Study Notes:

While corporate bond investors should conduct their own due diligence on a proposed debt instrument, and its issuer, in large part by closely analyzing a company’s financial health, operational risks, interest-rate environment, and impacts from central bank policies, they may also take into account third-party analysis from credit ratings agencies.

You may recall that investors in this asset class are more concerned with income generation and capital preservation rather than on growth, and, as such, are primarily focused on the return of their principal when the bond matures, as well as their timely receipt of interest payments as long as the debt is held.

By analyzing credit risk, a corporate bond investor is essentially evaluating the likelihood a company may default on its debt obligations – which is the primary objective of credit ratings agencies such as Moody’s Investors Service, S&P Global Ratings, and Fitch Ratings, among others.

The level of credit risk posed by a specific corporate bond, as well as by its issuer, generally indicates the severity of default risk an investor assumes.

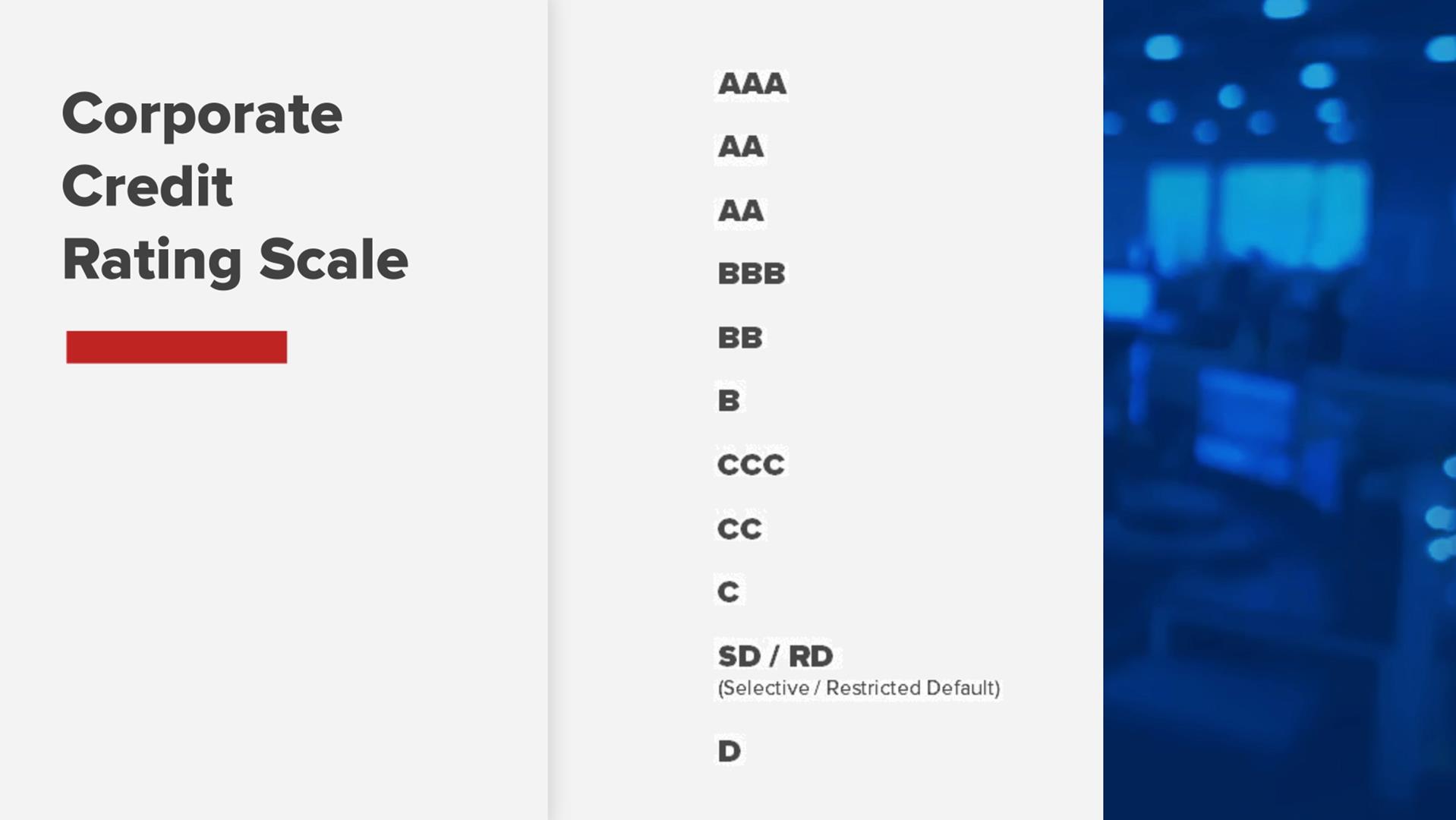

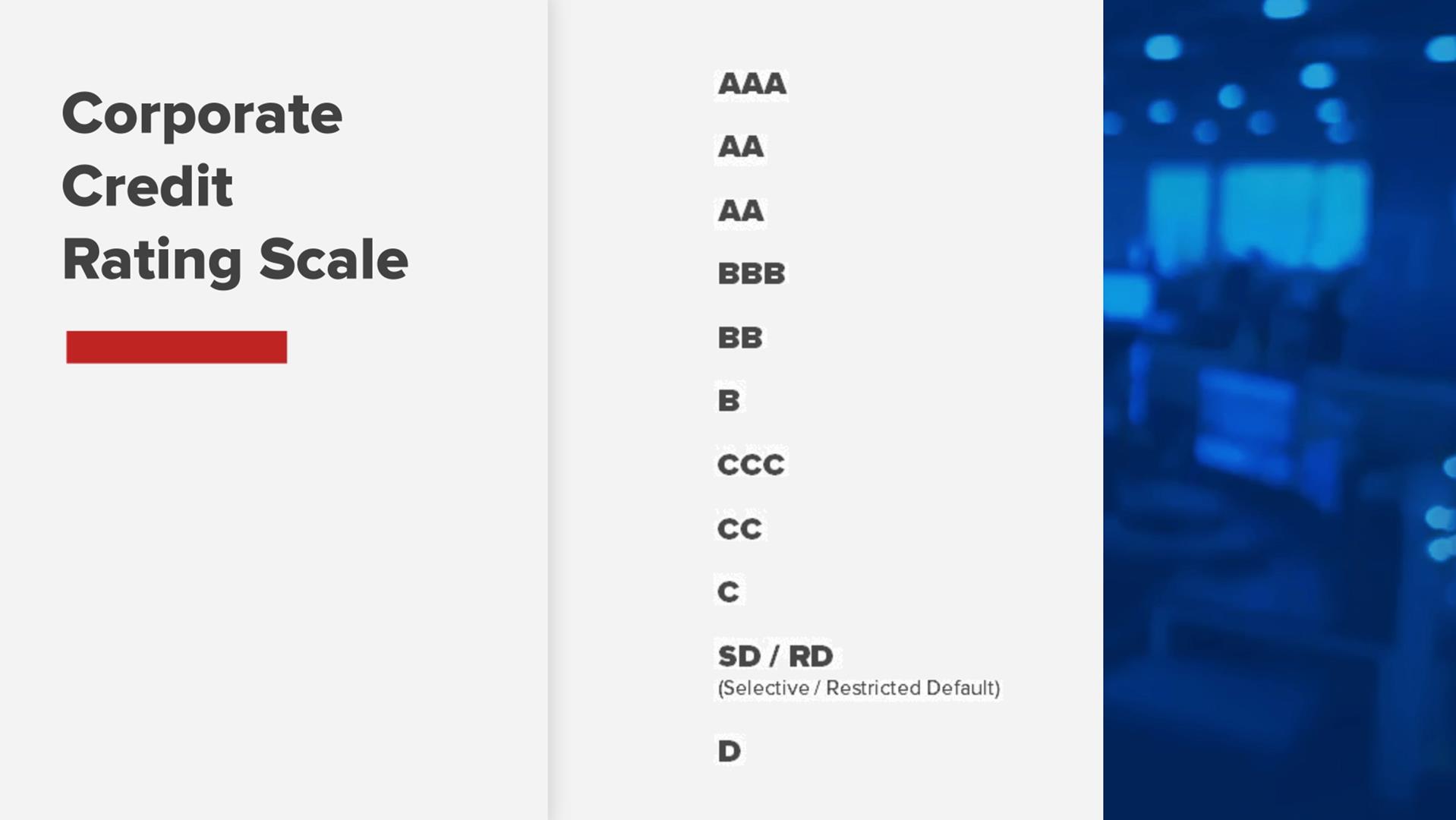

To rank this severity, credit ratings agencies typically use a scale. This scale categorizes the creditworthiness of most issuers of corporate debt, as well as their debt offerings, with designations usually divided into investment-grade (‘AAA’-‘BBB’) and lower-quality (‘BB’-‘C’) credits.

A corporate bond issuer assigned an investment-grade credit rating is considered by that ratings agency to be more likely to make timely debt service payments than those deemed non-investment-grade – which are also referred to as ‘high-yield’, ‘speculative’ or ‘junk’ bond issuers.

Corporate bond investors are generally compensated for higher degrees of credit risks in the form of higher interest rates.

