1/ Deep Value BNTX Sees Momentum Pick Up

2/ Bitcoin Nears New Breakout

3/ Net Highs on the Nasdaq Support Higher Prices

4/ Shark Ninja Reverses after a Powerful Uptrend

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Deep Value BNTX Sees Momentum Pick Up

Having benefited massively from the COVID pandemic, BNTX has since fallen out of favor with investors, declining more than 80%. Declines have been so severe that BNTX has become a deep-value play with a market cap of $24 billion while sporting only $2.5 billion in liabilities versus $24 billion in assets, with nearly $20 billion being current assets. Once current assets are discounted, most of the business can be had for very little. Today, the stock saw substantial interest as it surged 11% on the largest volume in over two years. It appears some investors have determined that BNTX is finally attractive again.

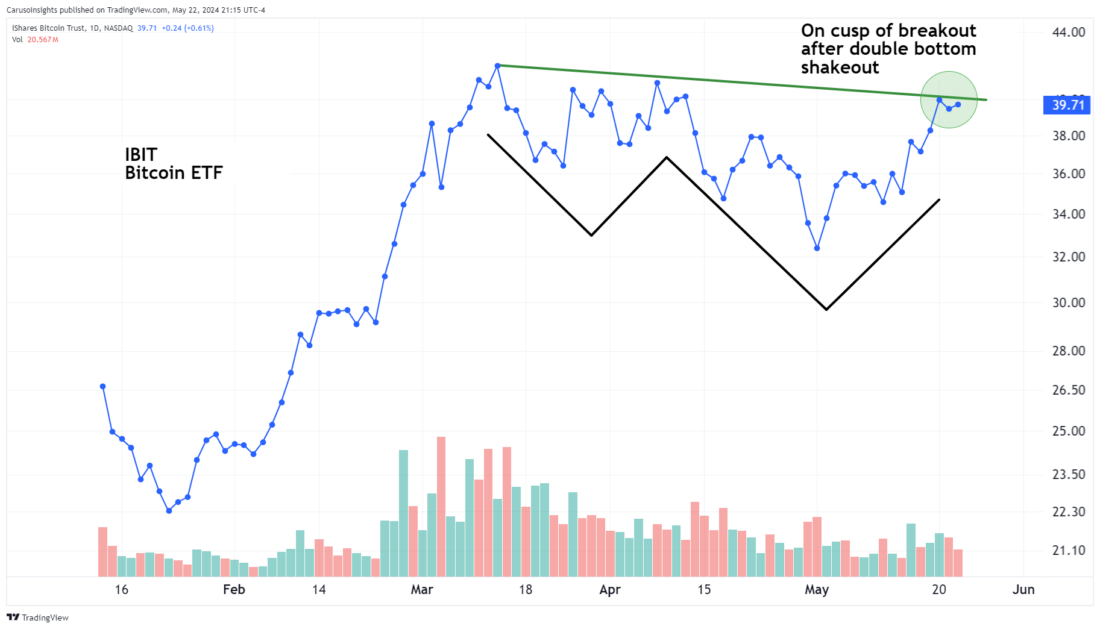

2/ Bitcoin Nears New Breakout

Having garnered substantial ETF inflows, Bitcoin has surged near its record highs once more. Initial enthusiasm subsided as the ETF corrected in April and May. However, renewed optimism that a similar Ethereum ETF approval may soon occur has bolstered interest in crypto once more. As a result, IBIT (one of the most successful Bitcoin spot ETFs) is approaching a breakout after forming a double-bottom basing pattern.

3/ Shark Ninja Reverses after a Powerful Uptrend

Restaurants have been hit with numerous obstacles, including higher food, employee, and real estate costs. These increases need to be passed on to an already overstretched consumer. As a result, eating at home has become more appealing, and Shark Ninja(SN) has ridden the wave of innovative at-home cooking appliances.

The stock has soared since its IPO, but enthusiasm may have become excessive as it formed a major reversal at a well-defined upper channel line. A retracement back to its 50-day moving average is likely and may set up a new opportunity to buy.

4/ AZEK Building Supplier Preparing for Much Higher Prices

Investing legend Warren Buffett recently said, “AI may be better for scammers than society.” This paints a bleak outlook for AI, but it also highlights a bright future for companies that can help prevent bad actors from exploiting cybersecurity vulnerabilities.

If we can’t identify whether an image is real or fake, better security will be required to keep cyber infrastructure safe.

CrowdStrike (CRWD) led its peers in 2023 and continues to do so in 2024. It has already notched new all-time highs, far ahead of the IHAK Cyber Security ETF. Anyone seeking an investment in the cyber space should focus on CRWD as it is the clear leader in its field to date.

About This Week’s Author

Matthew Caruso, CFA, CMT is a member of the CMT association, having previously served as the president of CMT Canada. As a professional investor and former market-maker, he boasts an impressive track record, including holding the 9-month record in the US Investing Championship. Matthew’s expertise extends to Caruso Insights, a dedicated service aimed at educating investors on constructing and refining high-growth investment strategies. To explore his insights further, visit Carusoinsights.com.

—————————————————-

Originally posted on May 23, 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.