Study Notes:

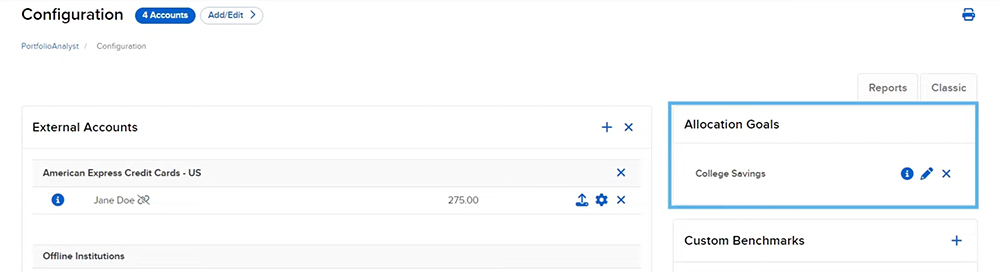

Investors have the ability to create Allocation Goals and Custom Benchmarks to use throughout PortfolioAnalyst to analyze portfolio performance. To do so, the investor selects the Configuration button located at the top right of the PortfolioAnalyst home page. The right side of the screen will display boxes for Allocation Goals and Custom Benchmarks.

Allocation Goals

The PortfolioAnalyst Allocation Goals feature allows investors to view their current vs. target asset and sub-asset class allocations for seamless portfolio rebalancing. Once goals are configured, the investor can run the Allocation Goals Report to identify over and underweighted asset and sub-asset classes vs. the configured goal. In addition to the Allocation Goals Report, investors can view actual weightings compared to their goal weightings through the Planning widget on the PortfolioAnalyst dashboard.

Creating an Allocation Goal in PortfolioAnalyst

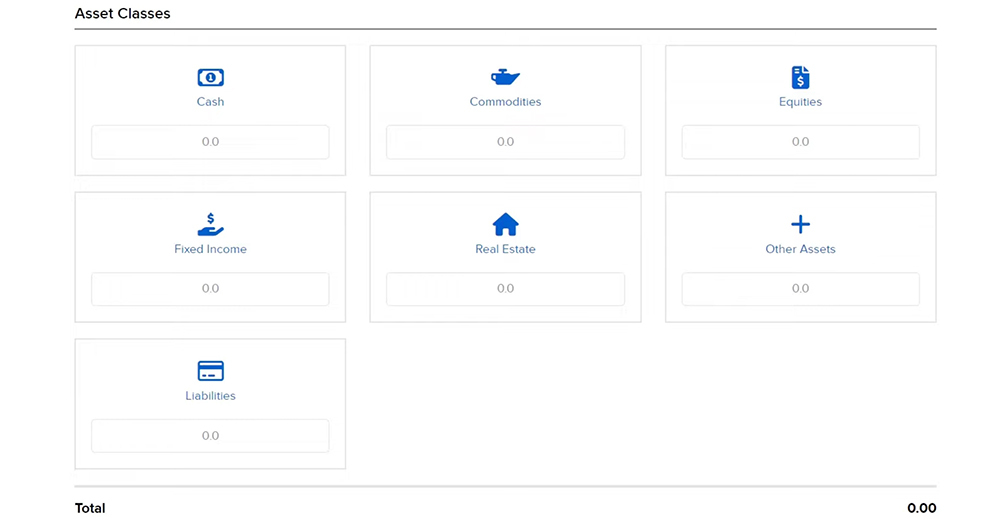

To create an Allocation Goal, investors can select the + button. The investor then enters a Goal Name and, from the dropdown, can choose to configure the report by Asset Class or Sub-Asset Class. There are seven asset classes to choose from:

- Cash

- Commodities

- Equities

- Fixed Income

- Real Estate

- Other Assets

- Liabilities

Sub-Asset Classes will be broken down by the seven asset classes with the option to fill in a total of 33 sub-categories.

Investors can choose to set their goal either by Percentage or Dollar Amount. If using percentage, please note that goals must total to 100%. Investors will enter their desired allocation amount in the various Asset Classes at the bottom of the page. Once filled in with the investor’s desired amount, they can select Continue, review the allocation goal and select continue again to save.

