Key takeaways

A delicate dance continues. Stocks look set to continue their stutter-step motion into 2023 after a downbeat and extremely volatile 2022. As we look toward the first quarter, we see:

- Need for balance and resilience in equity portfolios

- Some light at the end of the tunnel for stocks

- Earnings joining inflation and the Fed as wildcards

Market overview and outlook

Market ups and downs in the final months of the year reflected investors’ battle between ongoing fear and flashes of hope that the tough-talking Fed might be ready to ease its rate-hiking campaign. With inflation remaining elevated and the Fed intent on batting it down with higher interest rates, we see the equity bounces as bear market rallies rather than the start of a new bull trend ― for now. Such “speedbumps” are not uncommon on the path to solid longer-term returns.

Against this backdrop, we believe a focus on resilience remains paramount in equity portfolios. This includes stocks with quality characteristics and positions that seek to balance offsetting risks (e.g., value coupled with growth; defensives alongside cyclicals).

Good news, bad news

Many risks remain as the calendar turns to 2023, keeping the market’s volatile pattern intact. But we also see some potential light at the end of the tunnel for stocks:

Inflation past peak

We believe headline inflation has peaked for this cycle, even as it is retreating slowly. While the Consumer Price Index (CPI) hasn’t declined at the hoped-for pace since its high reading of 9.1% for June, anecdotal data on the economy is moving more quickly: Housing demand and prices are easing, consumer confidence is waning and retail sales growth is showing some signs of stalling. This suggests CPI will eventually catch up, then giving the Fed room to pause its rate-hiking campaign.

Election fog lifted

History generally has been kind to markets in the year after a midterm election. Our analysis shows you’d have to go back to 1938 to find a 12-month period where stocks were negative after an election. The consistency of the pattern suggests it’s not just chance. It’s often because markets have generally been weak leading into midterms, as elections inject an element of uncertainty. In our review of 23 midterm election cycles since 1930, we found the 12-month change in U.S. stocks leading up to the election was 2%. This year was -17%. The average change in the 12 months after was 13%.*

An attractive starting point

Valuations on the S&P 500 Index, as measured by trailing 12-month price-to-earnings (PE) ratio, have dropped from 24.7x at year-end 2021 to 19.7x as of Nov. 30. Could stock prices cheapen further from here? Yes. But is current pricing a compelling opportunity? We believe it is. We looked at S&P 500 returns starting from different PE ranges across time. Since 1957, average five-year returns have come in at 65% when stock valuations were at a starting point of 15x-25x.

Starting valuations and returns across time

Source: BlackRock Fundamental Equities, with data from Bloomberg, 1957 to November 2022. Past performance is not indicative of current or future results. It is not possible to invest directly in an index.

The market bottom debate

Our work last quarter found that inflation peaks have historically coincided with market bottoms. Other evidence suggests equity bottoms most often take place during a recession. Yet it’s important to note that recession onsets are called in hindsight ― once the National Bureau of Economic Research (NBER) analyzes past data and makes a formal declaration. Similarly, the market bottom may only be clear in hindsight, with much of it hinging on the Fed and its read of inflation and the economy. Bottom or not, investors with a long-term mindset have a decent entry point today. We see an opportunity to capture value in stocks unduly punished in the downturn or those with quality characteristics that can offer greater resilience through a recession.

About that recession

We believe a recession is likely, for a few reasons. History suggests that inflation above 5% is a recipe for recession. And this time around, the Fed has made dramatic rate moves in a short time to catch up from a late start in addressing inflation. Fed actions historically affect the economy with long and variable lags, so the economic consequences are yet to be fully felt.

