There is no shortage of opinions regarding inflation at the moment. Thankfully, the Consumer Price Index (CPI) seems to have finally peaked, but much debate remains about how long it will take to reach the Fed’s long-term target of 2%. Even if we exclude food and energy, which tend to exacerbate the volatility of price movements and therefore can obscure the long-term impact on consumers, the year-over-year increase in prices hovered around 6% for the entirety of 2022.[1] These are the highest CPI increases the economy has seen since 1982.[2]

With such high headline CPI reports, it is natural for investors and consumers to wonder when prices might come back down. Gas prices steadily declined for most of the fourth quarter, and with at least some grain shipments now leaving Ukraine, there may be some relief at the grocery store soon. However, the CPI ex food and energy does not capture the reversal of these specific short-term price spikes. And the less volatile nature of an inflation measure without food and energy gives us the opportunity to derive some interesting insights.

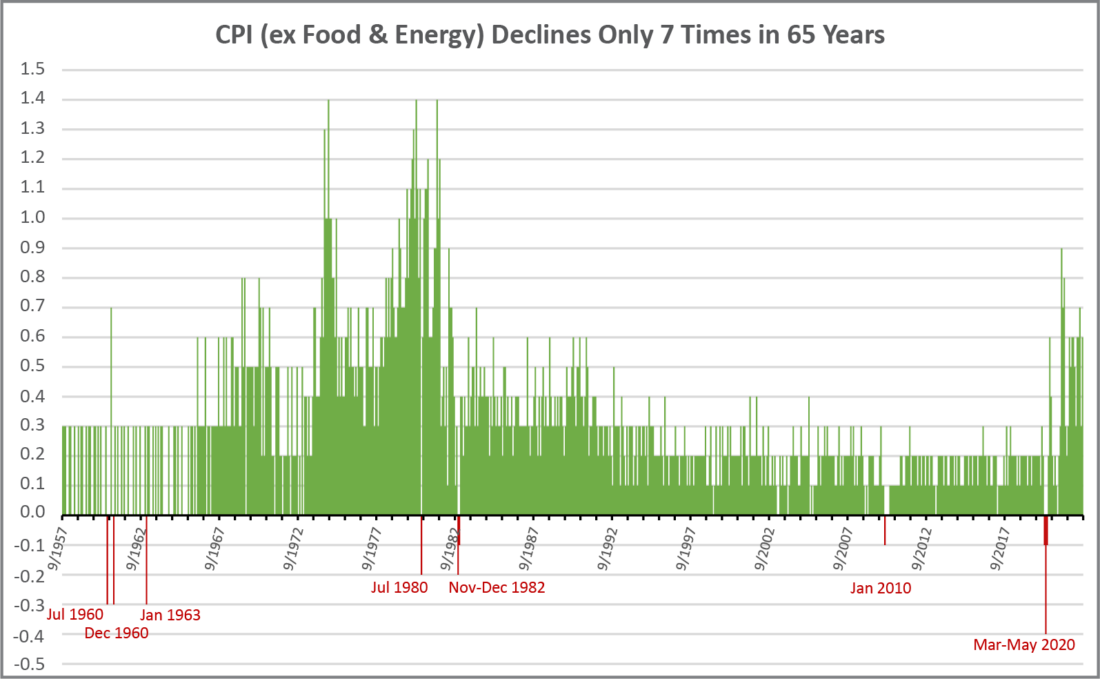

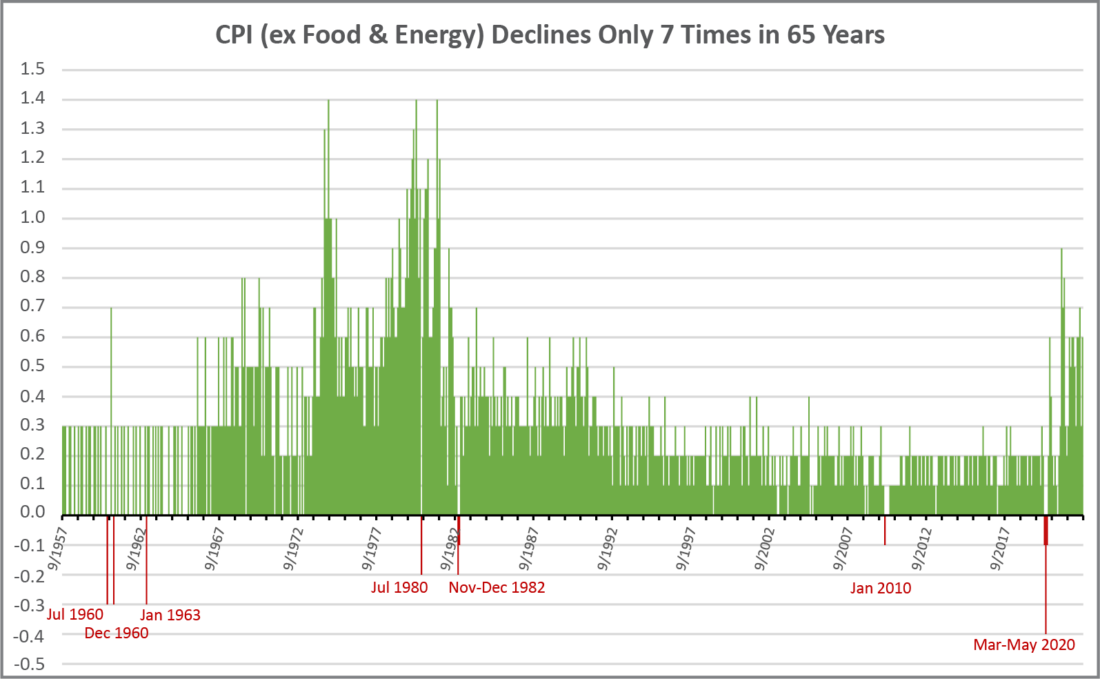

In addition, if we are going to assess the potential for recent price increases to reverse, we would be much better served by looking at month-over-month values to see the actual sequential change in consumer prices. And since the last time we saw inflation at the high rates we are seeing today was in the late 1970s to early 1980s, we decided to start there to answer a simple question: How quick and how prolonged were the CPI month-over-month declines to reverse at least some of the high inflation witnessed between 1974 and 1982?

The answer: “#N/A”.[3] Well, actually, the answer is that CPI declined a total of ~0.3% for just two consecutive months in November and December of 1982 (Figure 1). Two months. -0.3%. Not even enough to reverse the price increases from the two prior months of September and October 1982, let alone any of the CPI increases that took place during the eight years prior to that. Moreover, in the last 65 years, CPI has declined month-over-month only seven times. Of those seven times, only twice have there been consecutive monthly declines. In every instance of a CPI decline in consecutive months, the price index reached its previous high in six months or less, and in that case (first half of 2010), the extent of that decline was -0.10% in a single month, followed by several flat months before prices began increasing again.[4]

Figure 1: CPI ex Food & Energy declined on a month-over-month basis just seven times in the last 65 years and only twice for consecutive months. (Source: Bloomberg Finance, LP, September 30, 2022)

The bottom line: It seems prices do not go back down once they go up. Even in the most extreme upward price scenarios in history, prices were sticky. And this does feel somewhat alarming, especially given that the Federal Reserve kept their target Fed Funds rate between 4.75% and 20% in that 1974-1982 timeframe. Yes, 20%.

