Study Notes:

In this video we will walk through how to enter an order using the Size Variant Percentage of Volume IB Algo. The Size Variant Percentage of Volume Algo is available for U.S. stocks and futures as well as some select non-US stocks and futures. This IB Algo is useful for larger size orders when you wish to minimize market impact on the price of the security. The Size Variant Percentage of Volume algo allows you to participate in volume at a user-defined rate that varies over the time selected depending on the remaining size of the order.

It is important to know the average daily volume or ADV to understand the participation rate you want to use for the order. While the actual daily rate on the day or days that the order is active may differ from the ADV rate due to current volumes or conditions the ADV is a good reference point and reflects the average trading volume over the past 90 days. The Average Volume data column can easily be added to the Portfolio tab or a Watchlist by clicking on the gear in the upper right-hand corner of the Monitor Panel and selecting “Average Volume” from the Available Columns area.

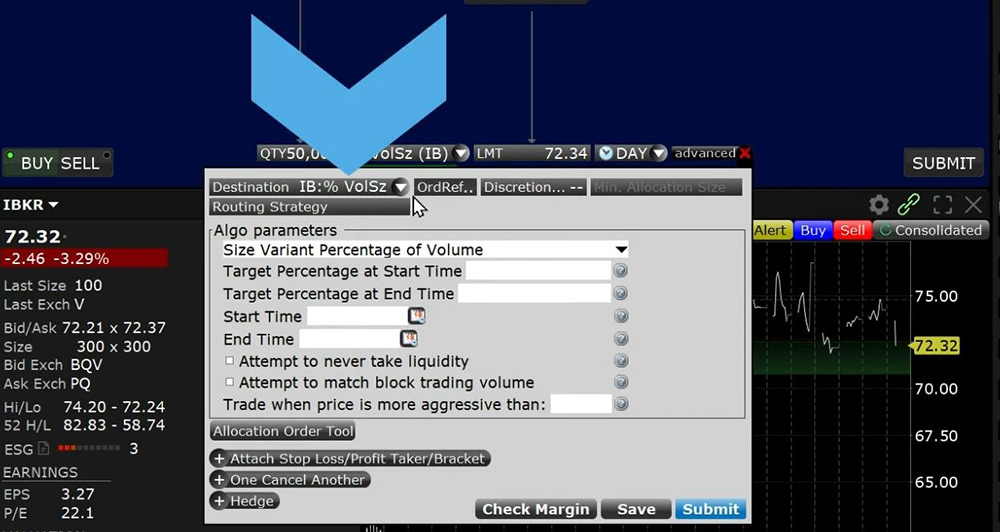

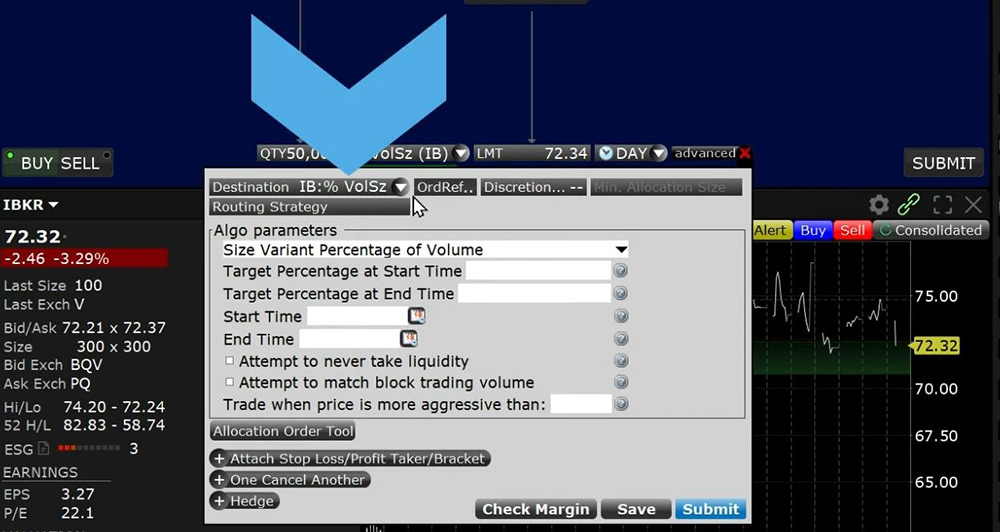

We will enter a Size Variant Percentage of Volume order using the Mosaic Order Entry Panel.

