Study Notes:

BookTrader in IB’s Trader Workstation (TWS) may be used to create an order at any price with a single click in a price ladder. BookTrader can be opened from Mosaic or Classic TWS and can also be added as a panel in a custom layout. Additionally, there is a pre-configured Book Trading layout available in the Layout Library.

It is possible to create a custom layout and open multiple BookTrader windows to view several tickers at the same time. However, the number of deep book data windows that you can display at a given time (including BookTrader, Integrated Stock Window and Market Depth) is dependent on the number of market data lines that you are allowed. Market data allowance is based on commissions, available equity, and other criteria. For details on how market data allowances are calculated, see the Market Data and News overview page on the IB website.

To launch BookTrader in Classic TWS, click Trading Tools from the top menu and select BookTrader under the Stock/Futures Focus section. In Mosaic, BookTrader can be opened by clicking New Window in the top left corner. Select BookTrader under the General Tools section. BookTrader can also be launched directly from the Order Entry Panel by clicking the dropdown arrow in the upper right corner and selecting BookTrader.

To launch BookTrader in Classic TWS, click Trading Tools from the top menu and select BookTrader under the Stock/Futures Focus section. In Mosaic, BookTrader can be opened by clicking New Window in the top left corner. Select BookTrader under the General Tools section. BookTrader can also be launched directly from the Order Entry Panel by clicking the dropdown arrow in the upper right corner and selecting BookTrader.

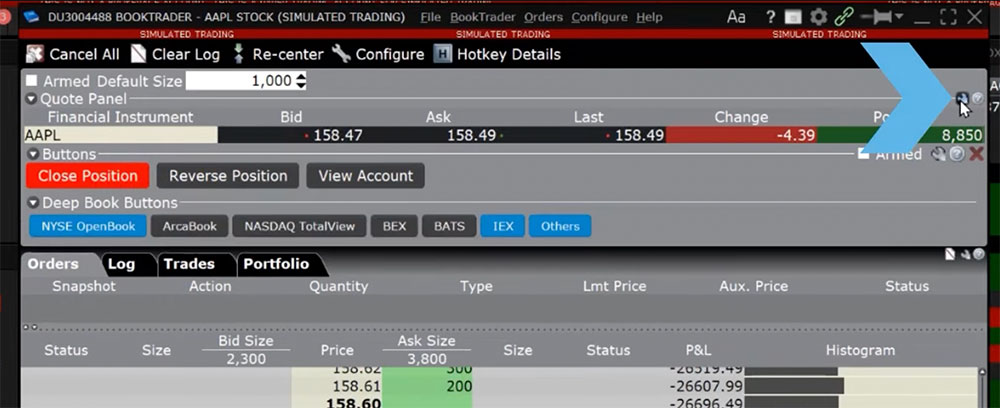

BookTrader will open as a new window with the most recently selected financial instrument and will show a series of prices above and below the best bid and ask in the price ladder. You can adjust the financial instrument in the Quote Panel at the top of the page. For example, I will enter AAPL and select the stock. The wrench icon in the upper right corner of the Quote Panel can be used to manage the data columns that are displayed here.

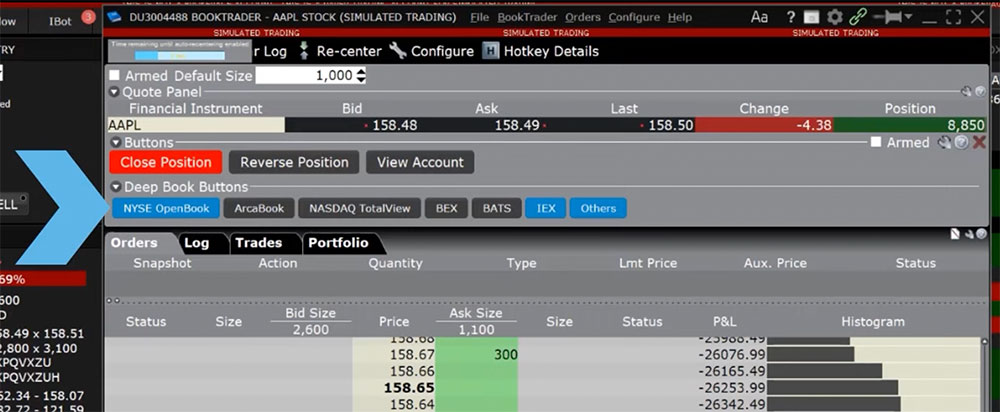

Click one of the Deep Book Buttons to add data from a market center to the Price Ladder. Once selected, the button will turn blue indicating the data from that market center is now displaying in the Price Ladder below. If you do not have the market data subscription for the selected exchange, a pop-up window will open informing you of the missing subscription. You may open Client Portal and subscribe from the market data subscription page. Select Cancel to close the pop-up or select OK to open Client Portal in your default web browser.

Click one of the Deep Book Buttons to add data from a market center to the Price Ladder. Once selected, the button will turn blue indicating the data from that market center is now displaying in the Price Ladder below. If you do not have the market data subscription for the selected exchange, a pop-up window will open informing you of the missing subscription. You may open Client Portal and subscribe from the market data subscription page. Select Cancel to close the pop-up or select OK to open Client Portal in your default web browser.

