Study Notes:

In this lesson I’ll be explaining the Harmonised Index of Consumer Prices – one of the lagging economic indicators of European Union’s economy.

Prices are crucial, people care about how much they need to pay for the goods and services that they want. The Harmonised Index of Consumer Prices or HICP quantifies price inflation or the change in prices paid by consumers for goods and services across nineteen member nations of the European Union. The report provides essential information concerning the prices consumers pay for a market basket of goods and services: the most essential and popular items that consumers purchase the most and pay the most for. Housing, food, transportation, and energy represent a hefty portion of the index because the average consumer spends a high share of their income on those items. The HICP is used to adjust many economic series for inflation as well as to adjust commercial contracts, wages, social protection benefits, financial instruments, and more. It’s also used to assess a country’s old currency prior to them joining the Euro monetary union. The HICP is calculated at the statistical office of the European Union, Eurostat. Eurostat collects price data from the National Statistical Offices of each country and then aggregates and weighs them. The numbers are released within the Harmonised Index of Consumer Prices press release at 9:00am London time on or around the first business day of each month. A revised data release with more complete information is provided on or around the nineteenth day of the month when better data are available. Eurostat’s mission is to provide high quality European statistics and data to support public and private sector decision making.

Prices are an important indicator of supply-demand fundamentals and the health of the Euro economy. Price pressures increase when demand is high, and supply can’t match up as more funds pursue fewer goods and services. On the other hand, price pressures will fall if the demand for goods and services falls, and supply remains unchanged as businesses lower their prices to sell inventories.

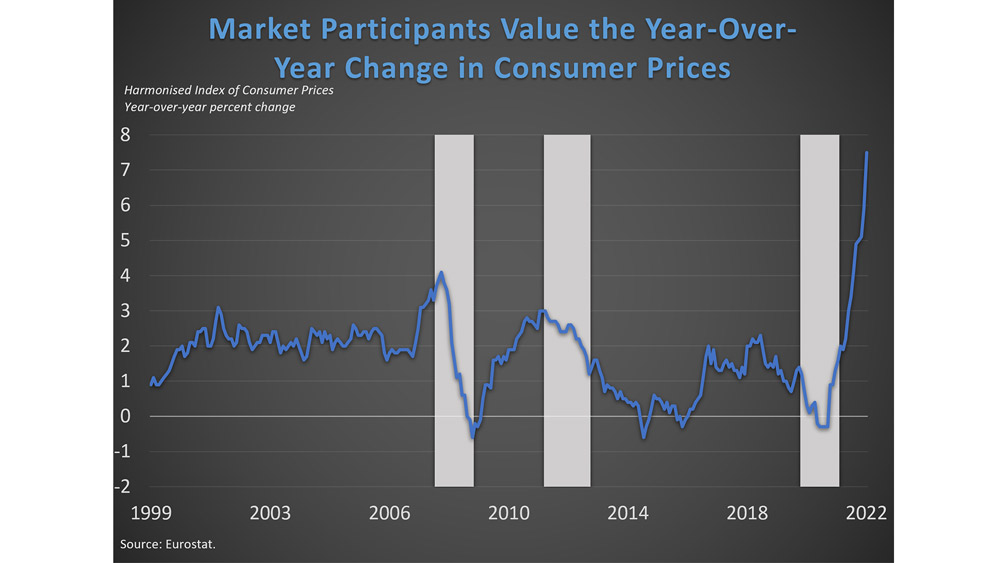

Market participants value the year-over-year change in consumer prices. Consumer prices rising at an accelerated pace could make things less affordable and turn into longer-term inflationary issues. To control inflation, keep inflation expectations “anchored” at a desired level and restore economic balance, the European Central Bank or ECB will likely tighten monetary policy. Consumer prices decelerating or outright falling, deflation, could be dangerous signals of weakness in the economy, weak population growth and/or recession. If demand declines on a long-term basis, wages may drop, unemployment may rise, and investment portfolios will be negatively affected. Since experiencing the negative consequences of deflation during the Great Depression of the 1930s, central banks have been cautious of deflationary developments and have favored prices rising in a gentle and predictable way to support economic and population growth, the ECB’s target for inflation is two percent.

If the ECB pursues a restrictive monetary policy stance to control inflation, demand could decrease domestically and globally. As rates rise to combat inflation, the Euro could strengthen, disadvantaging the Euro area of trade strength since their exports become more expensive for foreign buyers. The value of global corporate sales and profits may decline for EU corporations, due to the currency effects of a stronger Euro. Emerging markets may have trouble when the Euro strengthens as well since they must produce more to earn the same amount of Euros or “hard currency” as in the past. Inflationary episodes that require ECB tightening lead to declines in equity and bond prices.

