Study Notes:

Now that we’ve covered some of the fundamental factors that can affect a corporate debt issuer’s creditworthiness, this lesson we’ll explore interest rate risk — another major area of concern in the corporate bond market.

When an investor decides to purchase a corporate bond, it is important to monitor how interest rates may move over time. This is generally because prices of bonds, as well as an issuer’s borrowing costs, not only fluctuate with interest rate changes, but can also ultimately influence levels of supply and demand in the market.

Since corporate bond investments are considered riskier than U.S. Treasuries, investors are typically compensated for this risk in the price of the investment. This compensation is often known as the “yield spread” or the “basis point spread”.

While the maturity of the issuance, as well as the issuer’s creditworthiness, and bond’s liquidity each play a significant role in determining how much risk an investor will assume, interest rate movements themselves will also directly affect the value of a bond. A corporate bond investor will therefore make a judgment about the direction of interest rates before making a purchase.

For example:

If Verizon sold a 10-year note at 3% when the yield of the 10-year U.S. Treasury note was at 1%, and the yield on the Treasury later rose to 1.5% – notwithstanding any other changes – the yield on the corporate bond would also increase by the same amount, 50 basis points, to 3.5% — making them less valuable.

In this example, the value of Verizon’s debt fell because corporate bonds have an inverse relationship with interest rates – meaning, when interest rates rise, the value of the bond falls, and when they decrease, the corporate bond’s value rises.

This effect greatly influences the supply, demand, length of maturity, and pricing dynamics in the primary and secondary markets.

If interest rates were to increase to 1.5% from 1%, a corporate bond that was purchased before the increase would appear to be a less attractive investment compared to the issuance priced at the higher rate. To compete with the new issuance, the price on the existing bond – the one that was bought when rates were 1% —will most likely fall relative to the change in the market. This scenario would be reversed if interest rates declined.

Issuers of corporate debt may also decide to postpone or follow-through with a sale in the primary market depending on where interest rates are perceived to go. Although lower interest rates decrease an issuer’s borrowing costs, for example, if investors think they will likely increase at some later date, there may be less demand for the issuance. However, if investors think rates will remain low, and the yield offered remains attractive, there will likely be ample supply to select from.

To compensate investors for the interest rate risk, long-term bonds generally offer higher interest rates than short-term bonds of the same credit quality. If two bonds offer different coupons, and all other characteristics are the same, the bond with the lower coupon rate will generally be more sensitive to changes in market interest rates.

For example, if interest rates rise, the price of a bond carrying a 1% coupon will fall by a greater percentage than that of a bond with a 2% coupon, even if the two bonds have the same maturity and level of credit risk. This is another reason why investors should consider interest rate risk when they purchase bonds in a low-interest rate environment.

