1/ Small Caps Under Accumulation

2/ ACVA is Leading a Turnaround in Used Car Prices

3/ Net Highs on the Nasdaq Support Higher Prices

4/ AZEK Building Supplier Preparing for Much Higher Prices

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

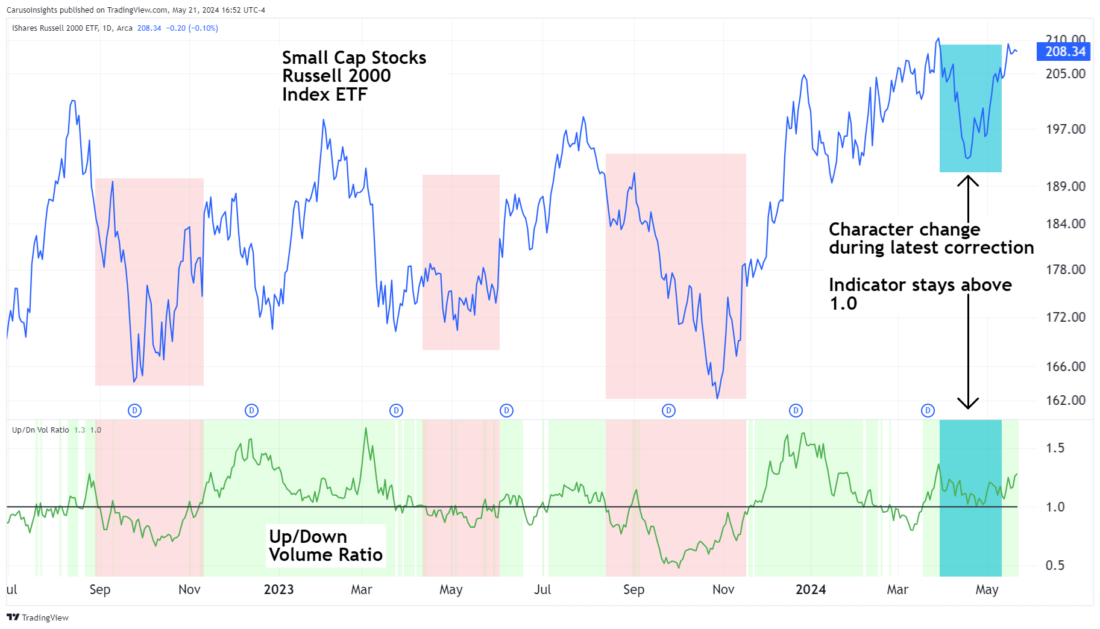

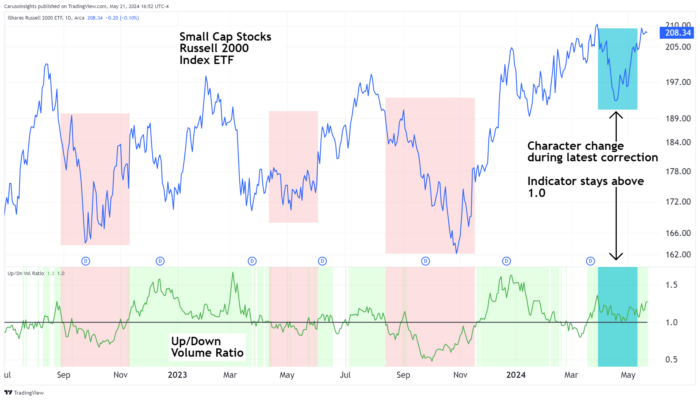

1/ Small Caps Under Accumulation

Despite dramatically underperforming all major indexes throughout 2023, the Russell 2000 small-cap index has begun showing signs of accumulation. The Up/Down volume ratio in the chart below identifies net buying over a 50-day period with a value greater than 1.0. As you can see, all prior corrections occurred with an associated drop in the Up/Down volume ratio below 1.0. This recent May correction had a different character and occurred with a backdrop of the ratio holding above 1.0. Coincidentally, legendary investor Stanely Druckenmiller just recently disclosed his new largest position to be call option on the Russell 2000.