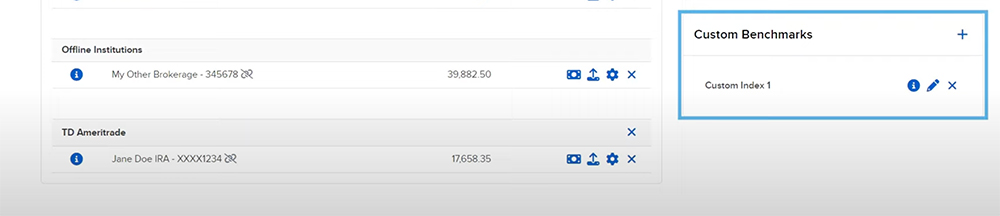

The Allocation Goal can now be seen on the Configuration page and is available for use in both custom reports and the Planning widget. From the Configuration page, the investor can use the “i” icon to view the details of the allocation goal, the pencil icon to edit the allocation goal and the X icon to delete the allocation goal.

For more information on running PortfolioAnalyst reports or utilizing Widgets, please see the PortfolioAnalyst Reports video as well as the PortfolioAnalyst Widgets video.

Custom Benchmarks

Next we will take a look at Custom Benchmarks. PortfolioAnalyst provides a large number of standard industry benchmarks for investors to choose from however, Custom Benchmarks will allow the investor to combine multiple existing standard benchmarks. Investors can then compare their portfolio performance to the Custom Benchmark.

Creating a Custom Benchmark in PortfolioAnalyst

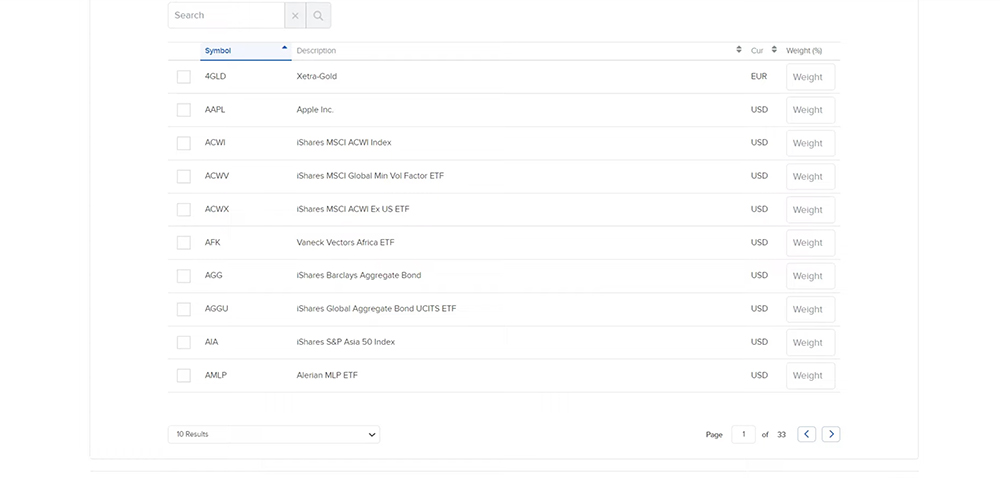

To create a Custom Benchmark, investors can select the + button. The investor then enters a Name and an Abbreviation for the benchmark. The Abbreviation can be used as a quick way to search for and find this custom benchmark when adding it to a custom report.

