Most mornings, I sit down to write a piece that I hope will attract readers’ attention. This morning, I know that my topic will attract more than its normal share of eyeballs. Tesla’s (TSLA) stock and options are typically among the most actively traded both at our firm and the industry overall. It was inevitable that a wide range of market participants will be eagerly eyeing TSLA’s earnings report after today’s close, but they have taken on greater importance with yesterday’s results from Microsoft (MSFT) dragging markets lower this morning.

We recently asserted that a number of this month’s best-performing stocks are benefitting from the January effect. In that article, we focused on Amazon (AMZN) and Meta Platforms (META), but we could have easily added TSLA to that analysis. Through yesterday, TSLA was up over 16% year-to-date after giving back about 2/3 of its value last year. For better or worse, it makes it more difficult to clarify whether investors are primarily defensive after last year’s declines or aggressive after the recent rally. Let’s see if the options market reveals any bias.

TSLA is a volatile stock on a normal basis and particularly after earnings. Its historical volatility is in the high 70’s, meaning that 5% daily moves are normal. In that light, its four most recent post-earnings moves of -6.7%, 9.8%, 3.2% and -11.5% don’t seem all that outlandish. Bear in mind that the consensus estimate for 4Q earnings is 1.12, which would be a record quarter for the company even as it aggressively cut prices in its key markets of the US and China prior to year-end. Knowing that TSLA cut prices even further since then, investors will be eager awaiting signals for whether volume increases have offset obvious margin pressures.