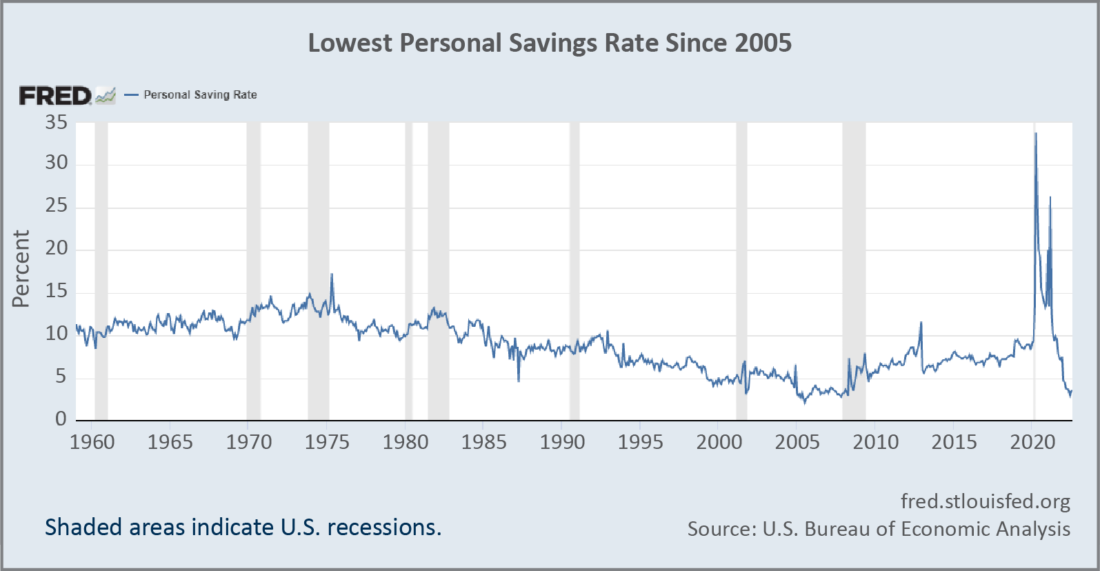

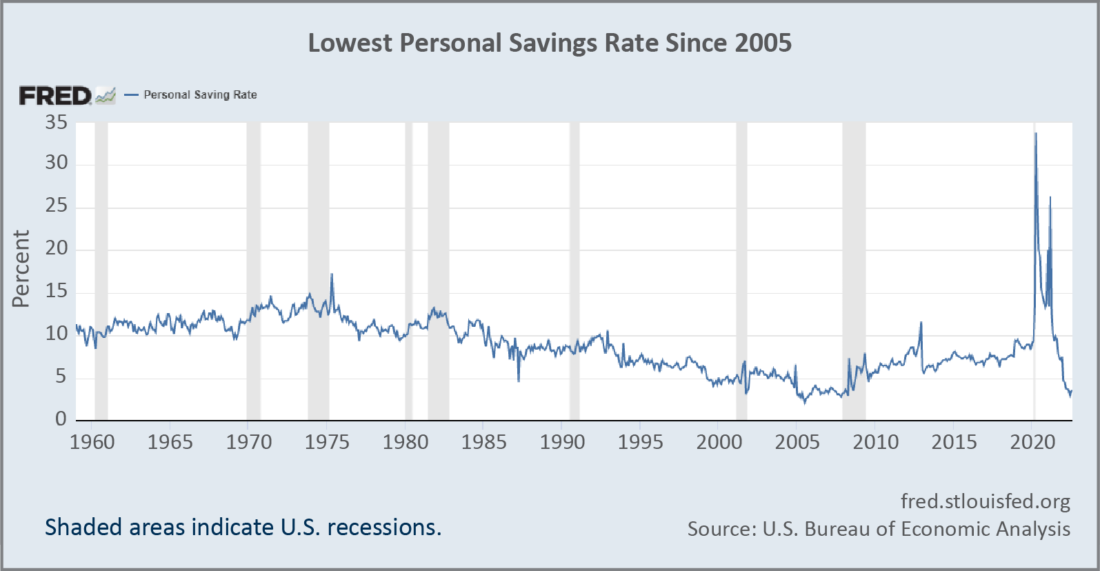

Even so, it is important to realize that these monetary policy efforts were to reduce the rate of price increases, not to reverse them. The same will be the case now. For those consumers for whom the higher prices are creating instability and insecurity, especially the most vulnerable in our society, the Fed cannot solve their problem. Nor can their savings. The personal savings rate is at historically low levels – less than one-third of where it was in the 1970s when consumers were last battling similar levels of inflation (Figure 2). Though these savings rates started to elevate at one point over the last decade, a long-term downward trend is undeniable, as are the absolutely low rates (notably the lowest since just before the 2008 financial crisis) we have seen in the most recent data released by the U.S. Bureau of Economic Analysis.

Figure 2: Personal Savings Rate, measuring personal savings as a percentage of disposable personal income. (Source: U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT, September 30, 2022.)

Put simply, there appears to be little relief coming from the current level of high prices even as the Fed fights to lower the rate at which prices continue to increase. Meanwhile, those most impacted will likely have less cushion, if any, in their household budgets to absorb a potentially permanent increase in their day-to-day expenses. The band-aid of fiscal stimulus, a favorite tactic of politicians in election years, risks making the situation worse. Stimulated demand is temporary but, as we have learned, the price impact is permanent. It seems to us that the only way to solve this affordability problem is to pay people more,[5] better known to economists as wage inflation. However, increased wages likely add to the demand today’s Fed is resolved to attack in their effort to reduce inflation, making a 2% inflation target look very much like a Sisyphean endeavor[6]. For fixed income investors, the silver lining is that higher prices plus wage inflation could make it difficult for the Fed to lower rates anytime soon, which should translate into higher bond yields across the market.

—

Originally Posted January 10, 2023 – Things Are Getting Sticky. Prices Always Have Been.

[1] Excluding food and energy also has the helpful effect of somewhat neutralizing the potentially temporary effects of Russia’s invasion of Ukraine, which impact both energy prices and global supplies of grain.

[2] From early 1974 until late 1982, CPI ex food and energy was approximately 6% or higher for over eight years, with a substantial portion of that time showing year-over-year price increases of over 10%.

[3] Shout out to my fellow Excel nerds. Did you know about this? And yes, it was actually televised by ESPN.

[4] Notably, the only time we ever saw three consecutive months of CPI declines was March to May of 2020 under circumstances that, to say the least, are unlikely to happen again in the foreseeable future. We hope.

[5] The scenario we are painting here shows that recessions do not have a monopoly on hurting markets. Any wage inflation would likely come at the expense of corporate margins and profits, placing an overhang on equity valuations even in this slightly less recessionary scenario in which consumers got an unexpected income bump to offset higher prices and avoid a severe pullback in consumption.

[6] As punishment for cheating death, Sisyphus was forced for all eternity to push a massive boulder up a hill, only to have it roll down once it neared the summit. Luckily, Chairman Powell has something Sisyphus did not: free will to stop and a mandate from Congress and the American people. Let’s hope the Fed sees the futility of rolling their inflation target boulder toward a 2% summit in the near term and the severe and disproportionate risk to the economy and the American people of insisting on doing so at any cost.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Osterweis Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Osterweis Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)