By Alex Cole

1/ GoNoGo Charts: 3 questions, $SPY

2/ Around the Assets: Treasury Rates

3/ Around the Assets: Gold

4/ Around the Assets: Oil

5/ Around the Assets: Dollar

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

GoNoGo Charts: 3 questions, $SPY

In yesterday’s note we took an indepth look at the S&P 500 Spdr using the full suite of GoNoGo Charts to give a complete technical analysis overview. Let’s use what we know, make the process easy and answer three simple questions.

- What is the trend?

- Where is momentum?

- Is there anything interesting happening around the zero line?

Courtesy of StockCharts

When looking at $SPY, we get the following:

- The weight of the evidence tells us the trend is a “Go”, but GoNoGo Trend is showing weakness with aqua bars

- We saw Go Countertrend Correction Icons (red arrows) as Momentum fell from overbought levels and it is now at zero and volume is light

- GoNoGo Oscillator is testing the zero level from above where we will watch to see if it finds support, as it should if the “Go” trend is to remain healthy

2/

Around the Assets: Treasury Rates

Treasury rates can impact equity prices. Generally speaking, rising rates can be seen as a headwind for the equity markets. Let’s use the GoNoGo charts to answer our three questions.

Courtesy of StockCharts

- GoNoGo Trend is painting amber “Go Fish” bars. This tells us that there are not enough criteria being met to identify either a “Go” or a “NoGo” trend. This reflects uncertainty. As Jesse Livermore once said, there is a time to go long, a time to go short, and a time to go fishing

- The oscillator is dipping its nose into positive territory which is out of step with the previous “NoGo” trend. If momentum remains in positive territory we are likely to to see GoNoGo Trend begin to paint “Go” bars

- After riding the zero line for a few bars causing a small GoNoGo Squeeze to build, the oscillator has broken into positive territory

3/

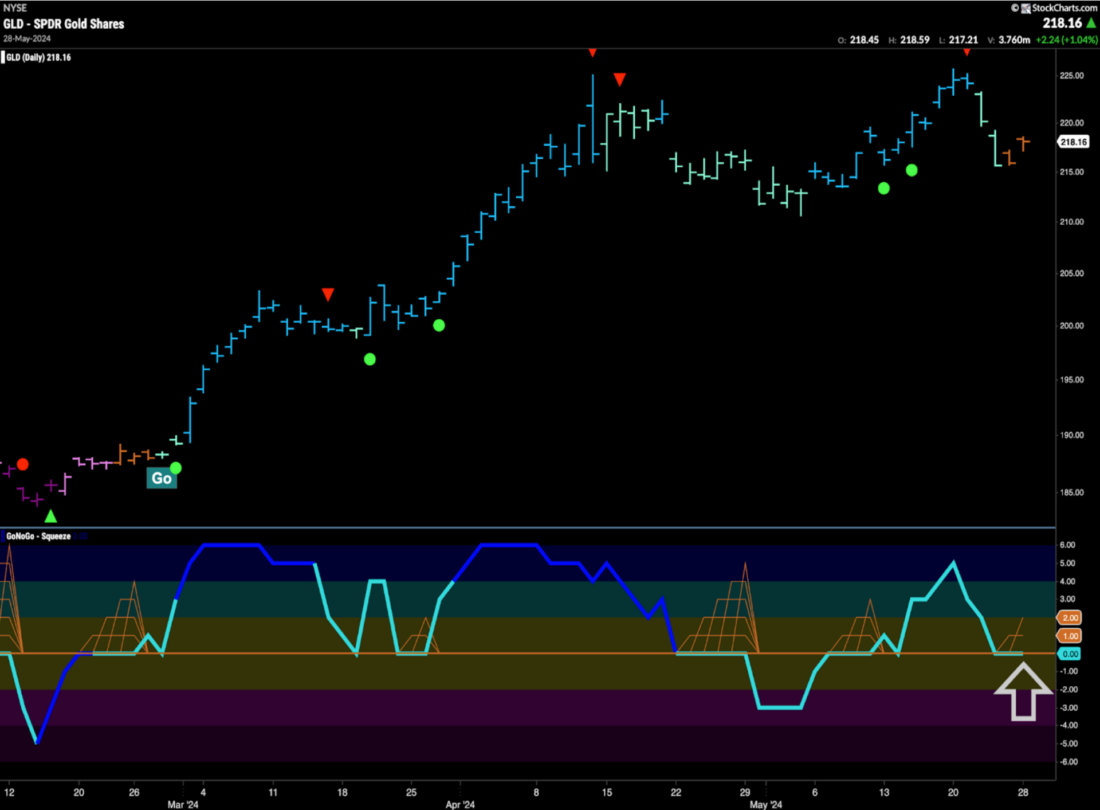

Around the Assets: Gold

Gold has seen a strong run and price has broken above decade plus resistance. We’ll answer our three questions using the GoNoGo Charts to assess the technical environment.

Courtesy of StockCharts

- GoNoGo Trend has fallen out of the “Go” trend that it has been for a few months and is painting amber “Go Fish” bars that represent market uncertainty

- After a Go Countertrend Correction Icon (red arrow) a few bars ago, GoNoGo Oscillator is at a value of zero and volume (for the ETF) is light

- As GoNoGo Oscillator rides the zero line, we see the beginning of a GoNoGo Squeeze build and we note the reduced volatility. It will be important to pay attention to the direction of the break of the GoNoGo Squeeze to help determine price’s next direction

4/

Around the Assets: Oil

There are inflection points everywhere it seems! The U.S. oil fund fell out of its “Go” trend around a month ago and has been moving sideways in a “NoGo” trend since. Having failed to make a new lower low, price rallied yesterday.

Courtesy of StockCharts

- GoNoGo Trend is painting “NoGo” bars albeit weaker pink ones as the “NoGo” trend has lost its strength

- GoNoGo Oscillator is at a value of 1 and volume is light

- The zero line has acted as resistance twice already during this “NoGo” move, but now we see that it failed to hold and the oscillator has broken into positive territory

5/

Around the Assets: Dollar

Another asset that can impact equity prices is of course the U.S. dollar. A fast rising dollar can be a headwind for equities and a falling dollar can be a tailwind. Answering our 3 questions can give us an understanding of the technical situation for the greenback.

Courtesy of StockCharts

- GoNoGo Trend is painting weaker aqua bars as price failed to set a higher high

- GoNoGo Oscillator is at 0 and volume is light and so we must pay attention to its next move

- The zero line has acted as resistance twice since it crossed below zero several weeks ago. We will watch closely as it rides the zero line and we see a GoNoGo Squeeze building. The breakout of the GoNoGo Squeeze will likely determine price’s next direction

—

Originally posted 29th May 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.