Study Notes:

What is the IBUSOPT Pegged-to-Best order type?

The Interactive Brokers IBUSOPT Pegged-to-Best order type is useful for investors to direct nonmarketable or liquidity providing orders to the IBUSOPT order destination that compete with the near side National Best Bid and Offer (more commonly known as the NBBO) as well as other same side liquidity adding resting orders on the Interactive Brokers IBUSOPT order destination.

The Pegged-to-Best order type floats so that it will always be one penny more aggressive than the better of the near side NBBO and the best priced same side resting liquidity-adding order in the IBUSOPT order destination, up to the NBBO midpoint minus (for a buy) or plus (for a sell) a user-defined number of increments, providing a high probability of trading with IBKR client Smart Routed orders on the opposite side.

How to access the IBUSOPT order destination?

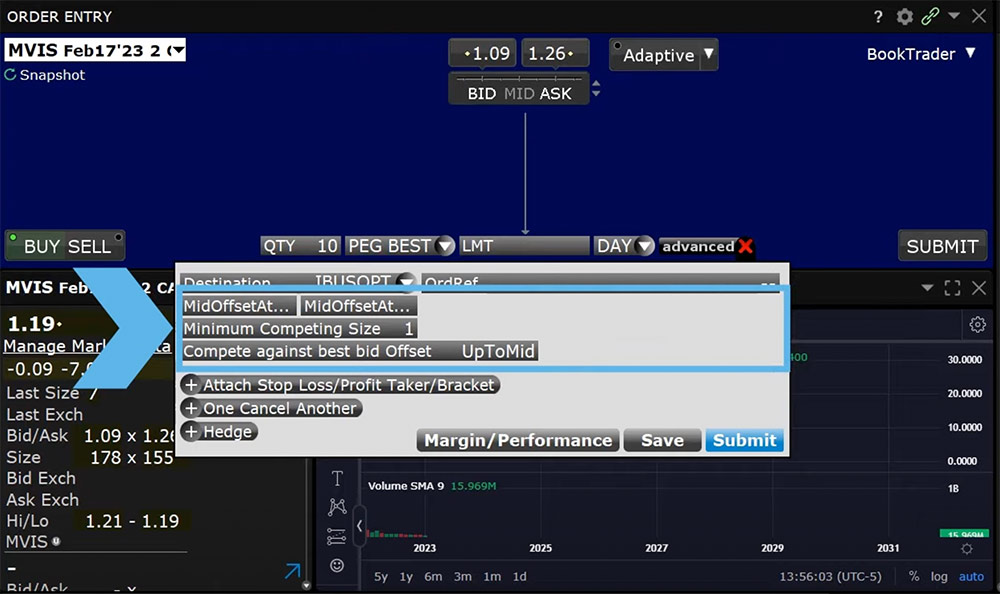

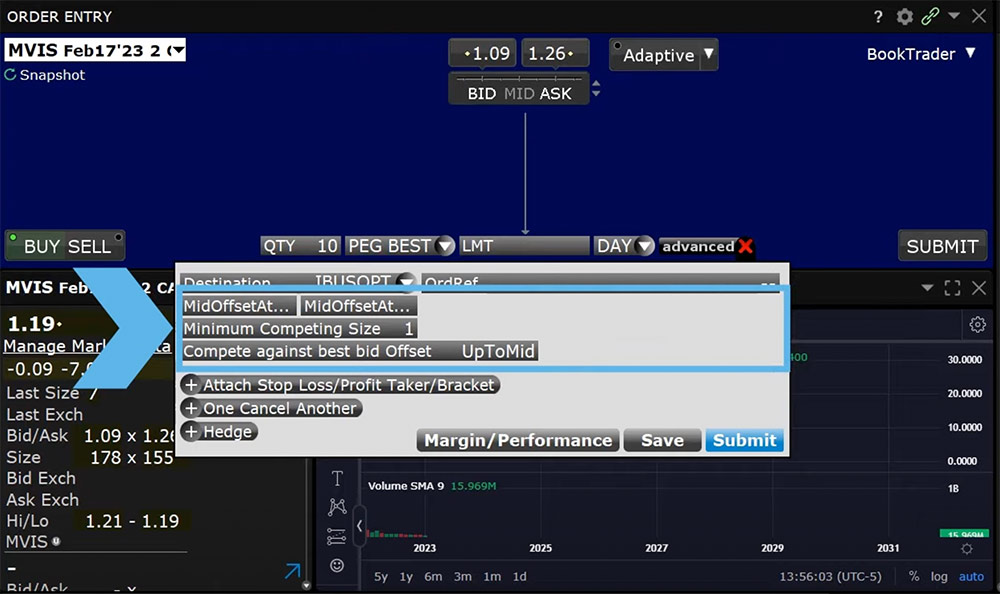

To access the Interactive Brokers IBUSOPT order destination from Mosaic, the investor should enter the option in the Order Entry panel, select buy or sell, and the quantity they want to trade. Next, the investor should bring up the Advanced Panel – click on the plus sign next to Advanced.

