Study Notes:

The unemployment rate in Australia reveals how constrained or tight the labor market is. It is computed by dividing the total labor force by the number of persons without a job. In general, a person who is unemployed doesn’t currently have a job but has recently looked for one and is available to start working. The aggregate number of persons who are employed and unemployed is referred to as the labor force. Information and specifics on unemployment as well as several other labor market indicators are included in the monthly labor force report.

Data by age, state, territory, gender, and full-time/ part-time workers are provided. Since certain industry groups, including retail, construction, and tourism, have varying unemployment rates throughout the year, seasonally adjusting the figures is important. The data is generally collected via surveys conducted in person, on-line and by telephone from approximately 26,000 households and 50,000 individuals. The labor force report data release is published by the Australian Bureau of Statistics near the 17th day of each month at 11:30am Canberra time. The Bureau publishes unemployment information and a wide variety of other data to support the decision making of Australian individuals, communities, businesses and governments.

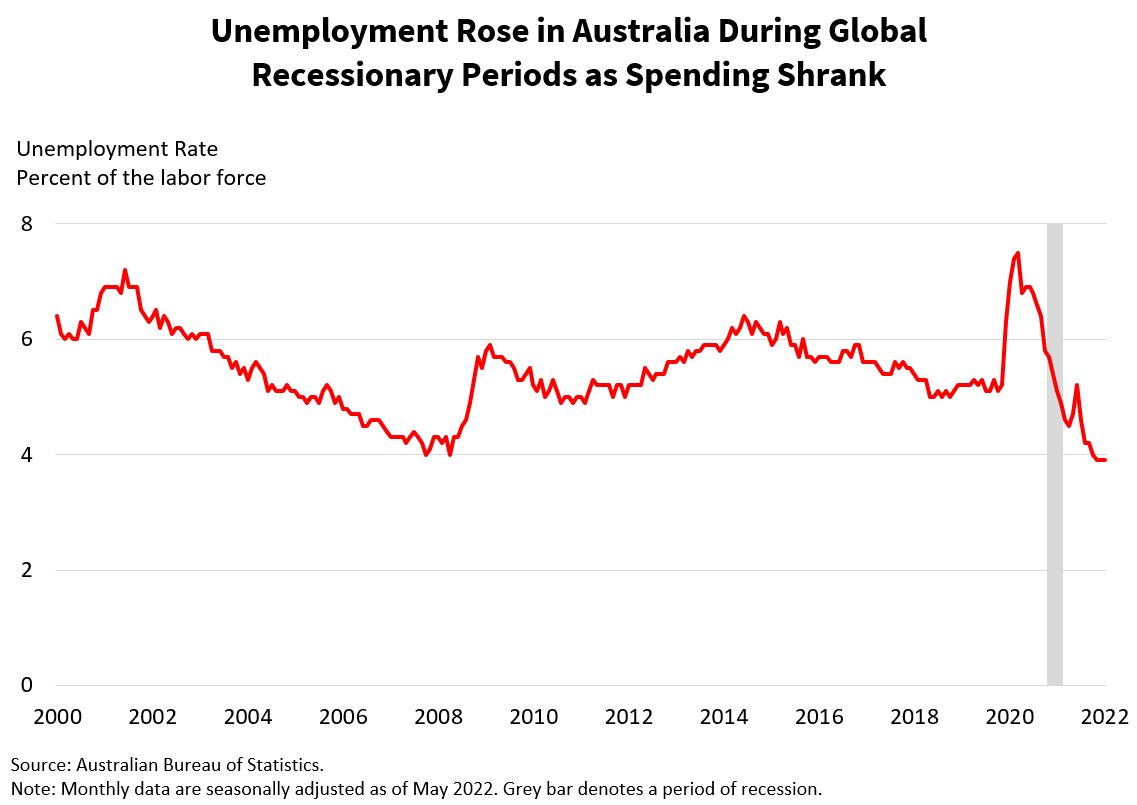

As an integral indicator of progress and productivity in the economy, the report provides valuable information on how easy or difficult it is to find work. Workers can find employment swiftly if unemployment levels are low. In contrast, when unemployment rates are high, it signals a lack of job opportunities. As employment and productivity decline, their negative effects ripple domestically and throughout international economies. In an economy with fewer jobs, people are generally not spending as much, resulting in reduced corporate revenues and rising layoffs. As a result of the globalized nature of the international economy and the notable influence of Australia’s largest trading partners, a weakened Australian economy results in a weakened global economy. In Australia and globally, the unemployment rate increased during the 2008 financial crisis and the COVID-19 recession as global consumer spending declined.

Forecasting the unemployment rate can be done using leading economic indicators, such as hours worked, building activity, and consumer and business confidence, since these indicators tend to weaken prior to employment dropping, the unemployment rate rising, and the economy decelerating. The new orders and employment aspects of the Purchasing Managers’ Index for manufacturing show how demand and employment are doing in this capital intensive and interest rate sensitive sector. In addition, tracking trends in retail trade to determine if joblessness might follow softening data is helpful. Valuable insights can be gained from company earnings calls for information regarding hiring plans, layoffs, hiring freezes, etc., since these tend to occur prior to the overall economy weakening.

Market participants place a higher value on the number of jobs added in the previous month relative to the unemployment rate because those numbers are more directly connected to growth and productivity. Unemployment may sometimes be misleading as a result of an aging population and/or discouraged workers, which reduce the labor force, the denominator that partially determines the unemployment rate.

Markets may be affected by the unemployment rate release. They may react negatively to readings above expectations, while the markets may respond positively to readings below expectations.

Monitoring the unemployment rate is crucial since it provides an indication of how tight the national labor market is and its implications for the international economy.

final test for this whole subject on Au, has a 2nd last qn with not all the answer options displayed, and the actual question not complete.

Being:” Elevated employment growth signals? CA”

You cannot choose its 1st choice= answer.

So you cannot submit the test trial as not all the questions can be ‘done’

Hello, thank you for pointing this out to us. This is now reflected in the quiz! We appreciate your feedback.