Study Notes:

Trading stocks on margin refers to the requirements your account is subject to by your broker. Stock trading margin is typically synonymous with borrowing money from your broker in order to support your investments.

For example, to buy $100 worth of stock, an investor would typically pay $50 and borrow $50 from their broker.

Futures

Trading futures on margin is approached differently. Investors buying or selling futures contracts don’t borrow anything from a broker. Rather, a portion of the investor’s cash is set aside by their broker to act as collateral throughout the investment period.

The minimum value of the collateral is set by the exchange upon which the futures contract trades, while the broker may require additional collateral on top to guarantee the trade. Futures margin can be thought of as a cushion against potential losses in the event the market moves against the client’s position.

Cash is used to buy stocks along with a broker loan. But for other products such as futures, single stock futures and stock options, the cash set aside from a client’s account is considered a collateral amount to absorb possible losses that inevitably occur when markets move adversely.

Whether you borrow, and how much you borrow is determined by regulatory calculations your broker is subject to. Those calculations are either rules-based or risk-based.

Rules based

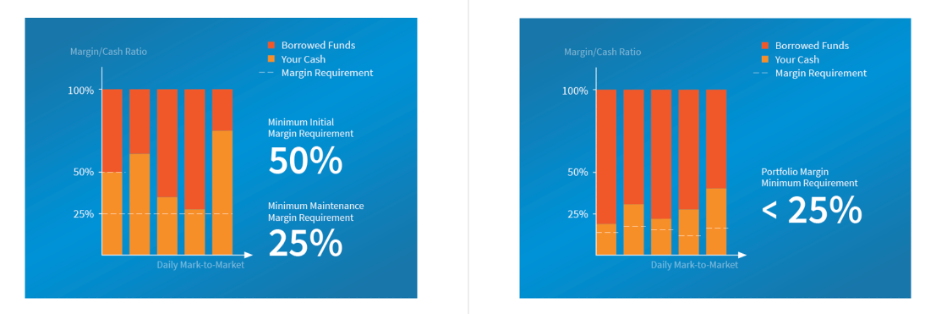

A rules-based system involves the oversight of some governing body whose role it is to determine rules surrounding what investors may do within their accounts, and how those rules are to be applied. Such rules are applied across the board regardless of the notion of portfolio diversification. A rules-based system is generally formulaic and uses a set percentage applied to the market value.

Risk based

Risk-based calculations take a broader view of an investor’s portfolio. Brokers and exchanges consider not only the individual riskiness of stocks, but also the collective risk of stocks when viewed through the lens of an entire portfolio. A risk-based is computed based on simulated worst-case scenarios. While market risk can never be diversified away, portfolio risk may be reduced through diversification across different industries and sectors as well as through long and short positions.

Since a rules-based method requires margin per position and does not benefit from portfolio diversification, margin requirements may be higher than under risk-based calculations.

Regulations

The US has two regulatory regimes, each with its own governing body. The SEC oversees securities markets, while the CFTC oversees the futures market.

US Securities Margin – The US securities market is governed by the Securities and Exchange Commission or SEC. The SEC permits both risk and rules-based types of accounts.