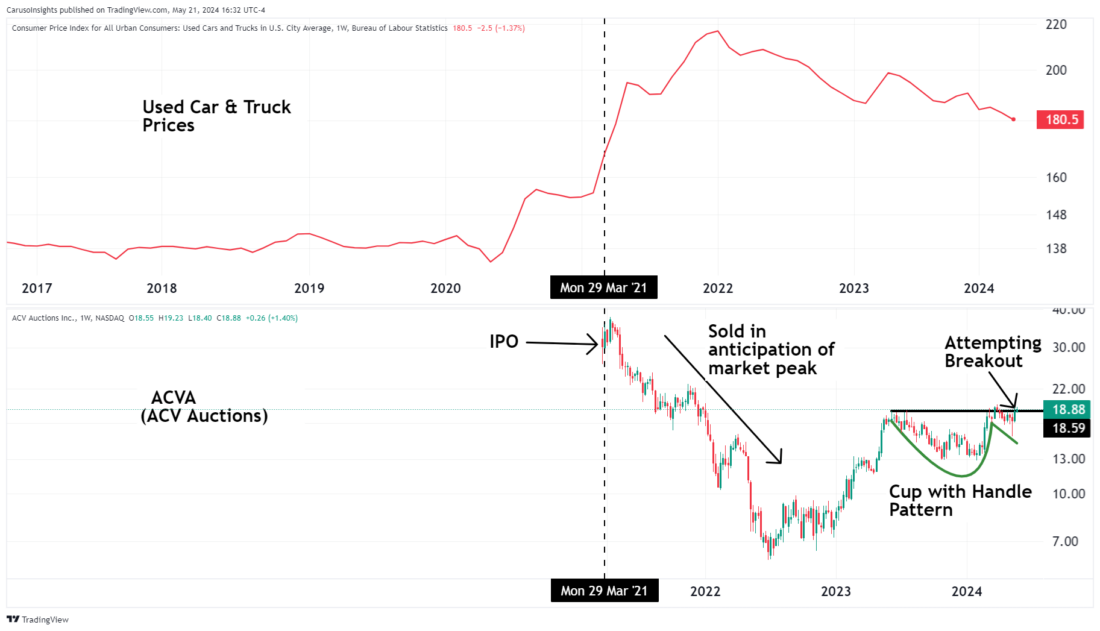

2/ ACVA is Leading a Turnaround in Used Car Prices

COVID caused many never-before-seen situations, one of which was a surge in used car prices and the odd situation where you could sell a used car for more than a new car’s list price. ACVA is attempting to redefine the wholesale used car market by bringing transparency to an incredibly opaque market.

Management intelligently came to market with an IPO near the top of the used car market euphoria, leaving buyers of the stock with quick losses. Management has now forecasted in their recent quarterly update that they anticipate the market will finally begin to improve later this year. It appears investors believe them as the stock is close to a breakout from a classic cup-with-handle chart pattern and may once again be a leading indicator for used car prices.

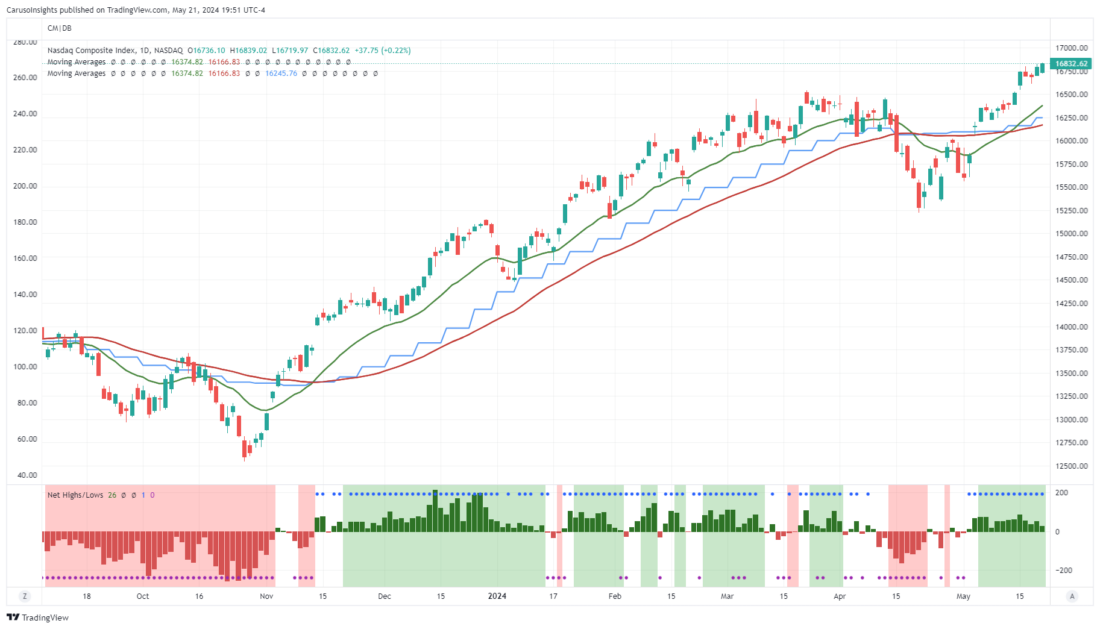

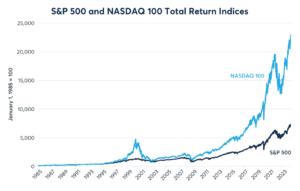

3/ Net Highs on the Nasdaq Support Higher Prices

Having discussed net highs for the precious metal mining sector in yesterday’s note, today we turn our attention to the Nasdaq. Similar to precious metal stocks, the Nasdaq is currently witnessing more stocks making 52-week highs vs. those making 52-week lows, resulting in a Net-positive number. This can be seen by the green columns below the chart.

This positive reading continues to indicate that investors remain net buyers of equities and supports the notion of a continued uptrend for the Nasdaq.

4/ AZEK Building Supplier Preparing for Much Higher Prices

It is expected to see a strong inverse relationship between the 30-year fixed mortgage rate and demand for building supplies. Therefore, the rise and fall of AZEK, a leading low-maintenance building products supplier, with the trends in mortgage rates seem appropriate. However, this relationship has recently diverged.

Despite the increase in mortgage rates in 2024, AZEK has maintained its powerful gains from 2023. Looking past recent trends, AZEK has returned to test its 2021 all-time highs despite the mortgage rate having more than doubled since that time. This is likely supported by strong demand for its products, which will only increase should mortgage rates fall and boost building demand. A breakout in AZEK accompanied by a drop in mortgage rates will likely result in much higher prices for AZEK.

About This Week’s Author

Matthew Caruso, CFA, CMT is a member of the CMT association, having previously served as the president of CMT Canada. As a professional investor and former market-maker, he boasts an impressive track record, including holding the 9-month record in the US Investing Championship. Matthew’s expertise extends to Caruso Insights, a dedicated service aimed at educating investors on constructing and refining high-growth investment strategies. To explore his insights further, visit Caruso insights.com.

———————————————-

Originally posted on May 22, 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.