The July 1 week includes the Independence Day observance on Thursday when there will be a full close of stock and bond markets in the US. The timing of the federal holiday will cause some shifts in the release calendar, but the monthly employment report will be released on Friday at 8:30 ET as usual.

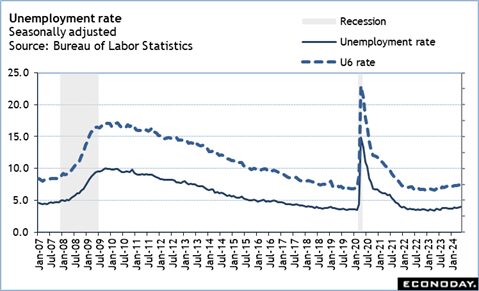

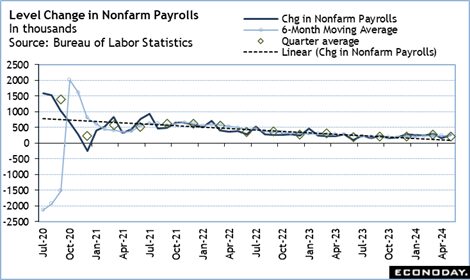

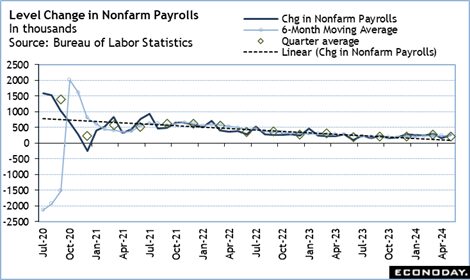

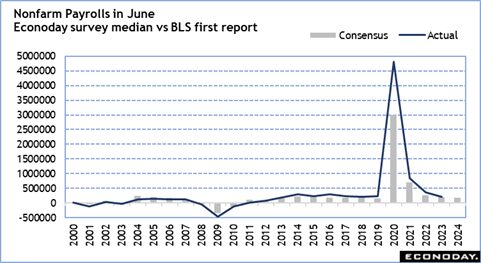

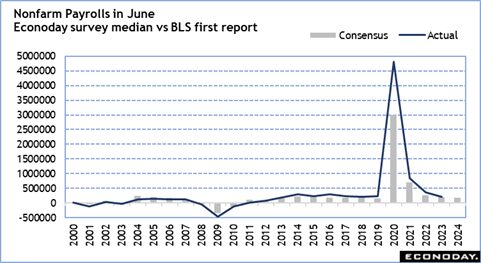

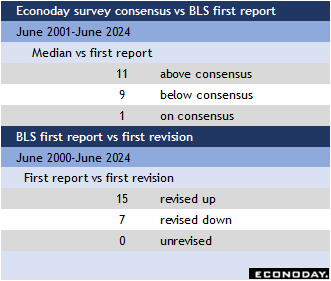

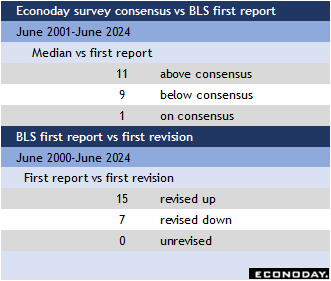

The June employment numbers are anticipated to tell much the same story as has prevailed in recent months. The June unemployment rate is expected to hold at 4.0 percent for a second month in a row. If the rate is a bit higher, it would be by no means high and would not be showing an acceleration in job losses. The change in nonfarm payrolls has early forecasts of around up 175,000. This would represent a modest slowing in the pace of job gains, but certainly not out of line with the underlying trend, and not out of line with FOMC forecasts. Historically, June has a slight tendency to come in above expectations. More importantly, the month has solid tendency to be revised higher in the July report. Right now, the monthly average for the second quarter 2024 looks roughly 200,000 which suggests the labor market remains tight and expansion modest.

The minutes of the June 11-12 FOMC meeting are set for release at 14:00 ET on Wednesday and will probably receive little attention. The release occurs on a day when both the stock and bond markets close early. Many offices will already be clearing out for a four-day weekend. Moreover, the minutes will be three weeks out of date. Fed policymakers have been active with public speaking engagements in recent weeks. Overall, they have been quite clear that the FOMC maintains its hawkish stance on the outlook for interest rates. If markets are anticipating that better inflation data will change policymakers’ views, they may be disappointed. As long as labor market data are healthy and consistent with ongoing rebalancing, any urgency the FOMC might feel about adjusting interest rate policy will be limited. Fed policymakers are cautious and want “greater confidence” that a few months of better data on inflation won’t give way to another “sideways” move in the near future.

Fed Chair Jerome Powell can look forward to many questions about the policy outlook in his appearance at an ECB conference on Tuesday at 9:00 ET, especially in light of June’s PCE data that showed scant monthly pressures and 2.6 percent annual rates both overall and for the core ex-food ex-energy reading.

At this writing, the official Fed calendar does not list the dates of Powell’s semiannual monetary policy testimony, and neither do the Senate Banking Committee or House Financial Services Committee websites. Press reports say that Powell will be before the Senate committee on July 8, which would make the most likely date of his House appearance July 9. Powell is going to face a difficult task in balancing the somewhat better inflation data against the solid readings for the labor market in offering any justifications for keeping rates at current levels.

—

Originally Posted July 1, 2024 – High points for US economic data scheduled for July 1 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.