“We tell ourselves stories in order to live,” Joan Didion (writer and journalist).

Thematic investing brings this notion to the fore. Avenues of investing aligned with megatrends are inherently predicated on visions of the future. But what makes thematic investing a lot more palatable than prophesizing, is that certain megatrends are already in motion. Thematic investors, therefore, need only observe the direction of the current and swim with the tide. The stories they tell themselves reveal what places they will witness along the way.

But, of course, timing does matter, and the bear market in 2022 has created an attractive entry point for long-term investors. Moreover, the investment industry now offers discerning investors ways to access differentiated themes aligned with unique megatrends.

So, for investors, this means more stories to choose from. But two themes appear especially interesting at present.

The Future Is Green—The Inevitable Energy Transition

Following 18 months of intense wrangling, the U.S. has passed a $700 billion economic package seen by many as a monumental step in tackling climate change. The bill includes $369 billion for climate action, including tax credits for households to buy electric vehicles, and support for renewable energy, carbon sequestration research, hydrogen power and small-scale nuclear reactors.1

Creating an energy sector that is both sustainable and sufficient will require major investment across all forms of clean energy including renewables, hydrogen, biofuels, hydro and even nuclear. Most recently, the European parliament has moved to classify future investment in natural gas and, more notably, nuclear power as environmentally sustainable (under certain conditions) in a pivotal shift that recognizes the need for an ‘all of the above’ approach to phasing out fossil fuels.

Low-Hanging Fruit

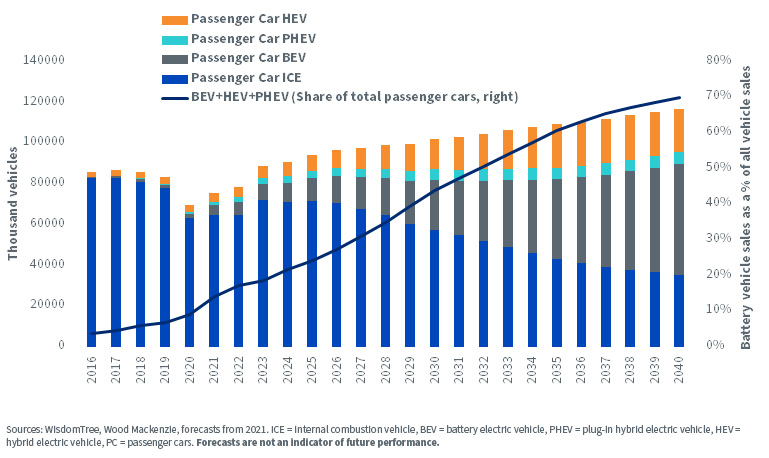

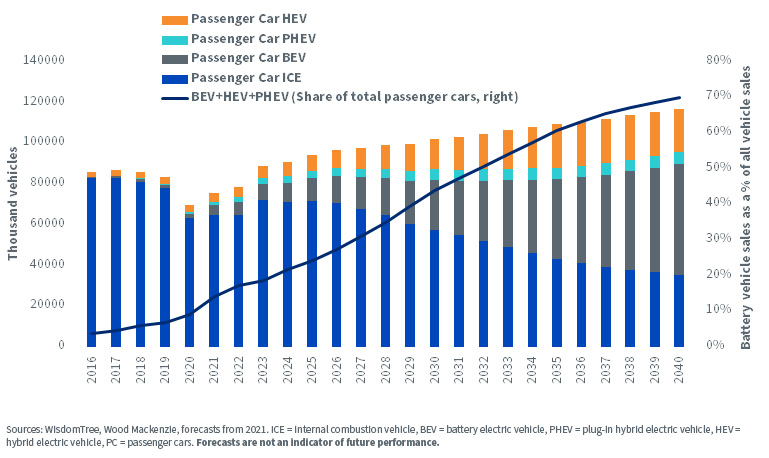

The energy sector accounts for around 75% of global greenhouse gas emissions, with road transportation accounting for the largest share at 11.9%.2 It therefore makes sense to start where most progress can be made and can have the greatest impact. According to Bloomberg New Energy Finance’s Long Term Electric Vehicle (EV) Outlook 2022, the EV market represents an $82 trillion market opportunity between now and 2050 in a net zero scenario. This takes into account not just the vehicles but also the ecosystem of industries surrounding them, including battery technology, commodities, charging infrastructure and recycling. With EV sales on an exponential trajectory already (see figure 1), such forecasts do not seem implausible.

Figure 1: Share & Total Market Size of Battery Electric Vehicles (BEVs)

No Half Measures

The electrification of road transportation could create a 27% increase in electricity demand by 2050.3 It is therefore crucial that the electricity itself is also clean.

Among renewables, offshore wind is all the rage right now. And for good reasons. According to Wood Mackenzie, almost $1 trillion is expected to flow into the offshore wind market over the next decade, given its scalability.

But more renewable power will also require more energy storage. Battery technology again comes into play. Lithium-ion batteries, effective for shorter duration storage, will be complemented by emerging longer duration storage technologies. This will ensure the energy supply is not only reliable for a few hours, but days and weeks.

