EPS revisions are moving down. And fast. In the context of a macroeconomic slowdown – one that appears to be accelerating – this is hardly surprising. But what does it mean for stocks, if anything? If you are in the technical analysis camp, this may not really be on your radar screen. However, evidence suggests it should be.

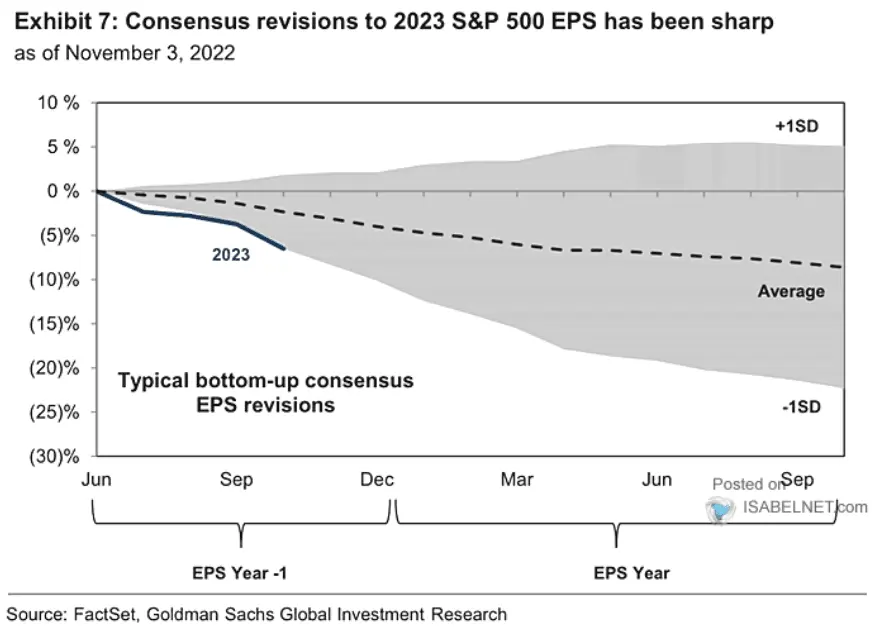

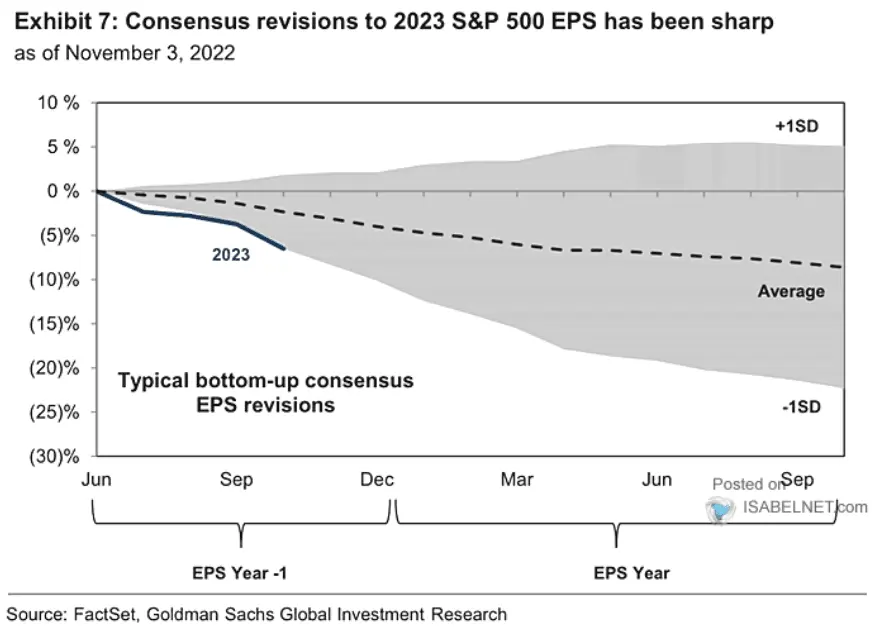

The chart below shows how current revisions are tracking for the forward year 2023 relative to a typical revision cycle. Quite clearly, this revision cycle is more aggressive than the usual experience.

