Study Notes:

Let’s say you have $10,000 to invest and you want to buy shares of a few companies. You decide to buy just 10 shares of Apple Inc. (Symbol: AAPL) at a price of $160 each for an investment of $1,600. (You will likely pay 35 cents commission to your broker for doing this.)

What is an Option?

However, rather than investing in shares of companies, many investors trade using the options market.

There are two types of options. Call options allow investors to position for upward movement in underlying share prices.

A call option is a contract that allows an investor to control 100 shares in a company.

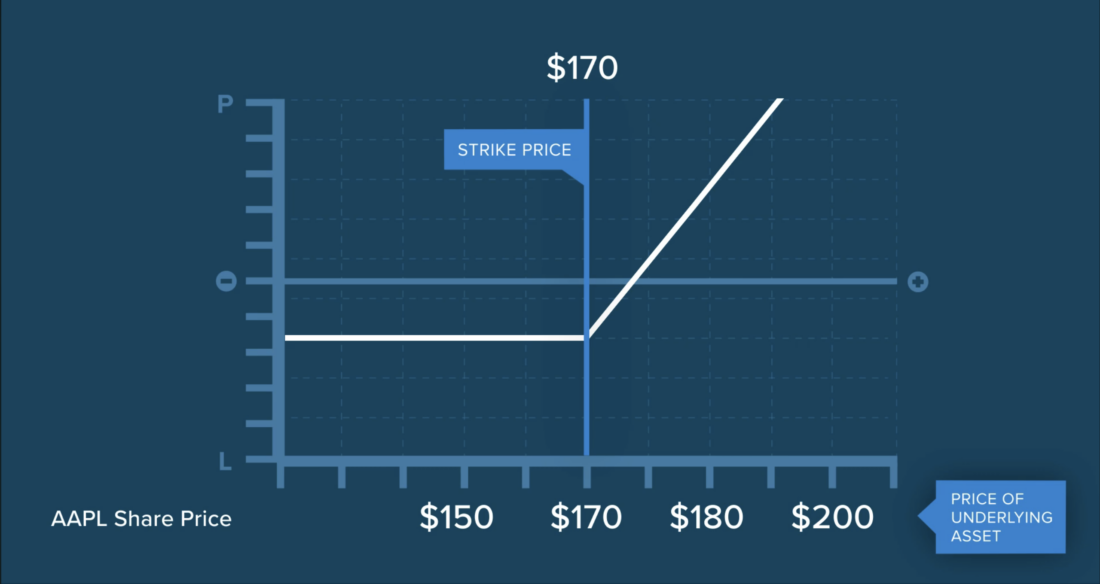

An option contract has an expiration date and a strike price. The price a trader pays for an option is called a PREMIUM. The buyer of the call option has the right to purchase the stock at the strike price at any time before the expiration time.

Let’s assume that an option at the $170 strike and one month to expiration costs $3.50 per contract. Since the contract is for the right to buy 100 shares at $170, it will cost $350.

If the stock rises to $200, you make $400 profit on the investment of $1,600. In case of the option 100*(200-170)-350= $2,650 – profit.

While buying the option looks a lot better, you must keep in mind that after 30 days the option expires and if the stock remains under $170 your $350 investment is all gone. On the other hand, the stock may rise much higher in the long run, even if temporarily the price goes down.

Vertical Spread

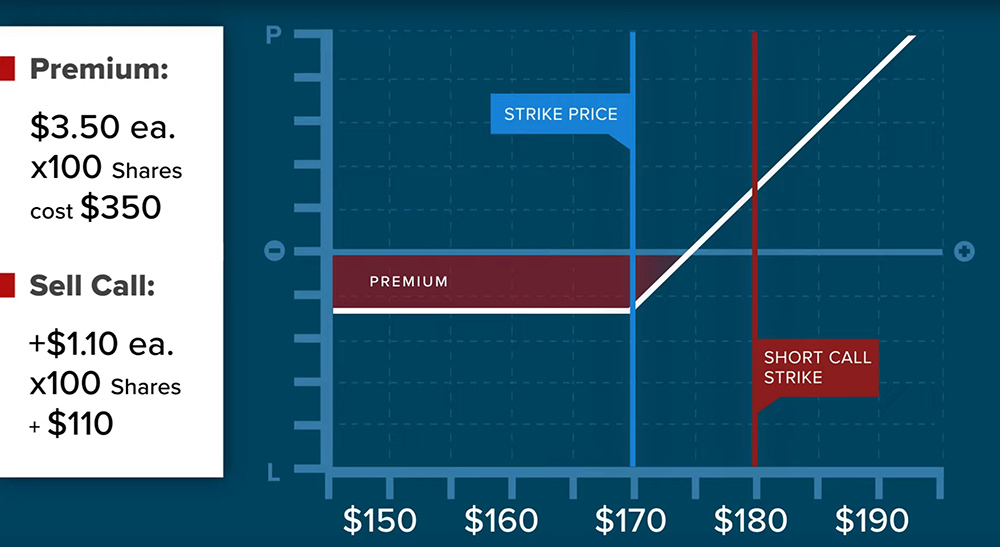

With shares in AAPL trading at $160, an investor paid a premium of $3.50 for a 30-day call option at the 170-strike hoping that the share price would rise.

