The foreign exchange market can be as vast as that of equities. With more than 150 currencies in circulation, there are enough single names to fill almost two Nasdaq indexes worth of components.

However, the best place to start can be a diversified basket, similar to the world of stocks. In the same way that many get their feet wet in equities with some version of the S&P 500 (ETF, E-mini futures, Micro E-mini futures, etc.), the US dollar offers a solid, central location for your first forex trade.

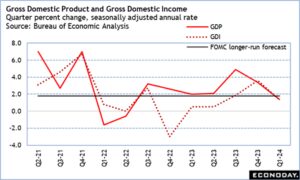

SFX \ Small US Dollar Index Components

Most USD products, like Small US Dollar futures, represent the dollar relative to a basket of foreign currencies to give it a well-rounded measure without too much reliance on one region.

How Do You Trade a Currency?

Short answer: just like any other market! Though there is some nuance to currencies, they rise and fall based on a multitude of factors the same as stocks, commodities, and cryptos. That said, price extreme traders and technical analysts can feel comfortable applying their usual mechanics to another market exhibiting daily price action.

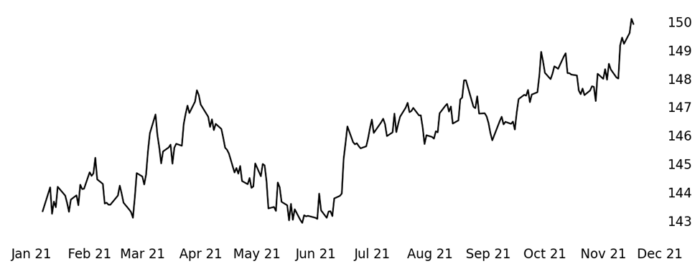

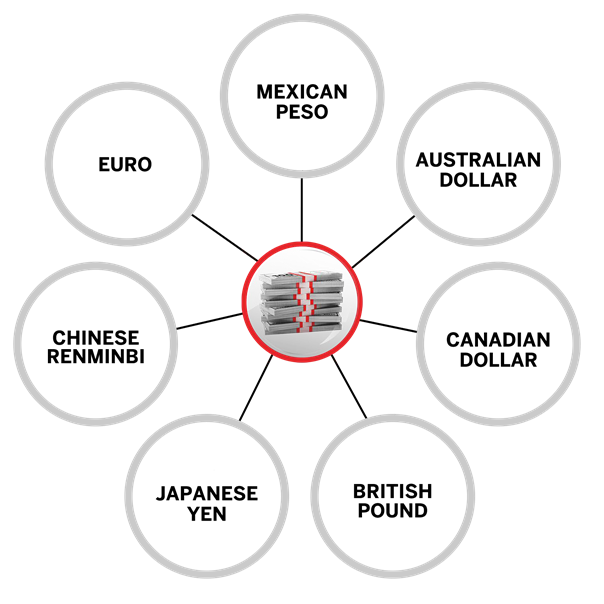

SFX \ Small US Dollar Index

Source: dxFeed Index Services (https://indexit.dxfeed.com)

What drives forex markets, though, is specific to the asset class. US dollar appreciation usually comes from higher interest rates and stronger economic data in the US relative to the Eurozone, Japan, Great Britain, and otherwise; and vice versa.

When You Buy USD, You Sell Foreign Currencies

Since traditional currencies are priced in terms of another currency, buying US dollars directly reflects a short position in one or a mix of Japanese yen, euro, British pound, etc.