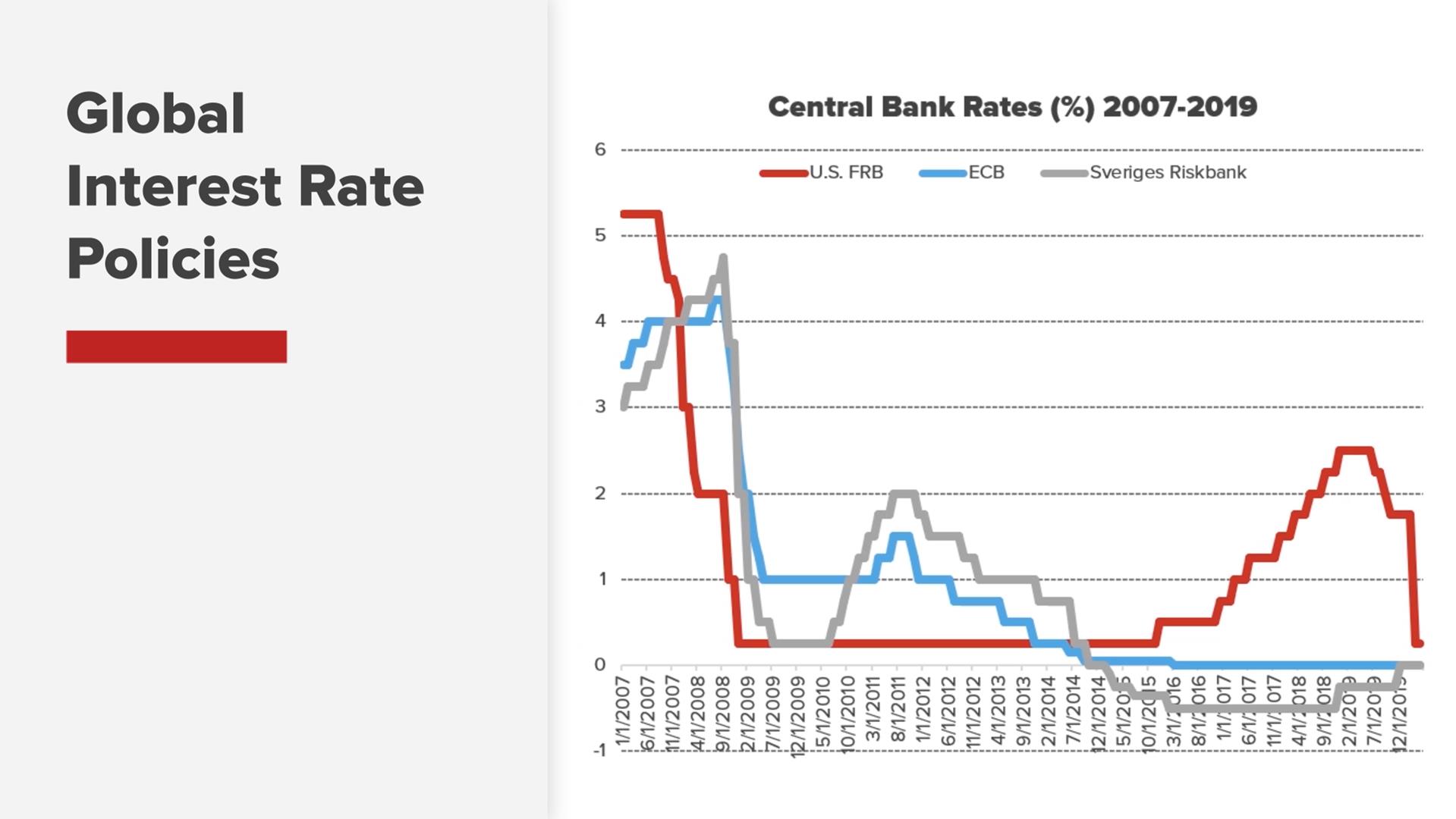

Meanwhile, the interest rate environment is also subject to central bank monetary policy.