The investor is bullish, but thinks that the share price might not reach $170, and is unlikely to go above $180 before expiration.

But the investor could SELL a call option at a higher strike.

Let’s say he sells a call option at the 180-strike and this time receives a premium of $1.10. Since the option contract covers 100 shares, he receives $110. By ‘spreading’ across the 170/180 strike prices he can reduce the cost of the trade and would face a lower maximum loss of $240 in the event shares failed to reach $170 by expiration ($350-$110=$240).

Why sell a call?

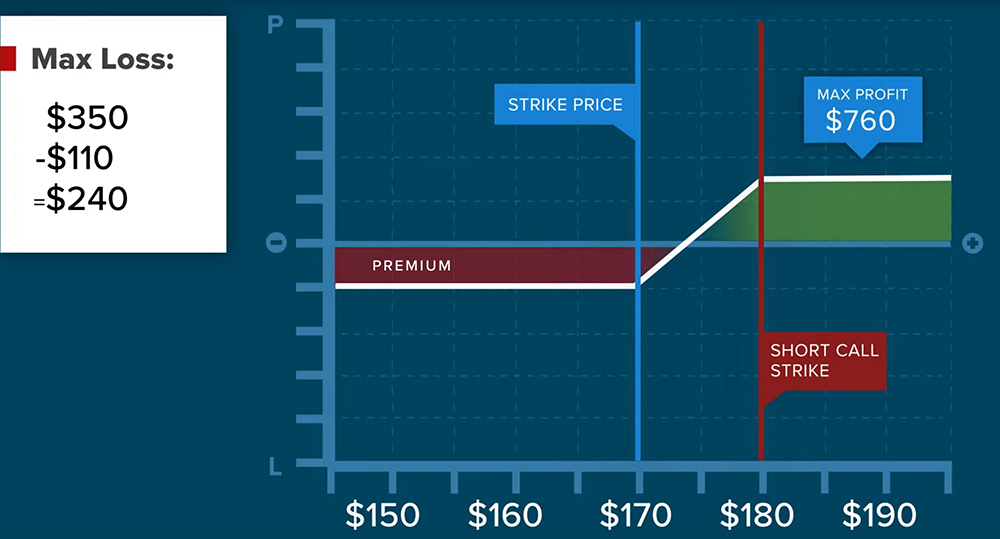

The call option offers upside exposure in the event the share price rises. However, by selling the 180 call the investor reduces the maximum possible loss to $240 and still could have a total profit, up to $760 that is the maximum. All profits above $180 on the stock are foregone.

The vertical spread would become profitable at the lower strike price plus the net premium paid for the two options or 170+$2.40 = $172.40. Profits grow at the point penny for penny as the share price increases. At $175 the call option is worth $500 less the $240 paid for the options or $260 profit.

The maximum profit from the trade would occur at the higher strike price (or above) and is defined as the distance between the strike prices minus the initial cost of the trade 100*(180-170)-$240 = $760.

Above a share price of $180 the spread is always worth $760 to the investor since both call options increase at the same pace. Profits on the long 170-strike call are equally offset by losses on the sold 180- strike call. Even if AAPL rises to $200 per share, the vertical spread limits the investor’s gains but is a less risky way of taking advantage of an upside movement in the share price.

Above a share price of $180 the spread is always worth $760 to the investor since both call options increase at the same pace. Profits on the long 170-strike call are equally offset by losses on the sold 180- strike call. Even if AAPL rises to $200 per share, the vertical spread limits the investor’s gains but is a less risky way of taking advantage of an upside movement in the share price.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Great Explanation!

Thank you, Johannes! We hope you will continue to watch our lessons!

Awesome Material, Great Learning. worth Spending Time on it.

Thank you for the kind words, AJ. Please share IBKR Campus with anyone you know who may be interested!

Very elaborate and clear.

Thank you, Roselyn!

It is well articulated, easy to understand for the beginner

Thank you for the compliment! We hope you will engage with more of our online lessons at IBKR Campus.

very good learning platform

Thank you for the compliment, Niaz! We hope you will check out our other lessons as well!

Good explanation

Thank you, Surya.

Thank you for this lesson. Very digest lecture

Thank you for the feedback, Rosalie!

I am trying to take the lesson quiz but it ask me to log in again? Do I have to have another user and password??

Hello Anonymous. To access more of the online features at IBKR Campus, you must register. If you have forgotten the screen name/password for your IBKR Campus account, please click “Login “ then “Forgot your screen name or password?” in the window that pops up. (If you already have an IBKR trading account, please note that for security purposes your Screen Name is separate and distinct from your Interactive Brokers Account Username and cannot be used to access your account.) We hope this helps clarify things!

