Study Notes:

I’m senior economist Jose Torres for Interactive Brokers and I’ll be explaining one of the leading indicators of the U.S. economy: The Purchasing Managers’ Index (“PMI®”) for manufacturing. The manufacturing PMI® is based on a monthly survey sent by the Institute of Supply Management® or ISM®. It is sent to roughly four hundred purchasing managers at different companies that are members of the ISM Business Survey Committee. The executives represent eighteen different manufacturing industries, whose answers are then weighted by the industry’s contribution to U.S. GDP.

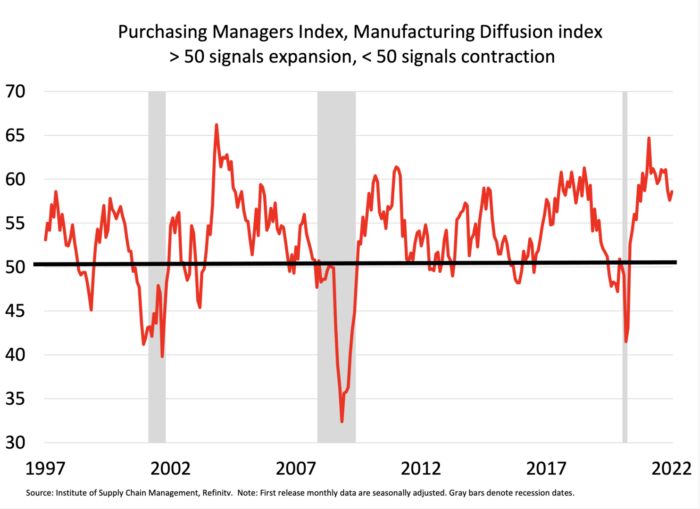

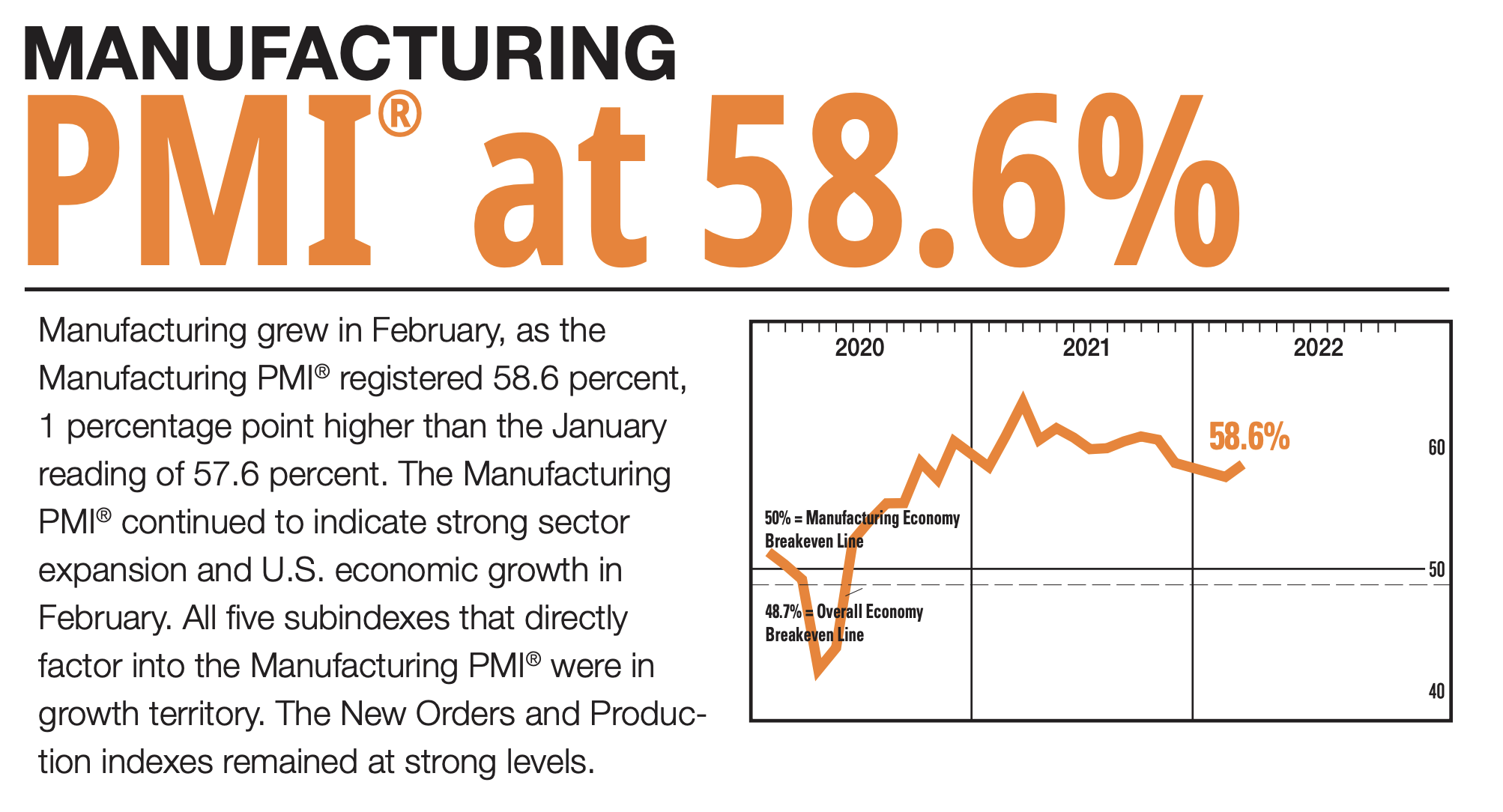

The manufacturing PMI uses a diffusion index when reporting both the overall and component pieces.

An index reading of 50 indicates zero change relative to the prior monthly reading. Readings above 50 indicate expansion within the manufacturing sector while readings below 50 mark a contraction.

The purpose of the manufacturing PMI is to provide economists with a snapshot within the manufacturing hub of the overall economy and to see whether momentum is building or cooling by viewing several important facets of the production process.

The headline number of the manufacturing PMI is an equal weighted average of the following five components:

- New Orders

- Production

- Employment

- Supplier Deliveries

- Inventories

Investors tend to focus on the New Orders component as a leading indicator on the health of the US economy.

And employment conditions are a heads-up to the forthcoming payroll report typically published a few days later.

The data is generally published by the ISM on the first business day of each month at 10:00am eastern time to give insights as to the health of the manufacturing sector.

PMI is a popular indicator of manufacturing conditions and is published globally in the Euro Area, China, India and others albeit by different providers. However, many of these providers utilize a similar diffusion methodology.

The manufacturing sector is capital intensive and requires the coordination of many moving parts within the economy.

Companies typically need banks for lending, commodities to put pieces together, people and heavy machinery for labor, and real estate to operate.

All the moving parts make the manufacturing sector and specifically the PMI, a strong predictor of future economic health.

If one of the contributors of the manufacturing sector appears weak, it’s likely a reflection of underlying weakness in the economy.

