Study Notes:

Building permits are generally required from local authorities before a construction company can begin building structures. The building permit data release tells us the dollar value of the newly permitted structures that have been allowed to be built for residential and non-residential purposes. Permits fall into two categories in the release: residential and non-residential.

The residential category is comprised of the single and multiple unit sub- categories while the non-residential category is comprised of the industrial, commercial, and institutional sub-categories. Building permits are calculated by Statistics Canada by collecting permit data from approximately 2,400 Canadian municipalities that comprise about 95 percent of the Canadian population. The data release is published monthly, generally near the 5th day of the month at 8:30 am Eastern time. Statistics Canada measures building permits in the Canadian economy to support informed decision making made by individuals, businesses, non-profits and governments.

Through the release of the data, difficult and hard-to-find data regarding the real estate sector can be analyzed. As a result of the release, information about the real estate industry, wealth indicators, capital intensive use, interest rate sensitivity, and the consolidation of information across multiple industries is gathered and communicated.

Construction of a structure usually involves getting approval from your jurisdiction, obtaining financing from a bank for the land, purchasing materials to build the structure, hiring labor to assemble the materials, and installing durable appliances once the unit has been built. Building permits can serve as an indication of the state of the economy as the process of building a structure involves many interdependent components that must coordinate and work together.

The positive effects of robust construction activity could be felt through many economic data points and across the economy. In contrast, a slowdown in building activity typically indicates underlying economic weakness reflected in one or more of the numerous factors that affect the real estate market.

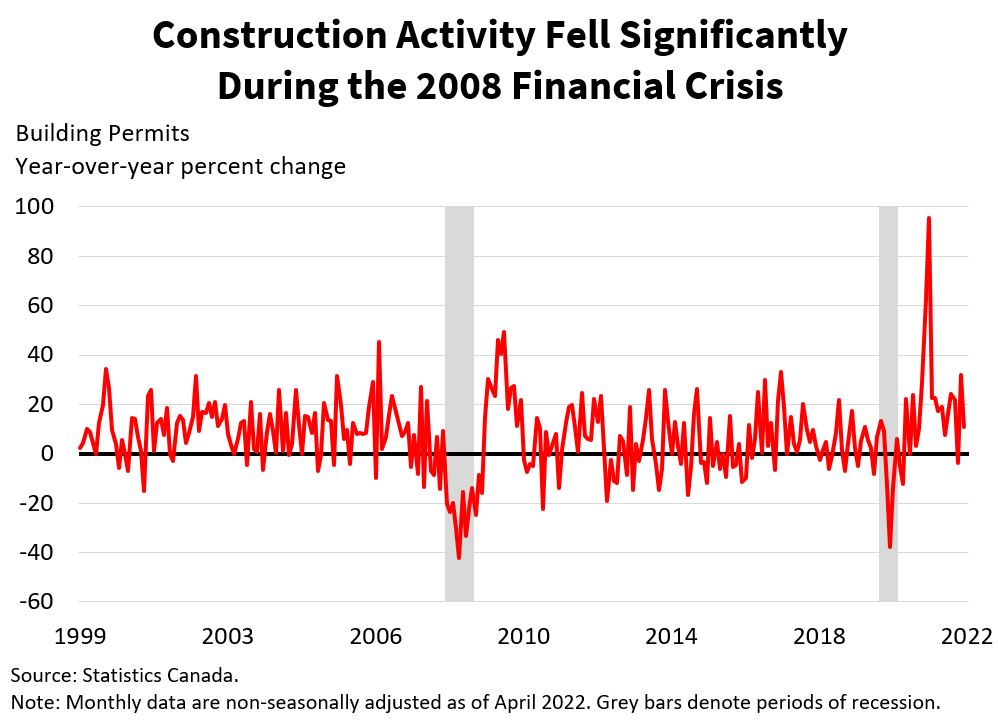

As in the 2008 financial crisis, a slowdown in the global real estate market may be reflected through slowing economic growth and weakness across a variety of economic indicators. In Canada and internationally, construction activity fell as a result of the 2008 financial crisis, which coincided with a period of weak economic growth, high unemployment, higher interest rates, and lower productivity.

When analyzing real estate markets, it is important to focus on the sentiment of builders, consumer demand for housing, and the cost of capital and supplies. For the purpose of determining the real estate market’s future, we use indicators such as homebuilder sentiment, consumer confidence, interest rates, real estate prices, sales, loans, and daily commodities prices to get an idea of how builders, banks, consumers, and investors feel about the real estate market.

The release of building permits is not normally a large driver for the market, however, if they are worse than expected, the market might fall more, and if they are better than expected, it might rise more. Market participants value the seasonally adjusted monthly percent changes and the inflation adjusted, or real dollar amount changes. In addition, they also watch the non-seasonally adjusted year-over-year percent changes and real dollar changes. Robust building activity has a positive impact on economic activity and the operating environment for businesses around the world.

Investments in construction are some of the most significant financial transactions made by individuals and businesses alike. An essential part of economic analysis involves tracking the capital-intensive and interest rate-sensitive real estate sector for signs of economic strength or weakness.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.