- First, enter the symbol in the order panel and choose Buy or Sell and the trade volume.

- In the order type drop down box scroll down to IBALGO and choose Size Variant Percentage of Volume.

- In the Advanced window IB:% Volume Size will appear as the destination in the upper left-hand corner.

- Moving to the Algo parameters area you will see Size Variant Percentage of Volume in the upper left-hand corner.

- Now set the Target Percentage at Start Time and Target Percentage at End Time.

- You can use any value from .01% to 50%.

- Setting a lower number in the beginning and a higher number at the end allows the order to be more aggressive toward the end.

- If you want the order to be more aggressive towards the start, enter a higher number for the initial rate.

- Next choose the Start Time and End Time.

- If left blank the start time will default to the start of market trading (or current time if entered after trading has begun) and the end time will default to the end of market trading.

- By checking the box next to the categories, you can attempt to never take liquidity which discourages the algo from hitting the bid or lifting the offer and/or match block trading which will allow the algo to trade against large block orders.

- Finally, you can make the algo conditional and only trade when the bid price, for a buy order, or the ask price, for a sell order is met.

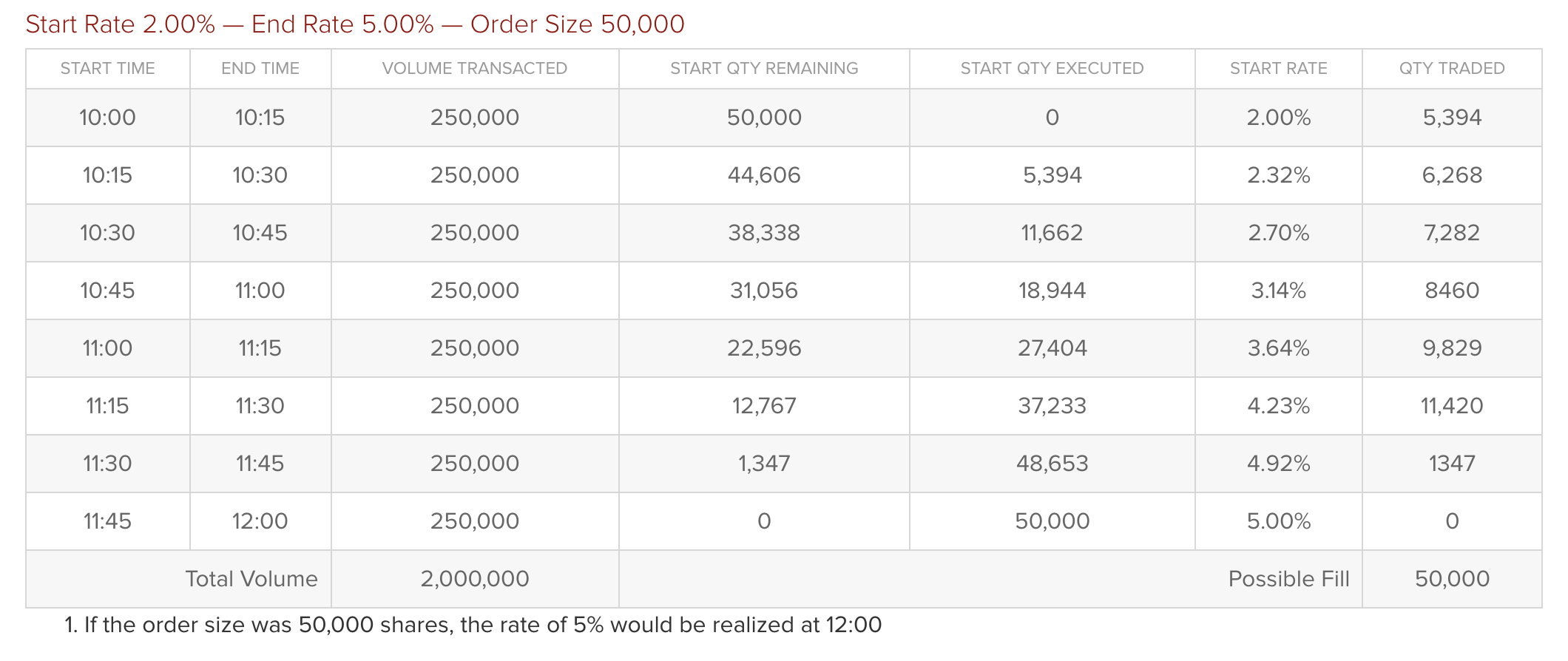

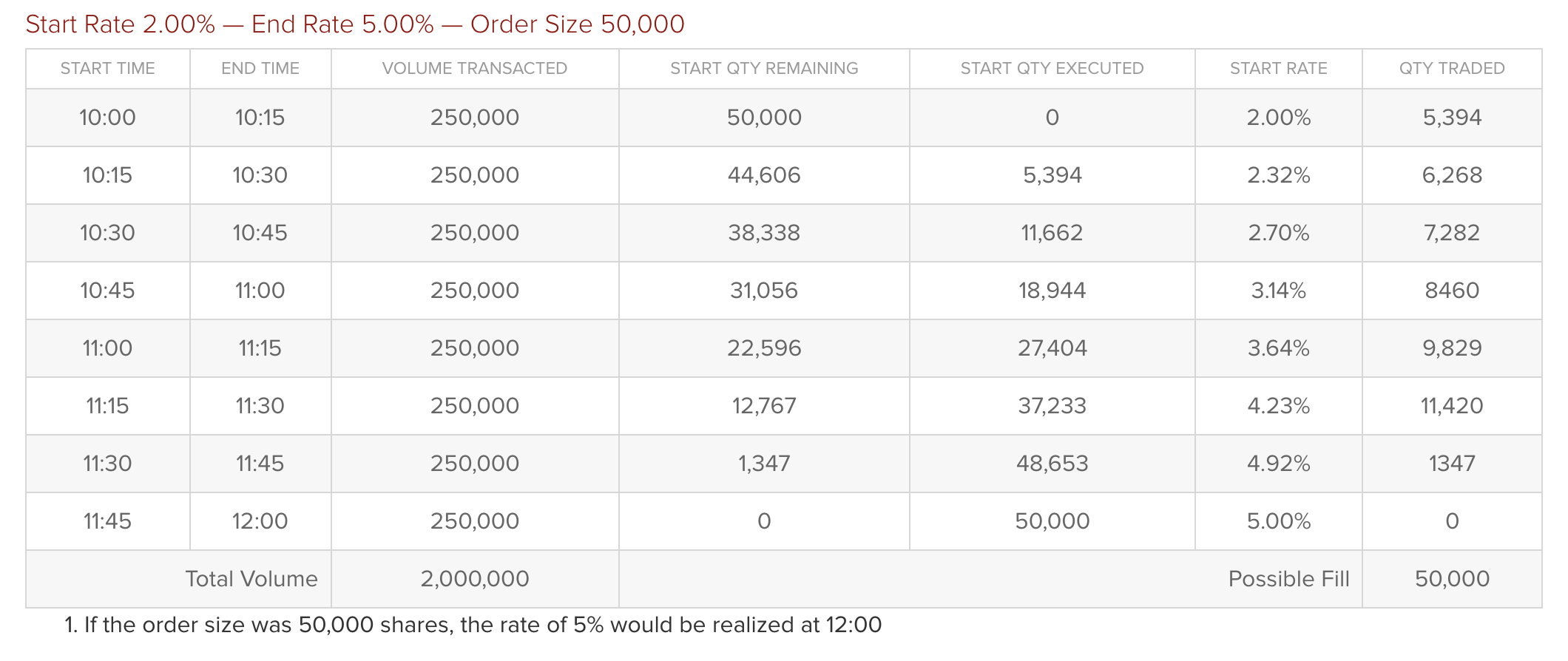

For example, let’s assume an ADV of 1million shares per hour, an investor wants to buy 50,000 shares between 10 am and 12 noon.

He enters an initial target of 2% and a 5% target at end time, the algo will adapt the pace of execution over the life of the order, stepping up the percentage each 15-minute period of the order’s time frame and filling just prior to the end of the period.

If the overall quantity was 10,000 with the same parameters, it would be filled within 45 minutes and if the overall quantity was 100,000 the order would only be partially executed leaving 50,000 shares unfilled.

Going back to the order when you are ready to send exit out of the Advanced window and click submit. The order confirmation window will appear summarizing the order and the inputs you selected. Click Transmit and the order will populate the Activity panel and show %VolTM(IB) in the Type data column.

Based on the conditions you set and actual volume the order may not necessarily fill within the same day.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.