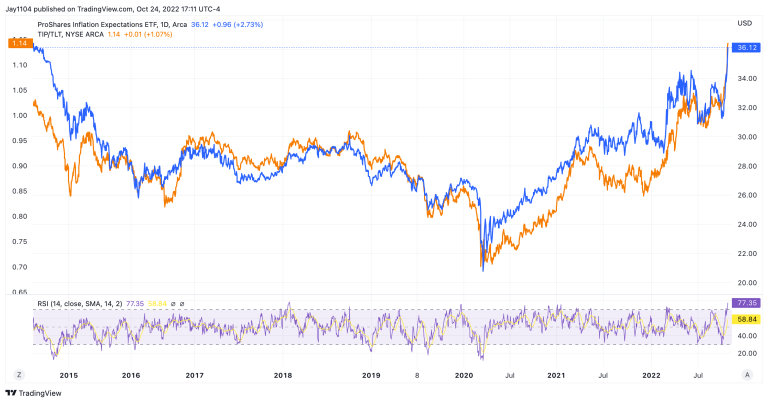

What is interesting is that you realize that the chart of the RINF looks an awful lot like the SPY to TLT ratio I posted yesterday. What this would suggest to me is that the reason the market is rising is that inflation expectations are rising.

Inflation expectations are rising because the 30-yr rate is soaring higher, but real yields stay put, causing the spread to widen and inflation expectations to increase. So this tells us two things: either inflation will get wildly out of control again, nominal rates have risen too far, or TIP rates haven’t advanced enough. The TIP to TLT ratio is another way to measure inflation expectations.

I guess if I had to choose based on the technical patterns, the TIP ETF probably needs to start dropping to rein in inflation expectations, and once the TIP ETF starts to drop, the stock market is likely to reverse course. Of course, the TLT could also begin to rise, which could also sink inflation expectations and stocks.

What is ironic here is that the headlines say that the market is rising due to the expectation of slower rate hikes. But indeed, it grows on expectations of higher inflation rates, which would suggest the Fed will not do its job in bringing inflation down. Why would the market rise on higher inflation rates? That is easy because sales and earnings are derived in nominal terms, and if inflation runs hot, then sales and earnings will run hot, which is good for stocks.

It is another way of saying that the Fed will not pivot because the market is telling it not to pivot, and every time the stock market rises, it is yet another indication to the Fed that it doesn’t have a handle on inflation. It will need to raise rates even more.

Originally Posted on 24th October – Stocks Rise on October 24, 2022, as Inflation Expectations Explode To The Upside

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)