During a week of mixed messages on the economy, this morning’s economic data has halted 2023’s fast and furious equity rally. This morning’s Personal Income and Outlays report from the U.S. Bureau of Economic Analysis showed that even though prices rose modestly last month, consumption declined for the second straight month. Perhaps most worrisome, investors waiting anxiously for this coming Wednesday’s pivotal Federal Reserve (the Fed) meeting are focusing on today’s data and other gauges released earlier this month that show that inflation has accelerated in the services sector. In past presentations, Fed Chairman Jerome Powell has emphasized that the central bank’s tightening policies have made progress in curtailing inflation in many areas, but the services sector has shown stubborn price increases that must be tamed before declaring a victory against inflation.

Markets initially sold off following the report but relentless buying by the bulls has managed to reverse the decline as they handsomely piloted the aircraft in the opposite direction. The S&P 500 is up 0.4%, the tech-heavy Nasdaq is up 0.6% and the value tilted Dow is up 0.4%. Yields are continuing their increase after yesterday’s firm GDP report, led by the long-end as the 10-year is up 5 basis points to 3.54%. WTI crude oil is down 1% to $80 on recession fears while the dollar is roughly unchanged.

The Fed’s preferred inflation measure, the Core PCE Price Index, climbed 4.4% year-over-year (y/y) and 0.3% month-over-month (m/m) in December, in-line with market expectations and hotter than November’s m/m reading of 0.2%. The general PCE Price Index, which includes food and energy, increased 5% y/y and 0.1% m/m. Personal spending accelerated its decline from last month, down 0.2% from 0.1% in November. Incomes are doing just fine, but falling spending indicates that higher interest rates and inflation are taking a bite out of consumer spending. Personal savings have increased significantly from a low level, as a strong job market and contracting spending in tandem have boosted reserves in the short-term.

Based on the Fed’s prior statements about services inflation, the central bank appears far from declaring the end of monetary policy tightening. Prices for goods decreased a considerable 0.7% but prices for services accelerated to 0.5% m/m, the fastest pace since September.