The Future Is Highly Connected—The Ongoing Digital Transition

According to Statista, the number of internet of things (IoT) connected devices worldwide rose from 8.6 billion in 2019 to 11.3 billion in 2021 and will likely reach 29.4 billion by 2030.4 The world is becoming increasingly connected. And there are many facets to it.

Every Cloud Has a Silver Lining

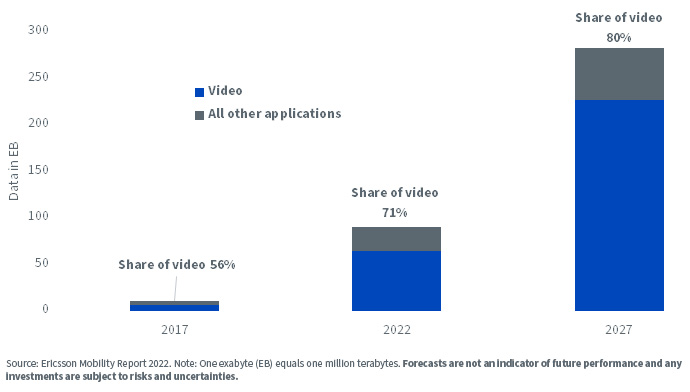

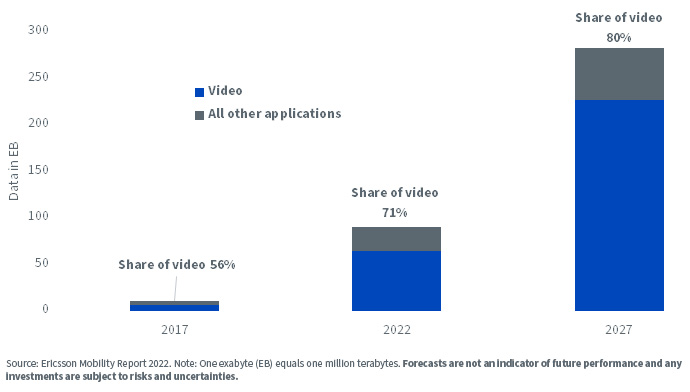

The world has shifted quickly from renting cassettes and DVDs to cloud-based streaming services that use artificial intelligence to offer a personalized experience. Video streaming is not just occupying our television screens. It dominates our mobile phone usage as well.

According to Ericsson, global mobile data traffic has risen from 10.9 exabytes (EB) in 2017 to 90.4 EB in 2022 and is expected to reach 282.8 EB by 2027, with video the primary driver of this data binging (see figure 2 below).

Figure 2: Video Drives Surge in Mobile Data Traffic

Gartner forecasts that public cloud end user spending will grow by 20.4% in 2022 to 494.7 billion, up from 410 billion in 2021. This number will reach nearly $600 billion in 2023.5 Now, for end users sitting in their homes streaming content, movies and TV shows, everything may be in the ‘cloud.’ But for YouTube and Netflix and Spotify, this data needs to be stored somewhere physically. The explosion in data usage will require more data centers and ever-increasing internet speeds. For investors looking at cloud computing as a megatrend, the opportunity is not just in the software, but also the real estate that provides the necessary infrastructure.

This Megatrend Is Not Optional

If a business hastens to shift to the cloud, collect all the necessary user data to improve its service, but then bungles it all up by falling victim to a cyber attack, the result could be catastrophic. More connectedness means more points of vulnerability for nefarious types to exploit. Cybersecurity Ventures expect global annual cybercrime costs to reach $10.5 trillion by 2025, up from $3 trillion in 2015.

As a consumer of any product or service, cybersecurity is something you never want to hear about. If everything is in order, nothing happens. But that is only possible if businesses ensure robust guardrails are in place. Cybersecurity, therefore, is a megatrend that is not optional, but mandatory. It is what makes a connected world sustainably possible.

But What about the Risks?

Yes, further hawkishness from central banks could create more turbulence. Nevertheless, monetary policy shouldn’t alter the direction of travel. So, keep an eye on those inflation prints and the response from central banks.

Deglobalization could also pose a challenge, especially for the energy transition, which depends on certain commodities. Supply chains span the globe and a coordinated effort to tackle climate change would be more fruitful than a fragmented one.

Conclusion

The protagonists will change, the antagonists will change, and there will be unforeseen twists and turns. And for each investor, the plot may thicken somewhat differently. But the stories are underway. And now is an excellent time for investors to not only observe that the world is becoming greener and more connected, but help drive the change they want to see.

1 Source: Financial Times, 9/8/22.

2 Our World in Data, based on 2020 figures.

3 Bloomberg New Energy Finance Long Term Electric Vehicle Outlook 2022.

4 Source: Statista, in cooperation with Transforma Insights, May 2022.

5 Source: Gartner, April 2022.

—

Originally Posted November 10, 2022 – The Future Is Green and Highly Connected. And It Starts Now.

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.