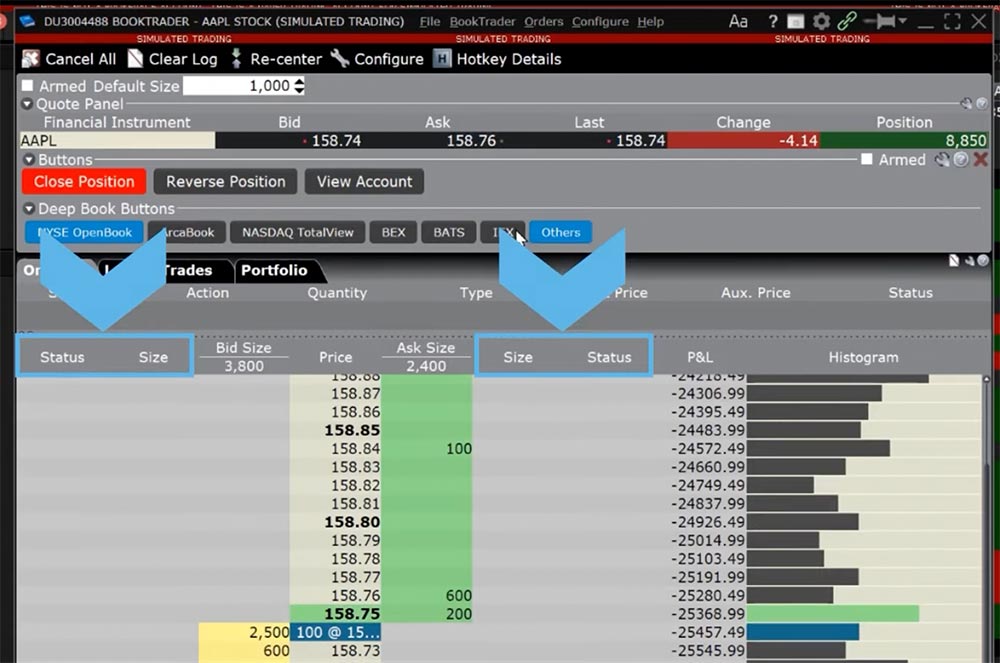

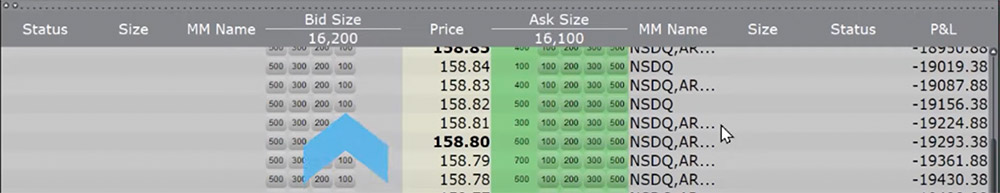

Within the Price Ladder, the Prices are shown down the center with the Bid Size column to the left and the Ask Size column to the right. The current cumulative Bid and Ask sizes are displayed at the top of their respective columns. The MM Name column will display the market maker name(s) and you can filter so see a single market center by using the Deep Book buttons mentioned earlier.

Within the Price Ladder, the Prices are shown down the center with the Bid Size column to the left and the Ask Size column to the right. The current cumulative Bid and Ask sizes are displayed at the top of their respective columns. The MM Name column will display the market maker name(s) and you can filter so see a single market center by using the Deep Book buttons mentioned earlier.

The Size and Status columns on either side of the price ladder will show the size and status of your working orders. Buy orders will populate the Size and Status columns on the left-hand side. Sell orders will populate the columns on the right-hand side. On the far right of the Price Ladder is a Price Histogram showing the daily volume traded at that given price point.

By default, BookTrader uses specific colors to convey information such as the High, Low, Bid, Ask and Last traded price. You can customize these colors by clicking the Configure button on the toolbar, and then selecting BookTrader Colors.

By default, BookTrader uses specific colors to convey information such as the High, Low, Bid, Ask and Last traded price. You can customize these colors by clicking the Configure button on the toolbar, and then selecting BookTrader Colors.

