Study Notes:

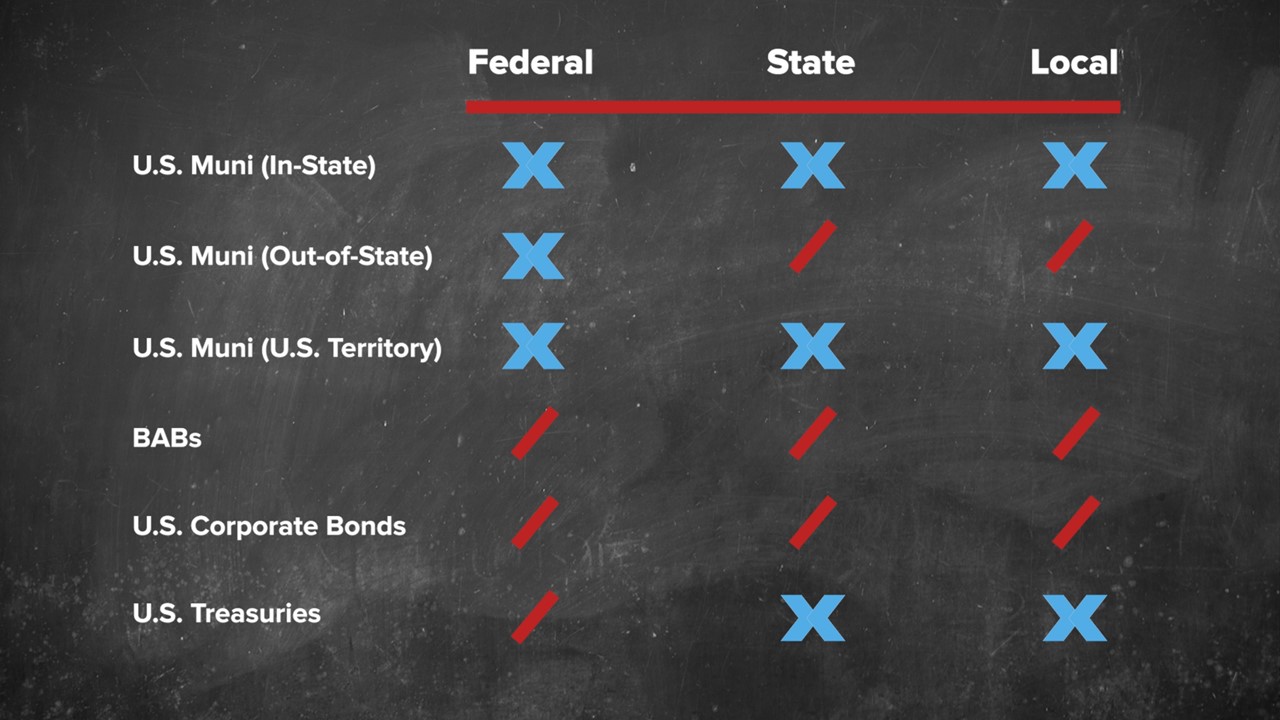

While investors of municipal bonds are not subject to federal tax, they may be required to pay taxes to the state, county, and/or city in which they reside.

As we discussed in our previous lesson, if an investor makes an in-state municipal bond purchase, the interest earned would be exempt from federal, state, and local income taxes. However, if an investor makes an out-of-state purchase, the interest earned is still exempt from federal tax, but typically subject to state and local taxes.

Some municipal securities may be referred to as ‘triple-tax-exempt,’ meaning the interest earned on bonds issued by a U.S. territory, such as Puerto Rico or Guam, are not subject to federal, state, or local taxes.

Build America Bonds (BABs)

BABs were a form of taxable municipal issuance, which originated with the American Recovery and Reinvestment Act of 2009.

The BABs program, which expired in 2010, was intended to help state and local governments finance capital projects, such as roads, bridges, and public schools, at a substantially lower cost. These generally aimed at attracting taxable, fixed-income investors.

Recall also from the previous lesson that we were able to calculate the net, after-tax yield of a taxable bond, as well as the taxable equivalent yield of a federally tax-exempt bond.

For handy reference, keep in mind that corporate bonds are typically subject to both federal and state taxes, while U.S. government debt is subject to federal taxes, but not state taxes, and municipal securities are not subject to federal taxes, and may not be subject to state taxes, depending on where the buyer resides (see table above for reference).

Tax Law Changes

Also, U.S. tax laws are always changing. One relevant, recent change was introduced with the Tax Cuts and Jobs Act of 2017, which effectively placed a cap on state and local tax deductions, commonly referred to as SALT deductions.

We’ve provided a link to the IRS website in the ‘Additional Info’ to this lesson, where you can find more details, as well as some examples, pertaining to this rule.

Capital Gains & Losses

It’s also important to note that municipal bonds are subject to taxes on their capital gains and losses, along with other capital assets such as stocks. These taxes differ from the taxation on a municipal bond’s interest.

Generally, if a municipal bond is sold for less than its cost, the result is considered a capital loss, and if it’s sold for more, then the investor experiences a capital gain.

While municipal securities are not subject to federal tax, a capital gain from a sale or redemption would face taxation, and in some cases, the gain would be reported as ordinary income.

Disclosures

Please keep in mind that the information in this presentation is provided for informational purposes and should not be relied on for tax, legal or accounting advice. Before engaging in any transaction, you should consult your own tax, legal and accounting advisors.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.