Study Notes:

The behavior of the individual is at the heart of microeconomics. Each individual is described as an economic agent, whose behavior is important because, in aggregate, can help microeconomists derive a demand curve for various goods and services.

Something that this area of study attempts to understand is how different consumers derive individual benefit or satisfaction from anything that they consume. The challenge here is that, while many consumers might be somewhat similar, each is that individual economic agent and they are constrained by a budget. Each individual has his or her own unique tastes or preferences. Only they can tell an amount of benefit or pleasure derived from buying something. Further, such benefit is also seen by microeconomists in the context of pleasure or benefit derived from consuming everything else they spend their income on each month.

Demand for any good then becomes a function of the price of the specific goods, the prices of other goods that the consumer could have consumed instead, and the wealth and income of the economic agent.

The Law of Demand states that, when the price of a good falls, consumers will buy more. When the price of a good rises, consumers will buy less. Inextricably linked here is the so-called Substitution Effect, which observes that should the price of Good A rise, demand for a similar Good B will increase. Consumers will adjust their spending habits when faced with a change in prices that impacts the utility they derive from a good. Such changes will involve moving away from goods whose prices rise and where a substitute good is available. The Income Effect states that as consumers become wealthier or simply have greater income, demand for most goods that they purchase will increase, forcing the demand curve to shift up and to the right.

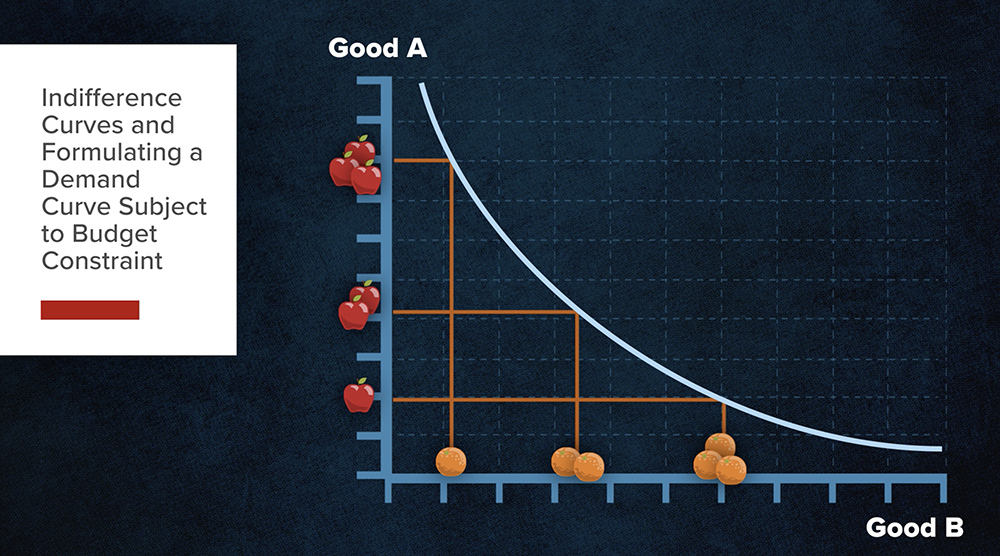

Indifference Curves and Formulating a Demand Curve Subject to Budget Constraint

Assume that the consumer is faced with a choice of two goods – Good A and Good B. Further, his consumption is constrained by a monthly income. We can then display graphically each combination of A and B for which the consumer is equally satisfied. By joining the combinations on a graph, we can derive a so-called Indifference Curve. Any point on the curve represents the same amount of utility derived by the consumer.

The consumer’s ability to purchase any combination of the two goods A&B is constrained by a finite budget. We can express the budget constraint by inserting a line that illustrates possible combinations of goods A&B starting at ALL Good A, declining to ALL Good B. The budget constraint can only intersect with the indifference curve at a single point. Point J is that point where consumer utility is maximized. This is a very clear way of expressing the trade-off when it comes to consumption of two different goods when faced with changing prices and incomes by economic agents.

Indifference curves map out the combination of utility between goods derived by an individual. We can display additional indifference curves to the plot, which simply show greater levels of utility between two goods. Curves further to the right imply more satisfaction than any curve to its left.

Assume that an alternative but lower quality type of Good B exists. Within the identical budget constraint, the consumer can achieve combinations of Good A and more of Good B subject to the same income constraint. The consumer can always only buy the same maximum amount of Good A, but could then choose to combine with larger amounts of Good B. The additional indifference curves express the different combinations of Goods A&B that yield greater levels of consumer satisfaction or utility at the same restricted income.

In other words, the consumer can yield more satisfaction by combining fewer amounts of Good A with greater amounts of the lower quality Good B. Notice too that while the combinations yielding greater satisfaction move to indifference curves with higher utility, the budget constraint remains the same. However, the overall utility derived by the consumer has moved out to the right illustrating greater satisfaction but from the same level of income.

Now consider that the price of Good B increases. This has the same effect as reducing the consumer’s income.

Once again, the consumer can still afford a maximum quantity of Good A should he buy none of Good B. On the other hand, due to the increase in price of Good B, he could afford a smaller amount if he bought none of Good A. A new indifference curve is therefore mapped out pairing many combinations of the two at which he is indifferent. However, the initial budget constraint line is no longer attainable due to the price increase of Good B. The new budget constraint cuts the updated indifference curve to the left of the earlier line displaying that the consumer will now purchase a higher amount of Good A and fewer amounts of Good B due to the change brought about by the shift in the budget constraint.

The theory of consumer demand makes a lot of assumptions about the consumer including that they have perfect knowledge and always make good decisions. It assumes that consumers do not make dumb decisions and always act rationally. Trying to model how consumers think is helpful, although imperfect when it comes to the real world, but it does allow economists to explain behavior as incomes and prices change. We can get a really good sense of how consumers behave when faced with choices of different goods under assumptions of finite wealth or budgetary constraints.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.