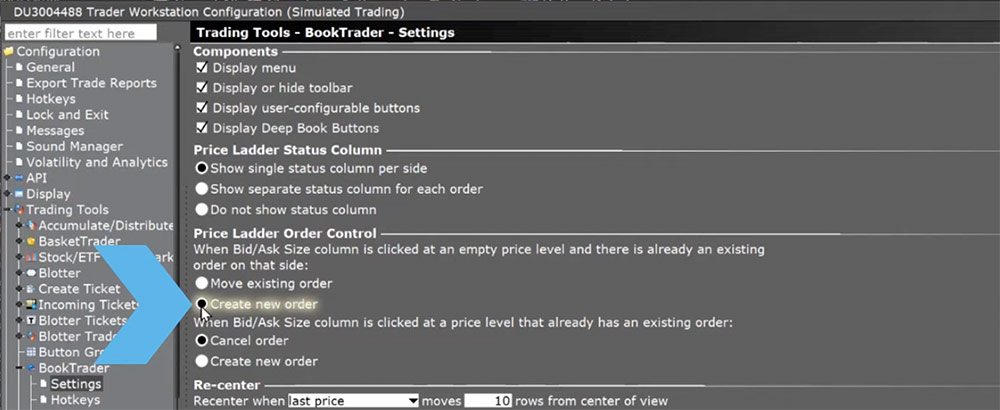

The Price Ladder will automatically re-center to keep the best bid/ask price or last traded price always visible in the center screen. By default, BookTrader is set to automatically re-center when the last price is more than 10 rows from the center view. When the user is scrolling the ladder using either the Up/Down arrow keys or the scrollbars, and the inside market (or last trade price) falls outside of the display area, auto-recentering will occur five seconds after the user has completed scrolling. This five second time-period is counted down visually in an animated progress bar. You can disable the progress bar display or adjust the parameters for the automatic re-center in the BookTrader settings by clicking Configure in the toolbar and select Settings.

Alternatively, you can manually re-center the Price Ladder at any time by clicking the Re-center button at the top of the window.

To place an order via BookTrader, click on the Bid Size column for the desired price to submit a Buy order or click on the Ask Size column to submit a Sell order. An Order Confirmation will open to review the order details before clicking Transmit. TWS will use the order attributes as configured in your Presets.

To help speed up order placement, you can also define quick-click order buttons in the Price Ladder that will quickly create orders with a multiple of the default order size. To display the multiplier buttons, click Configure at the top of the window then select Show size buttons in Price Ladder. For example, the default size in my presets is set to 100 shares. The multiplier buttons are set to one, two, three and five. Therefore, 100 shares times my multiplier of three would display a button for 300 shares. Clicking the 300 button will quickly place an order for 300 shares at that corresponding price. If my default order size was 200 shares, my button associated with the multiplier of three would be reflected as 600 shares.

These buttons can be customized in your order presets by clicking the wrench icon to the right of the Show size buttons in Price Ladder in the Configuration menu. Please see our other video lesson for further information on configuring order presets.

These buttons can be customized in your order presets by clicking the wrench icon to the right of the Show size buttons in Price Ladder in the Configuration menu. Please see our other video lesson for further information on configuring order presets.

The Order Confirmation popup can be disabled by checking the box in the lower left corner for “Don’t display this message again”. If you elect this option, your orders will transmit instantaneously from that point forward.

Your working orders within the price ladder and the Status and Size columns will be populated with your order details. The working order is also displayed in the Orders tab slightly above the price ladder. Here you can modify the working order by changing the quantity or limit price and clicking Update to submit the modifications.

Alternatively, you can modify the existing buy order within the price ladder by clicking the Bid Size column at another price level. A new pop-up confirmation will open indicating you are cancelling the existing order and replacing it with the new order at the new price. Once ready, click Transmit to submit the modifications.

It is possible to configure the BookTrader settings to allow a second order on the same side to be submitted at the new price instead of modifying the existing order. To do so, select Configure at the top and click Settings. Under the Price Ladder Order Control section, select the circle next to Create new order for When Bid/Ask Size column is clicked at an empty price level and there is already an existing order on that side. Click Apply and OK.

Underneath the Quote Panel is a Buttons Panel which can be used to quickly modify existing orders or submit new orders. The default buttons can be used to close your existing position, reverse your existing position, or view your account details.

Underneath the Quote Panel is a Buttons Panel which can be used to quickly modify existing orders or submit new orders. The default buttons can be used to close your existing position, reverse your existing position, or view your account details.

You can create new buttons, change the display order of the buttons, and edit or delete existing buttons in order to best suit your trading needs. To do so, click the wrench icon in the top right side of the buttons panel to open the Global Configuration window.

Select New to create a new button and select the action from the available drop-down list. For example, I will create a button to buy with a limit price at the Bid plus $0.02. When Buy is selected from the actions drop down, the window will expand to display additional customizations. I will select LMT as the Order Type and select Bid as the Limit Price. On the Limit Price line, enter 0.02 as the offset amount. I can also change the background color of the button and in this example, I will change it to Blue. Once my new button is added, I can click the button and my Buy order will be submitted with my defined order attributes.

The buttons can be armed for Instantaneous Transmission so that the order is instantly submitted without needing the extra clicks to replace the order. To do so, click the Armed checkbox in the top right corner of the Buttons Panel and agree to the warning disclosure. The button names will include an asterisk (*) when they are set to Instantaneous Transmission. The attribute can be removed by de-selecting the Armed checkbox.

Hotkeys can also be configured specifically for BookTrader. Hotkeys allow traders to assign keystroke commands to create shortcuts within TWS that are designed to rapidly create or transmit orders. For more information on creating and using Hotkeys, please see our dedicated lesson on Hotkeys.

As we have reviewed in this lesson, BookTrader allows traders to quickly transmit and modify orders via a price ladder.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.