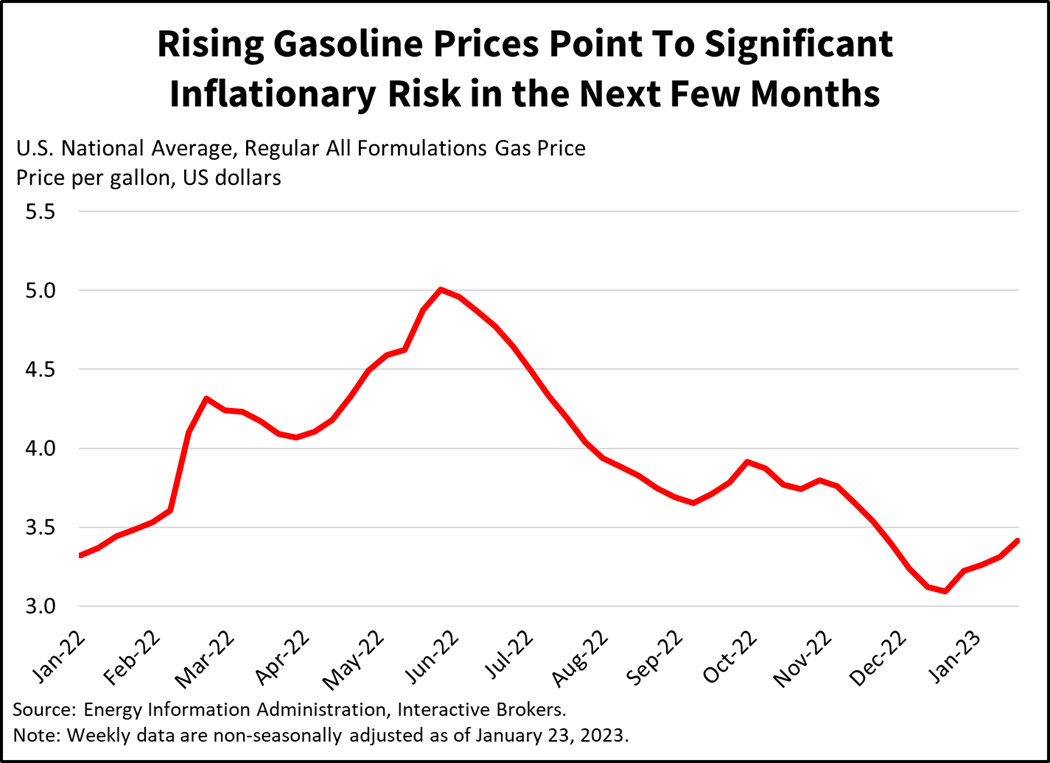

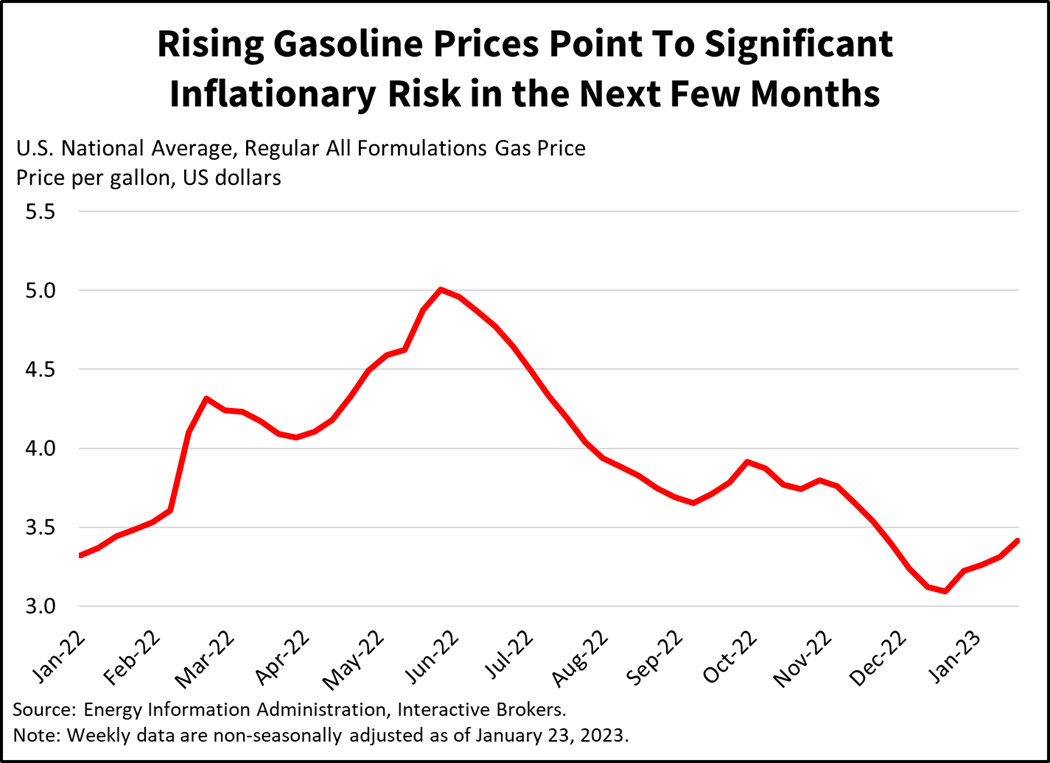

Based on the Fed’s prior statements about services inflation, the central bank appears far from declaring the end of monetary policy tightening. Prices for goods decreased a considerable 0.7% but prices for services accelerated to 0.5% m/m, the fastest pace since September. Services price inflation continues to be driven largely by the sizzling hot labor market, characterized by worker shortages and rising wages. Energy prices declined 5.1% illustrating strong inflation in other components of the index with the PCE headline number staying flat at 0.1%. Food prices, for example, climbed 0.2%. Energy continues to be a strong driver of sentiment among investors and consumers while a strong influencer of overall price changes. The most recent Consumer Sentiment survey showed strengthening sentiment partially because of energy price declines, but gasoline prices this month have been climbing, rising approximately 40 cents per gallon. Pain at the pump could weaken consumer sentiment and spending thereby destroying demand but increasing input costs for businesses.

Today’s release depicts a dreadful combination of weakening spending and higher prices, or stagflation, at least in the short term. While yesterday’s GDP release showed that the economy grew at an annualized rate of 2.8% in the fourth quarter of 2022, December’s declining consumer spending is troublesome. Such spending represents approximately 70% of U.S. GDP. Recent data also shows continued contraction in goods spending and real estate construction, including homes. This broad spending weakness defies recent improvements in consumer sentiment and was highlighted this morning when Intel disclosed its fourth quarter revenue declined a sobering 32% y/y, which caused the stock to tank more than 10% in early trading. While Intel is losing market share, it’s also been hit hard by declining demand for personal computers, which has caused retailers to decrease their computer purchases. With weakening consumer spending, GDP is likely to contract in first quarter 2023 while inflation remains persistent, creating challenging conditions for Wall Street and Main Street.

Visit Traders’ Academy to Learn More about Personal Income and Outlays, Gross Domestic Product and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.