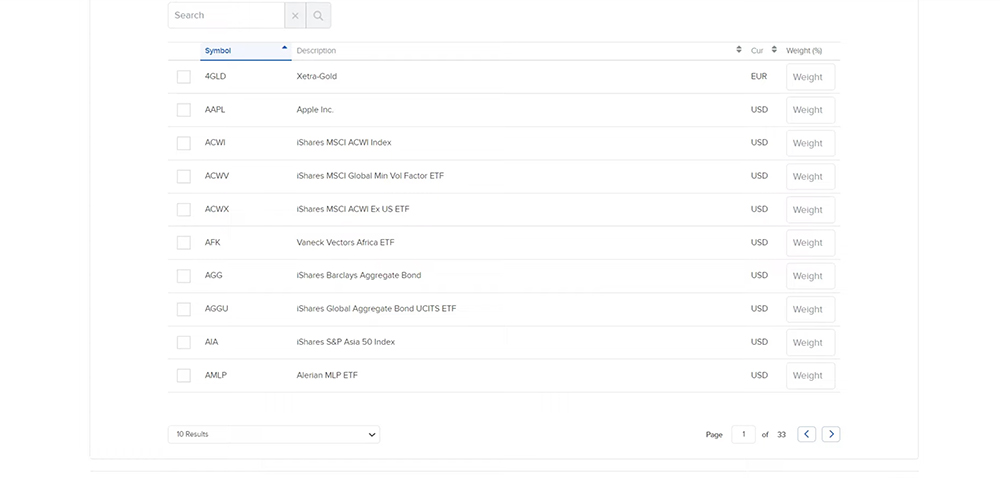

In the Benchmarks section, the investor can scroll through the choices by clicking on the arrows in the bottom right corner, choose how many results they would like displayed on a page, and use the Search bar to type the benchmark they wish to include in their custom benchmark. For example, to search for funds and ETFs related to the S&P 500 Index, the investor can type “S&P 500” into the search bar and a list of benchmarks containing those characters will appear.

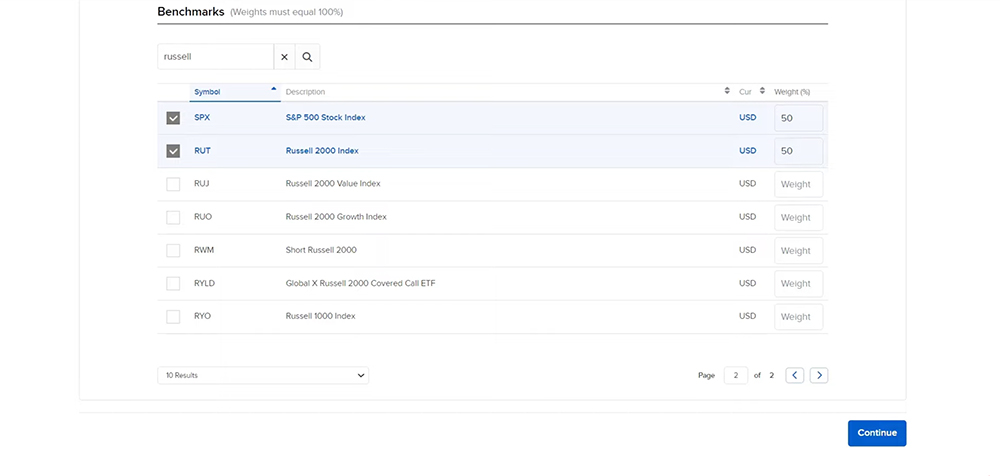

Investors can select the check box next to any benchmarks they wish to add and enter the weightings of each benchmark added. The investor must include at least two standard benchmarks when creating a custom benchmark but can add any number of standard benchmarks to their custom benchmark, as long as the total weight equals 100%. In this example, the investor has added the S&P 500 as well as the Russell 2000 Index and would like both to be of equal weight, so they type 50 for each benchmark to make sure the total adds up to 100%. The investor then selects Continue at the bottom and is taken to the Review screen. Once the investor is ready to save the Custom Benchmark, they click Save Changes.

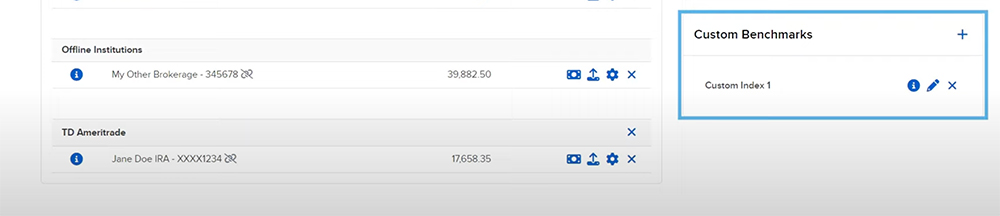

The Custom Benchmark can now be seen on the Configuration page and is available for use in custom reports. From the Configuration page, the investor can use the “i” icon to view the details of the custom benchmark, the pencil icon to edit the custom benchmark and the X icon to delete the custom benchmark. The custom benchmark can be added to custom reports through the Reports tab by searching for the custom benchmark in the Benchmarks section.

For more information regarding configuring Allocation Goals or Custom Benchmarks, please see our user guide.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.