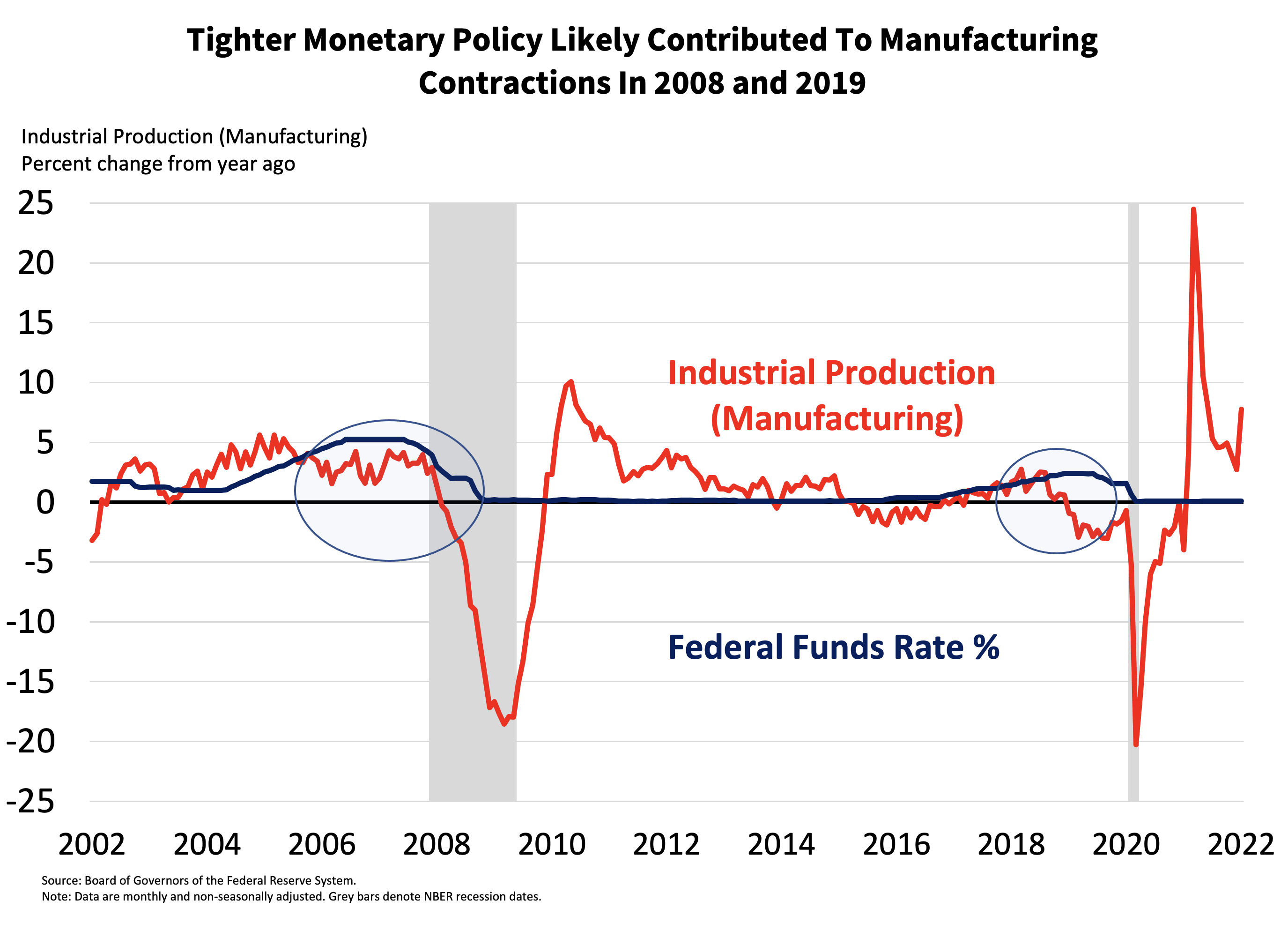

When the manufacturing sector slows, it typically means that businesses don’t want to invest, credit is tightening up, or demand from customers is weak.

Strong PMI data signals a hot economy where companies are placing orders for goods and materials in order to satisfy consumer demand.

In addition, credit conditions are favorable, and an incentive exists for businesses to invest.

When the PMI is expanding, it’s a reflection of strong economic growth that will likely lead to a positive sequence of events.

Strong economic growth generally leads to gains in consumption, employment, investment, capital flows, tax revenue and ideally more prosperity and opportunity.

If manufacturing weakens in the U.S. like it did during the 2008 financial crisis and the COVID-19 recession, it likely signals a recession for the global economy.

The rise of globalization has contributed to the world’s largest economies significantly impacting global economic growth.

While the U.S. only makes up four percent of the world’s population, it makes up a quarter of the world’s GDP.

This means that economic activity in the U.S. heavily impacts the world. In addition, the U.S. is the largest importer in global trade and issues the world’s reserve currency (USD), amplifying its impact.

For a full and comprehensive look at manufacturing conditions globally, follow the:

- German Ifo

- Eurozone PMI

- China PMI

These are useful since the U.S., China and the Eurozone regions represent roughly half of global GDP.

To forecast manufacturing PMI, look at economic indicators such as weekly unemployment claims to see if the risk of layoffs hampers manufacturing activity, durable goods orders as a measure of consumer demand, weekly steel production and daily commodity price action to gauge how manufacturing inputs are performing, and look at expected credit conditions to monitor business credit access. In addition, listen to the earnings calls and monitor the stock performance of some of the largest manufacturing companies for signs of an economic slowdown or expansion.

Some examples to look at might include Caterpillar, Boeing, Northrop Grumman, Sherwin Williams, Toyota, Ford, Raytheon, General Electric, Apple, and .

In general, higher interest rates and tighter credit conditions discourage business investment and may constrain capital intensive industries like manufacturing and real estate. Tighter policies likely contributed to the manufacturing contractions in both 2008 and 2019.

The manufacturing PMI is sometimes the main contributor to market moves. A PMI reading below expectations may lead to lower stock prices due to the assumption of slower economic growth. A PMI reading above expectations may lead to higher stock prices due to the assumption of economic strength.

Purchasing Managers are the persons directly responsible for approving or rejecting large purchases before the finished products reach consumers. They have a good understanding on the near-term demand outlook for goods. Their behavior is important to monitor when analyzing the potential risks of an economic slowdown or recession, as well as the potential benefits of economic growth.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Very informative. Enlightening

Thank you for the feedback, Steve!

this information is value, it show us the differents market’s trends and crisis around the world.

.

Thank you for the feedback, Rafa!

a failure of the purchasing manager can change the PMI

Very useful information for the beginner. Thank you.

Thank you for the compliment, Ktp. Be sure to check out our other lessons on IBKR Campus!