Starting early last year, the Dollar Index began a long, upward move that culminated with a 20-year high in September. It has since retreated and has given back a good portion of those gains. Despite a recovery move this week, it remains on-track for its first three-month losing streak since August 2020. It could also see significant declines during the first half of 2023.

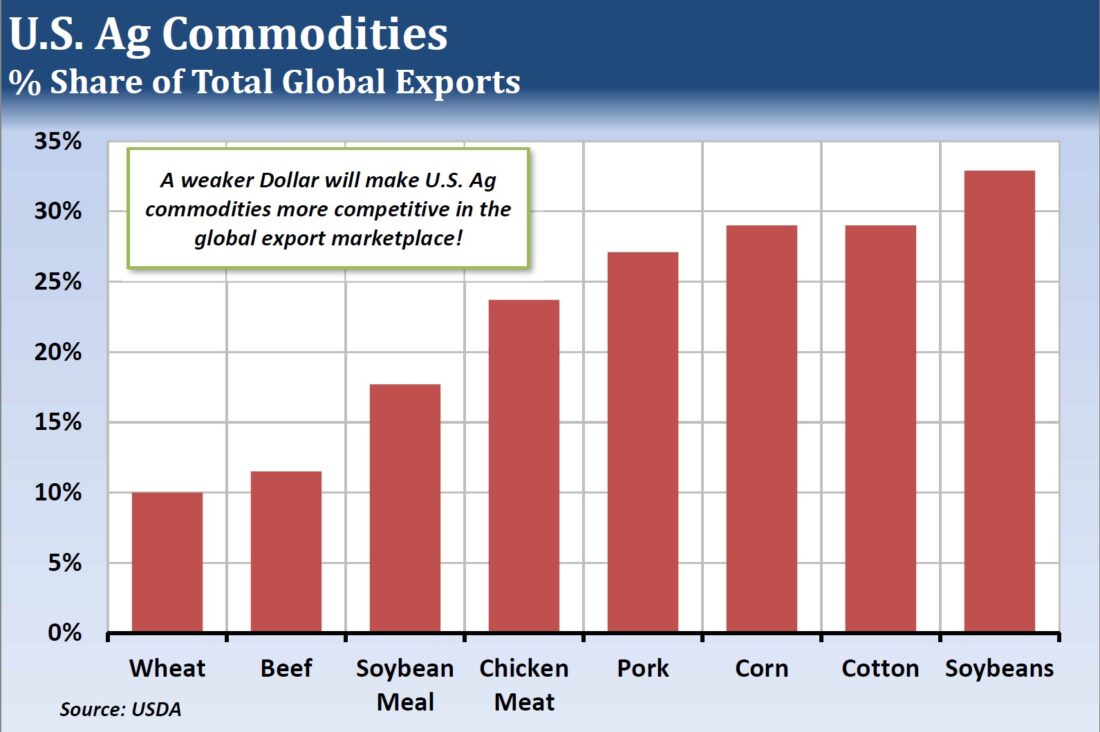

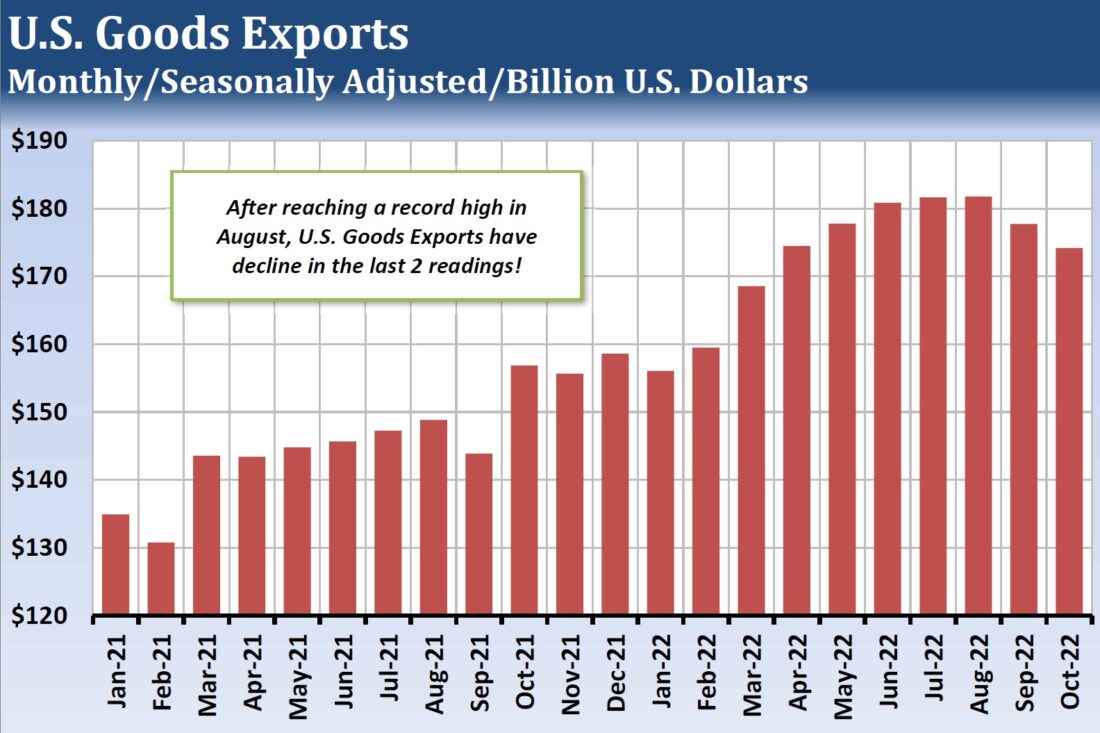

The US Census Bureau provides monthly data on US commodity exports in their monthly International Trade in Goods and Services report, which includes the goods trade balance, which is measured by the value of the imports and exports in dollars. The global post-pandemic economic recovery and across-the-board inflation led to a surge in US goods exports this year. They reached $184.014 billion in August, which was a record for a single month. There were back-to-back declines in September and October, which were the largest since early 2020.

The Census Bureau divides US goods exports into six categories: 1) Industrial Supplies and Materials, 2) Capital Goods, 3) Automotive Vehicles and Parts, 4) Consumer Goods, 5) Foods, Feeds & Beverages, and 6) Other Goods. The grains, oilseeds and meats are covered in