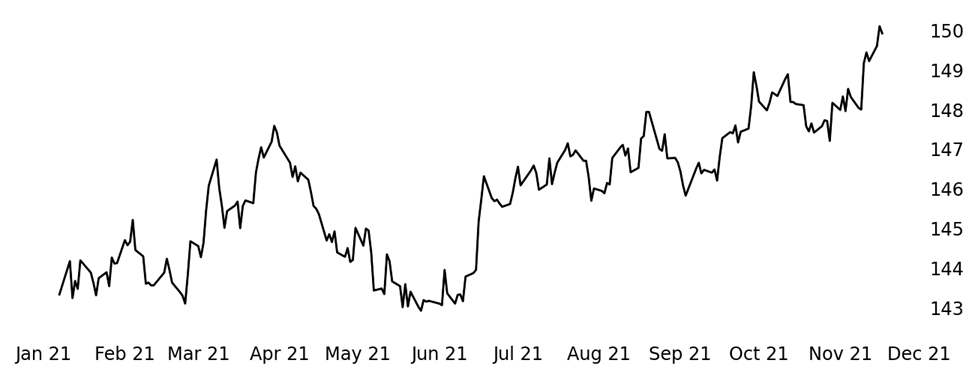

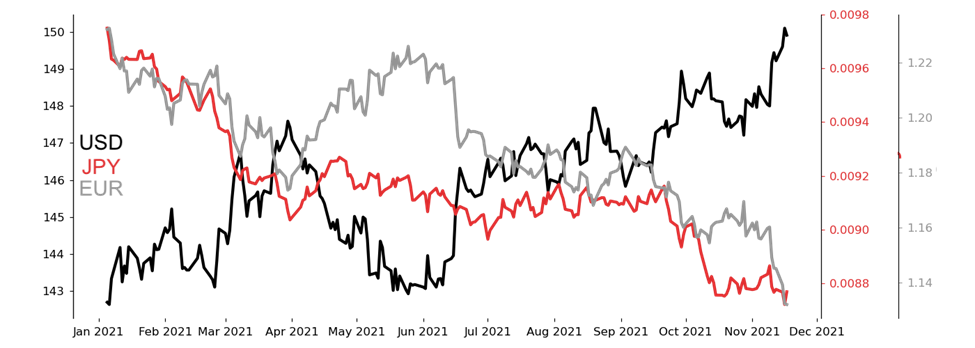

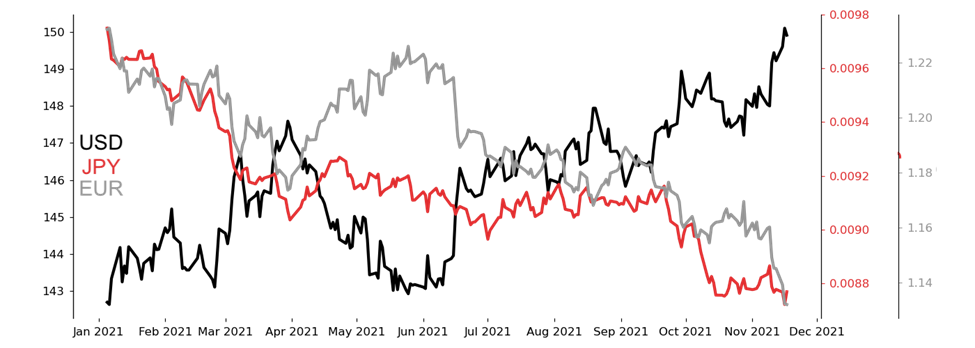

SFX, 6J, & 6E \ USD, JPY, & EUR Indexes

Source: dxFeed Index Services (https://indexit.dxfeed.com) and Yahoo! Finance (https://finance.yahoo.com/)

With US dollars at their highs for the year, you might be looking at a short position to play the potential for mean reversion, especially if your base currency is USD and you’d like to hedge some of that exposure. Selling a Small US Dollar future converts USD to yen, euro, pound, renminbi, and more in one trade.

Forex often seems like an exclusive asset class that requires a background in the field, but you can get started and grow your currency trading skills just like stocks.

—

© 2021 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. The information presented here is for illustrative purposes only, and is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Trading in derivatives and other financial instruments involves risk.

Disclosure: The Small Exchange

© 2022 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Trading in options, futures, and ETFs is not suitable for all investors. The risk of loss in the trading of options, futures, and ETFs can be substantial. Trading in derivatives and other financial instruments involves risk. Trading futures involves the risk of loss, including the possibility of loss greater than your initial investment.

Interactive Brokers Group, Inc., the parent company of Interactive Brokers, LLC, is a minority owner of Small Exchange Inc.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Small Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Small Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.