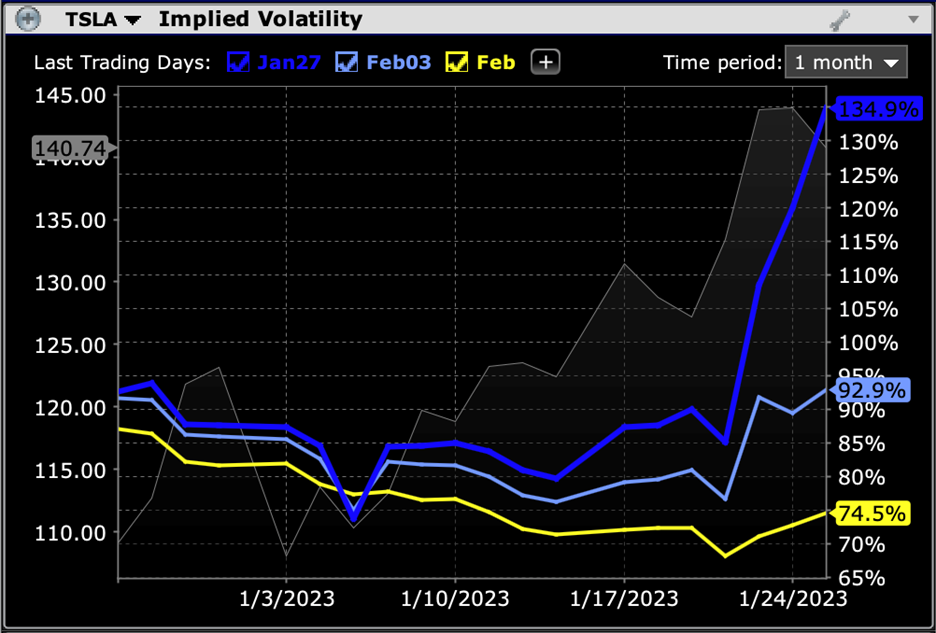

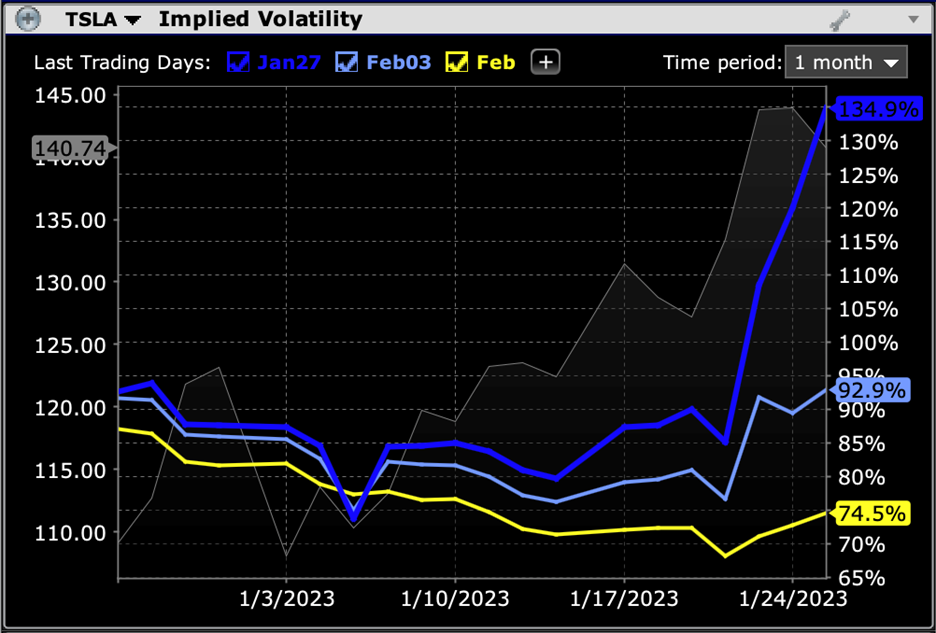

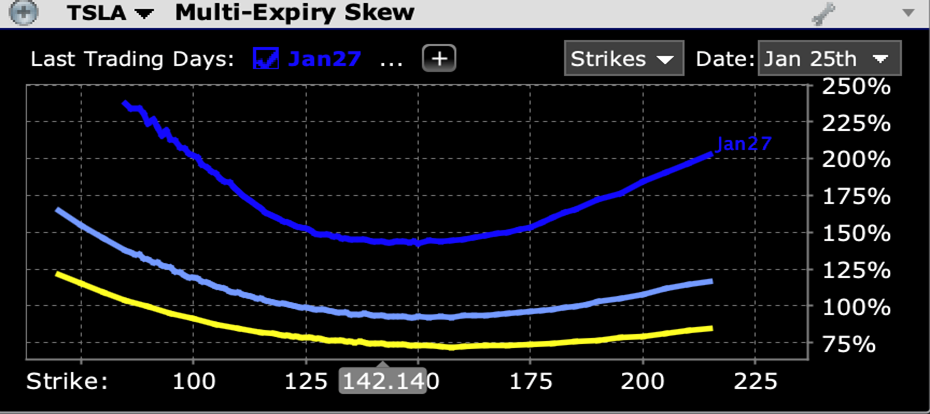

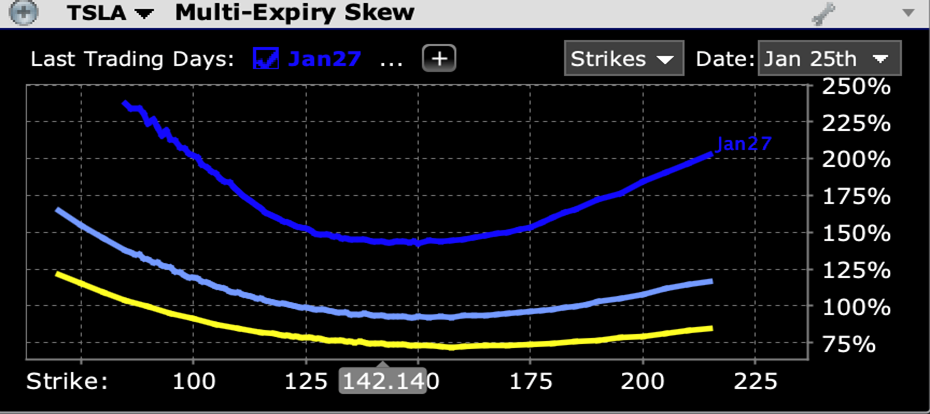

Options traders appear to be quite mindful of the two push-pulls referenced above. At-money options expiring on Friday are sporting a hefty 135% implied volatility. That implies an average 8.4% daily move for the rest of this week, or a one-day post-earnings move of well over 10% tomorrow if we use the equations that we outlined yesterday:

Implied Volatility for TSLA Options Expiring January 27th (dark blue), February 3rd (light blue), February 17th (yellow)