Foods, Feeds and Beverages. Petroleum, precious metals, industrial metals, cotton, and lumber are covered in Industrial Supplies and Materials, which has been the largest-valued category over the past two years.

Crude oil, petroleum products, and natural gas are the largest US commodity exports in dollar terms. The US has been a net exporter of crude oil and products combined for several years, with the ten largest weekly surpluses on record occurring since April. These items are priced in dollars in many parts of the world. Attempts to have them priced in other currencies have gained little traction in the global energy marketplace.

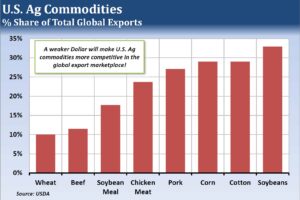

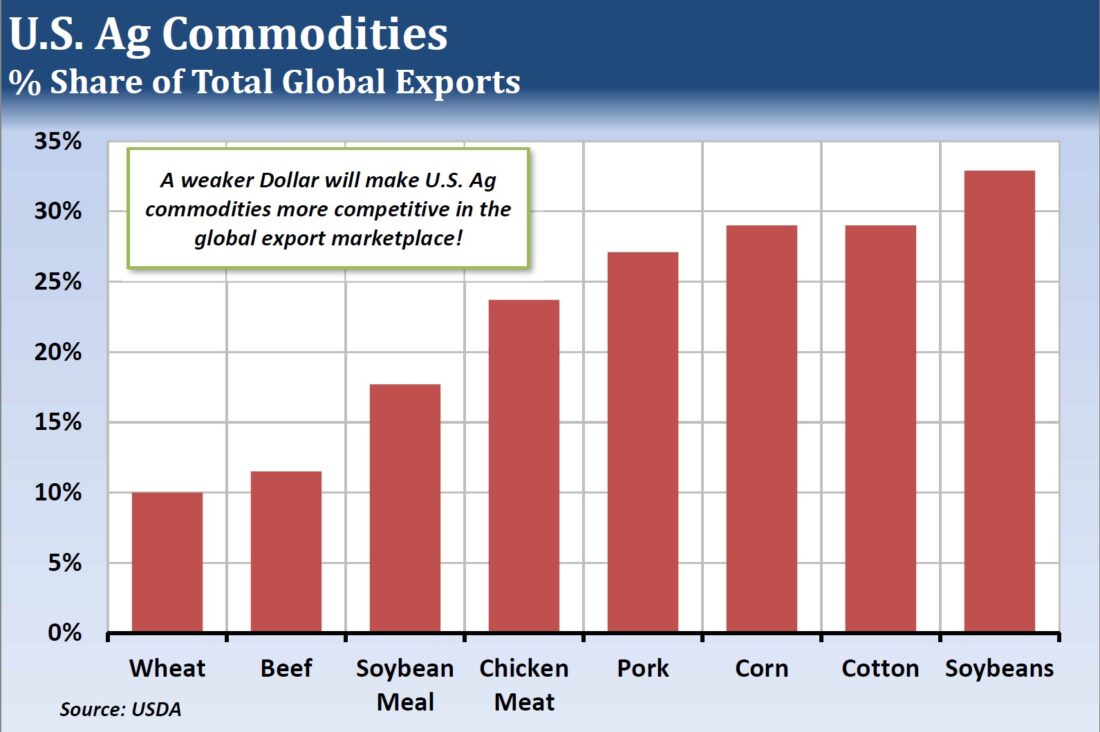

It may be in agricultural commodities that a weaker dollar will provide the biggest benefit to US exports. The US has a 25% share or higher of global exports in soybeans, cotton, corn, pork, and soybean meal exports. Those will become more competitive if the dollar continues to weaken. And while the US has only a 10% share of global wheat exports, there is room for expansion in the wake of the Russia/Ukraine war and if the dollar continues to lose value.

—

Originally Published December 23, 2022

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)