As we begin 2023 looking at technology-oriented investments, a ‘consumer-slowdown’ and related macroeconomic factors are front and centre in investor considerations:

- Worldwide shipments in personal computers (PCs) totalled 286.2 million units in 2022, a 16% decline from 20211.

- Global Information Technology spending contracted 0.2% in 2022, dropping to a total figure of $4.38 trillion. It is rare to see this figure, which represents spending in many different categories of things, contract. PCs, smartphones and other devices are seeing the biggest cuts. Devices spending dropped more than 10% in 20222.

- Taiwan Semiconductor Manufacturing Co. (TSMC) has indicated that its revenue can drop as much as roughly 5% in the current quarter, and that it expects lower capital expenditures when measured against the 2022 figures. TSMC is the world’s largest contract chip maker, and it has set the capital expenditure budget at $32 to $36 billion, which compares to $3.3 billion 20223.

However, the fact that semiconductors companies behave in a cyclical fashion, sensitive to the ups and downs of supply and demand is not new. There was a deluge of negative news and a downplaying of forward looking expectations in the second half of 2022. During earnings call, the CEOs of semiconductor companies put on a masterclass of seeking to lower forward-looking expectations.

Therefore, we could be in a position where, at the start of 2023, any news that does not represent the most bearish of possible outcomes is actually viewed positively.

Semiconductor Companies have Rallied Strongly to Start 2023

When many investors think about ‘growth’ or ‘tech’, they first thing of the Nasdaq 100 Index. This index functions as a baseline, where the top holdings are some of the world’s largest companies driving what we think of as ‘information technology’ forward.

In Figure 1a, we created a ratio chart, where, as the line moves from the left to the right of the page4:

- An upward or positive slope represents the outperformance of Semiconductors companies relative to the Nasdaq 100 Index.

- A downward or negative slope represents the underperformance of Semiconductors companies relative to the Nasdaq 100 Index.

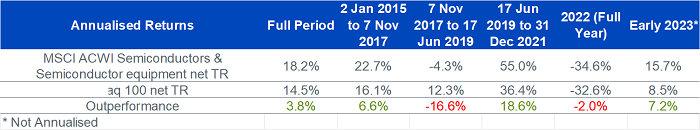

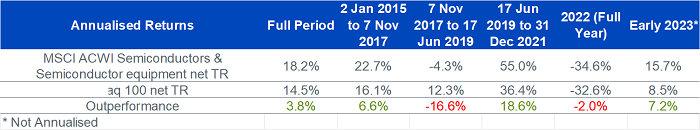

When we see that the overall trend going back to 2015, we know that Semiconductors companies have generally performed strongly—since the line is higher at the right of the chart than the left, we know that Semiconductors outperformed the Nasdaq 100 Index. However, the line is not stable or smooth, and it is characterized by sweeping upward and downward trends. We show those figures specifically in Figure 1b.

- This full period was strong from ‘tech stocks.’ The Nasdaq 100 Index was up 14.5% annualised, whereas Semiconductors were up 18.2% annualised.

- Our ‘recent memory’ is colouring our perception, so what we likely remember closely is how it felt to watch Semiconductors drop -34.6%, but at the same time the Nasdaq 100 Index dropped -32.6%. 2022, as we all well know, was a rough year for the returns of technology-oriented stocks.

- We would say that the 2022 experience was largely a result of what had come directly before—a massive expansion in near-term demand as many people shifted their working practices and purchased different types of hardware to allow them to work from anyway. From 17 June 2019 to 31 December 2021, Semiconductors returned 55.0%, annualised, while the broader Nasdaq 100 Index returned 36.4%.

- We find it interesting that, even with all the same headwinds, like higher interest rates and a higher cost of capital and a lowered expectation of global economic growth, Semiconductor stocks have risen 15.7% in the first 3 weeks of 2023, which compares with the Nasdaq 100 Index rising 8.5%. 3 weeks is not a significant length of time, but it’s notable that this period immediately precedes companies reporting their earnings results from the period ended 31 December 2022. Maybe there is an implicit assumption in these returns that the results could be ‘less bad’ than what the CEOs of the Semiconductor companies had guided toward in prior quarters.

Figure 1a: Ratio of Cumulative Performance—Semiconductors vs. Nasdaq 100 Index (2 January 2015 to 23 January 2023)

Figure 1b: Table of Returns over Selected Periods within Figure 1a.

Source: WisdomTree, Bloomberg. 1st January 2015 to 23rd January 2023. In USD. Semiconductors performance is proxied by the MSCI ACWI Semiconductors and Semconductor equipments net TR Index

Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion: The Two Forces of 2023 that Determine the Semiconductor Return Experience

No one knows how the performance of semiconductor companies will evolve over 2023, but we are watching two critical areas of the space.

- Even if 2022 was poor from a direct share price performance perspective, there was an enormous array of announcements of planned new plants to be built in different states in the U.S. There was also the passage of the ‘Chips Act.’ Even if it will take years before these plants will be making physical chips that can be sold, the signal that these companies are adjusting their supply chains to be less geographically reliant on Taiwan is an important one.

- As we stated, the general CEO of a semiconductor company was focused on lowering guidance for the upcoming quarterly earnings results. When this happens, the future reports become less about the number on the page and more about whether the number on the page is ‘less bad’ than the guidance. If there is a perception that things are ‘less bad’ it’s possible that share prices can rally even if the results in isolation do not look great.

If Semiconductors can continue to outperform the Nasdaq 100 Index through the upcoming earnings season, this would lend strength to the concept that they may be able to hold onto this for the year, as opposed to us remembering that quick 3 week period of strong performance before the market gave it all back.

Sources

1 Source: Jacob, Denny. “PC Shipments Drop Sharply in a Slump Expected to Last Until 2024.” Wall Street Journal. 11 January 2023.

2 Source: Loten, Angus. “Global IT Spending Decreased in 2022.” Wall Street Journal. 18 January 2023.

3 Source: Jie, Yang. “TSMC Warns of Possible Revenue Drop, Spending Cut.” Wall Street Journal. 12 January 2023.

4 When referencing Figures 1a and 1b, ‘Semiconductors’ is defined as the universe of companies within the MSCI ACWI Semiconductor and Semiconductor Equipment Index.

—

Originally Posted January 27, 2023 – What’s Hot: Semiconductors are off to a HOT Start in 2023…after a COLD 2022…

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)