Source: Interactive Brokers

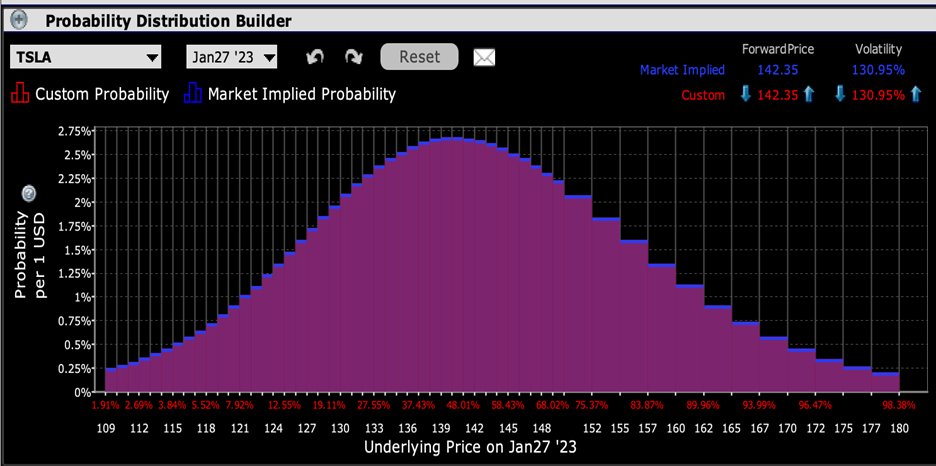

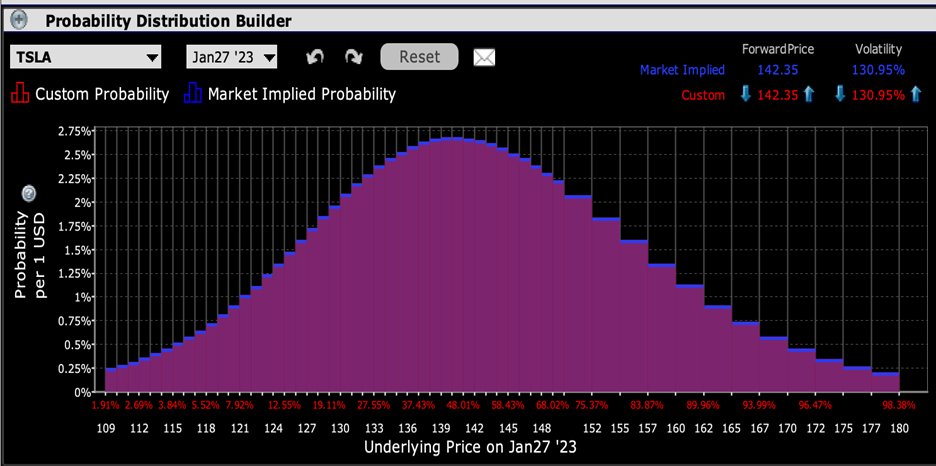

Unlike with MSFT, which showed options traders relatively agnostic about the company’s post-earnings prospects (remember, MSFT was up about 4% in the brief period between releasing earnings and beginning its conference call), TSLA traders are a bit more defensive. As is typical, we see a probability peak involving near-money options, but the distribution is somewhat more biased to the downside than neutral:

IBKR Probability Lab for TSLA Options Expiring January 27th, 2023

Source: Interactive Brokers

Skews on near-term options display a mix of risk-aversion and speculation. The curve is relatively flat for about 12% above and below the current stock price. While it is definitely steeper on the downside – which is typical – note the steepness on extreme upside ($175 and above). The faithful are keeping the faith.

Multi-expiry Skew for TSLA Options Expiring January 27th (dark blue), February 3rd (light blue), February 17th (yellow)

Source: Interactive Brokers

As with almost anything TSLA-related, the views are extreme. Implied volatilities ahead of earnings are well above the normally high levels that we see for the stock. There are traders willing to speculate on a return to past glory just as there are traders speculating that the recent rally is overdone. We’ll know who is more likely to be correct, at least in the short-term, after today’s close.

—

Note: The author has stock and options positions in TSLA

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