In the top left-hand corner of the panel, click on the arrow next to the Destination drop-down box, scroll down and choose IBUSOPT. Click on the order type drop down box directly above in the Order Entry panel and select Pegged-to-Best.

How to set up an IBUSOPT Pegged-to-Best order?

In the Advanced panel, four boxes appear below the Destination:

- Mid Offset at Whole or a Primary offset – which must be in whole cent increments, that is applied to the spread when it is an even number of cents wide. This is only used when the Compete against best bid offset is set to UpToMid,

- Mid Offset at Half or a Secondary offset – which must be in half-penny increments, that is automatically applied when the spread is an odd number of cents wide resulting in a whole penny price after it is added or subtracted from the midpoint price. Like the primary offset, this is only activated when the Compete against best bid offset is set to UpToMid,

- Minimum Competing Size – which is the minimum order size required for the investor’s Pegged-to-Best order to compete against other orders in the IBUSOPT.

- Compete Against Best Bid Offset – this offset denotes how aggressively relative to the combined NBBO, to compete with other orders. Offsets can be specified in pennies or set to UpToMid. The Pegged-to-Best order type allows the investor to add offsets to compete for liquidity.

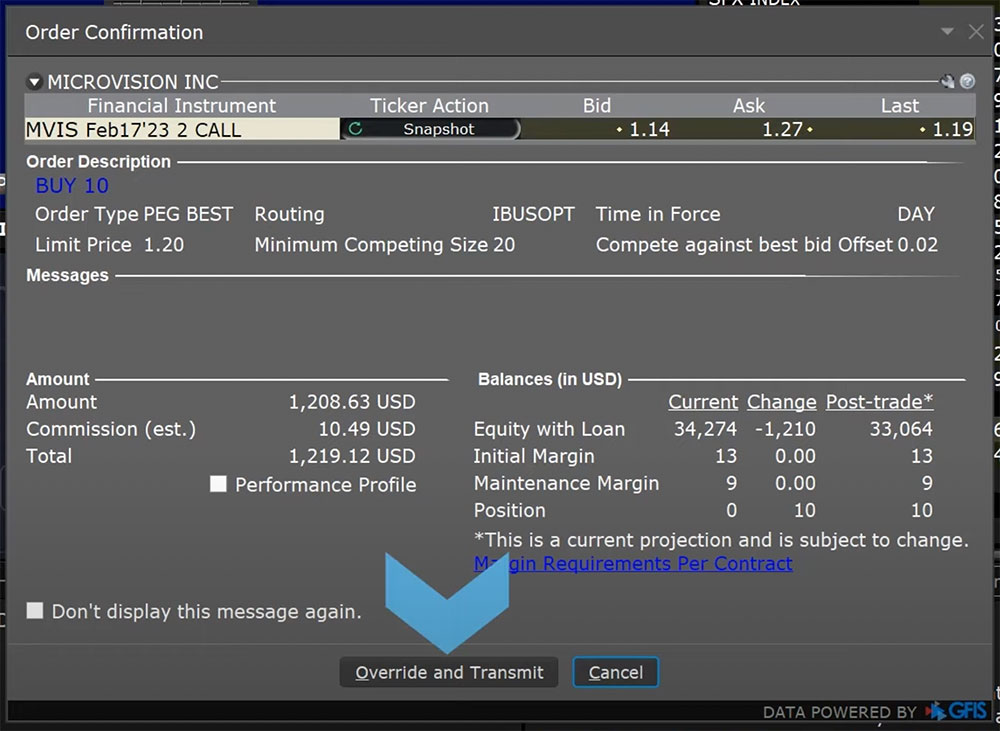

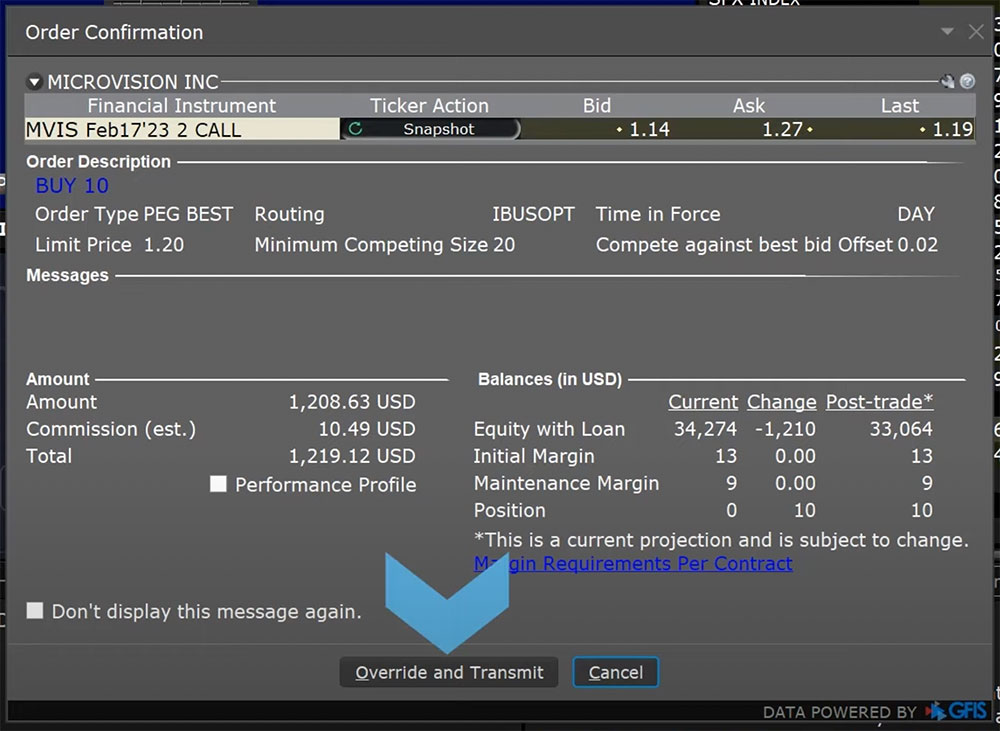

For this example, the investor will set the Compete Against Best Bid Offset to .02, set Minimum Competing Size offset to 20 and exit out of the Advanced Panel by clicking on the red X in the upper right-hand corner and adjust the limit price to the desired amount. The investor then clicks Submit and reviews the Order Confirmation screen for the values entered before clicking on Transmit to send the order.

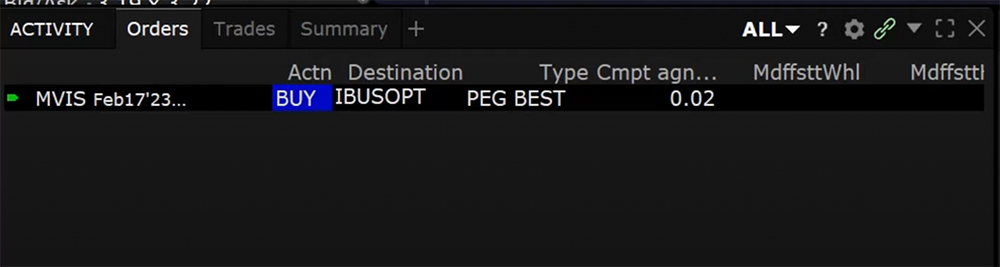

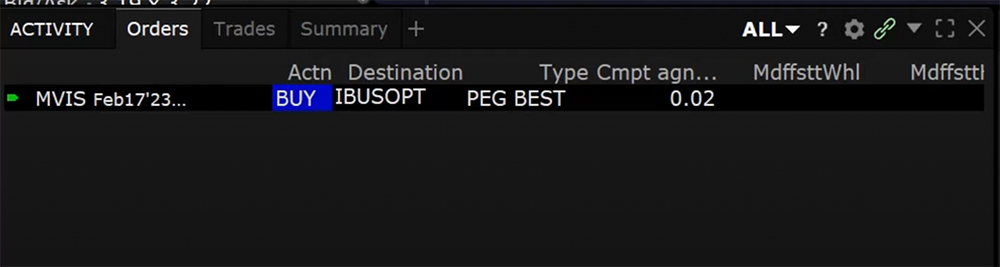

In the Activity panel, the order will show IBUSOPT in the Destination column, Pegged-to-Best in the Order Type column, and .02 in the Compete Against Best Bid or Offer Offset column. If Up to Mid was selected for the Compete Against Best Bid or Offer, then the values entered would appear in the respective columns: Mid Offset at Whole, Mid Offset at Half.

Additional Resources

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.