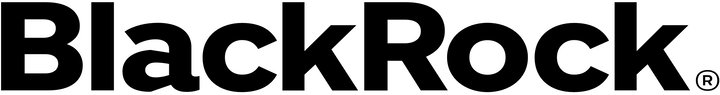

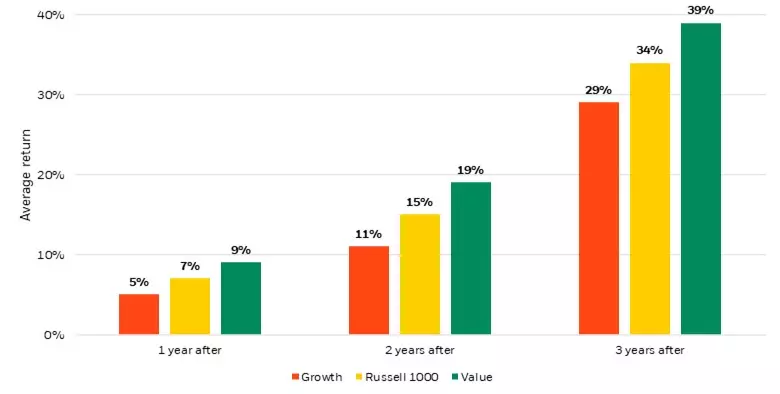

That said, we think any recession could be relatively shallow in depth and duration. The key reason: The consumer (which accounts for nearly 70% of U.S. GDP) remains in good shape without a heavy debt burden or balance sheet to repair, unlike the more protracted recession during the 2008 Global Financial Crisis (GFC). Using data from NBER, we calculate that the average recession in the post-WWII era has lasted just 10 months. Expansions, meanwhile, have averaged five years. Equity returns in the years following recessions historically have been positive, as shown below.

Returns around recessions

Average U.S. stock returns following recessions since 1978

Source: BlackRock Fundamental Equities, with data from Bloomberg and Russell indexes, November 2022. Data covers five NBER-defined recessions since 1978 (excluding the two-month 2020 recession). Growth and Value are based on their representative Russell 1000 indexes. Past performance is not indicative of current or future results. Indexes are unmanaged. It is not possible to invest directly in an index.

Earnings uncertainty

While inflation and Fed policy remain chief uncertainties headed in 2023, there is also a new wildcard weighing on stocks: company earnings. Companies have, for the most part, exhibited pricing power and an ability to pass rising costs on to consumers. But consumer lethargy amid higher prices is beginning to show. While consumer balance sheets are still healthy, saving rates are getting precariously low ― at 2.3% in October compared to pandemic heights of 26.4% in Q2 2020, according to data from the Bureau of Economic Analysis. The University of Michigan’s Consumer Sentiment Index hit a 70-year low over the summer and remains near this historical level.

For U.S. companies, the third-quarter earnings season started to expose signs of weakness. Earnings per share (EPS) growth of 2.4% on the S&P 500 Index was driven almost exclusively by energy companies. Goldman Sachs recently put EPS growth estimates for 2023 at 0%. As of mid-November, analysts’ outlook for Q4 earnings was deteriorating and coming in below the historical sequential trend. Our analysis of earnings declines in prior recessions found an average drop of 13% in the 10 recessions since 1957. If we exclude the outsized 40% earnings deterioration during the GFC, the average recession-period earnings decline was 10%. We could see this episode falling in the average range (10%-15%).

A growing active opportunity?

As in prior recessions, dispersion in analyst earnings estimates is rising. One upshot is that this presents an opportunity for active stock pickers to apply their own research and analysis to identify fundamentally strong companies that may be positioned to deliver earnings growth above consensus expectations.

Overall, we believe an active and nimble approach rooted in fundamentals could add value in 2023. Any market recovery is likely to be uneven, in our view, with individual company fundamentals increasing in importance and driving the speed and magnitude of any share price rebound.

Click here to read the full report

—

Originally Posted December 15, 2022 – Taking Stock: Q1 2023 Equity Market Outlook

© 2022 BlackRock, Inc. All rights reserved.

* U.S. stock data from Standard & Poor’s via Bloomberg, as of Nov. 30, 2022.

This material is provided for educational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of December 2022, and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. The material was prepared without regard to specific objectives, financial situation or needs of any investor.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of yields or returns, and proposed or expected portfolio composition. Moreover, where certain historical performance information of other investment vehicles or composite accounts managed by BlackRock, Inc. and/or its subsidiaries (together, “BlackRock”) has been included in this material, such performance information is presented by way of example only. No representation is made that the performance presented will be achieved, or that every assumption made in achieving, calculating or presenting either the forward-looking information or the historical performance information herein has been considered or stated in preparing this material. Any changes to assumptions that may have been made in preparing this material could have a material impact on the investment returns that are presented herein by way of example.

Investing involves risk. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Diversification does not ensure profits or protect against loss.

You should consider the investment objectives, risks, charges and expenses of any BlackRock mutual fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling 800-882-0052 or from your financial professional. The prospectus should be read carefully before investing.

© 2022 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc. All other trademarks are those of their respective owners.

Prepared by BlackRock Investments, LLC, member FINRA.

Not FDIC Insured | May Lose Value | No Bank Guarantee

USRRMH1222U/S-2639186

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)