It says something about one company’s dominance of AI chips when a presentation on power demand growth starts with Nvidia’s revenue forecast. But that’s how John Schultz of the Advanced Data Center Consulting Group opened a recent webinar. Unit volumes can be derived from sales, and the number of chips being bought determines the amount of new power demand.

Consequently, AI electricity use is forecast to more than double this year versus 2023.

Blackstone is investing $8BN with data center provider QTS preparing for the AI boom.

AI chips are power hogs, but less appreciated is the need for electricity to cool them as well. As more computing is packed into smaller spaces, the physical limits of blowing cold air on the equipment are being reached. Combining water with data centers was long rejected by the industry as too risky, but direct to chip liquid cooling is becoming the only practical way to stop the expensive kit from from melting.

Microscopic fragments in the cooling fluid can damage the chips, so stainless steel pipes are required to move PG25 (85% water/15% anti-freeze). Mesh filters with openings measured at 100 microns – ten times the size of a human blood cell — are used to trap particulates.

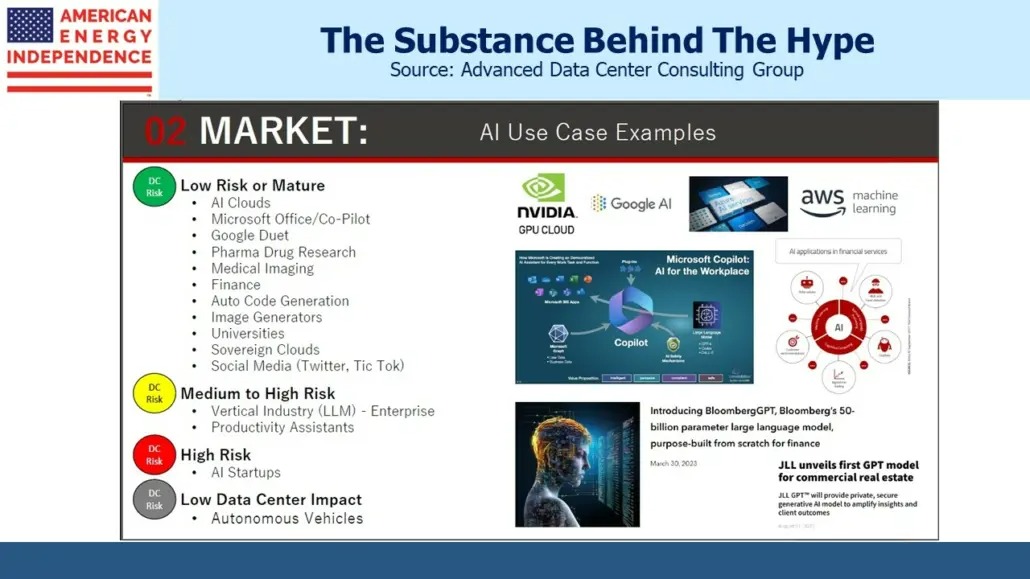

Schultz reviewed some of the AI uses already deployed.

Microsoft Office uses Copilot (dubbed “AI for the workplace”) to create powerpoint presentations, write in Word based on an outline and build Excel macros. Google’s Duet aims to compete.

There are important applications in drug research, where development times are coming down sharply. Terray Therapeutics captures 50 terabytes of raw data (more than 12,000 movies) on billions of molecular interactions every day in their quest for new treatments. McKinsey thinks pharmaceuticals have a “once in a century” opportunity.

Interpretation of medical images is 2.5X more effective since AI can learn from 10,000 examples in less than three months whereas a radiologist would need twelve years to see the same number of images.

Finance is using AI-powered chatbots for customer service, to detect fraud and to evaluate investments.

Data center location depends on proximity to its customers. AI training can be done anywhere as long as the data consists of words and text that can be moved easily. Video data requires far more bandwidth, so this type of AI training happens where the video is stored.

Latency is another issue. Microsoft’s Copilot can tolerate latency of 100-250 milliseconds, which means they need fewer data centers (Schultz believes four) across the US to serve most of their customers. Applications requiring less latency need more data centers across the country to reduce the physical distances data must cover to the customer.

Powering the AI revolution will be challenging. Some data centers will rely on dedicated electricity generation, with natural gas an obvious choice. Given the sensitivity of many IT companies to their green credentials, expect much buying of carbon credits and other efforts to offset CO2 emissions.

Solar and wind will require excess generation capacity to compensate for their intermittency. And nobody likes power lines passing over their land.

Microsoft is considering using small modular reactors, but given popular opposition to nuclear power, they’ll need to be in rural areas.

The scale of the jump in power demand is already a political issue. The Electric Reliability Council of Texas (ERCOT) now expects electricity demand to increase to 150GW by 2030, up from 85GW today. Last year their 2030 forecast was for 130GW.

This will challenge the current approach whereby customers sign up for power supply whenever they’re ready. ERCOT CEO Pablo Vegas said more than half the new demand will come from crypto-miners and data centers. Bitcoin production is a misallocation of resources and should be near the bottom of any priority list.

Data centers create few local jobs once they’re built, so there’s the potential for a political backlash if retail electricity prices are perceived to be rising because of AI. Some new customers, such as hospitals, schools and residential areas may receive priority in connecting to the grid.

It is somewhat reminiscent of the dot.com excitement 25 years ago. The internet brought hype but was hugely consequential. Overbuilt fiber-optic networks led to sharply lower communications costs which stimulated demand.

AI hasn’t yet had a discernible impact on how we do our jobs at SL Advisors. I still type every word of every blog, and the videos are me. But the use case examples provide compelling evidence that another computing revolution is underway. Increased power demand will boost natural gas consumption, benefiting companies such as Energy Transfer, Kinder Morgan and Cheniere.

Try googling will AI boost natural gas demand?

Pipeline multiples are still too low, with 6% dividend yields plus 4% growth providing a potential 10% total return.

—

Originally Posted June 19, 2024 – Drilling Down On AI

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The hype in AI brings back the dot com mess on steroids. I got hit hard? Massive incomes are being taken from us now by a handful of Trillionaires and secret powerful organizations, all bleeding the poor and low income users with repeated issuing of upgrades to complicate the exploding mess this all creates? I love engineering and innovation, producing huge and proven energy and environment saving, but this present system blocks such innovations from funding and using them. Here is what I see? NO NEW innovations can be created by regurgitation of old half assed ideas which we abandoned. Walking through such a dump in my view, is the slowest way to move forward to save our environment, when AI power consumption has to triple the energy use to sift the garbage dumps? Huge money not only does not help anymore tham massive government waste, in the hands of greedy and short sighted people. AI in the hands of real thorough thinking innovators will probably add some advancements, but not while tripling our energy use and environment destruction ?????

AI will never produce my high performance energy saving hull, by combing through past waste baskets of ideas and items which did not work. Imagine the innovators who are forecasting job elimination, power consumption increases of 2-5 times , and billionaires leading the charges. Now that’s progress??? Rea innovative and proven advances for cutting energy use in half, to help our environment, are ignored like a plague. My super efficient hull was designed, built and commercially fished 1977-1992. Government contribution? NIL, and they took my commercial fishing license, along with thousands of others, destroying the market for my 100% paid for hull. We are moving full speed in reverse, while increasing environment destruction at insane rates? Somewhere it was said “STUPID IS WHAT STUPID DOES”