Study Notes:

Earnings season is an exciting time for many market participants. It’s when the financial results from publicly traded companies are reported to the public. Many companies also issue revenue and earnings guidance for future quarters. Special announcements such as stock splits, mergers, acquisitions, changes in management, stock buybacks, dividend news, etc. may also be announced during company earnings calls.

Corporate earnings are an important measure of corporate financial health and therefore, a measure of economic health as well. In its simplest form, earnings or profits are company revenues minus company expenses. Earnings incentivize companies and the economy to continue growing. As earnings grow, much of the funds are allocated towards capital expenditures that increase the productive capacity of the economy. As company earnings grow larger, the economy can produce more goods and services. While each public company calculates and prepares its owns results, aggregate corporate profits are calculated at The Bureau of Economic Analysis (BEA) by using a mix of estimates from professional trade organizations and government agencies. The report on corporate profits is generally released roughly two months after the last day of the referenced quarter at 8:30am eastern time. Revised data are published about one month after the initial estimate, when higher quality data is available. The BEA provides corporate profit data so that investors, Congress, policymakers, business and community leaders have the necessary information to help them make informed decisions that affect the American economy.

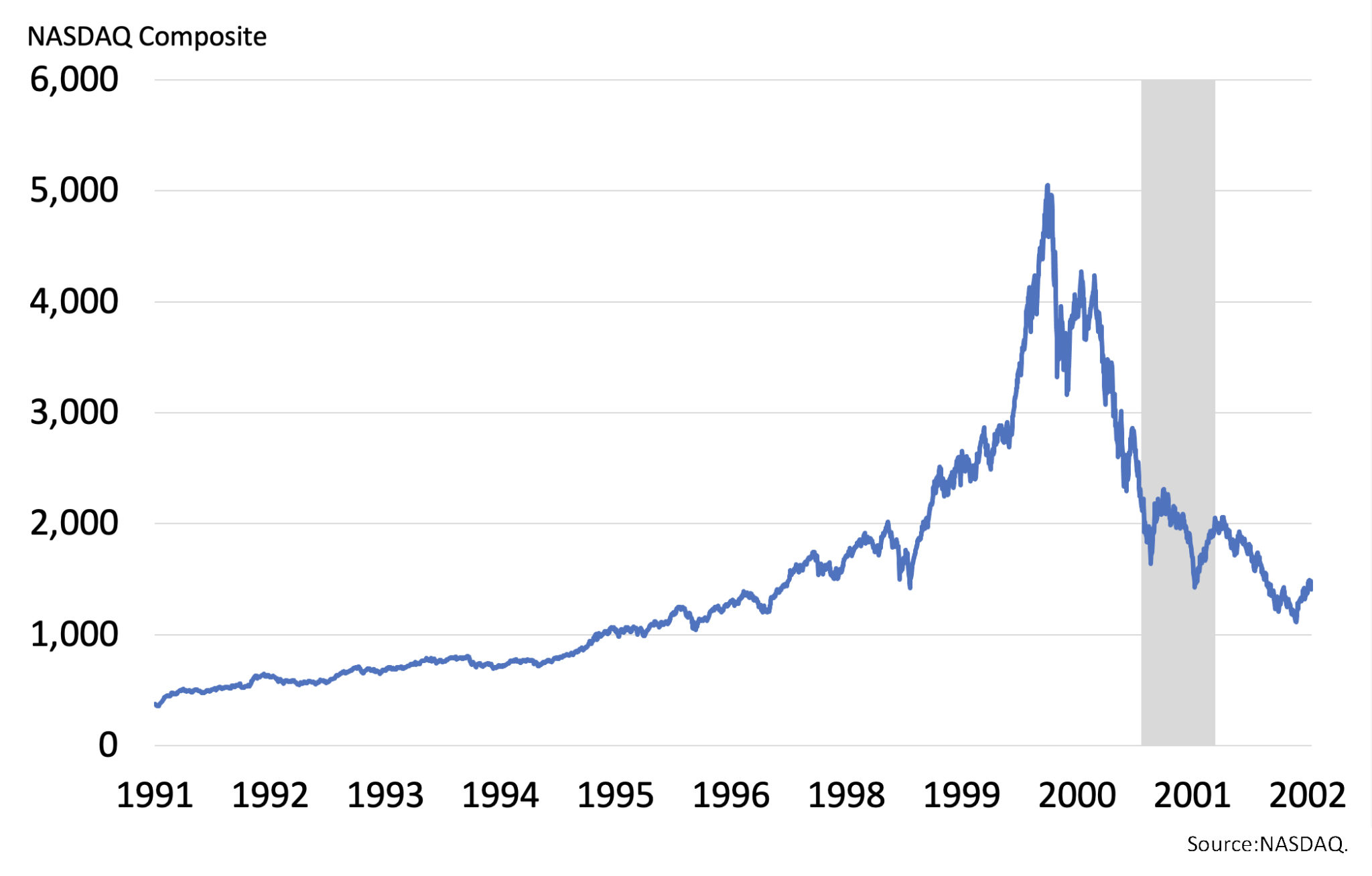

Profits provide integral support to financial markets globally. On the debt side, profits allow companies to continue paying lenders and ideally remain reliable borrowers with favorable credit ratings. On the equity side, profits pave the way for higher stock prices and ideally, higher valuations. One of the most popular valuation metrics in securities analysis is the price to earnings multiple, or the price of a stock divided by its annual earnings per share. As earnings rise, the denominator in the equation, pressure is placed on the numerator to rise as well in order to maintain a similar price to earnings multiple. Because the stock market is a forward-looking mechanism, when market participants sense that a company’s earnings will grow significantly in the future, they may be willing to add pressure to the numerator of the equation, the price, by buying stock. This is why companies with high growth prospects have higher p/e multiples, where earnings are expected to grow significantly and eventually bring the P and E into balance. If earnings don’t grow as expected or if there are disruptions with high p/e multiple stocks, stock prices can decrease quickly and significantly. The dot-com bubble in the early 2000s illustrate what can happen to high multiple stocks when expectations and reality don’t converge.

Higher earnings provide financial flexibility for companies to manage capital expenditure, debt, share -repurchase, stock-issuance, and dividend programs. In a macroeconomic context, higher earnings lead to a sequence of events that will likely lead to economic gains globally. An economic slowdown will weigh on corporate earnings, as revenue declines will weaken earnings. Higher expenses without commensurate increases in revenue will also weaken earnings trends.

To forecast corporate earnings, look at leading indicators like unemployment claims, housing permits, purchasing managers’ index for manufacturing, retail sales, durable goods orders, the yield curve, and consumer confidence that provide insights on the strength or weakness of economic trends. After all, earnings growth correlates with economic growth. In addition, Wall Street sell-side earnings estimates and revisions are important to watch. If earnings estimates and revisions begin to decrease, it means there are expectations for weaker numbers ahead and likely, lower stock prices.

Earnings season can provide market participants with positive sentiment when there’s fantastic news, negative sentiment when there’s adverse news, or indifference when results are in-line with expectations. In either case, earnings remain a significant component of financial markets and global economics.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.