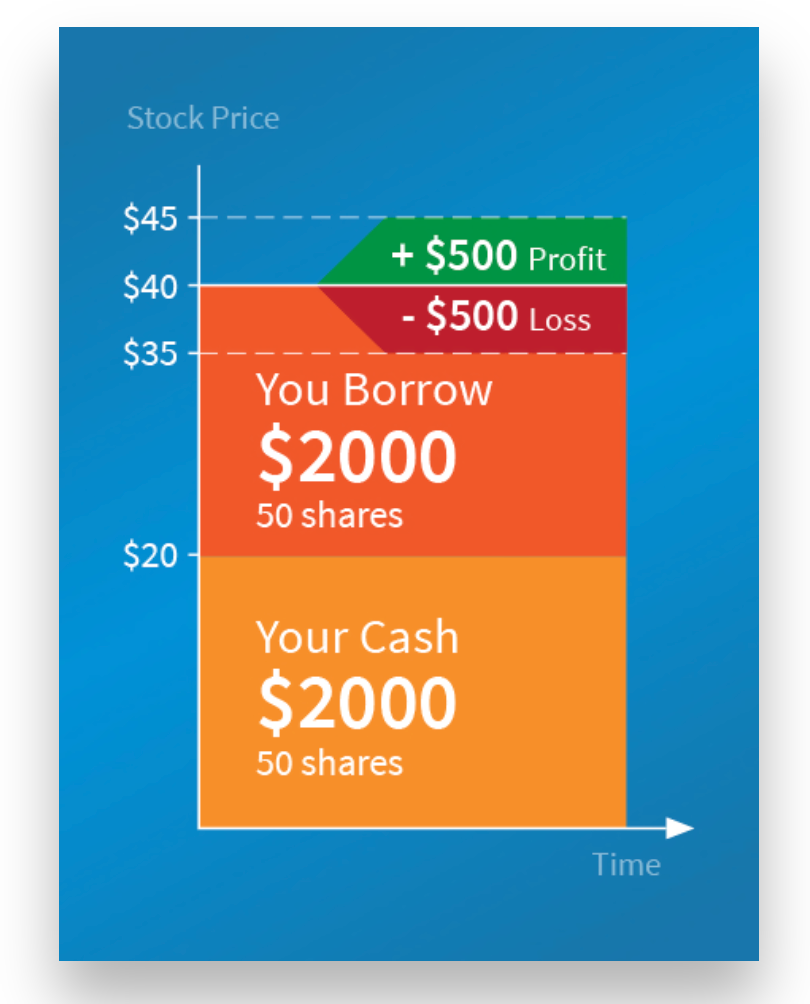

- For rules-based, the Federal Reserve sets rules for Reg T accounts, under which investors can borrow 50% of the value of stocks held and may borrow the remaining 50% from their broker.

- That means that an investor buying $10,000 of stock ABC Corporation will pay $5,000 and borrow the remaining $5,000 from his/her broker. That concept underlies the idea of initial margin, while the notion of maintenance margin is what the investor must maintain at a minimum to support the position. During the day, the investor must have at least 25% of the value of purchased securities in his account. Should the value of his/her shares decline, the broker will insist on the client adding cash to the minimum required levels.

For risk-based, brokers offer a Portfolio Margin.

- In many cases, the margin requirement may be lower than under Reg T since the probability of loss is lessened through diversification. The risk to the investor, and the broker, is lessened when a complete view of the portfolio is taken by including positions in different asset classes, such as stocks, ETFs, options, and bonds.

- A risk-based approach could mean that an investor holding shares in ABC Corporation could mitigate some risk by holding an offsetting amount of put options. In this case, the Portfolio Margin requirement is likely to be lower than under a rules-based scenario.

US Futures margin Futures margin in the US is risk based and determined by exchanges, taking the form of collateral rather than an amount the client borrows from their broker.

The investor cannot access the collateral while the position is open.

For example, an investor bullish on the price of crude oil decides to buy an oil futures contract. One crude oil futures contract, which controls 1,000 barrels of oil, might require initial margin of $10,000. The open position is marked-to-market each day. If the value of the investment rises, the investor’s account is credited, while if the value of the futures contract falls, the account is debited to reflect the open loss.

The futures broker will take at least the minimum amount of collateral or margin as set by the futures exchange where the contract trades. The broker has the right to take more if they choose. Futures margining in the US uses a risk-based approach and is generally determined by the exchanges.

Margin Outside the US – The global regulatory regime contrasts with that of the US because all other countries rely on risk-based margining.

Interactive Brokers is headquartered in the US but offers global market access to its clients on exchanges around the world. As a US clearing broker, we are sometimes required to overlay US requirements on top of those local requirements in other countries or regions.

Outside the US there is only one regulatory regime, not one for securities and another for futures.

Contracts for Difference (CFDs) are a close proxy for stocks. However, they are treated like futures and are subject to a collateral deposit.

The following lessons will show the investor how to see the expected margin impact prior to placing a trade, find margin values for individual positions, as well as the entire portfolio. After reviewing this course, the investor will have a better understanding of margin and how to monitor on both the Trader Workstation and Mobile Trading app.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

what is the margin rate for bitcoin or ethereum etfs

Hello, thank you for reaching out. Please review our margin rates and requirements on our website: https://spr.ly/CampusMarginRequirements

Let us know if you have other general questions.

I have 530$ in my portfolio account, and when I try to buy 1 Micro contract of S&P 500 it gives me an error of insufficient funds, why?

Hello, thank you for reaching out. When you receive an “Insufficient Funds” message for a margin trade, it typically means you do not have enough cash or securities to meet the margin requirement for the trade. A few things to check:

1. Make sure you have sufficient settled cash in your account to cover the margin requirement. Cash from recent deposits or trades may take a few days to settle and become available for trading.

2. Review your account value versus margin requirement. You need to maintain a minimum equity of at least $2,000 or 100% of the margin requirement, whichever is less.

3. If trading futures or forex, check that you have met the initial margin requirement for those products. The requirement may be higher than for stocks/options.

You may need to deposit additional funds, close other positions to free up margin, or reduce your trade size to resolve the insufficient funds issue.

Please reach out with any more questions. We are here to help!

May I use Treasury Bills as collateral instead of cash?

Hello, thank you for reaching out. US T-Bills may be deposited as collateral. Please review this FAQ for more information: https://www.ibkr.com/faq?id=77064278