AT A GLANCE

- Unlike the last four equity rallies of the 1990s, the early 2000s, 2010-2019, and the post-pandemic rally of 2020-2021, any equity rally this time around will have to fight the Fed

- Elevated volatility and more frequent setbacks are likely to remain significant features of the equity markets

U.S. equity indexes, having declined sharply in 2022, are fighting the Fed as 2023 begins. Previous equity rallies, after a disruptive event, began with strong support as the Fed provided significant accommodation. This time may be considerably bumpier.

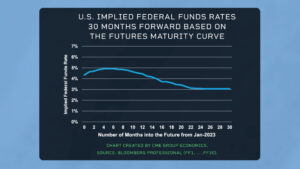

Based on Fed guidance, a peak federal funds rate between 4.75% and 5.50% seems likely to be achieved early in this year. Once the Fed acknowledges that it has reached a sufficiently restrictive rate at which it can pause, the Fed’s “hawkish inflation-fighting mantra” will shift back to a “data dependency” narrative, at which time market participants are likely to breathe a sigh of relief.

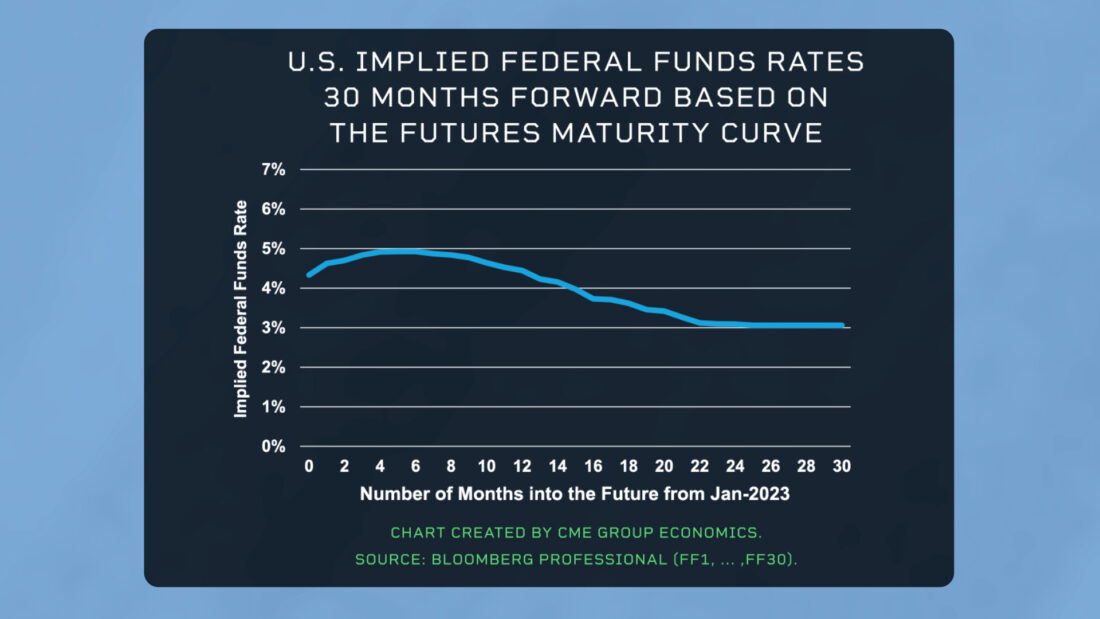

The inverted yield curve argues for recession, and equities appear to have discounted a significant probability of at least a mild recession. But, second half U.S. real GDP was solidly positive, and jobs data suggests a recession is not inevitable.

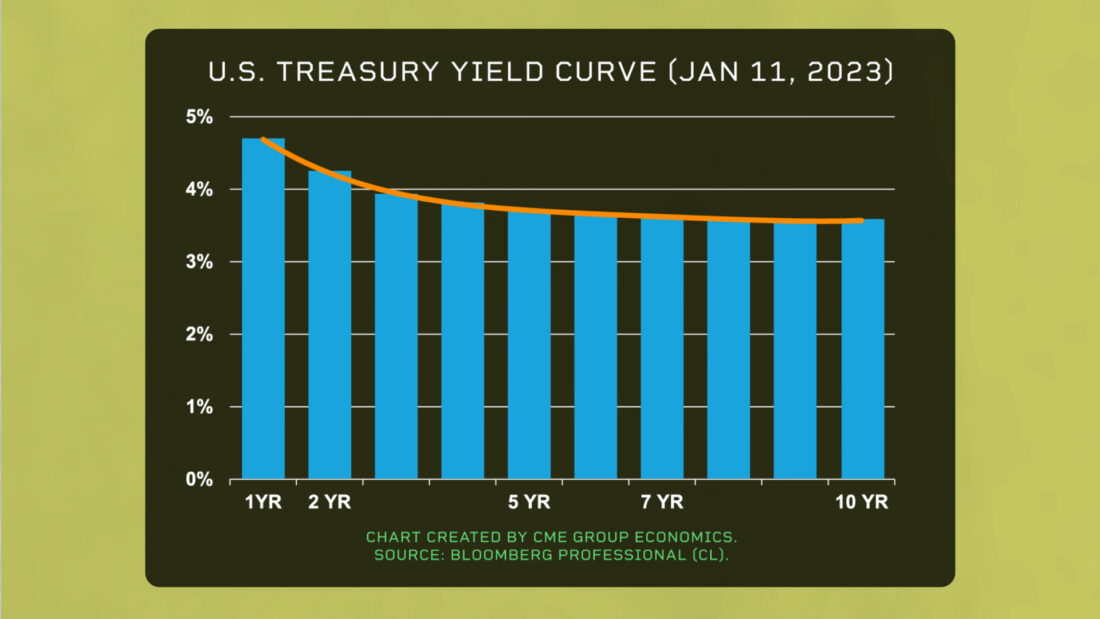

Consumption falters when job losses are happening. That is clearly not the case as 2023 commences. Job openings are abundant in hospitality and tourism, while cutbacks are coming in Silicon Valley and on Wall Street. On net, jobs are still growing, and the widely forecasted recession of 2023 may not occur at all. We are closely watching new unemployment insurance claims, and they show no signs of recession as we enter 2023.

The bottom line is that unlike the last four equity rallies of the 1990s, the early 2000s, 2010-2019, and the post-pandemic rally of 2020-2021, any equity rally this time around will have to fight the Fed. Yet, sentiment in early 2023 does appear to be shifting to a more positive state, given all the bad news absorbed by equities in 2022. Without the Fed’s support though, this rally, if it happens, will not look anything like the last four equity rallies. Elevated volatility and more frequent setbacks are likely to remain significant features of the equity markets.

—

Originally Posted January 23, 2023 – The Next Equity Market Rally May Depend on the Fed

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)