Study Notes:

“How many people are working” is one of the most significant questions in economics and answered in the monthly labor market overview report. Employment represents the number of people actively working while the year-over-year and month-over-month percentage changes represent employment growth, also provided in the report.

Additionally, the report breaks down employment by age, full-time/part-time educational status, ethnicity, and more. Information and specifics on employment as well as several other labor market indicators are included in the monthly labor market overview report. It is necessary to seasonally adjust the data because some industries, such as retail, construction, and travel have fluctuating employment levels throughout the year. The data is generally collected from 69,000 individuals through surveys conducted via email and telephone. The Labor Market Overview data release is published by the Office for National Statistics near the 17th day of each month at 7:00am London time. The Office publishes employment information and a wide variety of other data to serve the public good.

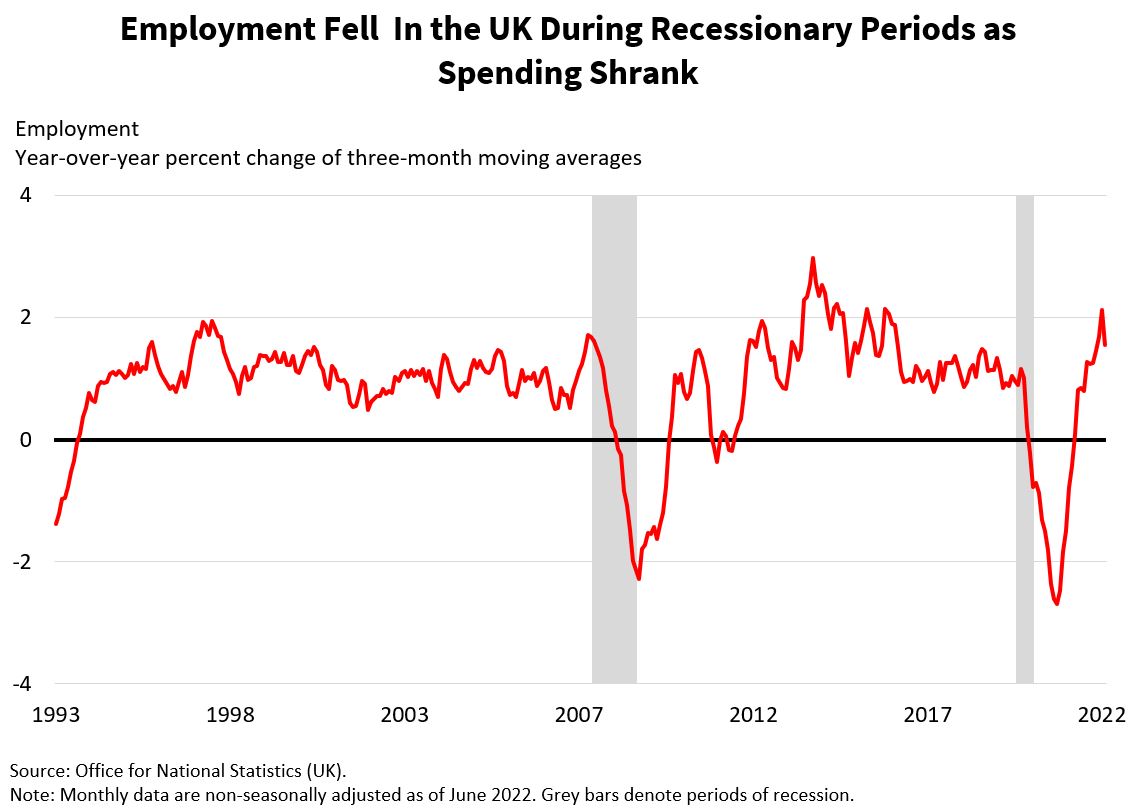

The report reveals the expansion of employment, or the speed at which employers are hiring staff, which acts as a key indicator of the economy’s productivity. An economy with high employment growth rates means businesses are adding to supply to meet consumer demand by hiring additional workers. The rate of employment growth is low or negative when there is a weakening economy, as businesses slow hiring or lay off employees due to weak demand from consumers. In response to weakening consumer demand during the 2008 financial crisis and the COVID-19 recession, companies laid off workers to cut expenses. A weaker UK labor market may lead to weaker global economic conditions due to the multinational nature of the international economy and the considerable influence of the Group of Seven nations.

The labor market overview report also contains other useful data points. Considering the unemployment rate is useful when analyzing the tightness or laxity of the labor market, or, in other words, is it generally troublesome or easy to find work? A good leading indicator of what may happen in the near future can be found in the hours worked data point because businesses may cut hours before laying people off. Based on the economic inactivity rate, we can determine the percentage of the working-age population that is out of the labor force. It is wonderful news when the economic inactivity rate is low because it means many people are working, encouraging firms to grow and boosting the economy. Together with the other indicators in the report, employment provides crucial information on the state of the UK’s labor market. A UK labor market characterized by increasing productivity and incomes is essential for the foundation of financial markets.

The labor market overview report also contains other useful data points. Considering the unemployment rate is useful when analyzing the tightness or laxity of the labor market, or, in other words, is it generally troublesome or easy to find work? A good leading indicator of what may happen in the near future can be found in the hours worked data point because businesses may cut hours before laying people off. Based on the economic inactivity rate, we can determine the percentage of the working-age population that is out of the labor force. It is wonderful news when the economic inactivity rate is low because it means many people are working, encouraging firms to grow and boosting the economy. Together with the other indicators in the report, employment provides crucial information on the state of the UK’s labor market. A UK labor market characterized by increasing productivity and incomes is essential for the foundation of financial markets.

To forecast employment, we can look at leading economic indicators such as hours worked, construction activity and consumer and business confidence since they tend to deteriorate prior to employment falling, the unemployment rate rising and the economy decelerating. The new orders and employment parts of the Purchasing Managers’ Index for manufacturing to find signals of how demand and employment are holding up in the capital intensive and interest rate sensitive manufacturing sector. Additionally, watching retail sales for trends in revenue and demand is useful for determining if layoffs might follow weakening data. Listening in on company earnings calls for hiring plans, layoffs, hiring freezes, etc., may provide useful information since these tend to occur prior to the overall economic situation deteriorating.

The release of employment information may move markets in a major way. On balance, if the employment number is worse than anticipated, the market will decline more, and if the number is better than anticipated, the market would rise more. The creation of more jobs leads to increased economic activity, higher productivity, and a more enthusiastic environment for financial assets and global economic growth.

The UK’s employment growth plays a crucial role in determining the health of its economy and its financial markets.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.