Study Notes:

The unemployment rate report measures the tightness of the EU’s labor market. The rate of unemployment is defined as the number of unemployed folks divided by the labor force. People are counted as unemployed if they are without a job but have been actively seeking work in the last four weeks and are available to start work within the next two weeks. The labor force is the number of unemployed people plus the number of employed people. The report provides details on the unemployment rate by gender, age, and each individual country. Unemployment is calculated by Eurostat, the statistical office of the European Union. Eurostat collects unemployment data from the National Statistical Offices of each country and then aggregates, weighs and seasonally adjusts them. In addition, the data release aggregates unemployment data for the E.A. 19 nations that use the Euro currency and separately aggregates data for the E.U. 27 nations to include the countries that don’t use the Euro currency like Hungary, Ireland, Slovakia and others. The data release is published monthly, generally near the 2nd day of the month, at 9:00 am London time. Eurostat’s mission is to provide high quality European statistics and data to support public and private sector decision making.

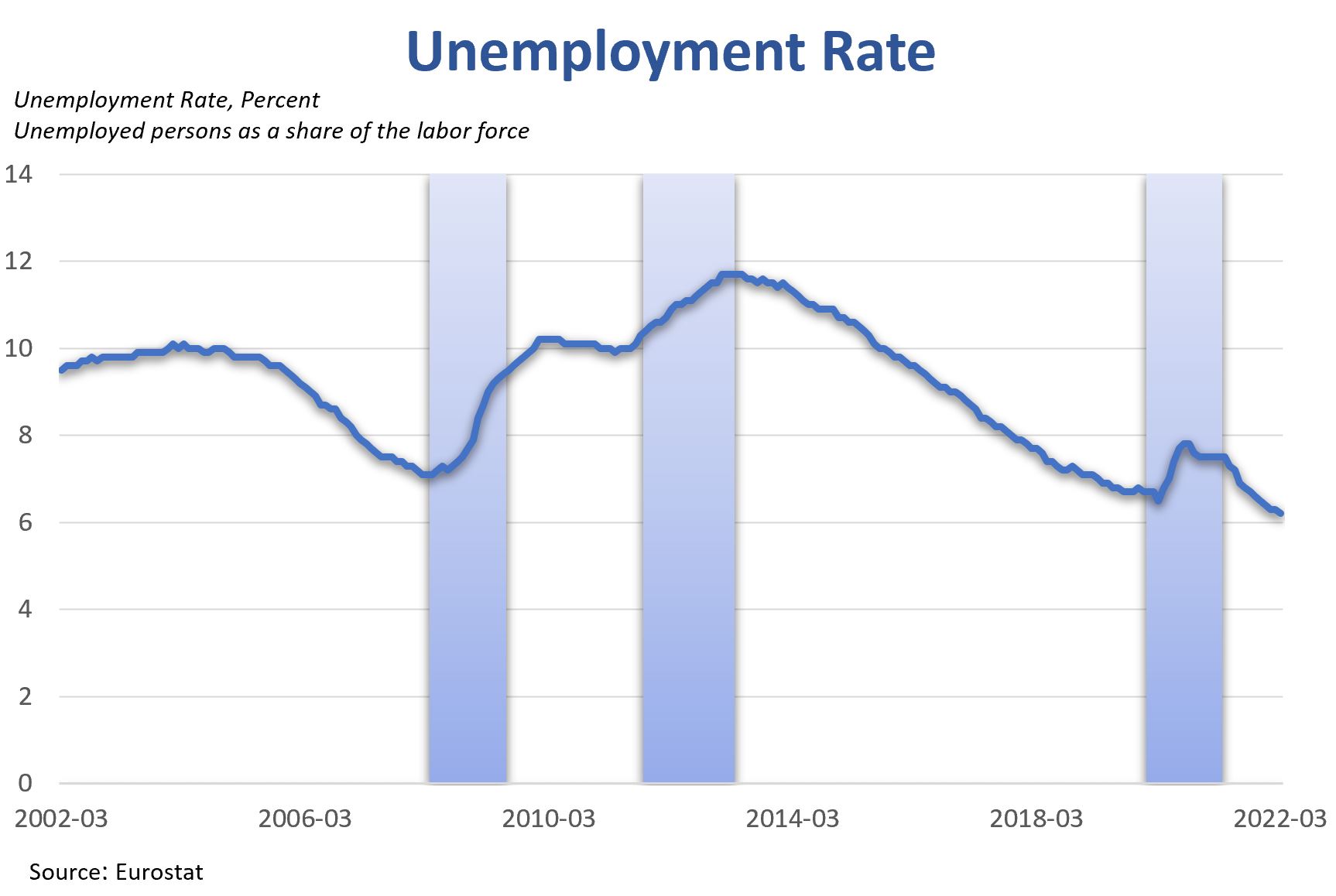

The report is published because unemployment is a key indicator of growth and output in the economy, and it provides vital information about how easy or challenging it is to find a job. Low unemployment rates would imply that workers can find employment swiftly. Unemployment levels that are high indicate a lack of job opportunities for workers. Employment and output declines have domino effects across the global economy. In an economy with fewer jobs, people are generally not spending as much, resulting in reduced corporate revenues and rising layoffs. Unemployment rose during the 2008 financial crisis, the 2011 Euro recession and the COVID-19 recession as demand fell. Weakening of the Euro economy results in a weakened global economy, as the global economy is interconnected and the E.U. makes up 15 percent of it. International markets care a lot about the strength of the Euro labor market.

To forecast the unemployment rate, we can look at leading economic indicators such as employment expectations, business expectations and consumer sentiment since they tend to deteriorate prior to the unemployment rate rising. The new orders and employment parts of the Purchasing Managers Index for manufacturing to get a gauge of how employment and demand are holding up in the capital intensive and interest rate sensitive manufacturing sector. In addition, watching retail trade and retail trade confidence to see if trends in business revenue are weakening and may lead to layoffs is useful.

Market participants value the amount of jobs added in the previous quarter more than the unemployment rate because it’s a more direct link to economic growth and productivity. Sometimes the unemployment rate may be misleading because of an aging population and/or discouraged workers that reduce the labor force, the denominator in the unemployment rate calculation.

The unemployment rate may move markets. A reading above expectations may lead markets lower while a reading below expectations may lead markets higher.

It is vital to track the unemployment rate as an indicator of how tight the European Union’s labor market is as it correlates with global economic health.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.