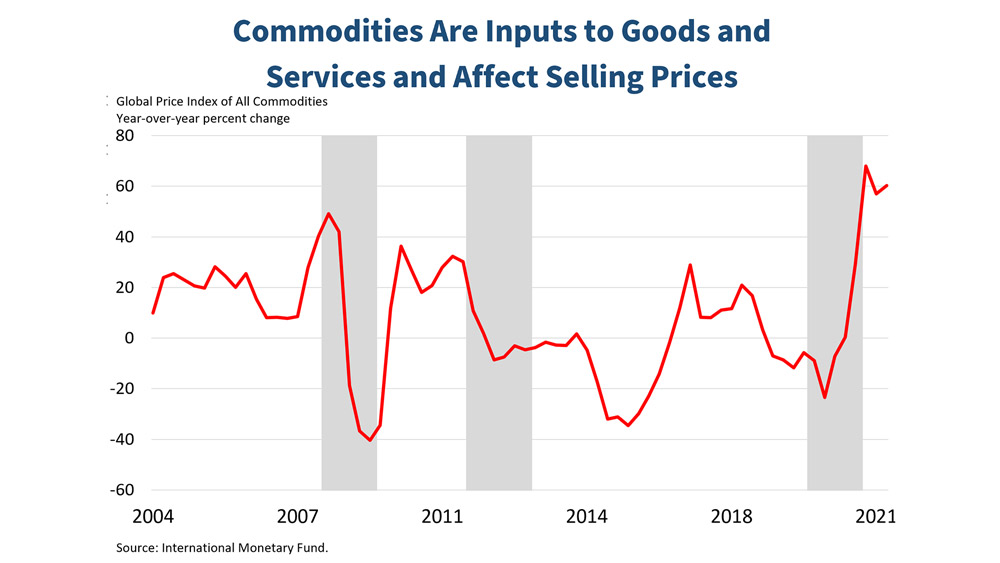

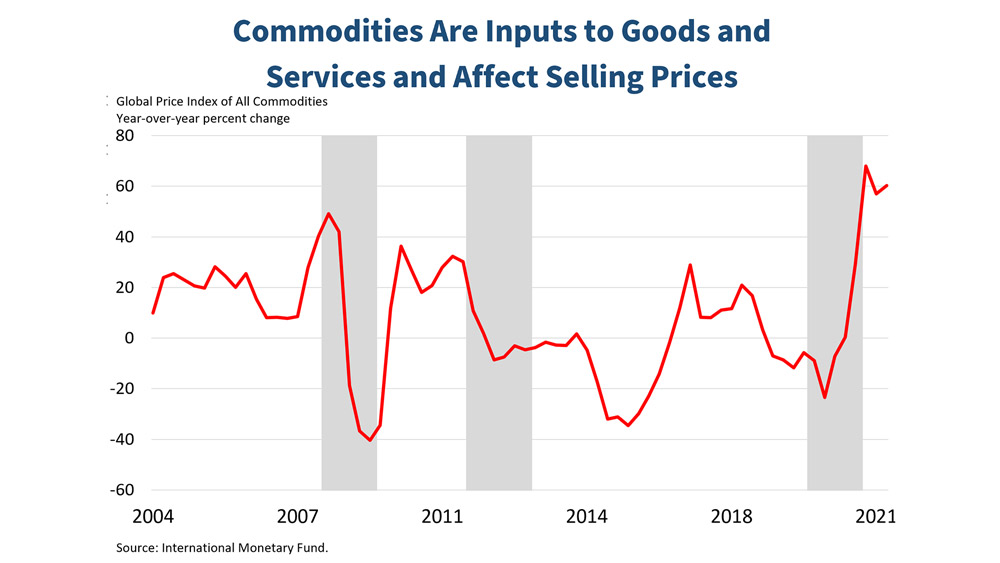

To forecast inflation in the Euro Area, money supply growth should be examined to determine if there is a risk of inflation arising from too much money in the system without commensurate productivity growth. Commodities are inputs to goods and services and affect selling prices, so forecasters can examine daily commodity prices. Examining how loose or tight the labor market is by watching employment, unemployment and wages is also helpful. Accelerating wage pressures can lead to higher and more resistant inflation across the economy as this propels business expenses. Finally, retail trade measures the heat of the economy and provides insight as to how demand is doing.

Inflation leads to constricted budgets, declining purchase power, and problems planning expenses for the average person. Inflationary episodes likely lead to recession since central banks need to tighten monetary policies to combat inflation and reboot the economy. A significant element of economic analysis is evaluating how briskly or steadily prices are rising or falling.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.