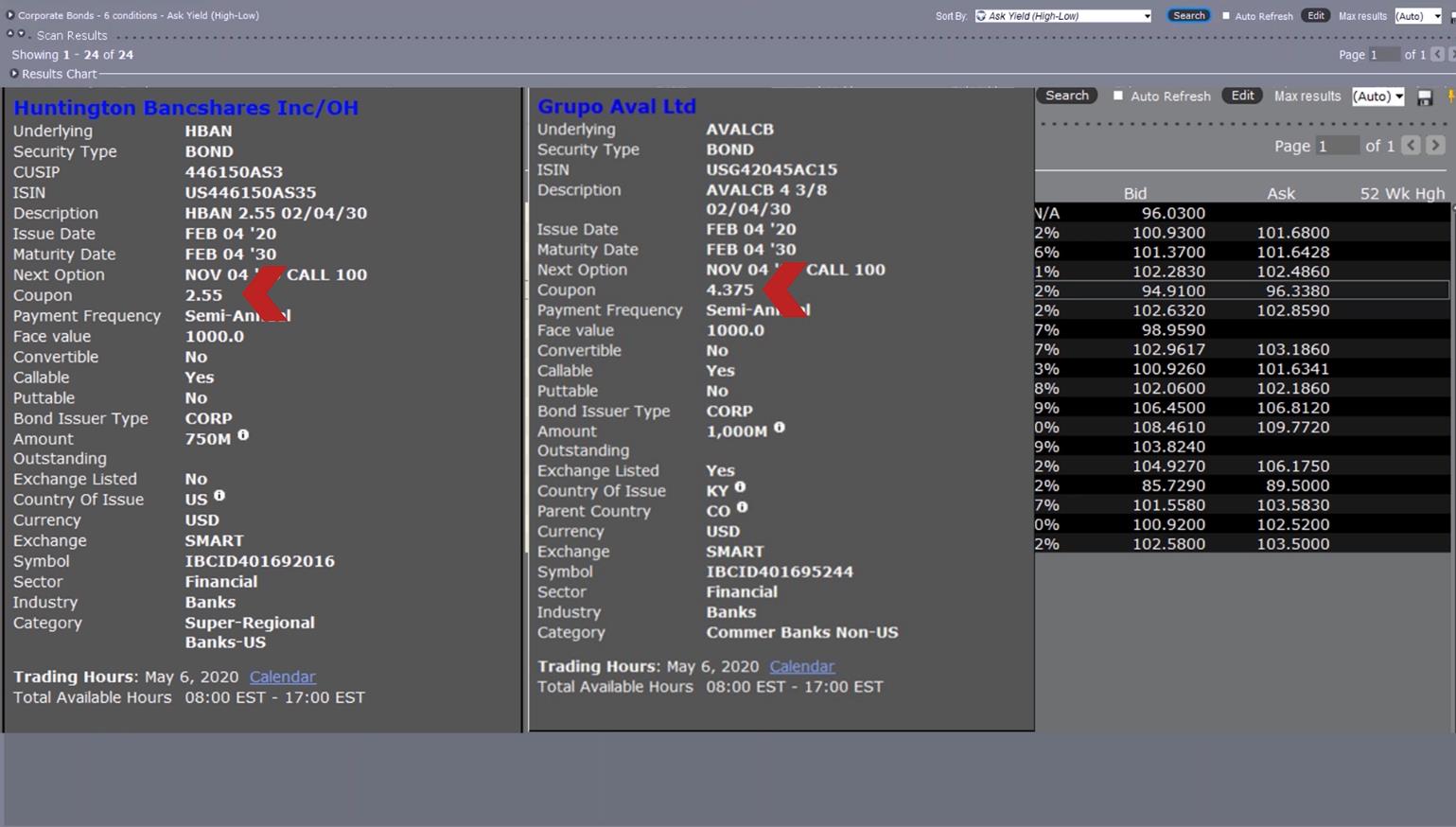

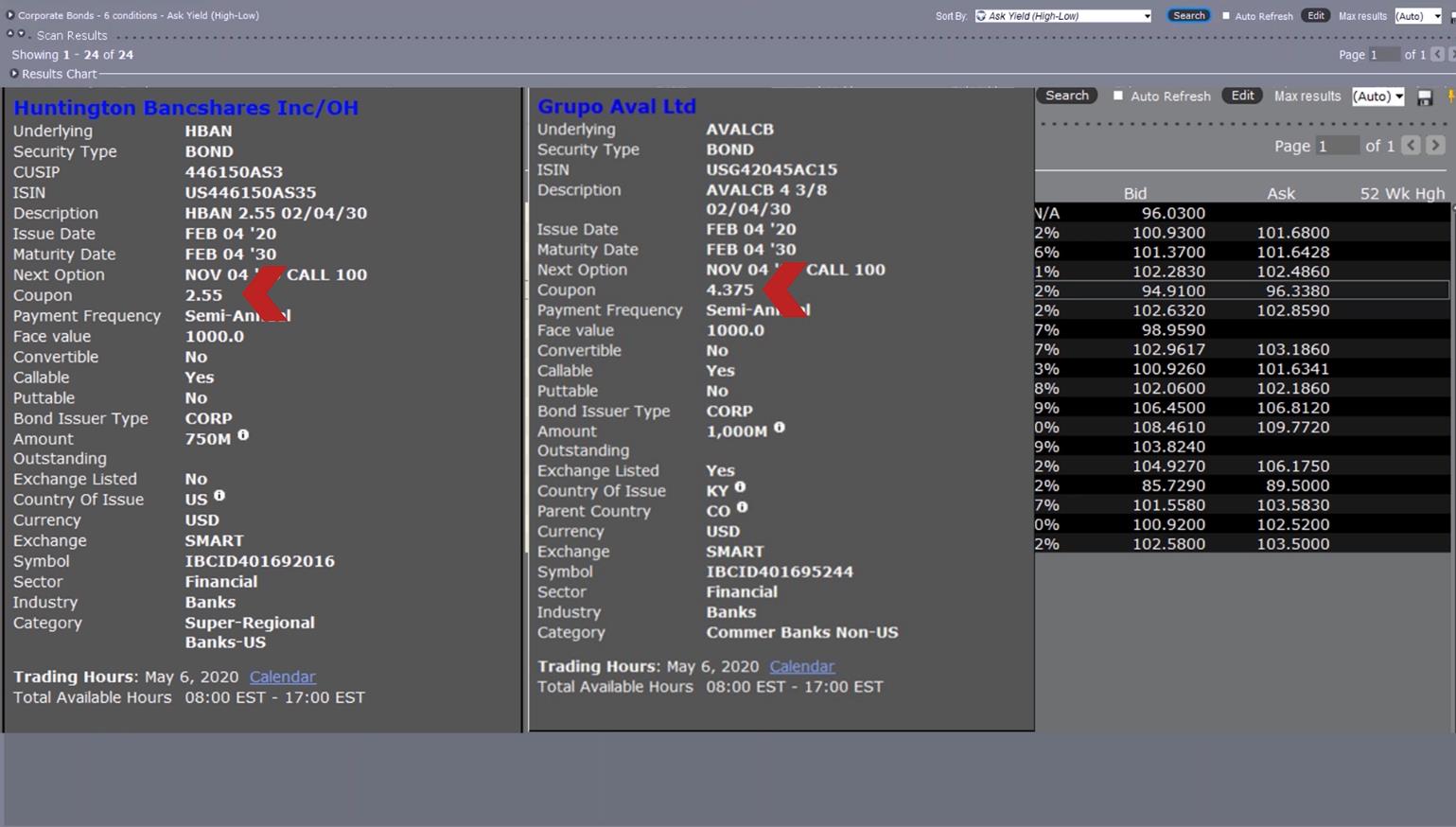

For example, using the Global Bond Scanner in the IBKR Trader Workstation, we’ll show how coupons on different grades of corporate bonds differ in value.

For illustrative purposes, we’ll select a corporate bond with an investment-grade credit rating by both Moody’s and S&P, such as ‘A’-rated Huntington National Bank’s bond due February 4, 2030, which carries a 2.55% coupon. Meanwhile, a non-investment-grade, ‘BB’-rated bond by Colombian financial services firm Grupo Aval, which was issued on the same day as Huntington National’s sale, and which matures on exactly the same date, carries a much larger 4.375% coupon.

They may provide an analysis of:

- The creditworthiness of an offering’s guarantor or insurer,

- Whether the deal offers forms of credit enhancement, as well as

- The issuer’s capacity and willingness to meet its scheduled financial obligations.

Certain terms of the issuance may also be addressed, such as collateral security and subordination, which, as we discussed in our lesson on default risk, could affect a bond holder’s ultimate payment in the event of the issuing company’s bankruptcy.

Credit ratings agencies also address what may cause their assigned ratings to rise or fall on their scales, and typically conduct periodic reviews to assess any impacts that may strengthen or weaken an issuer’s creditworthiness. These impacts may result, for example, from changes in the economy, or more directly from within their business or business sector.

The corporate bond market also generally uses certain terms to describe material changes in credit ratings.

An issuer that has crossed the threshold from investment-grade down into high-yield, for example, is typically referred to as a ‘fallen angel,’ and those that rise from non-investment-grade into the ranks of high-grade are considered ‘rising stars.’ A rating of ‘D,’ meanwhile, generally signals that the issuer is in default.

It‘s important to note that as not all corporate bonds are assigned credit ratings, investors may want to ensure they are satisfied with their own due diligence. They may also want to use these indicators as just one piece of their analyses, rather than relying on them to serve their sole decision-making needs.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.