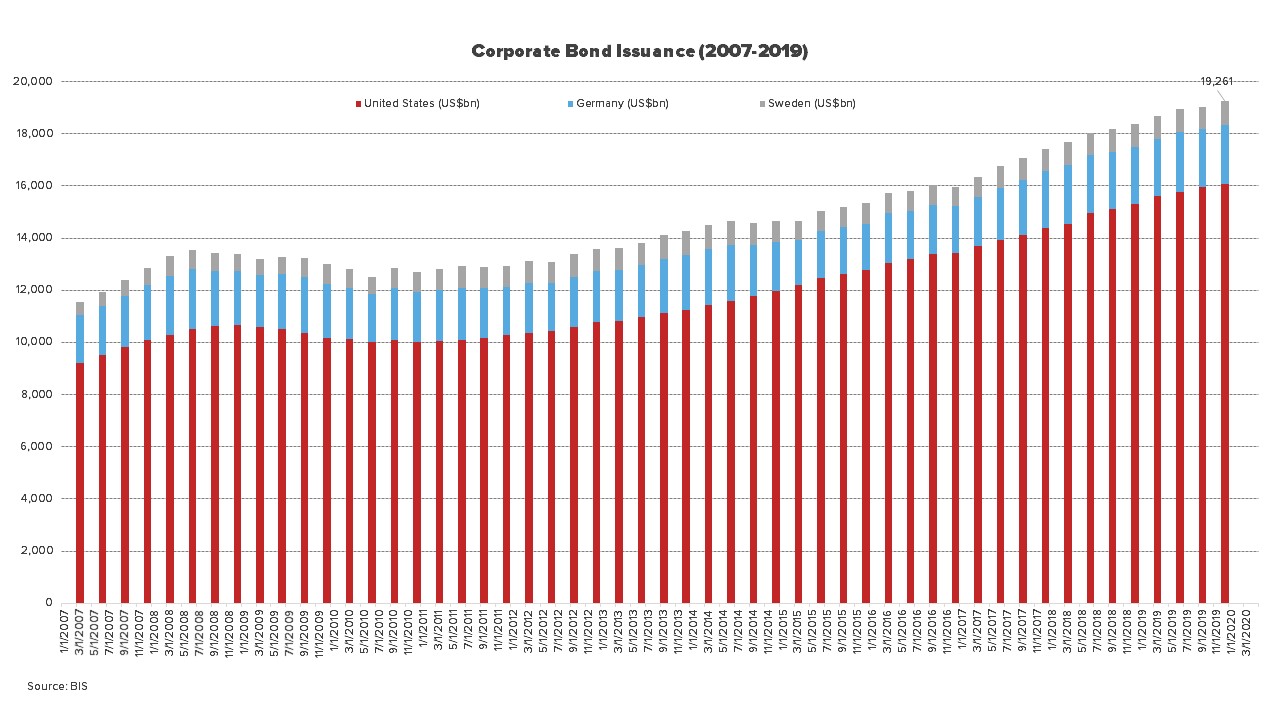

While this topic is a complex issue, the volume of the world’s non-financial corporate debt has generally skyrocketed over the past decade, amid ultra-low, zero, and even negative interest rate policies at several global central banks. These shifts in policy have generally remained in place since the financial crisis of 2008-09 and have generally lowered the cost of corporate borrowing.

The lower rate environment, combined with several variations of quantitative easing (QE) measures at certain central banks, including the U.S. Federal Reserve and the European Central Bank, have also generally spurred investors to assume more risk — this as government bonds have risen in price. However, QE’s effects of flooding the financial system with liquidity have also been blamed by many in the market for inflating asset prices and creating massive debt bubbles.

Against this backdrop, overseas-based bond investors who have grappled with higher prices in their local primary markets, or have a dearth of available corporate issuance, have generally turned instead to the U.S. fixed income markets for more attractive yields – prompting steady demand for the groundswell of corporate issuance over the past several years.

The more recent Covid-19 crisis had also spurred the Federal Reserve to commit to several unprecedented actions to help prop-up the financial system and the economy, including implementing corporate credit facilities for the primary and secondary markets, which were meant to purchase investment-grade bonds, and, under certain conditions, fallen angels, as well as certain U.S.-listed, fixed income-related exchange-traded funds (ETFs).

While uncertainties persist over how the Fed’s and other global central banks’ policies may be affecting the U.S. corporate bond market, it is clear they have held sway over its supply, demand, and price dynamics.

Furthermore, should interest rates rise from their depressed levels, along with inflationary increases stemming from the added, central bank-injected liquidity in the financial system, corporate bond holders will also see their investments fall in value to the same extent as the interest rate moves.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

On the topic of yield spreads, what bond ratings are the US treasuries typically compared to? AAA, BBB etc… or is it an average? Thank you in advance

Hello Chris, we appreciate your question. Investors can take into account third-party analysis from credit rating agencies. Please check out this IBKR Campus course: for more information https://ibkrcampus.com/trading-lessons/credit-ratings-2/. This could be a great resource for you!