I didn’t understand anything. Very complicated wording… Make it simpler to understand for beginners. For example, you didn’t even explain what a strike price is.

Hello, thank you for reaching out. Whether you are new to options or want to brush up on some risk basics, or you are learning TWS and want to know how to locate option fields and data, our Introduction to Options course is an excellent first step. Please feel free to check out the class. It could be a great resource for you.

https://ibkrcampus.com/trading-course/introduction-to-options/

Awesome presentation. Simple and direct to the points.

We are glad you enjoyed it!

what does the P and L from the graphs stand for?

Hello Anonymous, the “P” from the graph stands for profit and the “L” on the graph stands for loss. We hope this answers your question!

Mil gracias! muy educativo.

Thank you for the feedback. We are happy to hear that you are enjoying our articles!

Gracias por compartir con nosotros esta información importante, clara y sencilla, excelente plataforma.

Nothing makes us happier than satisfied customers.

Excelente muchas gracias

Thanks for engaging, Alvaro!

Clear & Basic

Thanks for engaging!

First video at 01:39… “potential loss is $1600” – only if price falls to zero, $0.00.

Possibility of that outcome is not very high, if any.

So, eventuall potential loss is not $1600, it is “Investment” minus “price fall%”.

SO, what happen if I decided to sell the call option contract if raised to 200 instead of 180?

Hello Alfred, thank you for reaching out. If an investor sold a call with a 200 strike it would have less premium than the calls with 170 or 180 strikes and would be assigned if the stock was 200 or above at expiration. Please reach back out with any more questions. We are here to help!

great explanation, clear and to the point

Thanks for engaging!

Could you please explain the result if AAPL in this example falls to $130 at expiry?

Buenas tardes, me gustaría saber cuanto es el mínimo que debo tener en la cuenta para invertir en opciones

Hello, thank you for reaching out. No minimum deposit is required for a Cash Account. A Margin Account requires a minimum deposit of USD 2,000 (or the non-USD equivalent). If approved, you have 270 calendar days to fund the approved Individual or IRA account application.

https://www.ibkr.com/faq?id=28226126

You can take a look at our commission structure here: https://www.interactivebrokers.com/en/pricing/commissions-options.php?re=amer

To open a trading account, please visit

https://spr.ly/OpenAccountfromIBKRCampus

Mind Blowing Explanation for Beginners 👍

We hope you continue to enjoy Traders’ Academy!

In a vertical spread example above, the investor’s profit is always $760, even if he/she is unable to sell the 180 call option?

If someone did buy the call option, the investor won’t have any APPL shares, right?

Very clear and simplified explanation. I have a question. If i have an account with 1000USD and iam interested in buying both stocks and options can i charge the account in full for both or divide the amount for each separately?

Thank you for commenting, mwas. We’re not completely sure what your question is about. Can you please provide more details?

Please note that cash accounts purchase assets based on the settled cash value in your account. Margin accounts can purchase assets based on the unsettled cash value in your account. Unlike a margin account, a cash account cannot borrow money from Interactive Brokers to purchase assets. https://www.ibkr.com/faq?id=34498610

Thank you for a great explanation. It made me to understand the options but also opened up a question. At the very beginning you mention investment capital of $10.000, followed with an example of an AAPL share priced at $160 and an option call with a strike price $170. In case a person would exercise a right to purchase an option calls and purchases 100 shares for $170 he/she would need $17.000. However his investment capital is $10.000. What am I missing? Thank you!

Hi, My call option is worthless now even though the expiration date is still 4 days away.

Will my worthless call option be exercised automatically by IRBK?

Thanks a lot!

Hello, thank you for reaching out. In the case of U.S. securities options, the OCC will automatically exercise any option that is in-the-money by at least $0.01 unless you provide contrary exercise instructions. For non-U.S. options, please refer to the Options Exercise page of our website for information on how the different clearinghouses will handle the exercise.

If the option is cash settled, your cash balance will be credited by the amount by which the final settlement price exceeds the strike price, multiplied by the contract multiplier and number of contracts you hold. If the option is physically settled, you will be obligated to buy the shares in exchange for a cash payment equal to the strike price multiplied by the contract multiplier and number of contracts you hold. Shares will reduce or close an existing position on your account to the extent that you hold a short position. If you do not have an existing short position of sufficient quantity to satisfy your purchase obligation, your account will carry a long position.

IBKR reserves the right to prohibit the exercise of options if the effect of the exercise would be to place the account in margin deficit. You can read more at

https://www.ibkr.com/faq?id=52483599

In vertical spread, what happens if APPL price drops to $150. How much losses?

If I hold a call option and stock price rises till expire, it will become worthless ($0.01). I make money after I sell close the call option before expiry date?