Study Notes:

Jose Torres here for Interactive Brokers, in this lesson I’ll be explaining one of the lagging economic indicators of the United Kingdom’s economy: Unemployment.

The UK’s unemployment rate demonstrates how competitive or tight the job market is. It’s calculated by dividing the total number of jobless, or unemployed people by the total labor force. An unemployed individual is generally defined as someone who has sought employment in the last four weeks and is ready for work in the next two weeks. The labor force refers to the total number of unemployed and employed people. The monthly labor market overview report provides information and details concerning unemployment and many other labor market indicators. Detailed unemployment information is provided for each age group, duration, region, birthplace and ethnic group albeit some of the data points aren’t updated every month. It is necessary to seasonally adjust the data because some industries, such as retail, construction, and travel have fluctuating unemployment levels throughout the year. The data is generally collected from 69,000 individuals through surveys conducted via email and telephone. The Labor Market Overview data release is published by the Office for National Statistics near the 17th day of each month at 7:00am London time. The Office for National Statistics publishes unemployment information and a wide variety of other data to serve the public good.

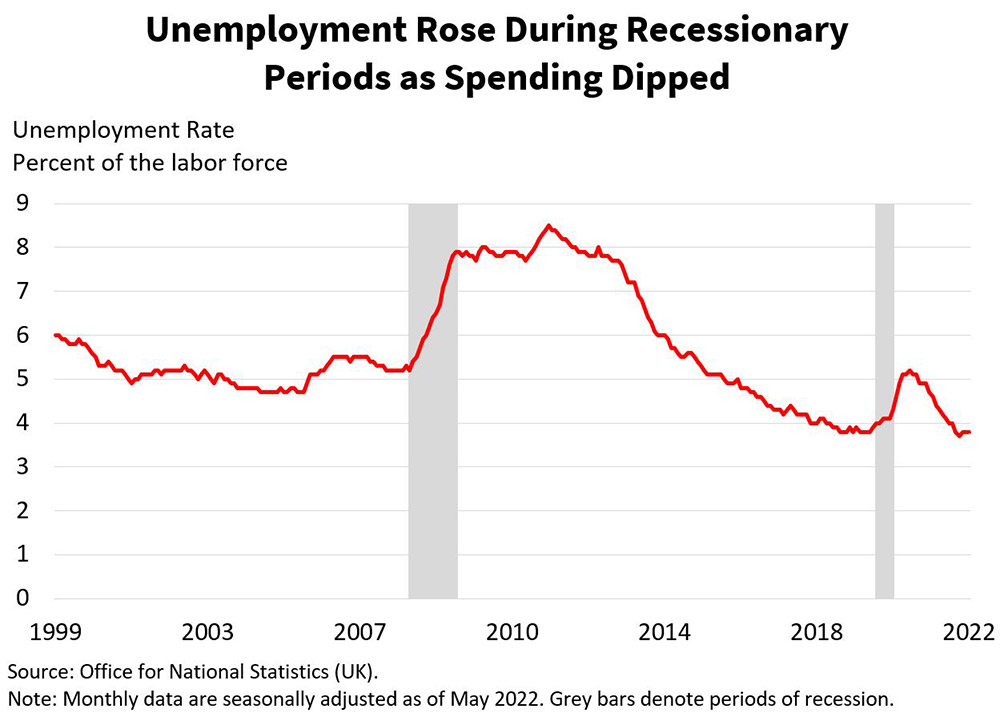

The monthly publication offers insightful data on how trouble-free or challenging it is for workers to find jobs and highlights the strong, positive correlation between employment availability and economic growth. Workers can rapidly find jobs if unemployment rates are low. A high unemployment rate, on the other hand, indicates a lack of work possibilities. The domestic and global economy suffers when employment and productivity declines. When there are fewer jobs available, people tend to consume less, which lowers company profits and may eventually lead to layoffs. A weaker UK labor market may lead to a weaker global labor market due to the multinational nature of the international economy and the considerable influence of the Group of Seven nations. During the COVID-19 recession and the 2008 financial crisis, consumer spending slipped, which increased unemployment in the UK and throughout the world.

Leading economic indicators, such as hours worked, housing starts, business confidence, and consumer confidence, can be used to forecast the unemployment rate since they have a tendency to fall before a slowing economy, rising unemployment, and recession. The Purchasing Managers’ Index for manufacturing uses employment and new order statistics to gauge the health of this cyclical, economically sensitive, capital-intensive and interest ratesensitive sector. Monitoring retail sales trends is also useful for predicting whether joblessness would follow lighter data as demand softens. Earnings calls may be a great source of information as well because businesses frequently disclose their recruiting initiatives, layoffs, hiring freezes, etc. before the broader economy begins to deteriorate.

Leading economic indicators, such as hours worked, housing starts, business confidence, and consumer confidence, can be used to forecast the unemployment rate since they have a tendency to fall before a slowing economy, rising unemployment, and recession. The Purchasing Managers’ Index for manufacturing uses employment and new order statistics to gauge the health of this cyclical, economically sensitive, capital-intensive and interest ratesensitive sector. Monitoring retail sales trends is also useful for predicting whether joblessness would follow lighter data as demand softens. Earnings calls may be a great source of information as well because businesses frequently disclose their recruiting initiatives, layoffs, hiring freezes, etc. before the broader economy begins to deteriorate.

Due to its increasingly direct connection to economic growth and productivity, market participants place a greater value on job creation in the previous month than on the unemployment rate. The labor force, which is the denominator of the unemployment rate, is reduced by an aging population and/or discouraged employees as they’re considered out of the labor force, hence the unemployment rate may be confusing depending on the demographics of the population.

Significant market movements may occur directly after the unemployment rate is released. The market may react unfavorably to results that surpass expectations and favorably to ones that fall short of expectations.

Monitoring the unemployment rate is essential as it signals how tight or loose the UK labor market is and its potential impacts for the global economy.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.