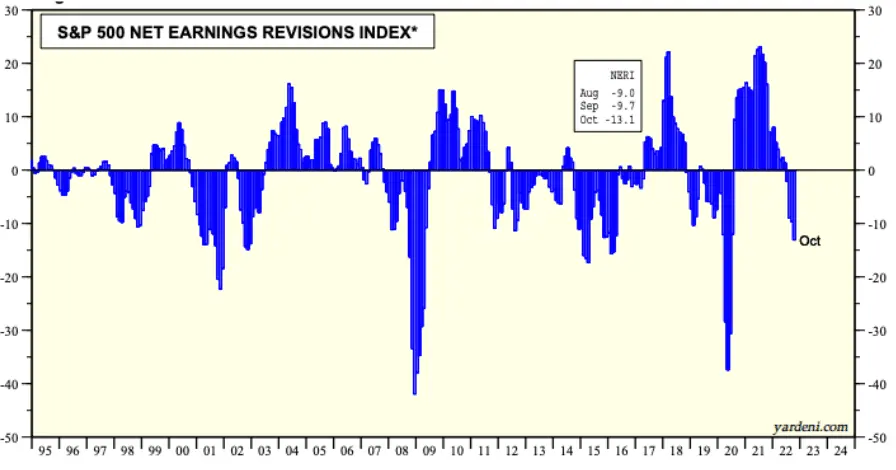

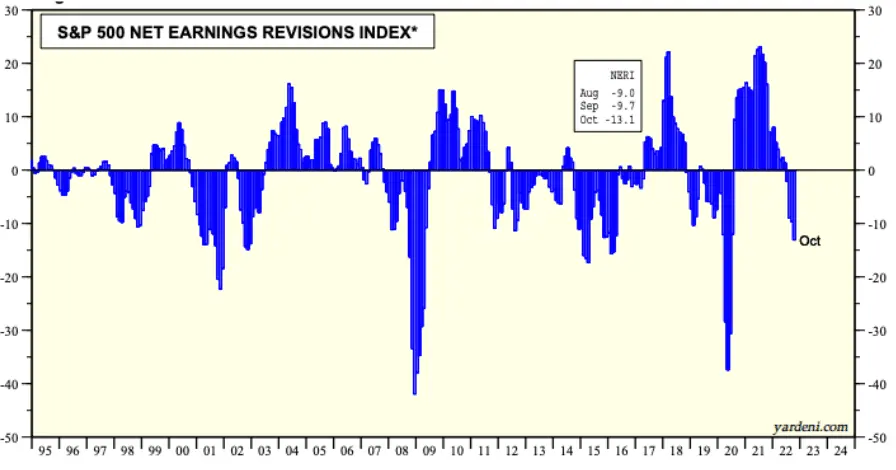

Another way to look at it is by simply comparing upgrades vs. downgrades. Here, too the cycle is well on the way to match the horrid 2015/16 experience, possibly worse.

Source: Yardeni research

The reason for this is likely two-fold.

One, the pandemic caused a large behavioral change globally and analysts were forced to decide how permanent or temporary the implications were, stock by stock. In some cases, the good times – think Netflix, Peloton etc. – were extrapolated too far into the future. Some of current revisions are a payback for earlier, misplaced optimism.

Two, the economy is indeed cooling quite rapidly. Housing is the most obvious indicator where rising mortgages are bringing previously hot housing markets off the boil. But more broadly, activity is slowing.

Still, why should we care?

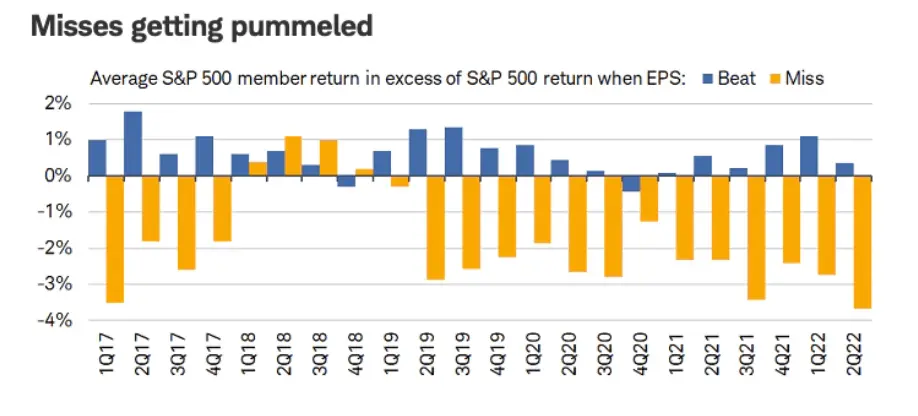

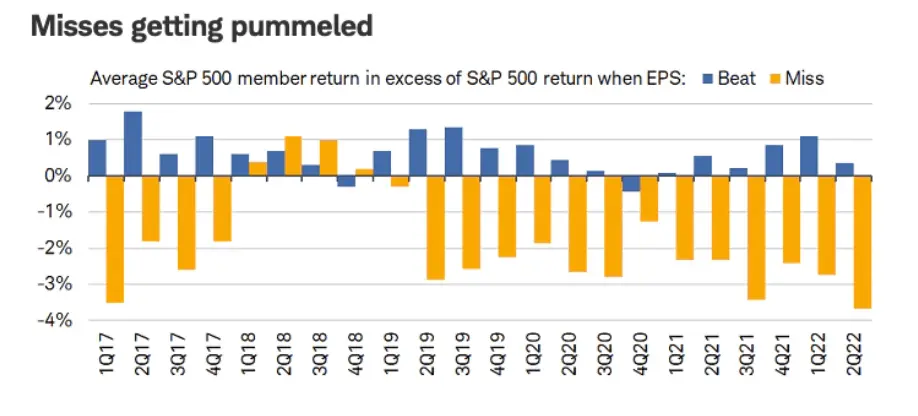

Earnings disappointments are getting punished a lot more than they have done in some time. As shown in the chart below (courtesy of Charles Schwab analysis), stocks that beat estimates were rewarded on the day of their earnings’ release but less than the prior two quarters. In contrast, stocks of companies missing estimates were punished to a more significant degree than anything seen over the past five years.

Source: Charles Schwab

Idea Spotlight: Fisker

TOGGLE analyzed 13 similar occasions in the past where entry point indicators for Fisker were oversold and historically, this led to a median increase in price.

Last Wednesday, Fisker reported a loss of 49 cents a share, versus Wall Street’s expectation of 42 cents. However, the company is on track to start production of its first EV, the Ocean SUV.

—

Originally Posted November 8, 2022 – Daily Brief – Why are the earnings revisions so big?

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)